Nasdaq FC Index Overview

The Nasdaq Fast Convergence Index (“Nasdaq FC Index”) powered by BofA uses an innovative technology (patent-pending) that aims to reduce risk and improve performance by adapting faster to changing market conditions.

The Nasdaq FC Index is designed with the goal of improving participation rates in an index-linked product; such as Athene Fixed Index Annuities.

You can now access an index known for innovation:

Since its inception over 30 years ago, the Nasdaq-100 Index has become one of the world’s preeminent large-cap growth indexes. The Nasdaq-100 Index is home to some of the world’s most innovative companies:

- Apple,

- Google,

- Intel, and

- Amazon

Volatility targeting in the Nasdaq FC Index takes place before the performance control mechanism is applied. The uncapped index (“Nasdaq FC Base Index”) applies a 12.5% volatility target. FC Technology measures and responds to volatility during the trading day.

When realized volatility increases above the 12.5% target, the Index aims to mitigate losses by allocating non-interest-bearing cash. When realized volatility decreases below the target, the index applies up to 175.0% leverage with the goal of capturing returns.

Nasdaq Fast Convergence Index (BOFANFCC)

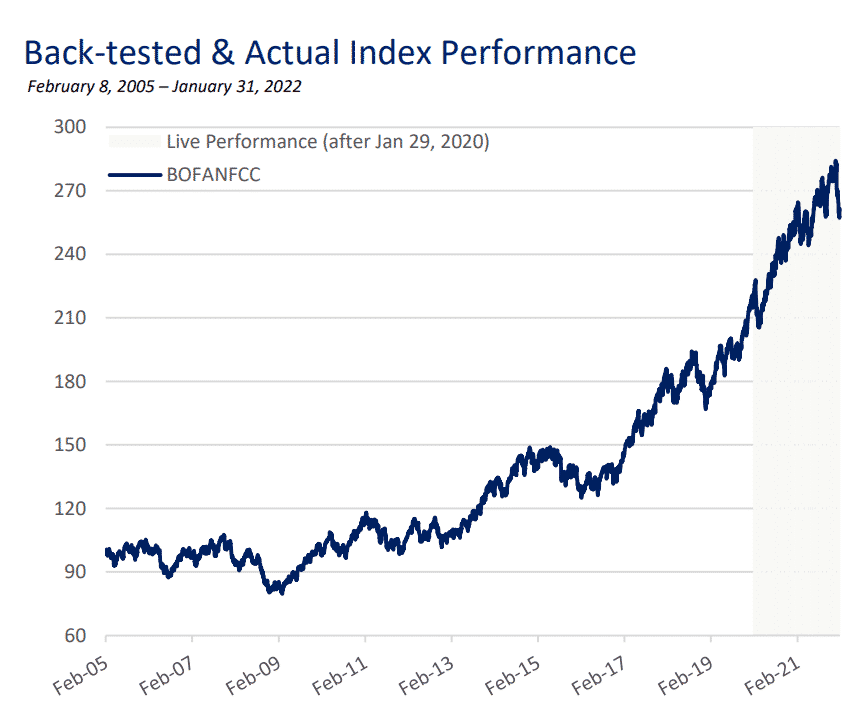

Nasdaq FC Index: Hypothetical Index Values

What makes the Nasdaq FC Index unique among its volatility-managed index peers is its ability to re-allocate hourly throughout the day; meanwhile the other volatility-managed stock market indexes only get that pleasure once per day.

Monitoring and managing market moves at this speed help the BOFANFCC more efficiently control the realized volatility of the index, with the goal of added consumer value.

Source: Bloomberg, BofA Securities The Nasdaq FC Index (BOFANFCC) includes a monthly performance cap rebalanced daily, and was created on 29-Jan-2020. Levels for the Index before 29-Jan-2020 represent hypothetical data determined by retroactive application of a back-tested model, itself designed with the benefit of hindsight. Past performance is not indicative of future performance. Actual performance will vary, perhaps materially, from the performance set forth herein. The performance of the Index includes a 50bps fee drag and does not include fees or costs of any financial instrument referencing the index.

Get a Nasdaq FC Annuity Quote

Nasdaq FC Index Performance Q4, 2021

The Nasdaq-100 TR Index started Q4 with a nearly 8% rally in October. While November and December performance was positive, gains were tempered by periodic draw-downs driven by the Omicron variant, inflation concerns, and the potential for multiple rate hikes in 2022.

The Nasdaq-100 TR Index reached all-time highs on December 27 and returned over 11% in Q4.

Fast Convergence technology is a patent-pending type of volatility control that reacts as often as hourly to market moves with the goal of mitigating draw-downs and capturing outperformance.

As markets moved over the period, exposure to the Nasdaq-100 TR Index ranged from a low of 42.3% to a maximum of 175% in October as markets trended higher. The Nasdaq FC Index returned 5.7% in October, capturing 72% of the Nasdaq-100 TR Index’s 7.9% return.

Reacting to heightened volatility, exposure to the Nasdaq-100 TR Index fell below 50% in early December. Lowered exposure to Nasdaq-100 TR Index losses over this time period helped the Nasdaq FC Index preserve gains to return 7.4% in Q4.

Nasdaq FC Index Performance in Athene Annuity

The two tables below show the hypothetical rate of returns for the Nasdaq FC Index inside of Athene Performance Elite 7 Fixed Index Annuity. The way you can purchase the Nasdaq FC Index is to select it as one of your index annuity crediting strategies in an Athene Index annuity.

The performance of the index is measured annually and every two years. If you select the annual point-to-point option you are credited with 47% of its total performance for the year, and you participate in 70% of the upside over a two-year period should you select that option.

If the Nasdaq FC index goes down you get for any of your terms your annuity gets zero percent for the year, regardless of how much the market was to decrease.

Additional Resources

BOFANFCC Index Overview

Frequently Asked Questions

What is the Nasdaq FC Index?

The Nasdaq FC Index applies this capability to the stocks in the Nasdaq-100. It aims to increase returns by rebalancing throughout the day to manage exposure to the Nasdaq-100. The Nasdaq FC Index strives to realize growth potential by targeting 12.5% annualized volatility.