PIMCO TBI: Exclusively in Allianz Annuities

The PIMCO Tactical Balanced ER Index is designed to tactically balance exposure to U.S. equities, bonds, and cash based on market trends and opportunities.

Developed by PIMCO’s Quantitative Portfolios Group, innovative features navigate and shift risks and opportunities according to market trends. Allianz is a leader in the U.S. Annuity Market and was the #2 overall fixed index annuity company in 2020.

Top 10 Best Fixed Index Annuity Companies 2026

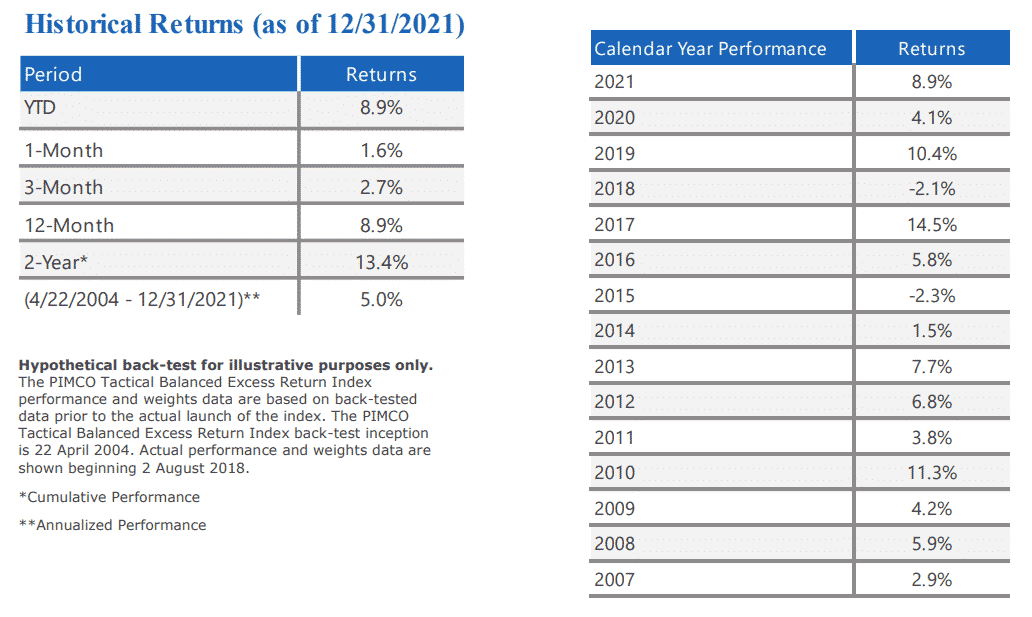

PIMCO Tactical Balanced ER Index Historical Returns

Get a PIMCO Tactical Balanced ER Index Annuity Quote

Fill out the form below to receive a free annuity quote within 4 business hours, or use one of our annuity calculators.

PIMCO Tactical Balanced Index Overview

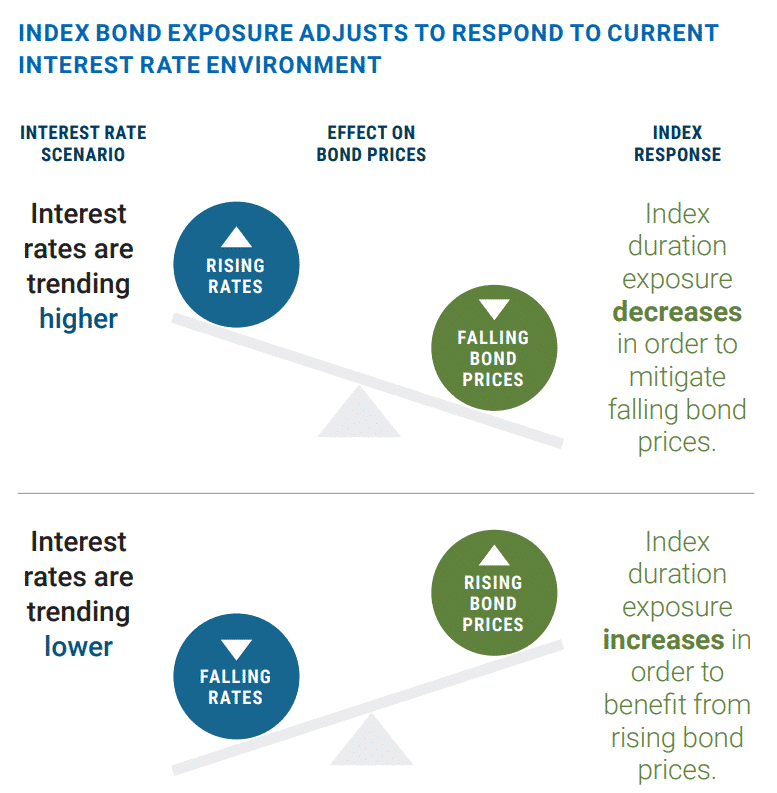

The DBTBIER index is designed to benefit from trends in the bond market, such as rising (or falling) interest rates. The path of U.S. interest rates is uncertain making it more important than ever to consider interest rate risk within bond allocations.

The PIMCO Tactical Balanced ER Index is comprised of the U.S. Equity Futures Custom Index, a bond component comprised of the PIMCO Synthetic Bond ER Index, and shifts weighting between them daily based on the historical volatility of each component.

PIMCO Synthetic Bond Index (SBI) is made up of 65% U.S. Investment grade credit and 35% U.S. Treasury bond exposure. The SBI is designed to allocate more to credit than traditional bond indexes in order to help mitigate drag from the historically low U.S. Treasury rates.

PIMCO TBI will adjust its interest rate exposure systematically based on market trends. As interest rates begin to trend higher, bond prices typically tend to trend lower and the index would decrease exposure to this declining asset and vice-versa when interest rates trend higher.

PIMCO Tactical Balanced Index Tactical Volatility Management

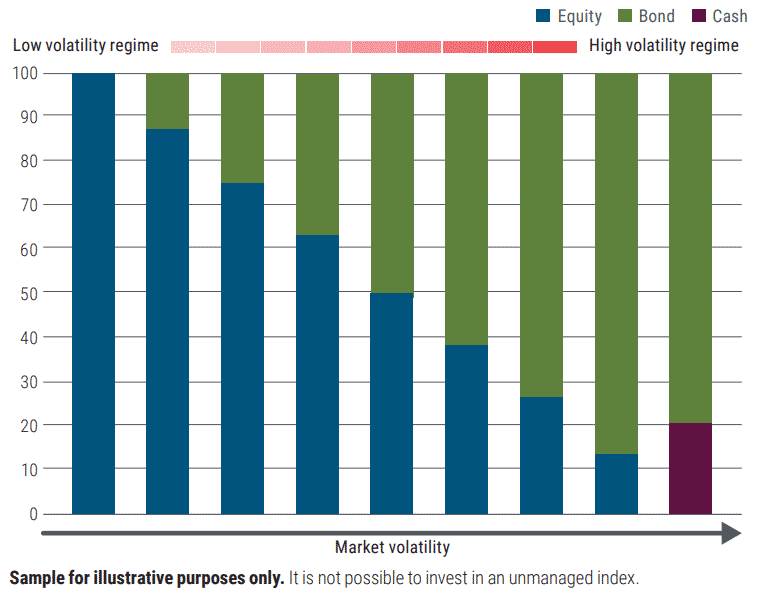

PIMCO Tactical Balanced Index Sample Allocations

If market volatility increases the allocation to equities will decrease and shift towards bonds to help stabilize risk. The equity allocation has gone to zero in times of severe market stress. During these times the bond allocation may decrease as well in favor of cash.

The allocation will shift back to equities as market volatility begins to stabilize. This dynamic approach can help reduce drastic fluctuations in the value of the index, which could lead to more successful long-term outcomes.

Volatility Managed Indexes In Index Annuities

Allianz Life was the first insurance company to offer a volatility-managed index in a fixed index annuity (Bloomberg Universal Dynamic Index: BUDBI). Today volatility managed indexes have become very popular and are available inside most indexed annuities.

Some index options illustrate unbelievably well but it is important to consider who developed the index and do they have a robust and time-tested process.

The PIMCO Tactical Balanced Index II is supported by the full spectrum of PIMCO’s extensive global resources. Their team of experts develops and executes managed volatility and other quantitative portfolios, which total $48 billion in assets under management (March 31, 2021).

Related Articles

Nasdaq FC Index (BOFANFCC) | In Athene Annuities: 2025

Fixed Index Annuity Comparisons

MLSB Index – Merrill Lynch Strategic Balanced Index

Bloomberg US Dynamic Balance ii ER Index