Innovative alternatives to long term care are available but most retirees don’t know they even exist. These specific types of annuity and life insurance policies are referred to as asset based long term care, or hybrid policies.

Although research indicates this risk causes anxiety among retirees, most are still not willing to purchase traditional Long Term Care Insurance for multiple reasons.

Health costs and medical spending present a tremendous challenge in retirement planning. Only 18 percent of workers feel very confident they will have enough money to pay for medical expenses in retirement. Everyone faces the possibility of a debilitating illness that will require advanced care over a long period of time, especially since the Life Expectancy of Americans continues to increase.

You may want to read, ” A Shoppers Guide to Long Term Care Insurance” published by the National Association of Insurance Commissioners.

Long term care is advanced and costly care that must be administered over a long period of time due to some type of debilitating illness. It is often referred to as (LTC) and traditional long term care insurance is many times abbreviated as (LTCI).

Long Term Care doesn’t just mean the nursing home. In fact, LTC needs may arise sooner than you think. Short-term access to long-term care can help you recover from a sudden illness or injury. For example, while recovering from hip surgery you may need rehabilitation therapy that requires several weeks or a few months at a nursing facility.

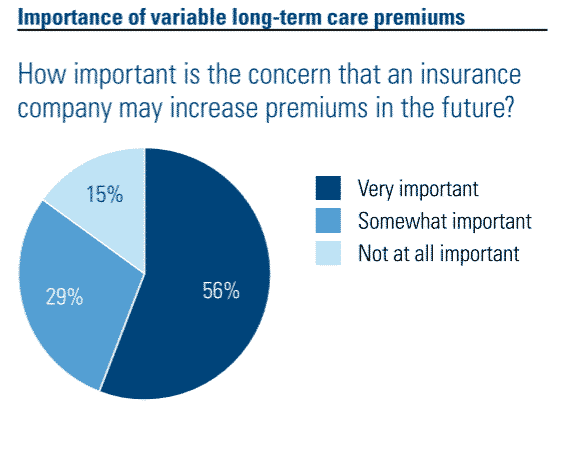

This risk is a source of anxiety for retirees, yet most are unwilling to accept the variable costs and potential loss of premiums paid under conventional health-based long-term care insurance products. And few have taken steps to understand the complete range of long-term care insurance product features and options available to them.

No one wants to think, “This could be me” and no one can predict the future. But, according to the U.S. Department of Health and Human Services (1):

The first barrier to long-term care insurance demand is that policy premiums are subject to increases based on claims experience.

This so-called “ambiguity aversion” affects the demand for similar financial products, such as fixed rate versus adjustable rate mortgages, despite the potential benefit of small loss in risk sharing between the consumer and the insurance company.

While the benefits of purchasing long term care insurance is well documented, retirees don’t purchase Long Term Care Insurance because of behavioral and rational reasons. Alternatives to Long Term Care Insurance that have return of premium if LTC coverage is not needed has been well received.

Traditional Long Term Care Insurance, which I will refer to as LTCI throughout this article, is paid for in annual premiums. Each year your premiums can increase.

Nobel Prize-winning behavioral economist Daniel Kahneman and his co-author Amos Tversky developed a theory of how individuals behave when faced with uncertain decisions that may involve gains and losses (Kahneman and Tversky, 1979).

They found that when subjects faced a decision that may involve a gain and a loss, they would overweight small losses and often ignore the possible impact of large losses. This so-called prospect theory has been confirmed in hundreds of experimental tests, and the effects of loss aversion can help explain behavior in markets for a number of consumer products.

This phenomenon has been dubbed, Prospect Theory. Prospect Theory states that individuals place greater emphasis on a negative event than they do on a positive event. The video below does a great job of illustrating prospect theory in one minute.

The chaos in the traditional Long Term Care Insurance (LTCI) marketplace over the past decade has led many middle-income retirees to essentially throw up their hands and ultimately decide to take their chances not need assistance in their old age.

As a result, Congress passed two laws to encourage alternatives to long term care insurance.

Health Insurance Portability Act (HIPPA)

Pension Protection Act of 2006 (PPA)

In 1996, under the Health Insurance Portability and Accountability Act (HIPAA), the federal government set forth the requirements for tax-qualified LTC policies. Until that time, the tax status of benefits paid under LTC policies was uncertain.

The second law passed to help long term care alternatives become a possibility is the Pension Protection Act.

Many couples at or nearing retirement age have deferred annuities and permanent life insurance. Often such couples consider repositioning these products without understanding the benefits of ex-changing such policies for asset based LTC policies.

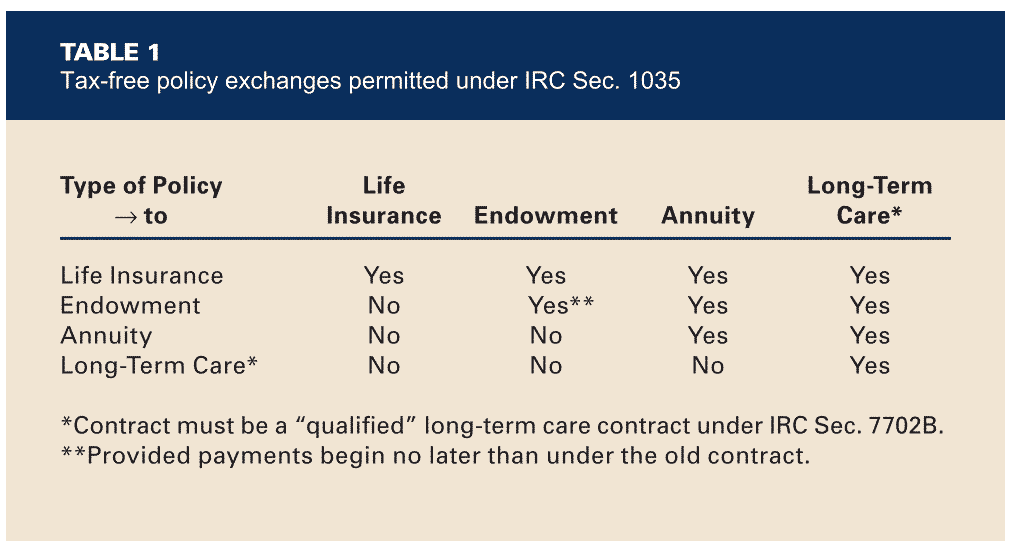

A benefit with life insurance and annuity policies is that IRC Sec. 1035 permits exchanges from one policy to another policy better suited to meet the needs of the insured. Current regulations also permit partial exchanges of deferred annuity policies with basis being allocated pro rata between policies. (24)

In a gain situation, a proper IRC Sec. 1035 exchange enables the policyholder to postpone the recognition of that gain. The policyholder’s cost basis in the new policy becomes the transferred basis plus any future premiums paid.

Example:

Surrender value: $400,000 transferred to new policy

Cost basis: $200,000 transferred to new policy

Potential gain: $200,000 tax deferred

Consider an individual, aged 70, who holds a traditional deferred annuity with a current account value of $400,000 and a basis of $200,000. If withdrawals are made from this annuity for expenses, LTC expenses included, the $200,000 gain in the annuity will be taxed first at ordinary income rates. If the annuity is exchanged under IRC Sec. 1035 for an annuity LTC policy, taxation of the gain will be deferred, and if withdrawals are made for LTC expenses, the distributions will be income tax free.

If this individual wished to allocate half of the $400,000 account value to LTC coverage, he or she could partially exchange half of the contract for an annuity LTC policy. The result after the partial exchange would be two policies: one traditional policy with an account value of $200,000 and a basis of $100,000, and one annuity LTC policy with an account value of $200,000 and a basis of $100,000.

The below table lists what types of tax-free 1035 exchanges are permissible.

SOURCE: Seeking Stable, Efficient Coverage for Long-Term Care with Asset-Based Products

by David A. Gresham, JD, CLU, ChFC. JOURNAL OF FINANCIAL SERVICE PROFESSIONALS | JULY 2016

You want to live out the last days of your life as comfortably and with as much dignity as possible. Whether you prefer home health care or living in a nursing home, preparation can reduce the expense and burden of long-term care on your loved ones.

Asset-based products appear to be more behaviorally appealing to consumers. With both the guaranteed death benefit and long-term care benefits, the potential for a positive impact on legacy also appears quite appealing.

Asset Based Long Term Care is a specific type of life insurance and annuity, than can provide long-term care benefits if care is needed. If you never need care, your asset passes to the next generation and becomes part of your legacy — making asset-based long-term care an innovative alternative to traditional long-term care insurance.

Use existing assets to protect you and your loved ones from the expenses, and perhaps the emotional strain, that can arise when a family faces the need for long-term care.

Advantages of Life Insurance with Long Term Care Benefits

Both Life Insurance with Long Term Care Benefits and annuities with long term care benefits are very good alternatives to long term care insurance. It is not possible to make a blanket statement claiming one alternative is better than the other because it will vary based upon each individuals unique situation.

If you are looking to purchase an asset based long term care product with cash or transfer an existing life insurance policy to and Asset Based LTC product I would recommend the Life Insurance based option more often than not, assuming your health permits you to qualify. This is because your money will create greater leverage for death benefit purposes should you not need long term care.

If you have an existing non qualified annuity with accumulated gains I will most often recommend the annuity with long term care rider. This is because fixed annuity rates are currently near all time lows and one could consider them to be an under-utilized asset. If you are currently earning 2.50% that would be a small price to pay for a 2 1/2 times leverage for long term care. In addition, the ability to withdraw gains income tax free further mitigates the cost of transferring to an annuity with a long term care rider.

Tip: Check spam/promotions if you don’t see our email on time.

Need help sooner or have a quick question?

What happens next

Tip: Check your spam or promotions folder if you don’t see our email within the time window.