The Bloomberg US Dynamic Balance Index ii ER Index reflects the performance of an index strategy that uses the S&P 500® Index and the Bloomberg Barclays US Aggregate RBI® Series 1 Index.

Bloomberg US Dynamic Balance ii ER Index in Allianz Annuities

The Bloomberg US Dynamic Balance ii ER Index is available as an index crediting option in some Allianz fixed index annuities.

Product Availability:

- Allianz 360™ Annuity

- Allianz Accumulation Advantage® Annuity

- Allianz Core Income 7® Annuity

Components:

- Bloomberg US Equity Custom Futures ER Index

- Bloomberg US Aggregate Custom RBI Unfunded Index

Volatility Target:

5%

BXIIUDB2 Overview

The Bloomberg US Dynamic Balance II ER Index (BXIIUDB2) is comprised of the Bloomberg US Equity Custom Futures ER Index and the Bloomberg US Aggregate Custom RBI Unfunded Index and shifts weighting between them daily based on historical realized volatility.

In order to manage index volatility during times of high volatility, the index weights may not add up to 100%. The Bloomberg US Equity Custom Futures ER Index is a custom index that tracks futures on large-cap equities, similar to futures on the S&P 500 Index.

The Bloomberg US Aggregate Custom RBI Unfunded Index is a custom index designed to track futures prices on the Bloomberg US Aggregate Bond Index – a well-established benchmark for the U.S. bond markets.

The Bloomberg US Dynamic Balance II ER Index employs an excess return methodology, tracking the price of futures. Futures prices reflect the expected future cost of an index and account for expected dividends.

The excess return structure is designed to create a level of stability in your participation rate (for the associated crediting method) from year to year by mitigating the impact of short-term interest rates on renewal rates.

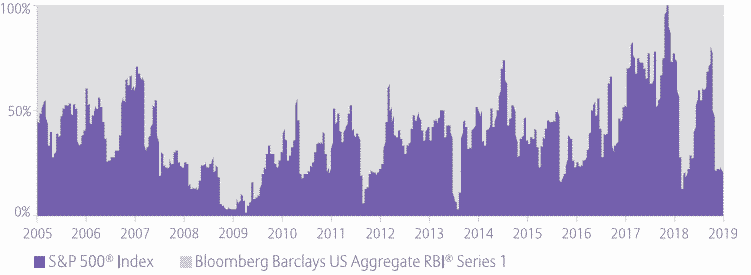

BXIIUDB2 Hypothetical Historical Weighting

Here is a hypothetical chart showing how the last 14 years of weighting between the two underlying indexes would have looked, had the Bloomberg US Dynamic Balance ER II Index existed (the BXIIUDB2 index was established on April 14, 2015).

As you can see, in periods like 2008, when volatility was high, the index would have shifted to be nearly all in the Bloomberg Barclays US Aggregate RBI® Series 1 Index.

The 14-year period shown reflects the longest common period of historical data available for each of the indexes that comprise the Bloomberg US Dynamic Balance Index II.

About Hypothetical Historical Depictions

The BUDBI II was launched on August 14, 2015. All information presented before this launch date is hypothetical (back-tested), and back-tested performance is not actual performance.

The back-tested performance is based on the methodology and mechanics of the index retroactively applied to historical market data, as if the index had previously existed, to generate hypothetical performance during the periods of time depicted.

This back-tested performance for any constituent that makes up the index may have actual performance and history, and it will also have back-tested data for any period before its inception.

Back-tested performance may not be a reliable indicator of future results. Prospective application of the methodology and mechanics of the index may not result in performance commensurate with the back-tested returns shown.

Bloomberg US Dynamic Balance ER Index II Mechanics

Realized volatility is calculated for the S&P 500® Index and the Bloomberg Barclays US Aggregate RBI® Series 1 Index over 20 days and 40 days.

- For the S&P 500® Index, the greater of the 20- or 40-day realized volatility is used to determine the weighting.

- Realized volatility for the Bloomberg Barclays US Aggregate RBI® Series 1 Index is calculated based on historical daily returns over the corresponding period of 20 or 40 days.

These realized volatilities are used to determine the final weight allocation daily.¹

One nice feature of these types of cross-asset strategy indices is the fact there is no human component involved. In recent months many fund managers have ventured beyond a fund’s normal asset quality in search of yield due to our ultra-low interest rate environment.

The allocation weights in the Bloomberg US Dynamic Index II are controlled purely by an algorithm from which it does not stray.

Bloomberg US Dynamic Balance ii ER Index Historical Performance

Let’s see how the Bloomberg US Dynamic Balance ii ER Index would have looked relative to its components (the S&P 500® Index and the Bloomberg Barclays US Aggregate RBI® Series 1 Index) over the last 14years.

Again, in periods like 2008 when the S&P 500® Index dropped significantly, the weighting would have shifted to the bond index, which would have helped keep the Bloomberg US Dynamic Balance Index II from a significant drop, as well.

Showing the index comparison doesn’t necessarily indicate how much interest would have been credited to a fixed index annuity over that time period. Actual contract results would depend on the crediting method chosen, and caps and spreads in place during that time period. Past results are not a guarantee of future performance.

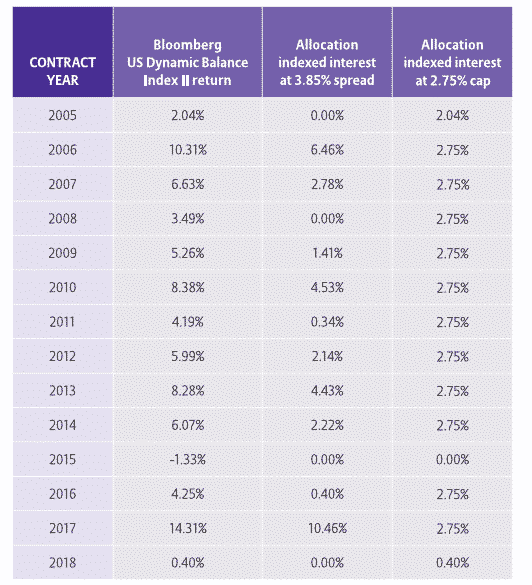

Allianz Annuities Return Using BUDBI Index

The Bloomberg US Dynamic Balance Index II allocation is available in Allianz Annuities using an annual point-to-point crediting method that has either a cap or spread – it’s up to you. It resets annually, which provides you with the opportunity to receive interest every year the index rises.

The chart highlights the last 14 years of hypothetical historical returns in the Bloomberg

US Dynamic Balance Index II, and the interest that Allianz would have credited after applying a cap or spread.

It assumes the Allianz annuity was issued on 1/1/2005 and was available during this time period, which it was not. The Bloomberg US Dynamic Balance Index II return reflects hypothetical historical data from 12/31/2004 to 12/31/2018 using current caps and spreads.

Remember, this chart represents past hypothetical results only. Actual caps or spreads that could have been applied over this time frame would have been different from the figures in this example and some cases may have been dramatically higher or lower, depending on several factors.

Actual results will vary depending on market conditions, index allocation choice, caps, and spreads. No single crediting method consistently delivers the most interest under all market conditions.

In an index scenario with flat or negative results, the LOWEST possible indexed interest rate is 0%. This is not intended to project or predict future results.

¹Weighting allocation can change up to 3% daily.

Read More Allianz Annuity Reviews

i

Sources & Citations

We regularly update this page and cite primary sources, carrier filings, and regulator guidance:

- Marketwatch. "S&P 500 US Index Quote" marketwatch.com

- Allianz Life Insurance Company. "Index Options" Allianzlife.com

- Bloomberg. "BXIIUDB2 Index Quote" Bloomberg.com