NAC VersaChoice 10 Review

In this annuity review we’ll be we’ll cover everything you need to know about the Versa Choice 10. Below is a list of some of the main points we’ll hit on.

- Product Details

- Product type

- Fees

- Current rates

- Realistic long-term return expectations

- How it is used

- How it is most poorly used

North American Company Ratings

It is very important to consider the financial ratings of the issuing insurance company when shopping for an annuity because it is a representation of it’s ability to fulfill it’s contractual obligations to it’s policy holders.

When it comes to financial strength and stability it doesn’t get much better than North American. They were founded in 1866, are privately held and have over 615,000 life insurance and annuity policies in place.

| North American Company for Life and Health Insurance | Rating |

|---|---|

| Mailing Address | P.O. Box 79905, Des Moines, IA 50325-0905 |

| A.M. Best Rating (15 Possible Ratings) | A+ |

| Fitch Ratings (Financial Strength, 21 Ratings) | A+ (5) |

| Weiss | B(5) |

| Comdex Score (Percentile of All Rated Companies) | 89 |

| Standard & Poor's (Financial Strength, 20 Ratings) | A+ (5) |

NAC VersaChoice 10 Product Details

The Versa Choice 10 is a fixed index annuity designed to be a long-term retirement savings vehicle. A fixed index annuity is a type of fixed annuity that provides principal protection, meaning your account value will never decrease due to market performance.

Unlike a traditional fixed annuity, it does not guarantee a specified rate of return. Instead, the interest you earn on an annual basis is tied to the performance of an external stock market index.

When purchasing this annuity it is important to note that you are making a 10 year commitment. During the 10 year contract period the owner is able to take an annual withdrawal of up to 10% of the previous years account value.

| North American Company | Versa Choice 10 |

|---|---|

| Product Type | Fixed Index Annuity |

| Duration | 10 Years |

| Free Look Period | 20 Days |

| Maximum Issue Age | 79 |

| Minimum Purchase Premium | $20,000 |

| Free Withdrawal Provisions | 10% annually beginning year 1 |

NAC VersaChoice 10 Fees

Example Fee Calculation:

Assuming account value of $100,000: $100,000 X .60% = $600 annual fee. The optional enhanced liquidity benefit (ELB) rider provides you with the following additional liquidity features:-

- Enhanced penalty-free withdrawals: Beginning in the second year, up to 20% of the beginning-of-year accumulation value penalty-free if no withdrawals, other than rider charges and any strategy charges, were taken in the prior year.

-

- Return of premium (ROP): Any time after the third contract year, the client may terminate the contract and receive no less than the contract’s net premium paid. Net premium is equal to initial and subsequent premiums minus any withdrawal amounts, excluding the rider cost and any strategy charges, after any surrender charges or market value adjustment.

-

- ADL-based surrender charge waiver 5: If client is unable to complete two of the six activities of daily living (ADLs) after the issue date and otherwise qualifies, it’s possible to get up to 100% of accumulation value immediately with no surrender charges.

-

- ADL-based payout benefit 5: After the second contract anniversary, if a client is unable to complete two of the six ADLs and otherwise qualifies, they may choose to draw an income over five years that is based on an enhanced accumulation value amount (percentage varies by contract year, see chart). This accumulation value multiplier increases the longer money is kept in the annuity, maxing out after six years. See the brochure and disclosure for ADL definitions.

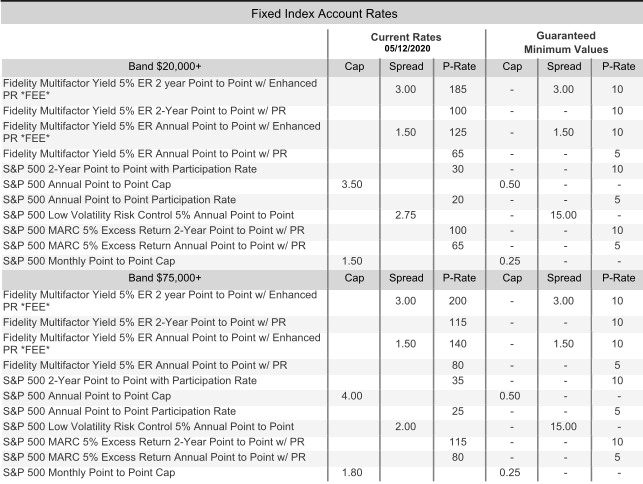

North American VersaChoice 10 Rates

The Versa Choice 10 has quite the abundance of different indexes and crediting options to choose from. Below is a list of the available indexes along with the crediting method and rates for each.

Shop and compare other fixed index annuity rates

VersaChoice 10 Realistic Return Expectations

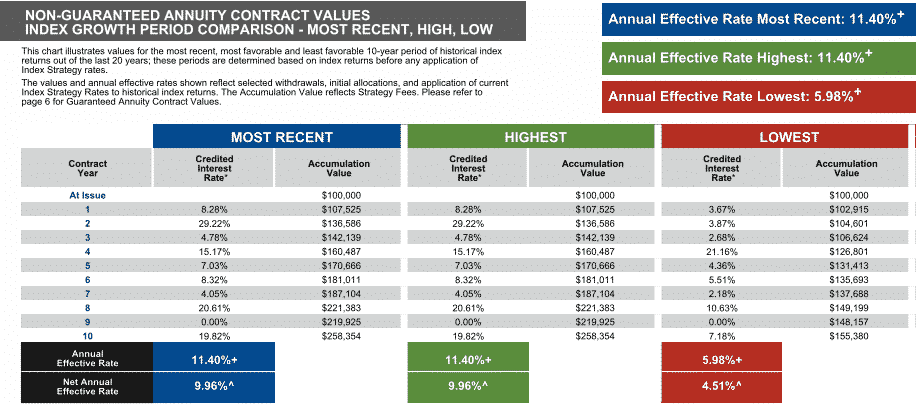

We ran a hypothetical illustration using the software provided by North American on their website to get an idea of what type of performance one could expect. The below table shows what the hypothetical returns would have been for the best, worst and most recent 10 year periods.

The most recent 10 year period in this case also happened to be the best 10 year period. As you can see the most recent and best 10 year periods annual effective yield was 11.40% and the lowest 10 year period had an annual effective yield of 5.98%.

For the purposes of this illustration we placed 50% of the premium in the Fidelity Multifactor Yield 5% ER annual point to point with participation strategy and the other 50% in the Fidelity Multifactor Yield 5% ER two year point to point with participation strategy.

These returns are unusually high for an index annuity, but quite impressive. If the policy could deliver even the lowest shown effective annual yield of 5.98% over the next 10 years we would consider this to be a very good return for an investment product with zero downside risk.

Recently Launched Fidelity Multifactor Yield 5% ER Index. Ticker: FIDMY

The Fidelity Multifactor Yield Index 5% ER is built on …

Expertise

Diversification

Consistency

Market fluctuations seem to be the only constant these days. And you may be searching for new ways to help manage this volatility, while also growing your assets for retirement.

One option is to harness the power of factors with the Fidelity Multifactor Yield Index 5% ER.

This rules-based index blends six equity factor indices with U.S. Treasuries and cash, using a dynamic allocation approach that seeks to reduce volatility to deliver more consistent returns over time.

North American has licensed the Fidelity Multifactor Yield Index 5% ER for exclusive use on select fixed index annuity products.

Managed by a Fidelity Team with 50+ Years of Quantitative Investment Experience

Research Team

• Nearly 100 quantitative investment professionals across equity, fixed income, and asset allocation

• Provides expertise to retail, intermediary and, institutional strategies

Tools & Resources

3,000+ equity and fixed income characteristics in the research library

• Style factors

• Macro factors

• Custom, proprietary risk-management tools

Final Thoughts on NAC VersaChoice 10 Index Annuity

The North American VersaCoice 10 may be a an annuity option for anyone who has money they’d like to invest for a 10 year time horizon. In our mind it would be a great option for someone 10-15 years from retirement with a 401k that could be rolled over from a previous employer.

The amount of options and the impressive hypothetical performance of the brand new FIDMY Index would be hard to beat anywhere in the annuity marketplace. Couple the strength of the product with an insurance company with more than 150 years under their belt and an A+ AM Best rating and you have an attractive offer. That is, if you have a 10 year time horizon.

Back to Annuity Reviews

This is an independent annuity product review, not a recommendation or solicitation to buy or sell an annuity. North American Company has not endorsed this review in any fashion and we don’t receive any compensation for it.

Be sure to do your own due diligence, we recommend consulting with a properly licensed professional regarding any questions you may have. Values shown are not guaranteed unless specifically stated otherwise.

Rates and annuity payout rates are subject to change. Actual values may be higher or lower than the values shown. The illustration is not valid without all 18 pages and the statement of understanding.

Client Reviews

As Seen On: