Best 10 Year Fixed Annuity Rates Compared

The best 10-year fixed annuity rate is 5.90% as of May 15, 2025. A 10-year fixed annuity pays a guaranteed interest rate for 10 years.

Today's Best 10 Year Fixed Annuity Rates

| Term | Insurer | Rate | Review | Annuity | AM Best | Application |

|---|---|---|---|---|---|---|

| 10 Years | 5.90% | DirectGrowth MYGA | DirectGrowth MYGA | B++ | Apply | |

| 10 Years | 5.35% | Farmers Life | Safeguard Plus | B++ | Apply | |

| 10 Years | 5.35% | Clear Spring Life | Preserve MYGA | A- | Apply |

You’ll find Fixed Index Annuity Rates here if you’d like to look at them instead.

Free Annuity Quote

Fill out the form below to receive a free annuity quote within 4 business hours, or use one of our annuity calculators.

What is a 10 Year Fixed Annuity?

A 10-year fixed annuity pays a guaranteed interest rate for 10 years.

After the initial 10-year guarantee period, you will have the option to either renew for another 10 years at the new declared interest rate, withdraw your annuity account value, convert your annuity to monthly income payments, or transfer to a new annuity using a tax-free 1035 exchange.

As stated above, in addition to providing a guaranteed rate of return for the initial 10-year investment term, 10-year fixed annuities provide the opportunity to turn your savings into lifelong, pension-like income. The fixed annuity rate guarantee is backed by the financial strength of the issuing insurance company.

IMPORTANT NOTE: You have likely heard of a fixed annuity referred to as any of these other names:

- CD-type annuity

- Multi-Year Guaranteed Annuity (MYGA)

- Single-Premium Deferred Annuity (SPDA)

- Traditional Fixed Annuity

- Flexible-Premium Deferred Annuity (FPDA)

Fixed Annuity Definition:

With a fixed annuity, the insurance company guarantees both the rate of return (the interest rate) and the payout to the investor. Although the word “fixed” might suggest otherwise, the interest rate on a fixed annuity can change over time.

The fixed annuity contract will explain whether, how, and when this can happen. For a 10-year fixed annuity, the initial interest rate is fixed for 10 years and a new interest rate is declared at the end of the 10 year contract period.

Source: “Learn to Invest, Investment Types, Annuities, Fixed Annuities.” Financial Industry Regulatory Authority (FINRA)

Fixed Annuity vs. CDs

Fixed annuities work very much like a certificate of deposit (CD). Both a fixed annuity and a CD provide principal protection, meaning your account value will not decrease due to market performance.

A fixed annuity, or MYGA, guarantees a set interest rate for a specified period of time, just like a CD. However, Fixed annuity guarantees are backed by the claims-paying ability of the issuing insurance company and are not insured by the FDIC like a CD.

While not FDIC-insured, State Insurance Guaranty Associations provide a safety net for their state’s annuity policyholders. These Guaranty Associations guarantee policyholders continue to receive coverage (up to the limits spelled out by state law) even if their insurer is declared insolvent.

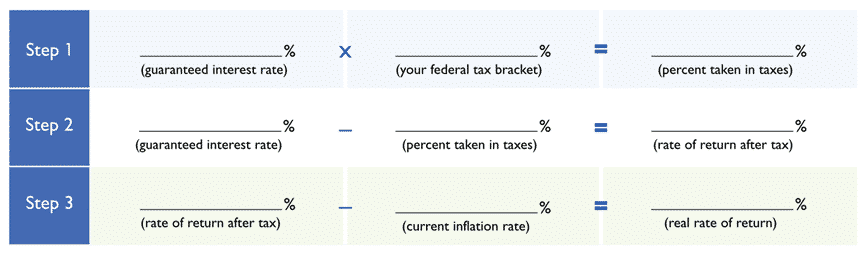

Calculating Real Rate of Return for CDs

In 18 of the past 30 years, CDs have had a negative return (after taking into account the impact of taxes and inflation), and in three of the positive years, they earned less than a 1% real rate of return.

Have you considered the impact that taxes on interest and adjustments for inflation may have on your overall rate of return?

Generally, the interest received in these types of vehicles may not keep pace with inflation. This could mean lower purchasing power for you over time. Also, at renewal, a new rate along with a new withdrawal penalty may apply.

Here’s a quick way to determine your CD’s real rate of return:

Fixed Annuity vs CD Comparison Table

| FEATURES | FIXED ANNUITY | CD |

|---|---|---|

| Issued By | Insurance Companies | Banks |

| Investment Amount | $2,000 - $1,000,000 | Essentially Any Amount |

| Investment Term | 2 years - 10 years | 3 months - 5 years |

| Interest Rates (APY) | Varies by product. | Varies by bank, term and investment amount. |

| Liquidity | Usually, 10% annually or interest earned. | Almost always accumulated interest. |

| Guarantees | Backed by Insurer & State Guaranty Associations. | Backed by the FDIC. |

| Death Benefit | May avoid probate. | Probate process required. |

1035 Exchange Rules

The Internal Revenue Service (IRS) allows you to exchange an annuity policy that you own for a new annuity policy without paying tax on the investment gains earned on the original contract.

This can be a substantial benefit.

This rule is governed by Section 1035 of the Internal Revenue Code which is why these are called 1035 Exchanges.

Below is a direct link to the complete text of the code.

U.S. Code > Title 26 > Subtitle A > Chapter 1 > Subchapter O > Part III > Section 1035

There are a couple of important rules that must be followed in order to receive the benefits of a 1035 Exchange.

- The tax code says that the old annuity policy must be exchanged for a new policy – you cannot receive a check and apply the proceeds to the purchase of a new insurance policy.

- You can 1035 exchange from a life insurance policy to an annuity

- You can 1035 exchange from an annuity to a long-term care policy.

- You can not 1035 exchange from an annuity to a life insurance policy

Here is an example of an actual 1035 Exchange form you would need to complete to move from one annuity to another via a 1035 Exchange.

How is a Fixed Annuity Taxed?

The deciding factor on how your fixed annuity will be taxed depends ultimately on the money you used to buy it. Whenever a client asks us how annuities are taxed, our first response is Where did you get the money to buy it?

Since we are talking about taxes, there is no way to say with certainty exactly how your annuity will be taxed. Tax laws and tax rates can and do change all the time.

However, we can make very educated guesses about certain scenarios based on how annuities have been and are taxed currently. First, we will look at the types of funds you can use to purchase an annuity and explain the differences in how they are taxed.

Roth IRA Annuity Taxation

If you purchase a fixed annuity with funds from a Roth individual retirement account (IRA) or Roth 401(k), it is very likely you won’t have to pay federal income tax at all on the money when you withdraw it from your annuity. That includes the principal and interest.

Qualified Annuity Taxation

Firstly, an annuity purchased with qualified funds is considered a qualified annuity. Qualified funds are monies that you have never paid taxes on, such as a traditional IRA or a traditional 401(k).

When you begin to make withdrawals from a qualified annuity, you will pay normal federal income taxes. Meaning, that 100% of your annuity is treated as ordinary income, and 100% of the funds will be taxed when they are taken.

Non-Qualified Annuity Taxation

A non-qualified fixed annuity is an annuity purchased with after-tax dollars, such as money from a taxable personal savings or checking account or a personal brokerage account.

If you own a non-qualified annuity, you will only pay income tax on the gain in your contract, but not the money you used to purchase the annuity.

The money used to purchase a non-qualified annuity is considered the “basis”. Insurance companies keep track of your “cost basis,” which is the original amount used to purchase an investment.

This “cost-basis” is the amount of money on which you will not pay taxes because you’ve already paid taxes on it once. The interest earned will be taxed as ordinary income, with a few exceptions that we will discuss momentarily.

Lifetime Income Annuity Taxation

A 10-year fixed annuity can be converted to an income annuity at the end of the initial 10-year annuity contract period via annuitization.

There are really two types of income annuity payout options: lifetime or period certain. A lifetime annuity is an annuity that guarantees payments for as long as you are alive, whereas a period-certain annuity guarantees payments for a specified period of time.

Remember, if you own a non-qualified annuity, you only pay taxes on the interest earned, not the original cost basis. So, to determine what portion of your monthly payments are taxable, there is a calculation that needs to be done to establish what percent of each annuity is principal (or cost-basis) and what percent is interest earned.

These calculations establish your exclusion ratio, or in plain terms, the percentage of each annuity payment that is exempt from income taxes. The method of determining the exclusion ratio varies depending on whether you have a period-certain annuity or a lifetime annuity. Let’s look at an example for each.

10 Year Fixed Annuity Buyers Guide

Fixed annuities, or Multi-Year Guarantee Annuities (MYGAs), are the simplest of all annuities, making them the easiest variety to shop for and compare. However, there are still a few important items to consider when shopping for the best 10-year fixed annuity rates, other than the guaranteed interest rate.

1. Duration: Typically, the longer the contract you purchase the higher your guaranteed interest rate will be. But that is not the case, especially given the current inverted yield curve.

2. Liquidity: Almost all fixed annuities have some type of annual free withdrawals, but the amount available varies by product.

You’ll see that most of the fixed annuities at our marketplace provide interest-only withdrawals annually. Others allow for 10% Free Withdrawals (10% of the previous year’s account value) annually.

3. Insurance Company’s Financial Rating: It is very important to consider an insurance company’s financial rating because it is an indicator of its ability to fulfill financial commitments to its policyholders. Usually, a lesser-rated insurance company will offer higher fixed annuity rates, but this is not always true.

Pros and Cons of a Fixed Annuity

Pros

Fixed annuities are meant to be long-term retirement savings vehicles. They provide a safe, tax-advantaged way to earn a good return on savings needed soon. They are remarkably like CDs, with added benefits:

- Fixed Annuities Provide a Guaranteed Rate of Return

- A Fixed Annuity Grows Tax-Deferred

- A Fixed Annuity Provides Principal Protection

- Fixed Annuities Offer Some Liquidity

- A Fixed Annuity is the Most Simple of All Annuities

Cons

- Fixed Annuity withdrawals prior to age 59½ may have a 10% IRS penalty.

- Fixed Annuities Only Offer Limited Income Options

Fixed Annuity FAQs

Is a Fixed Annuity Safe?

Yes. Insurance companies as a whole have a long history of stability, even through our nation’s most difficult economic times.

Fixed annuities are backed by the full faith and credit of the issuing insurance company, so it is important to consider the financial strength of an annuity company when purchasing a fixed annuity.

What is a 10-year fixed annuity?

A 10-year fixed annuity is a ten-year annuity contract with a ten-year surrender charge schedule (CDSC).

Ten-year fixed annuity rates are guaranteed for the initial contract period, and you agree to keep the annuity for the entire 10-year contract term.

Can I access my Money?

When you purchase an annuity contract, you are committing to leave your money there for the duration of your annuity (usually 2 to 10 years). However, most fixed annuities allow taking free withdrawals of interest earned or up to 10% free withdrawals annually (varies by annuity company and contract).

Annuity Guides

Related Reading

24/7 access to the best annuity companies