Athene Performance Elite 7 Review

The Athene Performance Elite 7 is a fixed index annuity with a 7-year contract term. The Athene Performance Elite Annuity is designed for accumulation and not geared towards lifetime income.

The Performance Elite has 5 available indexes and four of them have “Un-Capped Index Annuity Crediting Methods.

The four market indexes with uncapped crediting options are:

- BNP Paribas Multi Asset Diversified 5 Index

- Nasdaq FC Index

- AI-Powered US Equity Index

- S&P 500 Daily Risk Control 2 8%™ Index TR (Total Return)

Athene Ratings

Before I dive into my Athene Performance Elite 7 Review, I want to knowledge the financial rating of Athene.

As you see in the table below, Athene is rated an A by AM Best, Fitch, Standard, and Poors and a Comdex Score of 78. These are strong ratings and so will judge this annuity purely on its own merit.

| Athene Financial Ratings | Rating |

|---|---|

| 7700 Mills Civic Parkway, West Des Moines, IA 50266 | |

| A.M. Best Rating (15 possible ratings) | A (3) |

| Fitch Ratings (21 possible) | A (6) |

| Comdex (percentile of all rating companies) | 78 |

| Standard & Poor's (20 possible ratings) | A (6) |

I also place a considerable amount of importance on how committed an annuity company is to the annuity market space when evaluating an annuity. All things else being equal, I would rate an annuity issued by one of the best fixed index annuity companies over a company that is not in the top 10.

| Annuity Company | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|

| Athene Annuity and Life Insurance Company | 1 | 1 | 1 | 2 | 2 | 2 | 3 |

| Allianz Life Insurance Company Ratings & Reviews | 2 | 2 | 2 | 1 | 1 | 1 | 1 |

| American General Life Insurance Company | 3 | 3 | 3 | 3 | 4 | 4 | 5 |

| Nationwide | 8 | 9 | 7 | 4 | 3 | 3 | 7 |

| American Equity | 10 | 6 | 10 | 5 | 6 | 6 | 2 |

How Much Does a $500,000 Annuity Pay Per Month?

North American Income Pay Pro Annuity Annuity Review

Performance Elite 7 Rates

After researching the available indexes, and running hypothetical calculations for all of the available strategies I believe the two best options are the:

- Nasdaq FC Index

- AiPex index

Here are very brief summaries of these two indexes:

The Nasdaq Fast Convergence Index is designed to improve participation rates in an index-linked product. By systematically monitoring market moves and rebalancing throughout the trading day, FC technology aims to more efficiently control the realized volatility of an index.

The AiPex Index is the first-ever U.S. Equity Index Powered by artificial intelligence and uses the IBM Watson Brain. It scores the 1000 largest companies by analyzing millions of pieces of information per day to select the best 250 stocks.

Reasonable Rate of Return Expectations

Let’s take a look at the historical rate of return for the Athene Performance Elite 7 with the following allocations:

- 50% Nasdaq FC Index Annual Point to Point

- 50% AiPex Performance Index Annual Point to Point

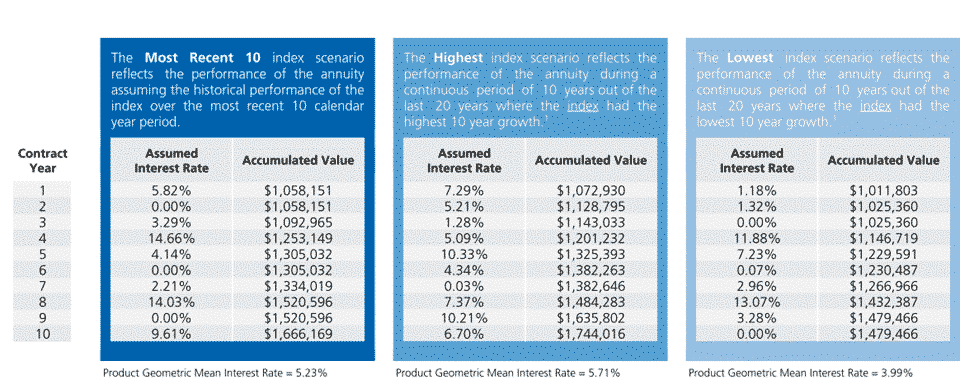

With our advanced annuity calculators we ran hypothetical and historical back testing to come up with a hypothetical average rate of return. Hypothetical returns are calculated by applying today’s current interest rates and applying them to the stock market index as if you purchased the annuity 10 years ago.

The hypothetical rates indicated assume a 50/ 50 allocation using the Nasdaq FC and AiPex annual point to point options’ (rates as of 10.11.2020).

As you can see in the tables below the average annual interest rate credited would have been:

- Most Recent 10 Year Period: 5.23%

- Highest 10 Year Period: 5.71%

- Lowest 10 Year Period: 3.99%

I also back-tested these two options separately to see how these strategies performed individually.

The Nasdaq FC index would have the performance at an average annual rate of 5.68% over the last 10 years.

The AiPex Index, the first-ever A.I. Powered US Equity Index showed an average annual rate of 4.78% over the same most recent 10 year period.

Nasdaq FC:

- Worst – 3.86%

- Best – 5.82%

- Most Recent – 5.67%

AiPex:

- Worst – 4.12%

- Best – 5.60%

- Most Recent – 4.78%

If you are considering an indexed annuity as a piece of your fixed income portfolio we will be happy to send you a personalized Athene Performance Elite annuity quote. Simply complete the form below or contact us – the #1 Authority on Fixed Index Annuities.

Performance Elite "Charge" Rate Strategy

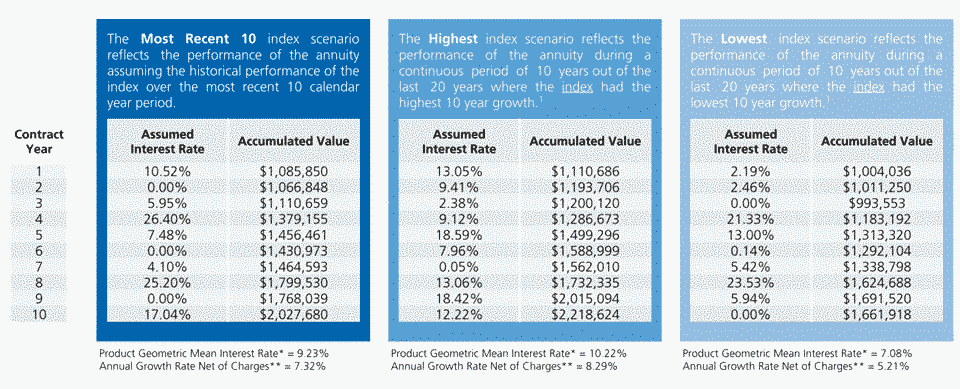

One of the more unique features of the Athene Performance Elite is the “with the charge” crediting option. For an optional fee of 95 basis points, you can purchase an increase in your annuity participation rates.

The 95 basis point fee equals $950 annually on a $100,000 annuity account value. For this fee the participation rate on the Nasdaq FC Index increases to 105% and 130% for the AiPex Performance Index.

The table below lists the most recent, lowest, and highest 10-year average rate of returns assuming we placed 50% in Nasdaq FC and 50% in AiPex just as before.

- Most Recent 10-Year Period – 9.23% Average

- Highest 10-Year Period – 10.22% Average

- Lowest 10-Year Period – 7.08% Average

Pros and Cons of Athene Performance Elite 7

Pros:

- 5 indices to choose from

- Uncapped crediting options available on 4 of the indexes

- Annual point-to-point and two-year point-to-point options available for diversification

- Innovative AiPex and Nasdaq FC Indexes

- Highly Rated and Experienced Issuing Company (Athene)

- Unique “with charge” option that allows you to purchase higher participation rates

- Above average Hypothetical Historical Rate of Returns

Cons:

- More complicated and obscure indexes and crediting strategies may seem confusing to clients and advisors alike; which may hinder some from considering them.

- Surrender Charges for withdrawals in excess of 10% annual free withdrawal amount during the 7-year contract period.

- Potential 10% IRS penalty on withdrawals prior to age 59 ½.

Athene Performance Elite 7 Review: Final Thoughts

Athene’s Performance Elite 7 Year Annuity contract is as good as any index annuity that’s come across my desk in quite some time. I really, really like the market indexes that are available inside of this annuity.

Three of which are proprietary to Athene and not available from any other annuity company. The variety of indexes and crediting methods are also a big positive.

I like the ability to purchase a higher participation rate for a fee; that is something we had not seen in any other indexed annuities at the time this annuity launched.

The historical rates of return are superior to almost all other 7 year fixed indexed annuities available today (issued by an A Rated Insurance Company). If your objective is safe accumulation I say the Athene Performance Elite 7 definitely warrants consideration.

Shop and compare Index Annuity Rates at our Online Annuity Store.

Additional Resources:

More Athene Reviews

Disclosures: This is an independent Athene Performance Elite 7 review, not a recommendation or solicitation to buy or sell an annuity. Athene has not endorsed this product review in any fashion and we don’t receive any compensation from it.

Be sure to do your own due diligence when considering an annuity, or before making any financial decision. My Annuity Store strongly recommends you consult with a properly licensed tax professional, attorney, and/or financial advisor regarding any questions you may have prior to making any purchasing decision.

Values shown are not guaranteed, annuities are backed by the claims-paying ability of the issuing insurance company. Rates and annuity payout rates are subject to change. Actual values may be higher or lower than the values shown. The illustration is not valid without all pages and the statement of understanding. Not available in all states.

Annuities are subject to the terms and conditions of the specific contract issued by the insurer, are not FDIC or NCUA insured, are not bank guaranteed, may lose value, and are not a deposit. Please call us at (855) 583-1104 if you have any questions or concerns.