You can lose money in a variable annuity and a registered index-linked annuity; you can not lose money in a fixed annuity, immediate annuity, or fixed index annuity.

Can You Lose Money In An Annuity?

Are you looking for a safe and steady way to grow your retirement savings? This annuity guide will cover which types of annuities you can lose money in and which types of annuities offer principal protection from a potential stock market downturn.

Can You Lose Money in a Variable Annuity?

Yes, you can lose your money in a variable annuity. When you purchase a variable annuity your money is invested directly in the stock market via sub-accounts; similar to a 401(k).

In addition, most variable annuities come with a fair amount of fees including:

• Sub-account fees

• M&E Fees ( mortality and expense)

• Fees for additional riders (typically lifetime income riders or death benefit riders)

Can you Lose Money in a Registered Index Linked Annuity (RILA)?

You can lose money in a registered index-linked annuity (RILA). RILA’s are a hybrid between fixed index annuities and variable annuities.

If the stock market does have a negative year you can lose money but the amount you lose is limited by a “floor” or a “buffer.”

In other words, when you invest in a RILA you know the most you can lose in a year, or you know that the insurance company takes on the risk for a portion of the downside e up to a certain percent.

Can You Lose Money in an Income Annuity?

Single-Premium Immediate Annuities (SPIAs) and Qualified Longevity Annuity Contracts (QLACs) convert a lump sum into an income stream that is contractually guaranteed for life or for a certain number of years.

You Can Not Lose Money in a Fixed Annuity

No, you can not lose money in a fixed annuity. Fixed annuities provide a guaranteed rate of return for a set period of time (usually 2 to 10 years).

Because of their similarity to bank certificates of deposit fixed annuities are often referred to as CD Type Annuities.

Can you Lose Money in a Fixed Index Annuity?

You can not lose money in a fixed index annuity; an index annuity guarantees that the least amount of interest you can earn in any contract year is 0%, even if the stock market crashes.

The amount of interest credited is determined by the performance of a stock market index; however, you are not directly invested in the market.

If the index goes up you will be credited with a percent of the gains and if it goes down you earn nothing and lose nothing.

Can you lose money in a Long Term Care Annuity?

You cannot lose money in a long-term care annuity as they are a type of fixed annuity.

These types of fixed annuities are designed to leverage your money to cover potential long-term care expenses rather than to accumulate interest.

Annuity Fees and Early Surrender Charges

Early Surrender Penalties

Annuities have a Contingent Deferred Surrender Charge (CDSC). This means you will pay a “surrender” fee if you liquidate your annuity contract before the end of your term.

If you’ve had experience investing in mutual funds you are likely familiar with the concept of a Contingent Deferred Sales Charge (CDSC). Investors who sell Mutual Fund Class B shares within a specified number of years from purchase are also assessed a CDSC – the same concept with an annuity.

Annuity Fees

Finally, index annuities with an optional income rider have become increasingly popular because they actually pay higher guaranteed lifetime income payments than traditional annuitization with a lot more flexibility.

If you purchase an optional income rider you may be charged an annual fee that will be subtracted from your account value. Your account value could decrease by an amount equal to the rider fee in a year in which you earn zero interest.

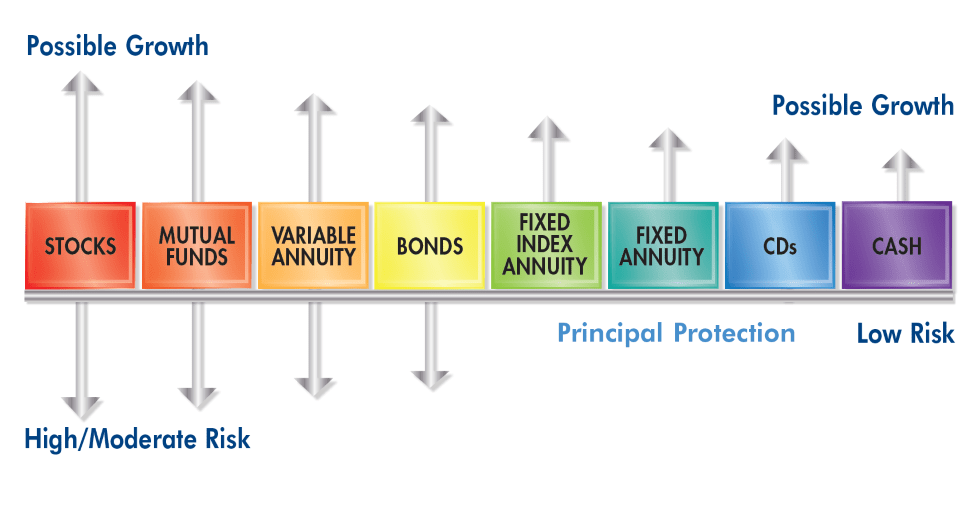

Risk Level by Type of Annuity Comparison Chart

get an Annuity Quote

Complete the form below and we’ll email you an annuity quote within four business hours. If your request is urgent please contact us at 855-583-1104. Or you can use one of our annuity calculators here.