Registered Index Linked Annuities, or RILAs, were created as a “middle ground” or “hybrid annuity”. RILA provides exposure to a published stock market index along with a level of protection from market loss. While this kind of annuity tracks the movement of an index, it does not directly invest in any stock or equity vehicle.

Because you assume some of the risks of loss from market downturns, a registered index-linked annuity may allow for greater growth potential than a fixed annuity or fixed index annuity.

Note: You may see or hear a Registered Index-Linked Annuity referred to as:

How much risk are you willing to take to grow your retirement nest egg?

Selecting a product with the right blend of risk and potential can increase your confidence in your retirement income plan, which will make it easier to stay the course along the way.

As you prepare for retirement, you may find yourself seeking a balance of growth and protection. A registered index-linked annuity offers indexed strategies that let you take advantage of positive market performance while providing a level of protection against market downturns.

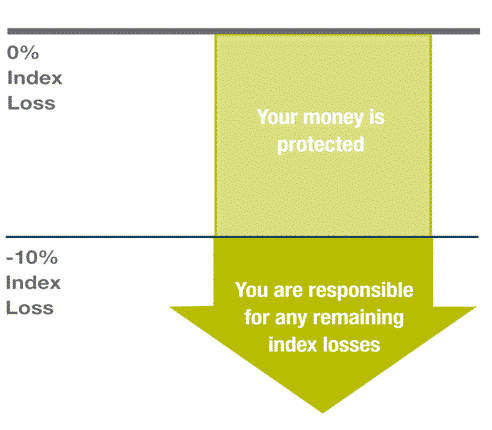

When index performance is positive during a term, strategies earn a return, up to a cap. When index performance is negative during a term, strategies may lose value, limited by either a buffer or a floor.

Some Insurers issue RILAs that offer both floor and bucket strategies while some insurer only offers one or the other options.

Cuna Member Zone

Great American Index Frontier

Nationwide Defined Protection Annuity

Lincoln Level Advantage

Annuities are designed to provide a guaranteed income stream for people during their retirement years and to provide financial security and peace of mind.

Annuities are best for individuals looking to save more for retirement in a tax-deferred investment vehicle or desire asset protection with upside growth potential.

Earn up to 20% More when you buy a fixed annuity vs. today's best CD rates.