Athene Annuity Ratings 2023

Athene is a financially strong company and is rated A by A.M. Best, Fitch, and Standard & Poors. They also boast a Comdex Score of 78 placing them in the 78th percentile of all rated insurance companies. The table below lists Athene Annuity Ratings including Standard & Poor’s, Fitch, Weiss, and AM Best.

Athene is a financially strong company and is rated A by A.M. Best, Fitch, and Standard & Poors. They also boast a Comdex Score of 78 placing them in the 78th percentile of all rated insurance companies. The table below lists Athene Annuity Ratings including Standard & Poor’s, Fitch, Weiss, and AM Best.

| Athene Annuity Ratings | Rating |

|---|---|

| A.M. Best Rating | A |

| Fitch Ratings | A |

| Comdex | 78 |

| Standard & Poor's | A |

Learn more about what these financial ratings mean.

Athene Investment Holding's

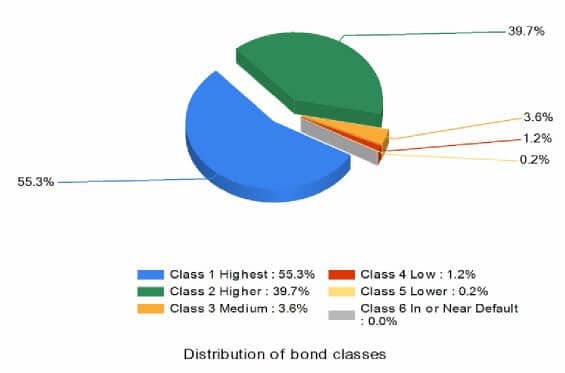

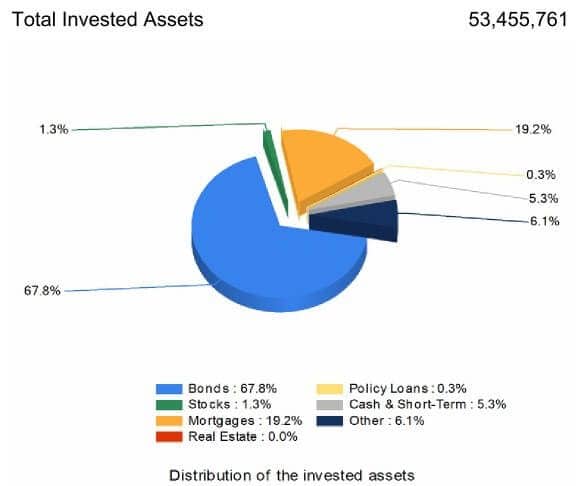

The pie chart below lists Athene’s invested asset distribution. As you can see they hold 67.8% of their assets in bonds and 19.2% in mortgages.

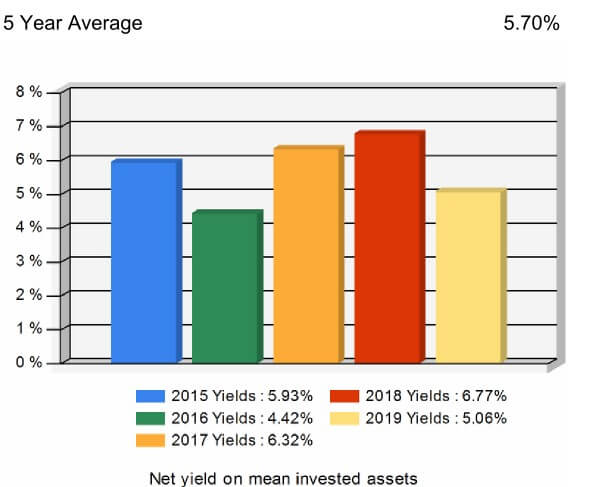

The percentage allocated to mortgages is much higher than most insurance companies. The bar chart shows their 5-year investment yields going back to 2015.

Athene Annuity and Life Insurance Company

Athene Annuity & Life Insurance Company is a leading provider of products in the retirement savings market. Athene has an A rating from AM Best and was founded in 1896.

Athene surpassed Allianz Life as the #1 Provider of Fixed Index Annuities in 2020, based on total U.S. Individual Fixed Index Annuity Sales. They also own the Athene Annuity & Life Assurance Company of New York which issues their annuity products in the state of New York.

In addition to issuing its own annuity contracts, Athene is also one of the nation’s top re-insurers of other insurers’ existing blocks of annuity business.

If you are considering purchasing an Athene annuity you may find one of the below Athene annuity reviews to be helpful. The Athene Agility 10 comes with a built-in income rider at no cost and is a good choice for someone wanting a lifetime income.

Meanwhile, the Performance Elite 7 is a good choice for safe accumulation.

Athene Annuities

Fixed Index Annuities

- Protector 7

- Accumulator 7 Annuity Rates

- Agility 7

- Ascent Pro 7

- Protector 5

- Accumulator 5

- AccuMax Annuity Review

- Performance Elite 15

- Ascent Accumulator 10 Annuity Rates

- Performance Elite 7 Review

- Performance Elite 10

- Agility 10 Review

- Ascent Pro 10

- Ascent Pro 10 Bonus

Fixed Annuities

Athene MaxRate Fixed Annuity 3, 5, and 7 years are available.

Index Options in Athene Annuities

Ticker Symbol: SGMDJMCI

Unlocking growth potential using the wisdom of the crowd. The index strategy features a performance engine designed by Janus Henderson® Investors based on analyst price targets and past dividends to select the stocks with the best growth potential among the largest US-listed companies.

A volatility feature targets a volatility level of 20%. A Performance Control Mechanism limits growth monthly in return for potentially higher participation rates.

Ticker Symbol: SPX8UN2

Strives to deliver stable, risk-adjusted returns in all environments. Represents a portfolio of the S&P 500® plus a liquid bond index. This volatility control index targets a volatility level of 8%.1 Rebalanced daily.

A dynamic and diversified index from a global banking powerhouse. Eight underlying components including equity futures, bond futures, and commodity indices provide exposure to a range of asset classes across three geographic regions.

A volatility feature targets a volatility level of 5% and rebalances daily.

Capitalize on growth potential in one of the world’s preeminent technology indices. Patent-pending FC technology is designed to adapt to constantly changing economic conditions more quickly and efficiently than traditional volatility control mechanisms. The Nasdaq FC Index applies this capability to the stocks in the Nasdaq-100.

Choose a smart large-cap equity strategy built by IBM Watson.® Each month, AiPEX selects approximately 250 equity stocks from the 1,000 largest U.S. companies using a scoring system that evaluates financial health and management strength as well as market sentiment, and economic and geopolitical risks.

AiPEX reacts daily to changing market conditions, reducing the impact of short-term volatility by adjusting exposure to the underlying stocks. The index manages a 6% daily volatility target.

Historical Athene Index Annuity Returns

| Athene Best Stock Market Index Options and Crediting Options | Best | Recent | Worst |

|---|---|---|---|

| Athene Performance Elite 7 2-Year Nasdaq FC PT P Participation Rate | 5.99% | 6.41% | 1.91% |

| Athene Performance Elite 7 Plus 2-Year Nasdaq FC PT P Participation Rate Bonus: 5% Rider fee: 0.95% | 5.99% | 6.41% | 1.91% |

| Athene Performance Elite 10 2-Year Nasdaq FC PT P Participation Rate 10 surrender yrs Bonus: 2% | 5.99% | 6.41% | 1.91% |

| Athene Performance Elite 10 Plus 2-Year Nasdaq FC PT P Participation Rate Bonus: 8% Rider fee: 0.95% | 5.99% | 6.41% | 1.91% |

| Ascent Pro 10 2-Year Nasdaq FC PT P Participation Rate 10 surrender yrs Rider fee: 1% | 5.99% | 6.41% | 1.91% |

Get an Athene Annuity Quote

Complete the form below and we’ll email your annuity quote within four business hours. For more immediate assistance you can reach us at 855-583-1104, or use our annuity rates calculator.

Athene Annuity Reviews

Athene Annuity Contact Information

Website: https://www.athene.com/

Overnight Mailing Address:

7700 Mills Civic Parkway

West Des Moines, IA 50266

Group Affiliation: Athene Life Group

State of Domicile: Iowa

NAIC Company Code: 61689

Year Founded: 1896

Athene Annuity Phone Numbers:

888-ANNUITY (888-266-8489)

8:00 a.m. – 5:00 p.m. CT, Monday – Friday

Fax Number: 866-709-3922

Athene Annuity Login’s

Athene Annuity Login

Athene Advisor Login

Frequently Asked Questions

Can You Reallocate Index Strategies in Athene Annuities?

Athene Index annuities allow you to allocate your money among one or more of the available interest crediting strategies at the end of each crediting term (annually or semi-annually depending on the strategy you select).

Who Owns Athene?

Apollo Completed Merger with Athene; Finalizing Key Governance Enhancements on January 03, 2022.

Apollo, together with certain of its related parties and employees, owns approximately 35% of the outstanding Athene class A common shares.

How Old is Athene Insurance Company?

Founded in 2009, Athene also serves as Apollo’s partner insurance company and had total assets worth $202.8 billion at the end of 2020, with operations in the United States, Bermuda, and Canada.

Is Athene a Strong Insurance Company?

Athene is a financially strong life insurance company with an A rating from AM Best, Fitch, and Standard and Poors. In 2020 Athene was #1 in U.S. fixed index annuity sales after placing 2nd the previous two years.