Bonds vs. Annuities

This year marks the 25th anniversary of fixed-indexed annuities. They’ve undergone much change over the past two and half decades. Some for the better and some for the worse… For years fixed index annuities have had a bad reputation by many financial advisors for being too complicated.

Yes, the same advisors who actively manage their client’s funds and talk to them about tactically re-allocating quarterly said index annuities are too complicated!

in 1995, Keyport Life introduced the first indexed annuity called the KeyIndex. If the KeyIndex were around today it would be in more demand than toilet paper at Sam’s Club. It had 100 percent participation and a 150 basis-point spread. Meaning, you would calculate the growth of the S&P 500 between your contract date and annual contract anniversary. If it went up you were credited with 100% of the growth minus 1.00%.

Even in 1995 people were excited about a financial product that allowed you to participate in some of the market upsides while providing downside protection from loss. Being the first to the game is not always a good thing as Keyport Life mispriced their first generate index annuities and gave away too much.

They ran into reserve problems by the time their first five-year term was up and ended up being absorbed by Sun Life in 2003. Many of the companies that sold the first indexed annuities are no longer around, but they certainly taught insurers a lot. They paved the way for the fixed-indexed annuities of today, which offer consumers a unique array of benefits that can’t be found elsewhere.

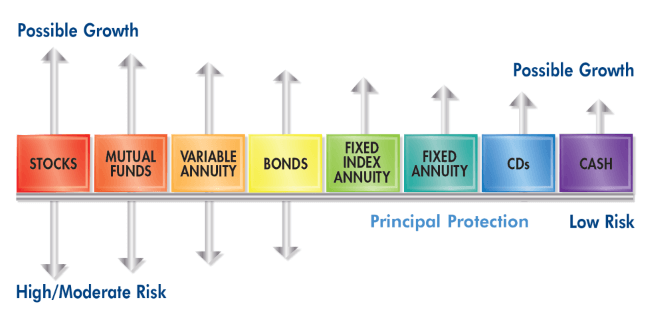

The above shows where a fixed index annuity falls on the investment continuum. They offer more upside potential than any other savings vehicle offering principal protection. As they turn 25 I believe they are finally beginning to feel accepted and getting some love that was perhaps due for some time now. If you aren’t familiar with Index Annuities you may want to check out our Beginners Guide to Fixed Indexed Annuities.

Fixed Index Annuities Finally Coming into Favor

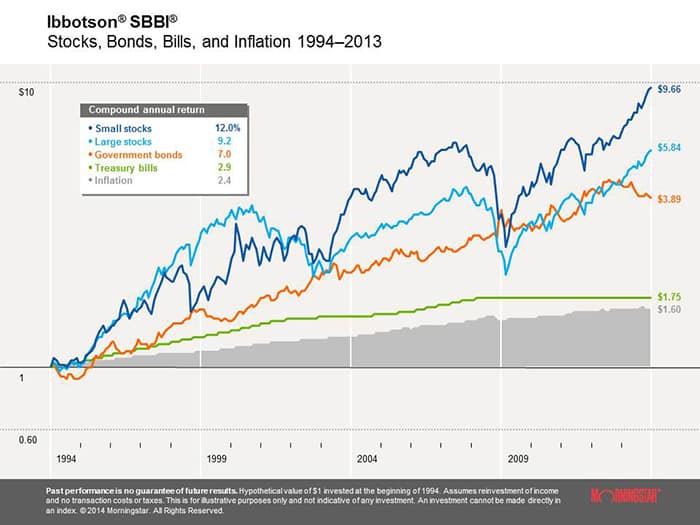

Robert Ibbotson, the economist known for his stock, Bonds, Bills, and Inflation chart, argued in his white paper that fixed index annuities have the potential to outperform bonds in the near future and smooth out the returns of a portfolio, thanks to the downside protection they so kindly provide.

Ibbotson’s seminal work was around the idea that as you take on more risk in a portfolio you get a higher return. But risk comes in the form of volatility and as one nears retirement, they can not afford a lack of stability. The sequence of returns risk is perhaps the greatest risk of all in retirement and a down year just before or just after retiring can have devastating impacts on a retirement portfolio.

Ibbotson’s whitepaper on fixed index annuities states that he’s always recognized you have to de-risk, but he now sees bonds are not necessarily the way to go today because yields are so low. He goes on to state that when added to the portfolio, fixed-indexed annuities can smooth out the return pattern.

Fixed Index Annuities: Consider the Alternative

If you’re considering a Fixed Index Annuity you will find our 10-Step Guide to Selecting the Best Fixed Index Annuity in 2020 to be an extremely helpful resource.

Again, If you are not familiar with index annuities they are a contract issued and guaranteed by an insurance company. Their growth is benchmarked to a stock market index rather than a fixed interest rate like a fixed annuity. As a retirement savings vehicle indexed annuities do receive favorable tax treatment from the IRS and accumulate on a tax-deferred basis.

They are most commonly available in durations anywhere from 5 to 10 years; allow for 10% free withdrawals annually, and charge a fee should you take excess withdrawals prior to the end of your contract.

Uncapped Fixed Index Annuity Crediting Options

Many Fixed Index Annuities available today are uncapped, come with a floor of zero percent, and are subject to a participation rate. In good years you can get a very good return for taking on no risk and in bad years you earn zero percent. In his whitepaper, Fixed Indexed Annuities: Consider the Alternative,

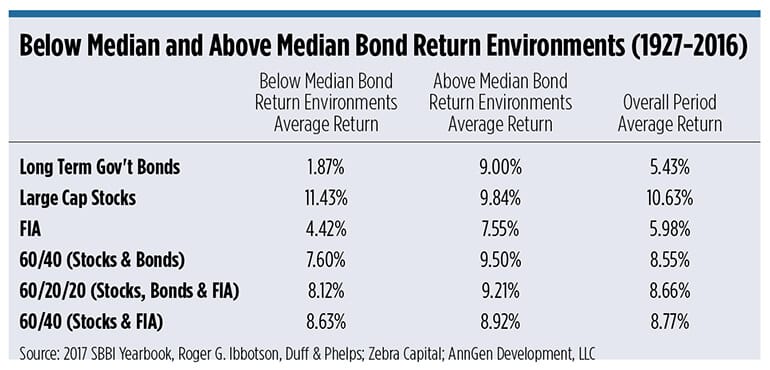

Ibbotson and his team at Zebra Capital Management ran hypothetical return simulations from 1927 to 2016 and found that net of fees, fixed index annuities had an annualized return of 5.81%, compared to 5.32% for long-term government bonds and 9.92% for large-cap stocks over that period (chart with his findings below).

Ibbotson and his team also simulated different portfolios and how they would perform in below-median bond environments (like the one we are in now) versus median bond return environments.

During the below median bond return environments from 1927 to 2016, a 60/40 stock and bonds portfolio returned an average of 7.60%. That compares to 8.12% for a 60/20/20 (stocks, bonds, fixed indexed annuities) portfolio and 8.63% for 60/40 stocks and fixed indexed annuities portfolio.

So in a below median bond return environment a 60/40 stock and index annuity portfolio beat out a 60/40 stock and bond portfolio by 103 basis points.

Yet in above median bond return environments, adding fixed indexed annuities brought returns down, although very slightly (see chart). In fact, in an above-median bond environment, a 60/40 stocks and bonds portfolio only beat out a 60/40 stocks and index annuity portfolio by 58 basis points.

Ibbotson made a point in his paper to reinforce he is not suggesting “you go all in”, on fixed indexed annuities, but that “he thinks a combination of stocks, bonds, and fixed index annuities are good.”

These products may also be a good addition to a portfolio, given the recent stock market volatility.

“The stock market—generally it’s gone up and does much better than bonds over the long term,” Ibbotson said. “And people don’t want to be out of it, but then of course there are all kinds of talk that maybe the stock market is high priced right now. So there’s a danger of being in it.”

If you are approaching retirement or already enjoying it; a fixed index annuity can help simplify your path to a financially secure retirement.

If you’d like to learn more about fixed-indexed annuities you can shop around our index annuity store.