Athene adds AiPex Performance Index to Fixed Index Annuities

Fixed Index Annuities (FIAs) have come a long way since the first generation of FIAs that typically used the S&P 500® as an index “measuring stick” to calculate interest credits.

With little variety in the marketplace, it was difficult to differentiate any single product. Athene just announced AiPex Artificially Powered Index is now available as an option inside of the Protector Series of indexed annuities.

Fewer retirees today have access to pensions that provide guaranteed income, while years of low-interest rates have sent investors into more volatile parts of the market in search of higher yields.

In an ultra-low rate environment, financial professionals have sought new ways to add a mix of relative stability and growth potential to their retirement income portfolios. Which in turn has led to the tremendous growth of fixed index annuity (FIAs) sales.

Indexed Annuities offer the opportunity to earn interest credits based in part on the growth of an underlying market index, such as the S&P 500®.

Index interest crediting strategies combine protection from loss due to market downturns with the potential for growth based on an external market index.

As American’s transition to retirement age most ultimately does a 401k Rollover into some time of fixed income investment. If you’re not yet familiar with fixed index annuities, you’ll find our Ultimate Guide to Fixed Index Annuities very helpful.

A floor level of guaranteed lifetime income is something most people want in their retirement income plans. A lack of educational materials and access to structured products and annuities has hindered the widespread adoption of these strategies in the United States.

All-time low-interest rates have made traditional fixed income solutions, namely bonds, much less effective in recent months and years.

As advisors search for new alternatives many have begun to reallocate their portfolios to a combination of bonds and indexed annuities along with equities. Without a doubt, indexed annuities have become increasingly popular, with sales reaching $60.9 billion in 2016, up 12 percent over the previous year. *

Annuity companies have innovated more in the past 5 years than in the previous 20. AIG’s launch of AiPex, the first-ever U.S. Equity Index Powered by Artificial Intelligence is certainly the latest example.

Fixed Index Annuity Innovation

Amidst that growth, another trend has emerged as insurance carriers look to differentiate themselves from competitors: an explosion of crediting strategies that track alternative indices.

Yet this proliferation of choices can be daunting to financial professionals seeking the right options for their clients’ needs. How do these strategies differ, and how can you determine which alternative indices provide real customer value?

The First Artificially Intelligent U.S. Equity Index

By working around the clock to keep up with the increasing volume of data created every day, the AI-Powered US Equity Index (“AiPEX”) uses the power of Artificial Intelligence (“AI”) to continually improve processes, in an effort to build an informational advantage as markets evolve and as new information becomes available.

AiPEX seeks to identify companies whose stock prices are poised for potential growth through an objective selection process that is like a fundamental approach, only thousands of times faster and broader in scope.

AI Powered Equity Investing

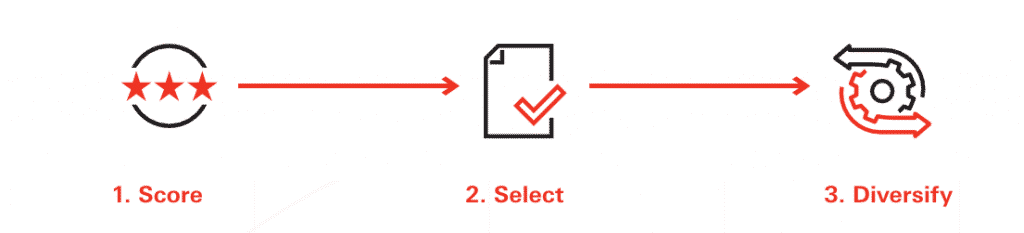

Applying what it has learned, AiPEX Performance Index objectively evaluates and scores each of the 1,000 largest U.S. publicly traded companies in order to find those whose stock prices are poised for growth and re-balances its portfolio monthly by following a 3-step equity selection process.

Scores for the 1,000 largest U.S. companies are calculated based on:

- Financial Health Score: evaluates a company’s fundamentals and key figures.

- Management Score: assesses a company’s management strength and thought leadership.

- News & Information Score: measures a company’s market sentiment, economic, and geopolitical risks.

Approximately 250 companies with the highest combined Financial Health, Management, and News and Information Scores are selected for the portfolio.

Companies are assigned portfolio weights, with the largest weights going to the companies with the highest combined scores (subject to diversification and market liquidity limits).

AiPex Performance Index Turns Millions of Pieces of Data into actionable insights

Applying what it has learned, AiPEX objectively evaluates and scores each of the 1,000 largest U.S. publicly traded companies in order to find those whose stock prices are poised for growth and rebalances its portfolio monthly by following a 3-step equity selection process.

AiPex Performance Index offers a new kind of equity strategy utilizing IBM Watson’s Artificial Intelligence. Watson enables AiPEX to understand the equity markets and to read and analyze millions of traditional (e.g. financial statements) and non-traditional (e.g. news articles) data sources each day.

With Watson, AiPEX is able to build intuition, experience, and continuously learn as headlines break and new information becomes available.

Applying what it has learned, AiPEX Performance Index objectively evaluates and scores each of the 1,000 largest U.S. publicly traded companies in order to find those whose stock prices are poised for growth and re-balances its portfolio monthly by following a 3-step equity selection process.

With a little help from IBM Watson; AiPEX Performance Index can identify and quantify relationships that are not readily apparent to humans. Rather than one analyst’s opinion, AiPEX selects stocks based on the insights uncovered by an entire army of simulated research analysts and traders who are in complete coordination, allowing for information learned by one to be instantly known by all.

AiPex Performance Index Historical Performance Simulated

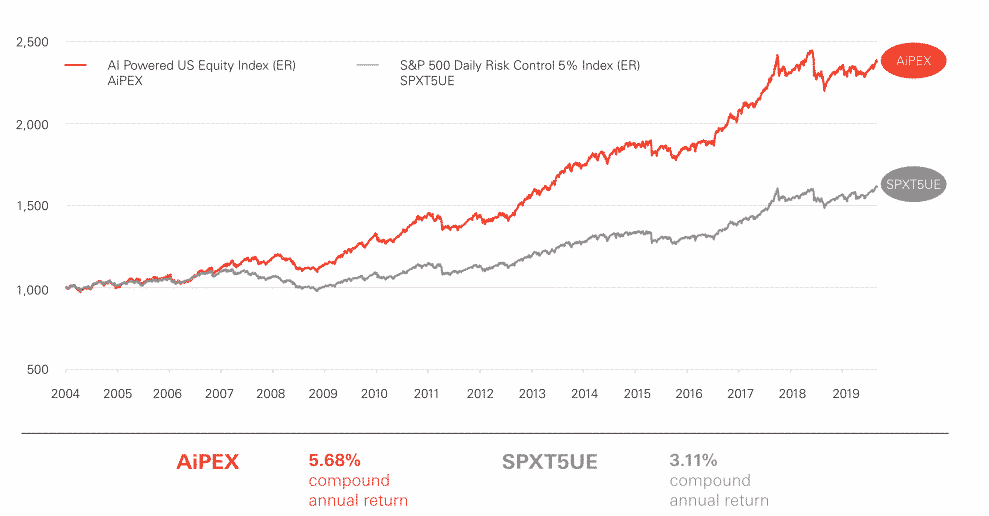

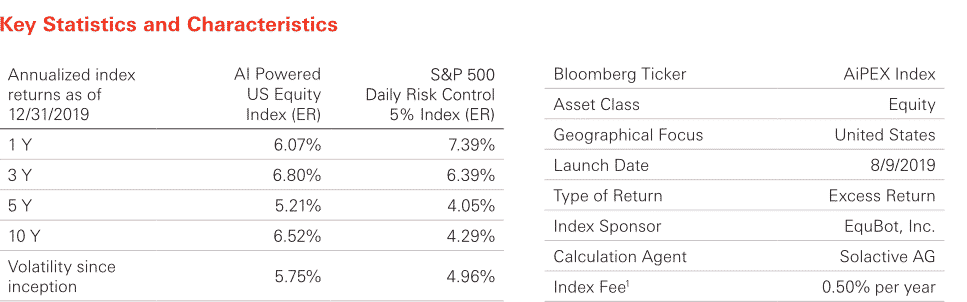

The AI-Powered US Equity Index would have provided growth through a variety of market environments due in part to a monthly equity selection process intended to adapt to market changes and mitigate potential risks.

While real-time calculations began on August 9, 2019, the graph below illustrates how AiPEX Performance Index would have provided long-term positive returns with low volatility.

AiPEX Performance Index values shown here, and as calculated and published by Solactive AG, are a net of the 0.50% p.a. Index Fee.

The graph and table above sets forth the hypothetical back-tested performance of the Index from April 30, 2004, through August 9, 2019, and actual index performance thereafter through December 31, 2019. See the risk factors and “Use of Simulated Returns” herein.

AI Beginning to Impact our Daily Lives

Technology similar to that which AiPEX uses to gain market insights is already helping to improve our daily lives, even if we don’t realize it.

- AI is helping the Mayo Clinic improve their breast cancer early screening results and match patients with clinical trials.*

- AI is helping our armed forces and law enforcement professionals identify persons of interest with facial recognition.*

- AI is helping power the billions of online searches each day and has transformed the communication industry with software such as text message auto-completion.*

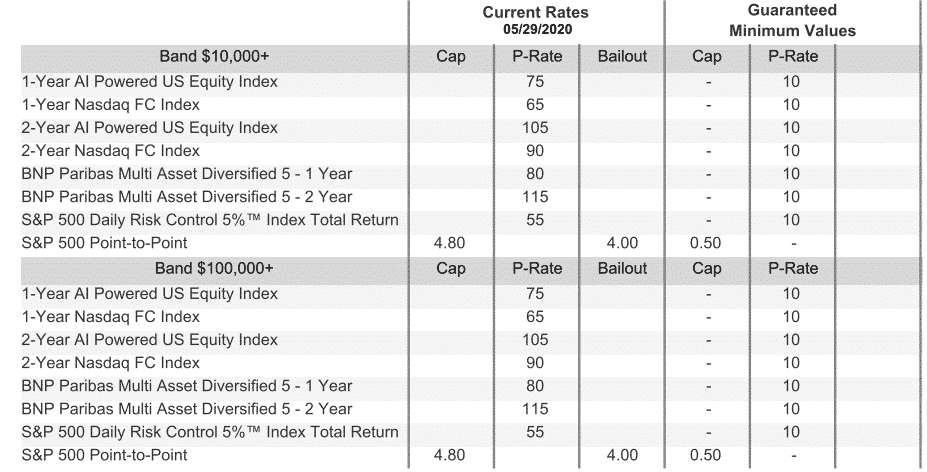

Athene Accumulator AiPEX Performance Index Rates

As of the date this article was written, an investor purchasing an Athene Accumulator Fixed Index Annuity would have an option to allocate some or all of their funds to the AiPex annual point-to-point crediting method.

In addition to the AI Powered US Equity Index, Athene’s Fixed Index Annuities also offer other attractive market indexes including:

- PTP BNP Paribas Multi Asset Diversified 5 Index

- PTP Nasdaq FC Index

- S&O 500

- S&P 500 Daily Risk Control 5 % Index, and a

- Declared Rate Strategy currently at 2.00% for the 7-year option.

To see more available fixed index annuity market indexes and compare current interest rates visit our fixed index annuity marketplace.

Learn more about Athene Annuity & Life Company. American General Life Insurance also just launched an innovative new index; AQR DynamiQ Allocation Index, that is worth checking out if you are shopping for an annuity.

Get an aIpEX Annuity Quote

Request an annuity quote below, use one of our annuity calculators.

Visit our online annuity store to shop and compare today’s best fixed index annuity rates.