Free Annuity Quote

Fill out the form below to receive a free annuity quote within 4 business hours, or use one of our annuity calculators.

Atlantic Coast Life Insurance Company was founded in South Carolina in 1925 and is rated B++ by AM Best.

On January 21, 2021, Atlantic Coast Life Insurance Company was assigned positive credit ratings by AM Best. Atlantic Coast Life received an AM Best Financial Rating of B++ and a Long-Term Issuer Credit Rating of BBB, both were assigned with a Stable Outlook.

| Atlantic Coast Life Insurance Company | Ratings |

|---|---|

| Mailing Address | 1565 SAM RITTENBERG BOULEVARD CHARLESTON, SC 29407 |

| Group Affiliation | Advantage Capital Group |

| A.M. Best Rating | B++ |

| State of Domicile | South Carolina |

| NAIC Company Code | 61115 |

| Assets | $466,382,649 |

| Liabilities | $425,333,973 |

| Website | ACLICO.com |

Atlantic Coast Life Insurance Company was founded in Charleston, South Carolina back in 1925. Initially, the company served local funeral homes and families in preparation for “end-of-life” situations. Since then, the company has grown to a nationwide scale and offers a variety of annuity and insurance products.

In 2015, Advantage Capital purchased Atlantic Coast Life from the Scarborough Family and Y. W. Scarborough returned to the position of president. Growth, expansion, and success have multiplied.

Atlantic Coast began an intense expansion that has helped them spread across the country! The new ownership has guided them into the Annuity Marketplace. Today they offer some of the best fixed annuity rates available anywhere.

Fill out the form below to receive a free annuity quote within 4 business hours, or use one of our annuity calculators.

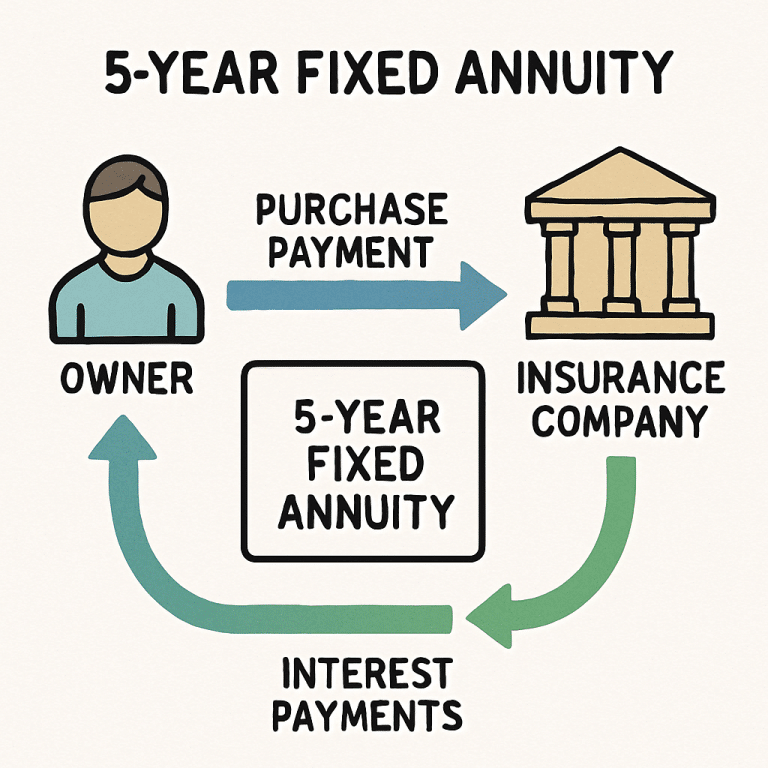

Multi Year Guaranteed Annuities

Atlantic Coast Life Insurance Company’s Fixed Index Annuities offer two market indexes to choose from:

Created by Goldman Sachs & Co. LLC, the Index, dynamically allocates to equities, as represented by the Aging of America Index, and U.S. fixed income, as represented by the 10-Year U.S. Treasury Rolling Futures Index.

The Aging of America index seeks to provide targeted exposure to companies in the healthcare and real estate sectors that may benefit from the growth in the older population in the United States.

Such segments can include Cancer Care, Cardiovascular Care, Orthopedic Care, Diabetes Care, Medicare Insurers, and Assisted Living.

Exposure to the 10- Year U.S. Treasury Rolling Futures Index, a known fixed-income benchmark, is based on a daily observed momentum signal.

The Goldman Sachs index includes a volatility control feature seeking to generate more stable, smooth returns over time.

The Goldman Sachs Aging of America Dynamic Balance Index is comprised of:

* An allocation above 100% represents leveraged exposure to the Index.

Volatility Controlled:

The index is a rules-based methodology that seeks to provide dynamic exposure to the equity and fixed-income components. Risk is monitored daily, and re-balancing generally results in higher weighting in components with lower historical volatility and less weight to those with higher historical volatility.

The index has a 5% volatility cap and to the extent, the volatility cap is exceeded, the money market allocation is increased. The index is calculated on an excess return basis.

Between 1925 and 1940 Atlantic Coast Life’s Home Service Distribution was built by recruiting sales agents and building district offices throughout South Carolina. In 1946, the Scarborough Family started Cosmopolitan Life Insurance Company, and in 1954 merged its operations into Atlantic Coast Life.

Their Home Service distribution reached its height in 1978 employing a field sales force of over 250 persons working out of 15 District Offices strategically located across the state of South Carolina.

In 1954, the Scarborough Family acquired one hundred percent of the Atlantic Coast Life stock and the company began an era of success and growth that has spanned nearly ten decades.

When Mr. Y. W. Scarborough passed away in 1956, the responsibility of leadership was passed to his son, Y. W. Scarborough, Jr., then to R. B. Scarborough in 1989, and then to Y.W. “Bill” Scarborough, III, in 1995. Wallace B. Scarborough served as President from 2013 to 2015.

In the mid-’90s their Home Service Distribution peaked, and the company’s growth slowed significantly. Y.W. “Bill” Scarborough had the vision to dramatically change the company’s distribution strategy and focused most of the company’s efforts and resources to launch a new distribution arm to reinvigorate sales and growth.

This decision transformed the course of Atlantic Coast Life’s voyage into the future. The Preneed Division set sail in August 2003. In 2005, after 18 months of success, above our expectations, they began to expand the Preneed Division into nine neighboring Southeastern states.

By 2008, we were known throughout the Southeast as a serious competitor and as a growing presence in the Preneed marketplace.

In 2015, Advantage Capital purchased Atlantic Coast Life from the Scarborough Family and Y. W. Scarborough returned to the position of president. Growth, expansion, and success have multiplied.

Atlantic Coast began an intense expansion that has helped them spread across the country! The new ownership has guided them into the Annuity Marketplace. Today they offer some of the best-fixed annuity rates available anywhere.

Kenneth King – Chairman

Daniel B. Cathcart – Chief Executive Officer

Charles E. Sanders – President

Douglas Anthony George – Executive Vice President of Business Development

George Cox Scarborough – Senior Vice President and Secretary

Sabrina Lemos – Treasurer

Kenneth King – Chairman

Daniel B. Cathcart – CEO

Douglas Anthony George

Y.W. Scarborough III

Robert Saliba

The Best Annuity Companies in 2023 Annuity products are very customizable which is likely why they’ve gotten a reputation for being too complicated over the

Use one of 20 annuity calculators and see how your annuity will grow over time, or calculate how much interest an annuity will pay you per month.

Updated — Today’s Best 5-Year Fixed Annuity (MYGA) Rates We’ve made it easy for you to compare today’s best 5 year fixed annuity rates from

Fixed Index Annuity Pros and Cons How to Guide in 2023: Independent, Unbiased and Transparent insights without industry jargon.

Tip: Check spam/promotions if you don’t see our email on time.

Need help sooner or have a quick question?

What happens next

Tip: Check your spam or promotions folder if you don’t see our email within the time window.