Prudential Defined Income Variable Annuity Review

The Prudential Defined Income Variable Annuity is a long-term retirement investment with a built-in guaranteed lifetime withdrawal benefit that tells you exactly what your lifetime income will be whether you begin taking income immediately or at some point in the future.

Variable Annuities

A variable annuity may be a good choice for those who want the long-term opportunity for growth in the market and who are able to handle the risks that volatility. The Prudential Defined Income Variable annuity is not as aggressive as many annuities so this investment would not experience the level of volatility equal to equities, or most variable annuities for that matter.

The defined income VA also comes with an included lifetime withdrawal benefit and a death benefit further reducing risk.

Advantages the Prudential Defined Income can Provide:

- A predictable annual income stream for life, without stock market exposure

- Guaranteed income, at a lower cost, than most variable annuities with living benefits

- The option to defer withdrawals and further grow your income

- The flexibility to access your funds (subject to contract terms)

- A built-in death benefit for your loved ones

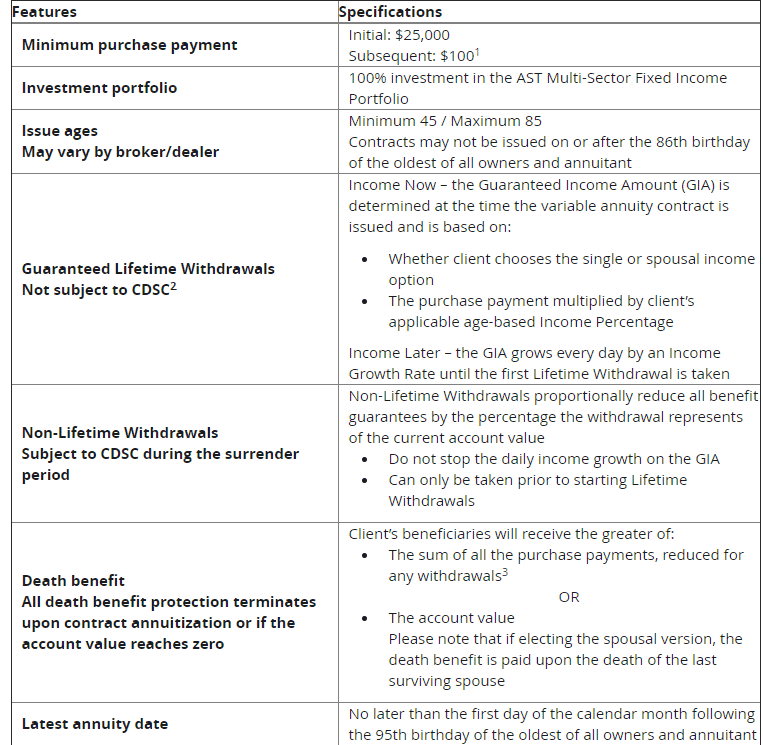

Prudential Defined Income Variable Annuity Product Specifics:

- Minimum age for initial purchase: 45

- Maximum age for initial purchase: 85

- Minimum initial purchase payment: $25,000

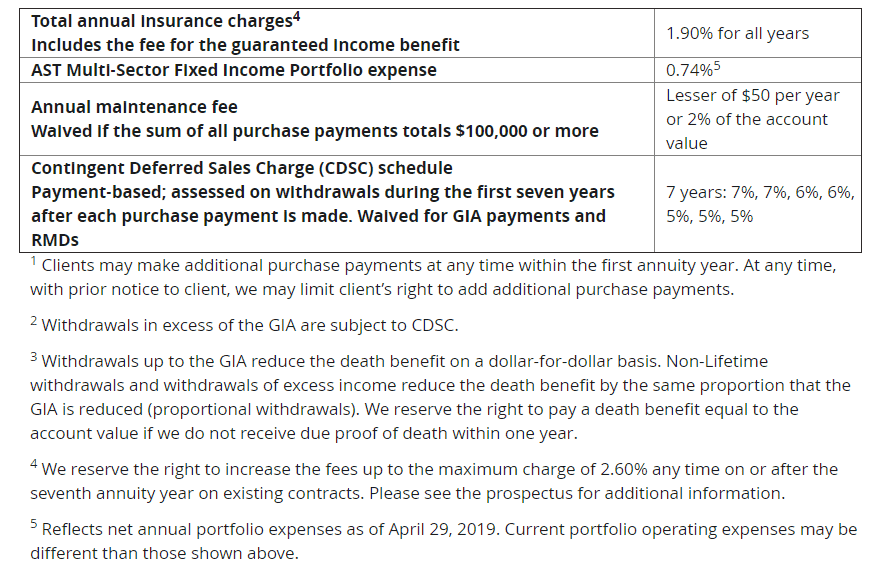

- Prudential stated fee: 1.9%

- True all in fee: 2.73-3.43%

- Website: www.annuities.prudential.com/investor

Prudential Defined Income Variable Annuity Fees:

- Annual Maintenance Fee:$50 or 2% of the account value, whichever is lesser

- Mortality & Risk Charge (M&E Fee): .95%

- Administration Fee: .15%

- Defined Income Benefit Charge: .80%

- Sub-account Fees: .83%

- Total Annual Fees: 2.73%

Investment Allocations:

Prudential Defined Income helps reduce your exposure to equity markets by fully investing your money in Prudential’s AST Multi-Sector Fixed Income Portfolio, a four-star rated fund in the Morningstar US Insurance Corporate Bond category (out of 169 funds).*

According to Prudential’s website as of 12/31/2019, actual allocations and credit quality may vary over time due to performance and/or portfolio manager discretion. The Portfolio may invest up to 10% of its invest-able assets in bonds rated below investment grade (which are commonly referred to as “junk bonds”). Due to rounding, percentages and portfolio composition may not sum to 100%.

Key Features:

Prudential makes a point of highlighting these in their sales literature:

- Create guaranteed lifetime income, even if your account balance goes to zero (as long as no excess withdrawals are taken)

- Grow your income by delaying withdrawals

- Gain access to your money if you need it

- Provide for your loved ones with a built-in death benefit

Prudential Defined Income Variable Annuity Product Specs

Fees and Charges (annually)

My Annuity Store's Final Thoughts

In all honesty I can not think of a situation when this would be the best possible annuity. Things that I don’t like about it:

- Only one investment allocation option

- The investment fun is made up of approximately 170 different bond mutual funds.

- The whole point of purchasing a variable annuity vs a fixed index annuity is getting more upside. The fact the only investment option is a fixed income funds lessens the appeal for me on this one.

- Guaranteed Lifetime Payout percentages are decent but there at least a dozen other annuity products that will guarantee more income if that is your objective.

- High Fees. Total fees are at 2.73% which seems quite high for what you are getting

Back to Annuity Reviews

This is an independent annuity product review , not a recommendation or solicitation to buy or sell an annuity. Prudential has not endorsed this review in any fashion and we don’t receive any compensation it.

Be sure to do your own due diligence, we recommend consulting with a properly licensed professional regarding any questions you may have. Values shown are not guaranteed unless specifically stated otherwise.

Rates and annuity payout rates are subject to change. Actual values may be higher lower than the values shown. The illustration is not valid without all 18 pages and the statement of understanding.