Athene Amplify Review: Independent & Unbiased

The Athene Amplify Annuity is a single premium registered index-linked annuity (RILA) with a 6-year duration (CDSC), 5 indexes, and a 95 basis point annual fee that uniquely offers both a buffer and floor index crediting options.

Registered Index-Linked Annuities (RILA)

Registered index-linked annuities(RILA) are the newest variety of annuities to hit the market. You may be asking yourself, “What is a RILA”? RILA’s are a hybrid annuity and fall between a variable annuity and a fixed index annuity in terms of both risk and opportunity.

While the annuity industry was down as a whole thru the first half of this year – registered index-linked annuities were up 8% over the same period in 2019. This marks the 22nd consecutive quarter-over-quarter growth for RILA sales, according to the Secure Retirement Institutes 2020 Q2 U.S. Annuity Sales Report.

Realizing that you are here for an Athene Amplify Annuity Review I will not spend much time discussing fixed index annuities other than to establish a reference point for which to compare.

If you’d like to dig deeper into the inner workings of indexed annuities at a later time you’d likely find our Ultimate Guide to Fixed Index Annuities to be a useful read.

A fixed index annuity at a very basic level is a type of fixed annuity that guarantees you won’t lose money due to a potential market downturn but provides an opportunity to earn more than when the markets perform.

Registered Index-Linked Annuities, or RILAs, such as the Athene Amplify Annuity, have the potential to lose some value due to poor market performance. However, unlike a variable annuity, the amount you can lose is either capped at a certain percent, or there is a buffer that protects you from loss up to a certain percent.

Athene Amplify Buffer and Segment Options

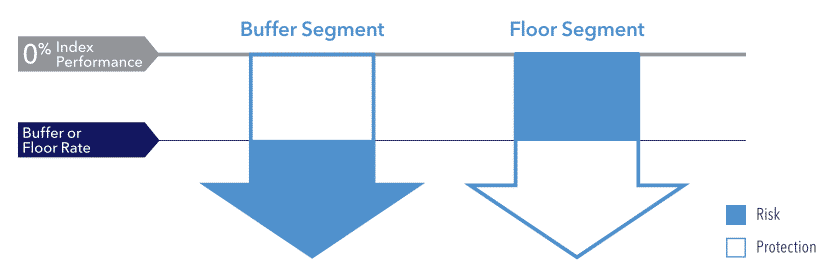

As I just briefly stated there are two types of credit options RILAs use:

- Buffer Segment Option – You are protected from market loss up to a buffer rate that is defined in your contract.

- Floor Segment Option – Your potential market loss is limited by a Floor Rate specified in your contract.

Below is an illustration that should help you be able to visualize this better. In the below example, Athene agrees to cover the losses shown in white and you agree to cover the losses shown in blue.

Many of the Registered Index-Linked Annuities on the market only offer one or the other of these options. The fact that you can allocate a portion of your investment to a Buffer Segment and a portion to the Floor Segment is one of the big positives the Athene Amplify has going for it.

Now that you have at least a basic understanding of how a RILA works let us dive into our Athene Amplify Annuity Review.

Athene Amplify Annuity Reviewed

Market Indexes Available

- S&P 500® Index

- MSCI EAFE PTP

- Russell 2000® Index (RTY)

- Performance Blend (SPX, RTY, MXEA)

Investment Options

Buffer Segment Option

10% Buffer Rate on all options, except the 6-year S&P 500® Index option 20% Buffer Rate on the 6-year S&P 500® Index option

You are protected from potential; market Loss up to a Buffer Rate defined in your Contract. Losses more than the Buffer Rate will reduce your Segment Value.

Floor Segment Option

10% Floor Rate on all options

Your potential market Loss is Limited by a Floor Rate defined in your Contract. Losses up to the Floor Rate will reduce your Segment Value. You are protected from any Loss beyond the Floor Rate.

Athene Amplify Contract Specifics

State Availability

Available states: AL, AK, AZ, AR, CO, CT, DE, DC, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY

Premium Payments

Single-Premium Only

Maximum: $1,000,000 without prior home office approval

Minimum: $10,000

Types of funds accepted:

- Non-Qualified

- 401k

- IRA

- 401a

- SEP IRA

- IRA-Roth

- SIMPLE IRA

- 1035 Exchange

Withdrawal Provisions

Free Withdrawal Percentage Schedule Year 1: 10% of the Purchase Payment

Year 2+: 10% of the Contract Value as of the previous Contract Anniversary

Initial Segment Term Bailout Provision

If the declared Cap Rate, Participation Rate, or Annual Interest Rate for an elected Segment Option at the initial Segment Start Date is lower than the Bailout Rate specified in your Contract, you may cancel the Contract within 60 days after the Contract Date and receive your Purchase Payment less any Withdrawals. This provision applies during the initial Segment Term Period.

Confinement Waiver

Withdraw up to 100% of your annuity’s Interim Value if you are confined to a Qualified Care Facility. This benefit is available if you are confined for at least 60 consecutive days and meet eligibility requirements. Withdrawal Charges will be waived if you qualify for this benefit during the Withdrawal Charge Period. Interim Value Adjustments apply.

You cannot be confined at the time your Contract is issued and confinement must begin at least one year after the Contract Date.1

Terminal Illness Waiver

Withdraw up to 100% of the annuity’s Interim Value if you are diagnosed with a Terminal Illness that is expected to result in death within 12 months and meet eligibility requirements. Withdrawal Charges will be waived if you qualify for this benefit during the Withdrawal Charge Period. Interim Value Adjustments apply. This waiver is available after your first Contract Anniversary, and the initial diagnosis of Terminal Illness must be made at least one year after the Contract Date.

Death Benefit

During the Withdrawal Charge Period, the Death Benefit is greater than the Purchase Payment fewer net proceeds from prior Withdrawals or the Interim Value on the date of death. After the Withdrawal Charge Period, the Death benefit is the Interim Value on the date of death.

Athene Amplify Annuity Rates

Pros and Cons of Athene Amplify Annuity

PROS

- It offers both Floor Segment and Buffer Segment Investment Options

- There are 3 different investment terms available within one contract (1,2 and 3 years)

- It is a relatively short contract at 6 years when compared to other RILAs available in the market today

- The average historical annual rate of return was in the 12 to 12.5% range for many of the available options.

- 10% Free Withdrawals Annually – including the first contract year.

- There is a Long Term Care and Terminal Illness waiver built into the contract making your account liquid should the unfortunate happen.

Cons

- Could be confusing to a potential buyer or even owner because it does have a Floor and Buffer option available as well as three investment terms and four different indexes.

Athene Amplify Annuity Review: Final Thoughts

This is likely not the appropriate annuity option for a typical fixed annuity or CD buyer. However, if this type of annuity investment fits your risk tolerance it deserves serious consideration. If you are someone who falls into the “KISS” Keep It Simple Stupid frame of mindset there are similar RILAs with much fewer options and one of those may be more up your alley.

We see this being a perfect fit for those of our clients who are in their early to mid-’50s seeking more upside than a bond or principal-protected solution can provide.

If you have a specific question, please feel free to ask in the comment section or submit it privately via the form below. Additionally, we are available via phone and email Monday thru Friday from 8:30 to 5:30 EST at (855) 583-1104.