What is Sequence of Returns Risk and Why Does it Matter?

The sequence of returns risk is the chance an investor will experience negative portfolio returns in the years just before or just after retirement.

This is a serious risk because suffering a loss during the first 5 years leading up to your retirement and the first 5 years after you retire can greatly reduce the chances your money will last your lifetime. During this “transition phase,” investors don’t have much time to make for losses, and making withdrawals during a down market only compounds the issue.

3 Primary Reasons the Sequence of Returns Matter

- Withdrawals lock in your negative market returns.

- Deteriorates your underlying retirement asset.

- Reduces your retirement income.

Sequence of Returns Illustrations

In this guide, I will use hypothetical examples to illustrate the impact sequence of returns has on a portfolio during three different market environments.

- Average Market Returns at Beginning of Retirement

- Strong Market Returns at Beginning of Retirement

- Negative Market Returns at Beginning of Retirement

We will be assuming a 6% annual average rate of return for each of the 3 scenarios with the only difference being the order in which the returns are earned.

Client Assumptions:

- $1,000,000 portfolio

- 6% average annual returns

- Annual withdrawals of $50,000 adjusted upward of 3.5% each year for inflation

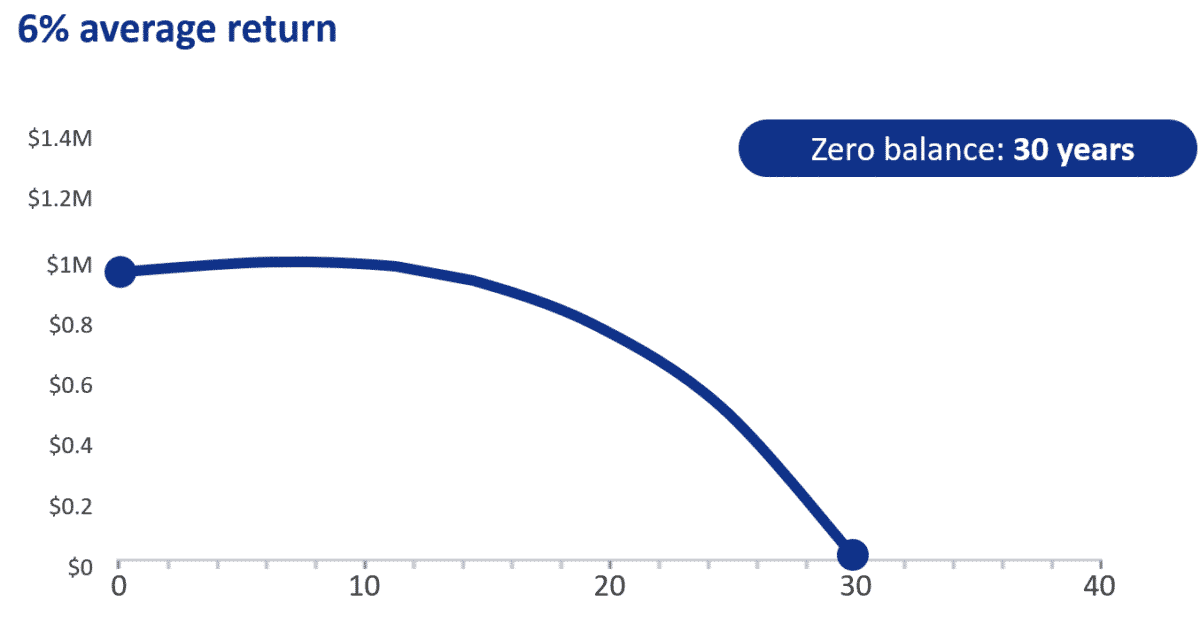

Retirement Income Portfolio with Average Annual ROR at Retirement

The below example assumes an investment portfolio earns 6% each and every year over the course of the retirement (6%, 6%, 6%,6%, repeating.).

Assuming a 6% annual return each and every year throughout the entire course of retirement, the portfolio would last 30 years.

This is a hypothetical example and is not intended to project the performance of any specific investment or index. If this were an actual product withdrawals are subject to ordinary income tax and, if taken prior to age 59½, a 10% federal additional tax.

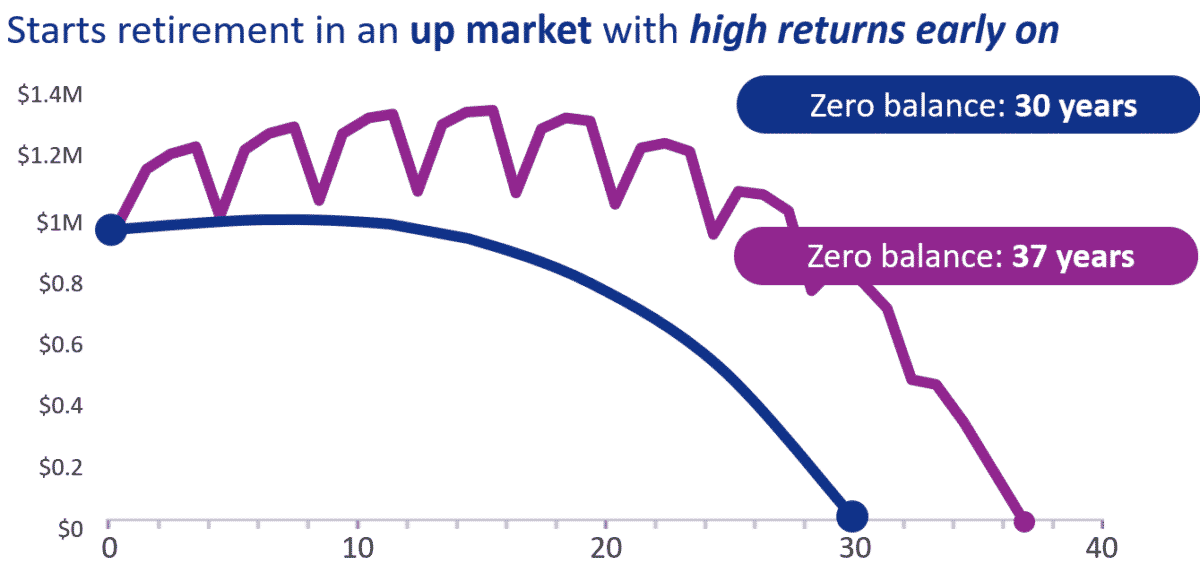

Strong Stock Market Returns at Retirement

Susan

In this scenario, Susan’s average annual rate of return is still 6%, but because she earned higher returns early on, (27%, 9%, 7%, -15%, repeating), the same $1,000,000 investment portfolio lasts 37 years.

This is a hypothetical example and does not represent an actual client. It is not intended to project the performance of any specific investment or index. It is not possible to invest directly in an index. If this were an actual product, the returns may be reduced by certain fees and expenses. Withdrawals are subject to ordinary income tax and, if taken prior to age 59½, a 10% federal additional tax.

Negative Market Returns at Retirement

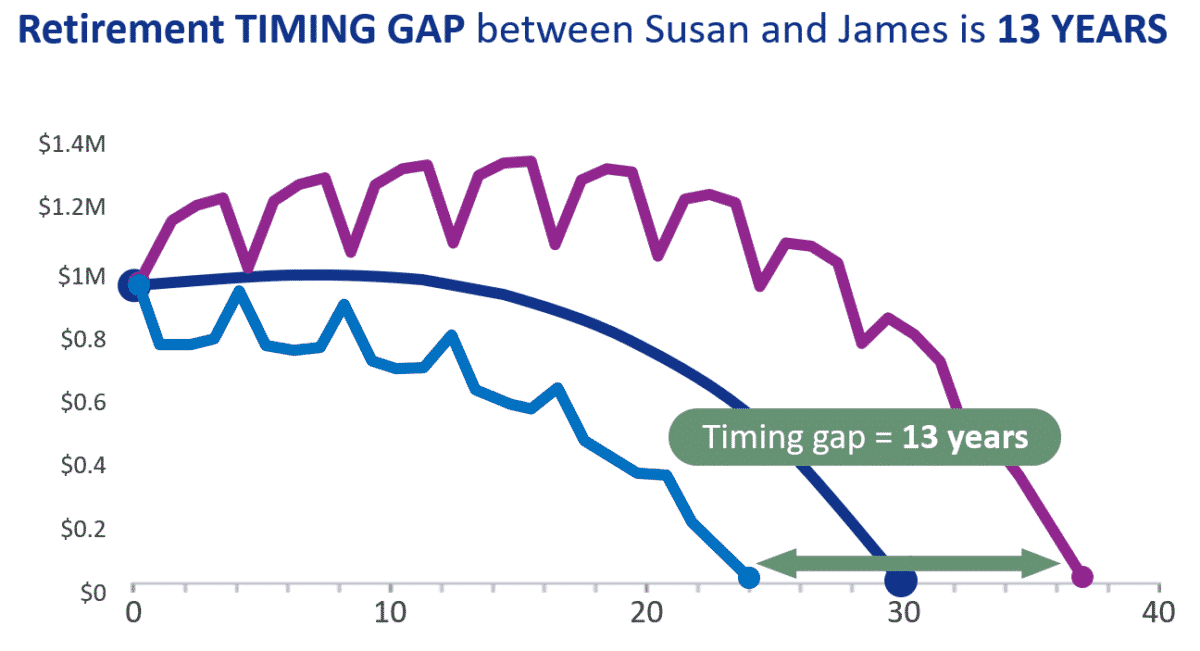

James

James earns the same exact annual rates of return as Susan but in the opposite order (-15%, 7%, 9%, 27%), with the negative return occurring in his first year of retirement.

In other words, the only difference is James experienced negative portfolio returns early in retirement.

Simply reversing the sequence of returns would cause James to run out of money in just 24 Years; 13 years earlier than Susan who was fortunate enough to retire in an upmarket.

This is a hypothetical example and does not represent an actual client. It is not intended to project the performance of any specific investment or index. It is not possible to invest directly in an index. If this were an actual product, the returns may be reduced by certain fees and expenses. Withdrawals are subject to ordinary income tax and, if taken prior to age 59½, a 10% federal additional tax.

Transition Phase (5 to 10 Year Period Before and After Retirement)

We can’t control how long we live, or the timing of the market volatility, but there are things you can do to provide more certainty in your retirement. Retirement planning isn’t rocket science but it does require a change in perspective.

Certainty is important in the income phase and can help reduce stress and anxiety and increase your confidence in a financially secure retirement.

The list below highlights some of the items you’ll need to consider as you begin to create a retirement plan:

- Required monthly expenses in retirement (must-haves).

- Discretionary retirement monthly expenses (your wants).

- What sources of guaranteed income do you have?

- What is your income (consumption) gap?

- Review your risk tolerance.

- Asset allocations and locations

- The most tax-favorable way to spend down your assets.

If after creating a basic retirement income plan you find that your portfolio can generate the desired retirement income with a high probability – why would you take unnecessary risks?

You may want to review and adjust your risk tolerance if you’ve done a good job of saving and don’t need to “catch up.”

How Can You Manage Sequence of Returns Risk?

How can you manage the sequence of returns risk? According to Wade Pfau, Ph.D., CFA, RICP, there are 4 general ways to manage the sequence of returns risk:

Spend Conservatively

Maintain Spending Flexibility

- Reduce Volatility (When it Matters Most)

- Build a retirement income bond ladder

- Build a lifetime spending floor with income annuities

- Rising equity glide path in retirement

- Use funded ratio to manage asset allocation

- Use financial derivatives to cut downside risks

4. Buffer Assets—Avoid Selling at Losses

- Cash reserve to fund near-term expenses

- Cash value of life insurance

- Line of credit from HECM reverse mortgage

Sequence of Returns in Conclusion

My Annuity Store specializes in getting our clients through retirement, so you are able to retire earlier and with confidence that your money will last your lifetime.

Many financial advisors only focus on accumulation – anyone can do that. You only know how good your financial advisor is when you see how well they do when the markets are down. As you approach and enter retirement it isn’t just about the rate of return, it becomes more about asset location, allocation, and tax-efficient withdrawal strategies.

I use a goals-based approach to retirement income planning. If you have enough retirement savings to generate enough monthly lifetime income to cover your required and disposable income – why would you take on additional risk.

If you are shopping for annuities you can request an annuity quote, use our annuity calculators, compare annuity rates or contact us via phone or email to discuss.

Try our holistic, comprehensive retirement planning calculator.

SOURCES:

- forbes.com/advisor/retirement/sequence-of-returns-risk/

- retirementresearcher.com/4-approaches-managing-sequence-returns-risk-retirement/

- hud.gov/program_offices/housing/sfh/hecm/hecmhome

- financial-dictionary.thefreedictionary.com/Funding+ratio

- forbes.com/advisor/life-insurance/cash-value-life-insurance/