Bonds vs. Annuities

Table of Contents

Annuities vs Bonds: The Basics

- Equities, and

- Fixed Income

Fixed Index Annuities

Annuities are retirement savings vehicles that offer guarantees issued by an insurance company. They provide tax-deferral during the accumulation phase and may provide monthly income payments guaranteed to last your lifetime. Fixed Index Annuities are a type of fixed annuity that provides a floor of zero percent and upside potential based on the performance of a stock market index. There are many different stock market indexes available inside of an indexed annuity and they vary from insurer to insurer. When you invest in an indexed annuity your money isn’t directly invested in the index. The index performance is just used to determine your return. There are quite a few index annuity crediting methods used to calculate your rate of return, below are a few of the most commonly used.- Cap – You get 100% of the stock market index’s annual increase up to the cap.

- Participation Rate – You are credited with a percent of the stock market index’s increase but are not capped on the upside.

- Spread – The stock market index’s annual return minus a spread and is not capped on the upside.

Bonds

- Used by all types of investors, including retirees

- Issued by corporations, municipalities, and governments

Annuities vs. Bonds

Annuities and bonds are popular ways for investors to generate an income stream. Both are considered members of the “fixed income” asset class. Bonds are more commonly used since they trade like stocks on the markets. Still, many financial experts argue that annuities are a better way to generate income in retirement because the payments last for life. When deciding whether a bond or annuity is best for you it is important to note the current economic environment. By studying past performance we know that bonds perform better in certain environments as do fixed index annuities. The United States has experienced a decreasing rate environment in recent years and today we are sitting at all-time lows. This has led to less return on fixed income assets which effectively increases the cost to fund retirement. Individuals are likely to adjust their portfolios in an attempt to offset this rising cost. A common strategy would be to invest in longer-term bonds which leads to greater risk of capital should interest rates rise. Or, they may look to high-yielding corporate bonds exposing them to even great risk of capital loss. Shorter-term bonds are an option with less interest rate risk but they generate lower, unsatisfactory returns. Relying on fixed income returns may steer financial plans off-course should interest rates rise, leaving retirees or those approaching it vulnerable. A second option would be to allocate more of a portfolio to equities to offset lower returns and interest rate risks on the fixed income portion. However, this creates even greater risk. For those approaching, or in the early years of retirement, a loss of capital can greatly reduce the likelihood of a retirement portfolio’s success. The sequence of returns risk is greatest in the years just before or just after retirement because these returns affect a longer history of retirement savings. Additionally, there is not as much, or any time to make up for the losses.Equities/Bonds/Annuities

There is another option for retirees to consider that can help smooth out the yield curve of their portfolio; especially during a volatile market or a below-average interest rate environment. A fixed indexed annuity can be a good fixed income alternative and should be considered as an asset class of its own. Fixed indexed annuities provide downside protection from loss and upside potential based on the performance of a market index. Risk-averse households who want a high probability of success that their financial plan will work will assume a lower rate of return on their investments. Since fixed index annuities manage downside risk by preventing a loss due to market performance they may provide greater accumulation – especially when stock markets behave poorly. Fixed indexed annuities can simplify the path to a successful retirement during down markets. The trade-off is accumulation during a good market environment will be reduced since the upside potential is also reduced. A portfolio simulator can analyze these trade-offs by comparing the performance of a portfolio with and without a fixed indexed annuity.Annuities vs Bonds: Portfolio Comparison

For this comparison, we will be using a fixed index annuity offering four different indexed strategies that all provide downside protection with a floor of 0% while providing participation in some of the market upside. Since it is a non-correlated asset, a fixed index annuity may serve as a suitable fixed-income alternative. For this simulation, we will be using a fixed index annuity, The Index Protector 7, issued by Great American Life Insurance Company to compare wealth accumulation outcomes for a portfolio with and without an index annuity. Below are the available stock indexes and ETF strategies:- S&P 500® Index – Seeks to track the investment results of an index composed of large-cap equities of the 500 leading companies that capture approximately 80% coverage of available market capitalization.

- S&P U.S. Retiree Spending Index – Seeks to track the investment results of an index composed of equities in economic sectors that are affected by retiree spendings, such as healthcare, entertainment, and leisure.

- iShares U.S. Real Estate ETF – seeks to track the investment results of an index composed of U.S. equities in the real estate sector

- iShares MSCI EAFE – Seeks to track the investment results of an index composed of developed market equities, including those in Europe, Australia, Asia, and the Far East

- S&P 500® point-to-point with cap – 6% Cap Rate

- S&P 500® Risk Control point-to-point with participation rate – 65% Participation Rate

- S&P U.S. Retiree Spending® point-to-point with participation rate – 65% Participation Rate

- iShares U.S. Real Estate® point-to-point with cap – 6.5% Cap

- iShares MSCI EAFE point-to-point with cap – 5.3% Cap

- Declared Rate Strategy: 3%

Bond vs Annuities Comparison Methodology

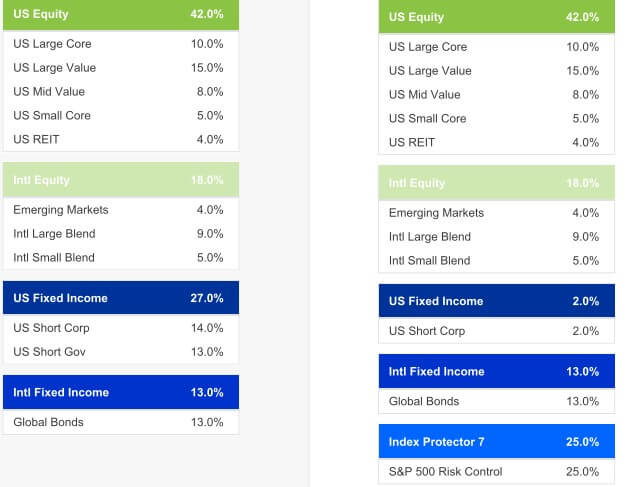

For our analysis, we will be comparing a 60/40 (stock and bond) portfolio to a 60/25/15 (stock, fixed index annuity, bond) portfolio. In this comparison, 25% of the portfolio was allocated to S&P 500 Risk Control point to point with a participation rate of 65%.Annuities vs. Bond Portfolio's Simulated

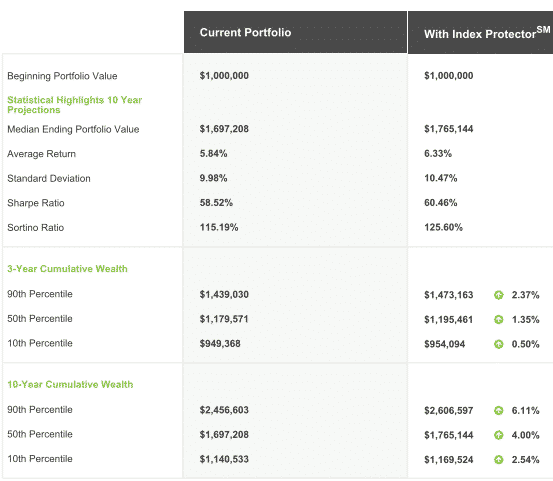

Annuity vs. Bonds Comparison Results

Portfolio Simulators

As you can see in the above results, the portfolio with an indexed annuity outperforms the portfolio comprised only of stocks and bonds. And as you may expect, the portfolio including an index annuity outperformed the 60/40 portfolio the most when market conditions were poor. Given the current interest rate environment and recent market volatility coming off of the longest Bull Market in history we believe an index annuity should be considered by those individuals who are near or already in retirement.Both Annuities & Bonds Should Be Considered

Wade D. Pfau, Ph.D., CFA® is widely recognized annuity, investment, portfolio management, and retirement planning expert and Professor of Retirement Income and The American University. Below is an excerpt taken from a whitepaper, “Managing Risks With Fixed-Indexed Annuities.” “Advisors should find the calculator useful in helping clients consider the range of potential outcomes for different investment strategies. The calculator helps to show clients how their choice of investments and the inclusion of an indexed annuity impacts the range of wealth outcomes both on the downside and upside. Even if the overall portfolio standard deviation increases with the inclusion of an indexed annuity, the ability to protect from downside losses, as returns for the indexed annuity do not follow a traditional bell-shaped distribution, may serve to reduce risk for the distribution of wealth outcomes. If the calculator shows that including an indexed annuity in a portfolio can raise wealth accumulations across the distribution of outcomes, then this serves as compelling evidence to the client that the indexed annuity adds value to the overall financial plan. Such findings speak to best serving a client’s interests, especially when wealth is raised across the distribution of outcomes. Because the calculator is agnostic, advisors can better determine when the inclusion of an indexed annuity may or may not improve financial outcomes for their clients, providing the documentation to show that the advisor has considered a range of possible strategies to seek the best results for their clients.”My Annuity Store, Inc.

My Annuity Store, Inc. provides a platform for individuals to acquire knowledge, request, compare, price and select income, fixed, and fixed index annuities. Our corporation was createdwith the sole purpose of elevating and simplifying the experience of acquiring annuity education and product solutions. >We provide the broadest, most unbiased, and independent, multi-carrier platform available to Americans to easily request, compare, price and purchase annuities at any age in their life-cycle. You’ll find our website is versatile, easy to use and is equipped with educational tools aimed to help our visitors better understand the role annuities can play in a retirement portfolio. Lack of educational materials and accessibility annuities has hindered the widespread adoption of these strategies in the United States. My Annuity Store strives to educate and provide individuals with the materials and tools to better understand these products, so they feel comfortable utilizing them to increase the likelihood of reaching their overall investment goals. If you have interest in exploring fixed index annuities further you can do so at our Fixed Index Annuity Marketplace.Disclaimer

inStream Solutions, LLC (“inStream”) makes no warranties, expressed or implied, as to accuracy, completeness, or results obtained from any information on this presentation. Historical returns are a simplifying assumption used to model investment returns. It uses returns from the past to model returns going forward. However, in the real investment world, returns vary widely and therefore the past returns are not necessarily indicative of future returns. Therefore, one should not think that the historical returns used in this plan will necessarily be accurate going forward.

Unlike actual performance, the modeled results may not accurately reflect the effect of certain material economic or market factors. Actual results may be higher or lower due to the impact of these factors. Actual trading practices are not reflected in these results, thus it is unknown what effects these factors may have had on the investment advisor representative’s decision making if it were actually managing client funds during the time period highlighted in this report. No representation is being made that any fund or account will or is likely to achieve profits or losses similar to those shown herein. In fact, there are often sharp differences between hypothetical performance results and the actual results subsequently realized by a client’s portfolio.

Any investment involves significant considerations and risks. Each potential investor should obtain and read the applicable prospectus or any other disclosure document from his or her financial professional, and should carefully consider the objectives, risks, and charges and expenses of an investment product before investing. Prospectuses may also be available through the U.S. Securities and Exchange Commission’s Electronic Data Gathering, Analysis, and Retrieval system (EDGAR).

IMPORTANT: The projections or other information generated by inStream regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Separate Account Manager Data © 2014 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Any projection or information generated by inStream regarding the possibility of any financial outcome, is hypothetical, does not reflect actual investment results, and does not guarantee future results.

Market conditions for US Equity, Intl Equity, Alternatives, and Index ProtectorSM 7 were calculated by taking the average annual returns for the corresponding index from 1/1/2005 to 12/31/2019 and taking the 10th, 25th, 75th, and 90th percentile to reflect each condition. For US and Intl Fixed Income, market conditions were calculated using effective duration and bond yields