Nationwide Peak 10 Annuity Review

This Nationwide Peak 10 Annuity Review will cover:

- Nationwide’s Financial Ratings

- Index Annuity Basics

- Product Highlights

- Income rider(s)

- Historical Performance

- Pros and Cons of Nationwide Peak 10 Annuity

The Nationwide Peak 10 Annuity is the latest of many innovative annuities offered by Nationwide Life and Annuity Company. As a fixed index annuity, Nationwide’s Peak 10 Annuity provides principal protection.

Nationwide Financial Ratings

If you are thinking of buying an annuity, it is important to consider the financial strength of the issuing insurance company all guarantees are subject to the claims-paying ability of the insurer.

Nationwide has an A+ A.M. Best Rating and Standard and Poor’s Rating, an A1 rating from Moody’s, and a 90 Comdex Score. In addition to its strong financial ratings, Nationwide has been serving clients since 1925 and is a Fortune 100 Company.

These ratings are certainly extraordinarily strong; the 90 Comdex score indicates they are in the top 90th percentile of all rated insurance companies.

| Nationwide Life & Annuity Company | Rating |

|---|---|

| One Nationwide Plaza, Columbus, OH 43215 | |

| A.M. Best Rating (15 possible ratings) | A+ (2) |

| Moody's (21 possible ratings) | A1 (5) |

| Standard & Poor's (Financial Strength, 20 Ratings) | A+ (5) |

| Comdex (percentile of all rating companies) | 90 |

Fixed Index Annuities

The Nationwide Peak 10 is a fixed index annuity. Indexed Annuities offer returns based on the changes in an underlying index, such as the S&P 500® Composite Stock Price Index, and

- Receive earnings when the underlying index goes up.

- Credit zero percent interest when the underlying index goes down.

Fixed-indexed annuities also offer a specified minimum that the contract value will not fall below, regardless of index performance. A fixed-indexed annuity is not a stock market investment, nor does it directly participate in any stock or equity investment.

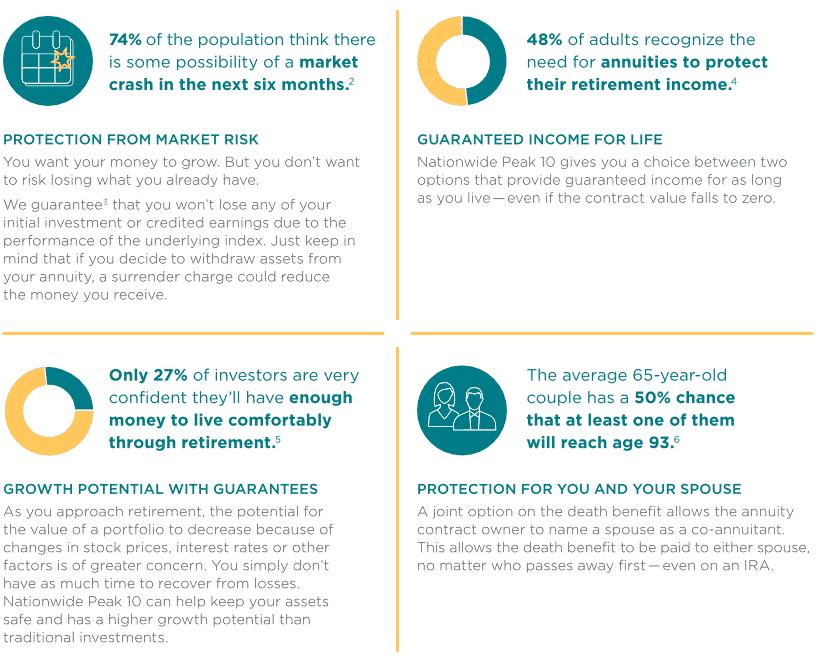

Peak 10 Annuity and Retirement Risks

As life expectancies increase and the responsibility of funding retirement shifts to the individual, a product that offers both growth potential and principal protection is more important than ever. That’s where a fixed-indexed annuity may help.

Nationwide Peak 10 Product Highlights

PLAN TYPE:

Nonqualified, IRA, Roth IRA, SEP-IRA, SIMPLE IRA, charitable remainder trust, and 401(a)

MAXIMUM ISSUE AGE:

Annuitant: 85 (single or joint); owner: any age

MINIMUM INITIAL PURCHASE AMOUNT:

$25,000 — qualified or nonqualified; single purchase payment; subsequent payments not allowed

ACCOUNT OPTIONS:

- Index account: Earnings may be credited for each one- or two-year term

- Fixed account: The annual interest rate is credited daily; tiered rates are available based on premium.

- Purchase payment: It may be allocated across any available fixed and indexed option, with a maximum combination of five (whole number percentages only).

SURRENDER CHARGE SCHEDULE FOR EARLY WITHDRAWALS:

Completed years | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

Surrender charge | 10% | 9% | 8% | 7% | 6% | 5% | 4% | 3% | 3% | 3% | 0% |

Death Benefit: Full Account Value

Long-term care or confinement waiver: 100% of the contract may be withdrawn penalty-free if you are confined to a nursing home for a continuous 90-day period; confinement must begin after the contract is issued and may not be available in all states; maximum issue age is 80.

Free Withdrawals up to 10% of your account value annually: (keep in mind that any distributions prior to age 59 1/2 may be subject to a 10% penalty tax).

Terminal illness or injury waiver: 100% of the contract value may be withdrawn penalty-free after the first contract year if terminal illness or injury is diagnosed after the contract is issued; maximum issue age is 80; not available in NJ; in CT, available only after the second contract anniversary.

Required minimum distributions, even if they exceed 10% of your contract value; please keep in mind that money withdrawn from the index account during the index term will forfeit potential earnings that would have been credited at the end of the term.

Guaranteed Lifetime Withdrawal Benefits

The Nationwide Peak 10 Annuity comes offers two-lifetime income rider options available; the Guaranteed Income Solution is included at no cost and the Bonus Income+ Rider can be added for a fee.

- Lifetime withdrawals can begin at any time — there is no waiting period

- Each calendar year, the Income Benefit Base becomes greater than the contract value or the roll-up value.

- Income Benefit Base: The numerical value used to determine how much your lifetime withdrawals will be; it is the higher your contract value or the guaranteed simple interest roll-up. It is not a cash value.

Free Guaranteed Income Solution

This is a built-in feature of your annuity and is included at no additional cost. It offers a 4% simple interest roll-up on the income benefit base (your premium) for 10 years or until the first withdrawal, whichever comes first.

Lifetime Withdrawal Percentages:

Bonus Income+ Rider

Cost: Single life: 1.00%; joint life: 1.30%. An annual fee is charged quarterly on the contract value.

- 10% bonus credited at contract issue and based on the purchase payment/initial premium will be included in the original Income Benefit Base; no vesting schedule

- Guaranteed 7.0% simple interest roll-up of the Income Benefit Base3 for 10 years or until the first-lifetime withdrawal, whichever is first

- Not available with beneficially owned contracts

- A joint life income option is available

- If withdrawals taken for the purpose of RMDs exceed the lifetime withdrawal amount, the Income Benefit Base will not be reduced

- One non-lifetime withdrawal may occur without stopping the simple interest roll-up or locking in the lifetime withdrawal percentage; it can be exercised only once and is available only after the first rider year; once lifetime withdrawals have started, the non-lifetime withdrawal feature is no longer available

Nationwide Peak 10 Hypothetical Historical Performance

The table below lists the hypothetical historical performance of each index crediting option available in the Peak 10 Annuity.

Pros and Cons of Nationwide Peak 10

Pros

- They have unique indexes in the Alliance and Bernstein Growth Value and JP Morgan Cycle index.

- Care Concierge is a value-add feature to the product that lets the policyholder and immediate family members have access to telehealth and additional health-related resources.

- Can issue out to age 85.

- Nationwide is an ANNUITANT-driven company.

- Nationwide is the ONLY company to allow such a feature in Qualified Dollars (IRAs, SEP, Roth IRAs)

- Nationwide allows a Co-Annuitant to be named to the contract.

Cons

- A 10-year surrender charge schedule is a long time if you do not intend to these funds into a lifetime income.

- Brand new index so not a lot of history on how it will perform.

Downloadables:

Get a Nationwide Annuity Quote

Complete the form below and we’ll email you an annuity quote within four business hours. If your request is urgent please contact us at 855-583-1104. Or you can use one of our annuity calculators here.