The SILAC Denali 14 is a fixed index annuity with a 14 year contract term, uncapped crediting strategies and a built-in lifetime withdrawal benefit with no fees or expenses.

Independent SILAC Denali 14 Review

In this SILAC Denali Review, I will explain the contract specifics, withdrawal features, fees, lifetime income rider, pros and cons, and historical rate of returns.

I believe it is important to evaluate the financial strength of issuing insurance company’s when reviewing an annuity, so before I dive into the DENALI specifics I’ll provide a quick overview of SILAC Insurance Financial Ratings.

Is SILAC Insurance a Good Company?

SILAC Insurance Company, formerly known as Equitable Life & Casualty Insurance Company, is one of the oldest life insurance providers in the state of Utah.

SILAC is headquartered in Salt Lake City, and it was founded back in 1935. The company has historically offered life insurance, Medicare supplement insurance, and health insurance, but it also has fixed and fixed indexed annuities for sale.

SILAC is licensed to operate in 47 states and Washington, D.C.

SILAC Insurance is rated B+ by AM Best which is the 6th highest rating out of 15.

Learn more about financial ratings

Assets & Liabilities

Assets: $1,636,173,672

Liabilities: $1,514,885,767

Capital and Surplus: $121,287,905

Assets to Liability Ratio: 108.01%

Product Features

* NOTE * Inherited IRAs with a date of death in 2019 or earlier will not be allowed on the Denali line.

Additional Deposits: Allowed in the 1st Year

Maximum: $1,000,000

Minimum: $10,000

Minimum additional: $2,000

Types of funds: Non-Qualified, 401k, IRA, IRA Rollover, IRA Transfer, TSA 403b, SEP IRA, IRA-Roth, SIMPLE IRA, Stretch IRA, Inherited IRA

Age Restrictions:

Owner 0 – 80

Annuitant 0 – 80

Death benefit: Accumulation Value

Market value: adjustment Yes

Return of premium: No

Bail out: No

ADL (Activities of Daily Living): Up to 100% of the Account Value can be withdrawn if the Owner is unable to perform 2 of the 6 Activities of Daily

Living without the physical assistance of another person and meets eligibility requirements. Available after the 1st Policy Year. Please see the Certificate of Disclosure for more information.

Nursing Home: Up to 100% of the Account Value can be withdrawn if the Owner is confined to a nursing home for at least 90 consecutive days and meets the eligibility requirement. Available after the 1st Policy Year. Please see the

Certificate of Disclosure for more information.

Terminal Illness: Up to 100% of the Account Value can be withdrawn if the Owner is diagnosed with a Terminal Illness that results in the Owner having a life expectancy of 12 months or less and eligibility requirements are met. Available after the 1st Policy Year. Please see the Certificate of Disclosure for more information

- The Lifetime Withdrawal Benefit is included automatically and is designed to provide a lifetime income stream while still maintaining access to the account value.

- Lifetime Withdrawals are available anytime after the first policy year.

- They are equal to the current Account Value multiplied by the applicable Lifetime Withdrawal Percentage. Future Lifetime Withdrawals may increase with Step-Ups and will not decrease unless a withdrawal greater than the Lifetime Withdrawal is taken.

- Wellness Withdrawals. A person for whom Lifetime Withdrawals are based cannot perform 2 of 6 Activities of Daily Living, certified by a qualified physician. The impairment began after the policy was issued and is expected to be permanent. Maximum Wellness Period – 5 policy years. Single Lifetime Withdrawals: 2.0. Joint Lifetime Withdrawals: 1.5

Available in: AL, AZ, AR, CO, CT, DC, FL, GA, IL, IN, IA, KS, KY, LA, ME, MI, MS, NE, NH, NM, NC, ND, OK, RI, SD, TN, VT, WV, WI, WY

Simplify Your Retirement with these Benefits

INCOME

The Denali™ Series allows you to create your own pension. You can begin taking Lifetime Withdrawals after 1 year. Your lifetime withdrawal amount depends on your current Account Value and your age when you start lifetime withdrawals.

LIFETIME GUARANTEE

Withdrawals are guaranteed for life as long as you don’t take any excess withdrawals – even if your account value falls to zero. An excess withdrawal will lead to a recalculation of the lifetime withdrawal.

COVERAGE AVAILABLE FOR YOU AND YOUR SPOUSE

When you begin lifetime withdrawals, you can decide if the withdrawals will last for your life (single) or as long as you or your spouse is alive (joint). Withdrawals can be taken monthly, quarterly, semiannually or annually.

PROTECTION WHEN YOU NEED IT THE MOST

Wellness Withdrawals are automatically included with your annuity. After the 2nd policy year, you can receive a wellness withdrawal if you cannot perform two of six Activities of Daily Living.

If you elected single lifetime withdrawals, then the wellness withdrawal will be double the amount of the lifetime withdrawal. Wellness withdrawals can last for five years.

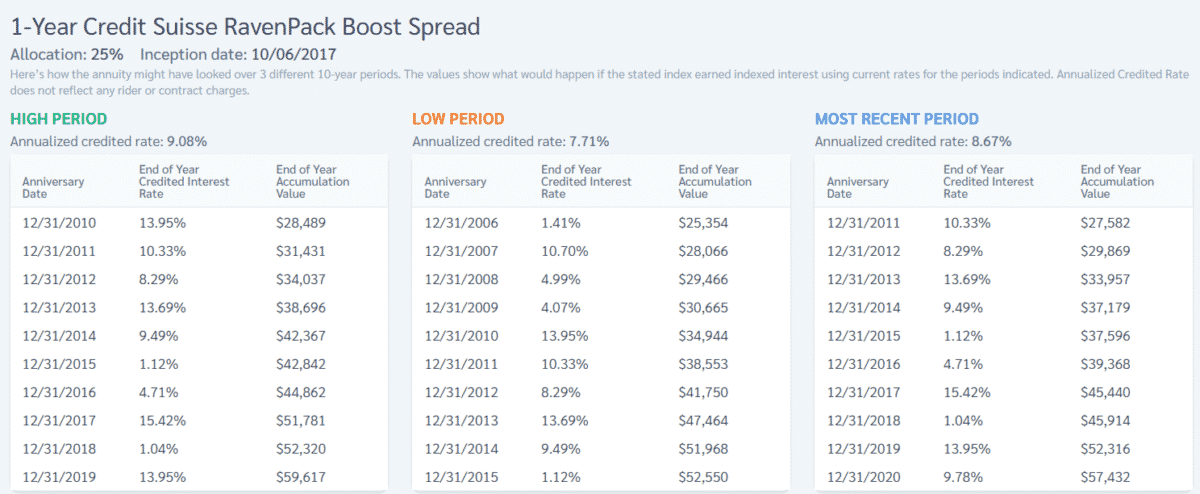

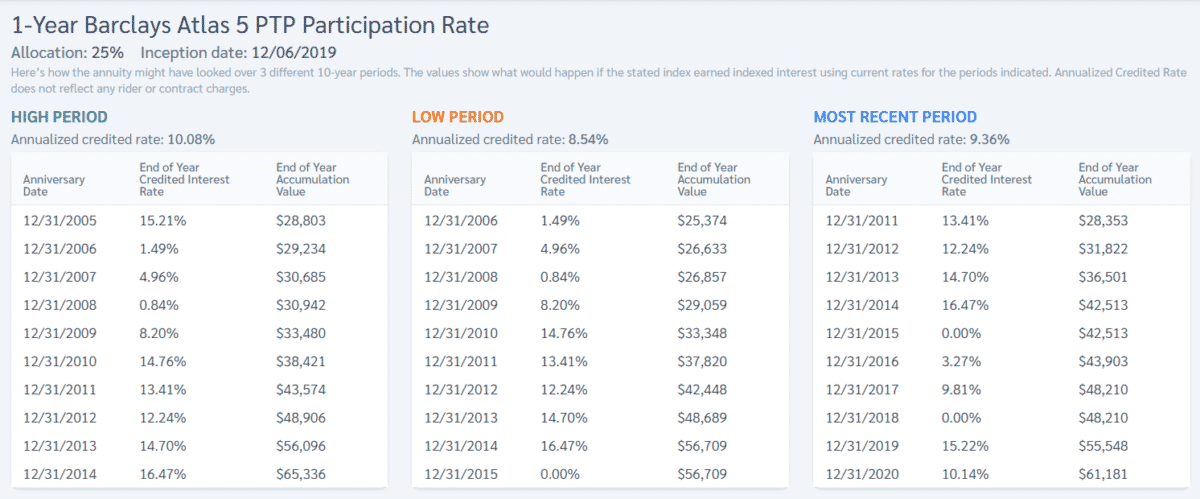

SILAC Denali 14 Historical Rate of Returns

The tables below show the hypothetical rate of return for the top two SILAC DENALI 14 indexes and crediting methods.

You’ll notice there are 3 separate tables for each index.

- High Period – Best 10 Year average annual rate

- Most Recent – Average annual rate for the most recent 10 year period.

- Low period – average annual rate of return for the lowest 10 year period.

Visit our online annuity store to shop and compare today’s best fixed index annuity rates.

Get a SILAC Denali Annuity Quote

Fill out the form below to receive a free annuity quote within 4 business hours, or use one of our annuity calculators.