How Much Does a $500,000 Annuity Pay Per Month?

If you’ve saved up $500,000 and are closing in on retirement, the big question is simple: how much income can that actually give you every month? For many people, the stock market feels too unpredictable and Social Security too uncertain to rely on alone. That’s why more retirees are turning to annuities—to turn a lump sum into a steady paycheck they can’t outlive.

In this article, we’ll break down how much a $500,000 annuity can pay per month at different ages and with different types of annuities, so you can see what this number really means for your retirement lifestyle.

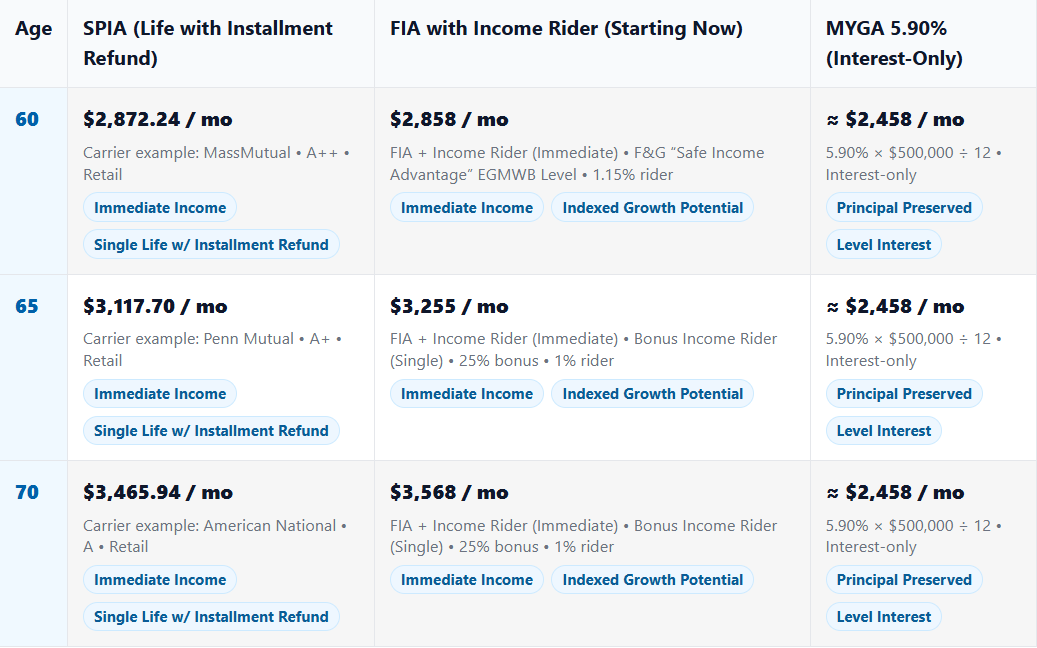

| Age | SPIA (Life with Installment Refund) | FIA with Income Rider (Starting Now) | MYGA 5.90% (Interest-Only) |

|---|---|---|---|

| 60 |

$2,872.24 / mo

Carrier example: MassMutual • A++ • Retail

Immediate Income

Single Life w/ Installment Refund

|

$2,858 / mo

FIA + Income Rider (Immediate) • F&G “Safe Income Advantage” EGMWB Level • 1.15% rider

Immediate Income

Indexed Growth Potential

|

≈ $2,458 / mo

5.90% × $500,000 ÷ 12 • Interest-only

Principal Preserved

Level Interest

|

| 65 |

$3,117.70 / mo

Carrier example: Penn Mutual • A+ • Retail

Immediate Income

Single Life w/ Installment Refund

|

$3,255 / mo

FIA + Income Rider (Immediate) • Bonus Income Rider (Single) • 25% bonus • 1% rider

Immediate Income

Indexed Growth Potential

|

≈ $2,458 / mo

5.90% × $500,000 ÷ 12 • Interest-only

Principal Preserved

Level Interest

|

| 70 |

$3,465.94 / mo

Carrier example: American National • A • Retail

Immediate Income

Single Life w/ Installment Refund

|

$3,568 / mo

FIA + Income Rider (Immediate) • Bonus Income Rider (Single) • 25% bonus • 1% rider

Immediate Income

Indexed Growth Potential

|

≈ $2,458 / mo

5.90% × $500,000 ÷ 12 • Interest-only

Principal Preserved

Level Interest

|

How Much Will a $500K Annuity Pay?

Because annuity income is highly personalized, there’s no one-size-fits-all answer to how much a $500,000 annuity will pay each month. Payments can vary based on your age, gender, health, the type of annuity you choose, payout options, and current interest rates. The examples below are for illustrative purposes only and are not a guarantee of future results.

Before purchasing an annuity, you should review your options and get a personalized quote from a licensed professional to see what payout structure best fits your goals and situation.

$500,000 Immediate Annuity Payments Table

The table below shows the exact monthly payment amount for a $500,000 annuity (rates are only guaranteed until the guaranteed date indicated in the table). Immediate annuity payments are listed for a 60, 65, and 70 year old single life and for a 60, 65, and 70 year old couple using joint life non-reducing.

| Age & Option | Carrier | Monthly Payout | Guaranteed Until | Product Type | Rating |

|---|---|---|---|---|---|

| 65 • Single • Installment Refund |

Penn Mutual

Penn Mutual Life Insurance Company

|

$3,117.70 | 11/03/2025 | Annuity: Retail | A+ |

| 65 • Joint Life • 100% Continuation |

New York Life

New York Life Insurance and Annuity Corporation

|

$2,916.20 | 11/01/2025 | Annuity: Limits | A++ |

| 70 • Single • Installment Refund |

American National

American National Insurance Company

|

$3,465.94 | 10/25/2025 | Annuity: Retail | A |

| 70 • Joint Life • 100% Continuation |

New York Life

New York Life Insurance and Annuity Corporation

|

$3,169.49 | 11/01/2025 | Annuity: Limits | A++ |

| 60 • Single • Installment Refund |

MassMutual

Massachusetts Mutual Life Insurance Company

|

$2,872.24 | 11/01/2025 | Annuity: Retail | A++ |

| 60 • Joint • Installment Refund |

New York Life

New York Life Insurance and Annuity Corporation

|

$2,736.18 | 11/01/2025 | Annuity: Limits | A++ |

Life with Installment Refund Annuity Option

The lifetime annuity payouts in the table above include an installment refund. This ensures that if you die before receiving payments equal to your initial investment, your beneficiaries continue receiving the same installments until the full amount is paid out.

The majority of our clients elect this option becuase it offers higher income than h a cash refund option. A cash refund option would maa a lump sum payment to your heirs immediately upon death and may be an option worth considering.

Next we will look at how much an index annuity with an income rider would pay. The payments will be slightly less than immediate annuity options but in exchange offers more flexibility.

Income Rider Payments for $500K

| Age & Rider | Carrier / Product | Monthly Payout | Assumptions & Fees | Channel | AM Best Rating |

|---|---|---|---|---|---|

| 60 • EGMWB Level |

F&G • Safe Income Advantage

Income Rider: EGMWB Level

|

$2,858 |

1.15% rider fee • Assuming 2.09% credit from 1-Year S&P 500 PTP Cap

Income begins immediately

FIA + Rider

|

Independent Agent | A |

| 65 • Bonus Income Rider (Single) |

Nationwide • Peak 10

Bonus Income Rider (Single)

|

$3,255 |

25% Income Base Bonus • 1% rider fee • Assuming 4.51% credit from 1-Year S&P 500 PTP Cap

Income begins immediately

FIA + Rider

|

Independent Agent | A+ |

| 70 • Bonus Income Rider (Single) |

Nationwide • Peak 10

Bonus Income Rider (Single)

|

$3,568 |

25% Income Base Bonus • 1% rider fee • Assuming 4.51% credit from 1-Year S&P 500 PTP Cap

Income begins immediately

FIA + Rider

|

Independent Agent | A+ |

What it is:

A Fixed Index Annuity paired with an income rider that guarantees lifetime income, you can start now or later.

The rider has rules (roll-up rates, withdrawal factors by age, and a fee if applicable). The “benefit base” used to calculate income is not your cash value.

Who it’s for:

You want a guaranteed income with the potential to defer and increase payouts, plus some account access/features that the immediate annuity doesn’t offer.

Why People Add Income Riders

Income riders can be useful if you:

- Want a known, guaranteed income floor in retirement

- Don’t have a pension and want to create your own

- Like the idea of keeping ownership and access to your account value (unlike most SPIAs)

- Want the potential for more income later if you delay taking withdrawals

MYGA at 5.90% — Interest-Only Income, Principal Intact

What it is:

A multi-year guaranteed annuity (fixed annuity) with a 5.90% guaranteed rate for the term.

You withdraw the interest monthly and keep your $500,000 principal intact.

Illustrative monthly income:

$500,000 x 5.90% = $29,500 per year Monthly interest-only income ≈ $2,458/month

Principal remains $500,000 at the end of the term, subject to renewal options or 1035 exchange

Who it’s for:

You prioritize safety, predictable interest, and keeping your principal intact.

You want flexibility at the end of the term.

Pros:

- Competitive guaranteed rate

- Access via interest withdrawals without reducing principal

- Simple and transparent

Considerations:

- Rate is guaranteed for the term only; future renewal rates may differ

- Early withdrawals above the free amount may incur penalties and surrender charges during the term

- See current fixed annuity rates and terms.

What Option Fits for Me?

Income Annuity Comparison Guide

Do you need a guaranteed income to start within the next 0–3 months?

- Yes → Do you want the highest possible monthly income and don’t need to access principal?

- Yes → Immediate Annuity (Life with Installment Refund)

- No / you want some liquidity or flexibility → FIA with Income Rider (start now)

No → You can wait 1–10+ years to start income

- You want to lock in guaranteed lifetime income that increases with age → FIA with Income Rider (defer and start later)

- You want safe, steady interest now and to keep your $500k intact → MYGA 5.90% interest-only

Is protecting a spouse with a joint lifetime income a priority?

- Yes → Choose Joint Life with 100% Survivor

- Note: Monthly payouts are lower than single life because income is guaranteed over two lives.

- Prefer more income now with simple guarantees → Immediate Annuity (joint life with installment refund)

- Prefer flexibility and the option to start later → FIA with Income Rider (joint option)

- No → Single life typically pays more per month

How much liquidity do you want?

- Minimal (okay if payments are irrevocable) → Immediate Annuity

- Moderate (some access to account value, features, and optional deferral) → FIA with Income Rider

- High (keep principal intact during term; take interest only) → MYGA 5.90%

What’s most important to you right now?

Simple next steps

- Want the exact monthly number for your age and state?

- Use the live FIA rider widget on this page for instant quotes.

$500,000 Annuity Payments: FAQs

Can I get quotes for my exact age and state?

Absolutely. Use the live widget above or contact us at 855-583-1104 or info@myannuitystore.com for personalized quotes.

Do income riders’ roll-up rates equal my actual return?

No. The roll-up/benefit base is for calculating guaranteed income, not a cash value you can withdraw. Your account value will grow per contract terms and may differ from the benefit base.

What happens at the end of a MYGA term?

You can renew, move to a new MYGA, annuitize, transfer via 1035 exchange, or withdraw per contract provisions. We’ll help you compare options at that time.

Can I change my mind after I start income?

Immediate annuities are generally irrevocable once issued. FIAs with riders allow changes before starting income, but after activating lifetime income, changes are limited. We’ll walk you through the specifics before you decide.

What if I want a joint lifetime income for me and my spouse?

Joint life with 100% survivor will reduce the monthly payout compared to single life, but guarantees income for both lifetimes. We can quote both options side-by-side.

What affects my payout the most?

Age, start date, payout option (life-only vs. refund vs. joint), state, carrier pricing, and current interest/rider factors.

How much does a $500,000 annuity pay per month?

It depends on product type, age, state, and payout options. As a ballpark for a 65-year-old:

Immediate annuity (life with installment refund): about $2,600–$3,200/month

FIA with income rider starting now: about $2,400–$3,000/month

MYGA at 5.90% interest-only: about $2,458/month, principal intact

Are annuity payments taxable?

Generally, yes. Qualified funds are fully taxable as ordinary income when withdrawn. Non-qualified funds are taxed on the gain portion only under exclusion ratio rules. Consult your tax professional.

What’s the difference between an immediate annuity and an FIA with an income rider?

Immediate annuity: typically higher income now, less liquidity and fewer features after income starts. FIA with rider: more flexibility, potential to increase income with deferral, and some access to account value, but often slightly lower income if starting immediately.

What does “life with installment refund” mean?

If you die before receiving payments equal to your premium, the remaining amount is paid to your beneficiary in installments until your full premium is returned.

Payouts vary by age, state, product design, options selected, and current carrier rates and rider factors.

The income rider benefit base is not cash value; fees may apply.

MYGA 5.90% rate and terms are subject to change; surrender charges and market value adjustments may apply to excess withdrawals during the term.

Taxes depend on qualified vs. non-qualified status; consult a tax professional.

Request an Annuity Quote

Complete the form below, and we’ll email you an annuity quote within four business hours. For more immediate assistance, you can reach us at 855-583-1104 or use our annuity payment calculator.