What is a Market Value Adjustment (MVA)?

Market Value Adjustment (MVA) is an adjustment applied to withdrawals from an annuity contract in excess of the free withdrawal amount during the initial surrender period.

Market Value Adjustment (MVA) Key Facts:

- An MVA is only applied when a surrender charge is applied

- Market value adjustments are not applied once your annuity is out of surrender

- An MVA can be positive or negative; meaning it could work in your favor

- An MVA does not impact the death benefit paid to beneficiaries

- MVA's don't apply to annual free withdrawals provided by the annuity contract (typically 10% or accumulated interest)

Market value adjustments will increase your annuities accumulation value upon surrender if interest rates are lower than they were at the time your annuity contract was issued.

When you buy an annuity the insurance company invests your money in fixed income assets- oftentimes bonds. If you surrender your annuity contract early the insurance company must sell these investments. If new bonds are paying higher rates they will incur a loss on the sale of their bond.

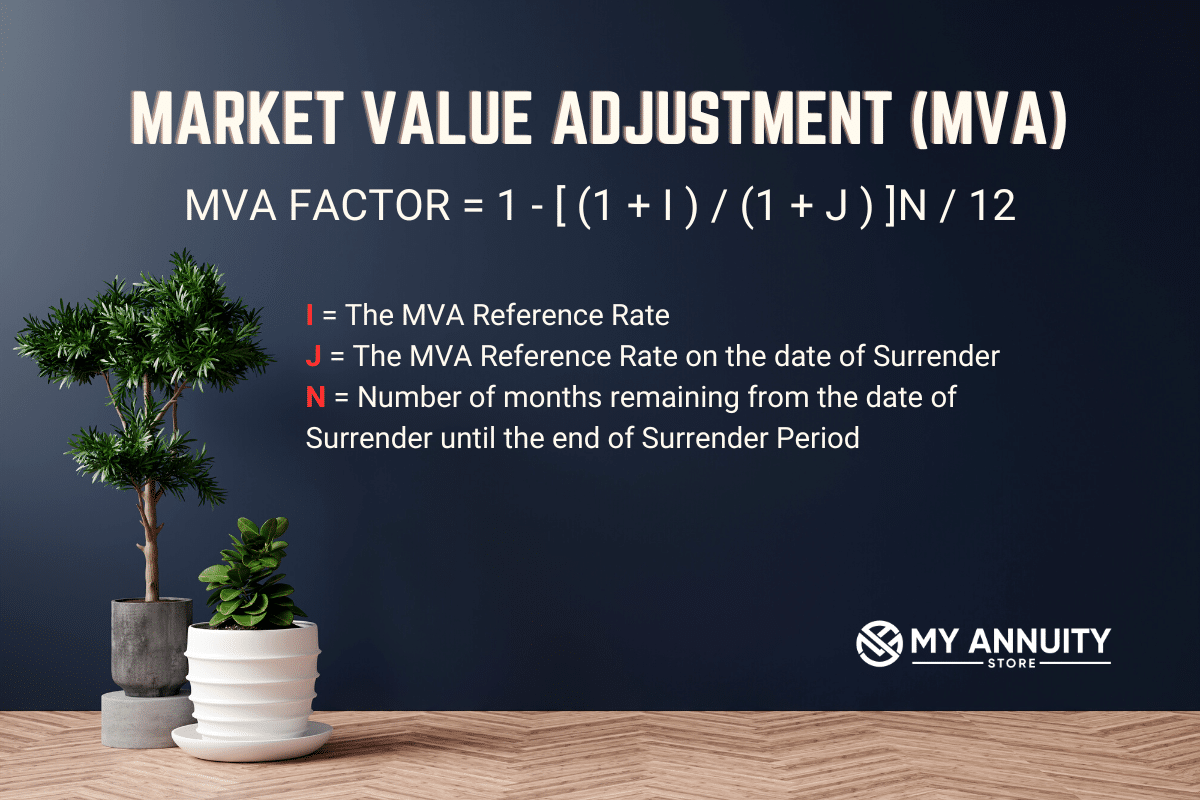

How is Market Value Adjustment (MVA) Calculated?

The MVA is calculated by multiplying the weighted average MVA Factor by the amount of the Accumulation Value surrendered. The MVA Factor for each premium payment is:

MVA Factor = 1 – [ (1 + I ) / (1 + J ) ]N / 12

Where:

- I = The MVA Reference Rate for the premium payment on the date the premium was credited to the Accumulation Value.

- J = The MVA Reference Rate on the date of Surrender.

- N = The number of full months remaining from the date of Surrender until the end of the Surrender Charge Period.

Individual MVA Factors are weighted by the original premium payment amounts to determine the weighted average MVA Factor. The MVA can be positive or negative.

MVA Reference Rate

The U.S. Treasury Constant Maturity yield is the most commonly used MVA Reference Rate for the maturity matching the duration of the Surrender Charge Period.

The average is measured using yields on the 1st, 8th, 15th, and 22nd day of the calendar month preceding the calendar month for which the MVA Reference Rate applies. If the U.S. Treasury Constant Maturity yield is not published for a particular day, the next published yield is used.

If the U. S. Treasury Constant Maturity yield (or the contractually declared MVA Reference Rate) is no longer published or is discontinued, the insurer may substitute another suitable method for determining this component of the MVA Reference Rate.

Any substitution of the U.S. Treasury Constant Maturity yield is subject to approval by the Interstate Insurance Product Regulation Commission (IIPRC).