Company Profile

Zionsville, IN 46077

Company Information

Gainbridge Life Insurance Company ("Gainbridge"), domiciled in Delaware with its principal office located in Zionsville, Indiana, was established in 2015. As an Insurtech subsidiary of Group 1001, Gainbridge aims to enable consumers to manage their financial future by offering accessible solutions designed for a wide range of budgets and levels of financial expertise.

The company's platform delivers straightforward financial products supported by advanced technology, ensuring transparency without unnecessary complexity or hidden fees. Group 1001 employs over 1,400 professionals, manages more than $65 billion in assets, and serves upwards of 950,000 customers. Its portfolio includes Delaware Life, Gainbridge, Clear Spring Health, Clear Spring Property and Casualty Group, Clear Spring Life and Annuity Company, RVI Group, and other affiliated brands.

Assets and Liabilities

Ratings

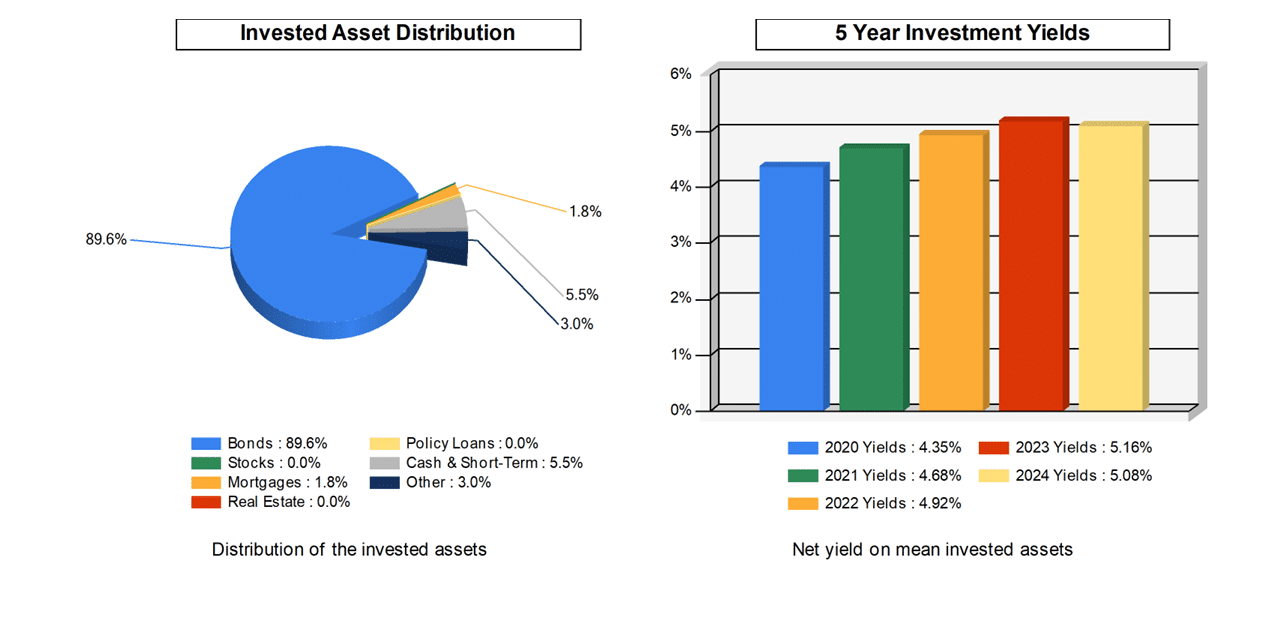

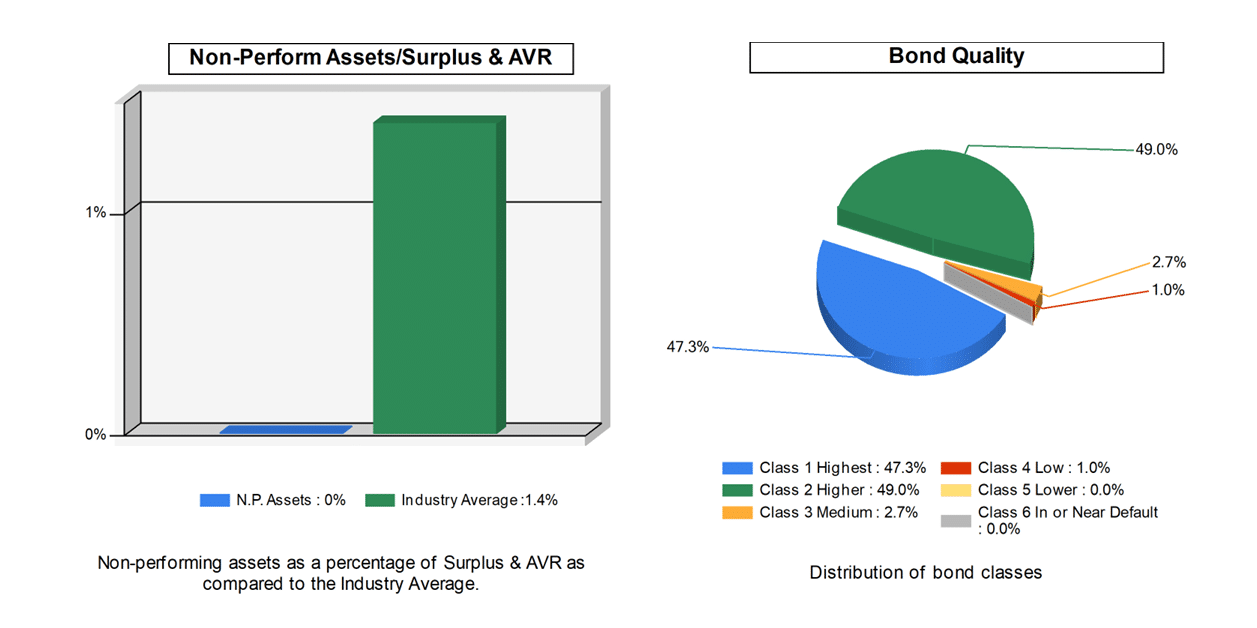

Insurer Financial Charts

Gainbridge Annuity Reviews

- Gainbridge FastBreak Annuity — Download Brochure (PDF)

- Gainbridge PartyFlex Annuity — Download Brochure (PDF)

A Best's Financial Strength Rating opinion addresses the relative ability of an insurer to meet its ongoing insurance obligations. It is not a warranty of a company's financial strength and ability to meet its obligations to policyholders. View our Important Notice: Best's Credit Ratings for a disclaimer notice and complete details at http://www.ambest.com/ratings/notice. Financial data for Year-End 2024 from the life insurance companies' statutory annual statements. All ratings shown are current as of October 15, 2025.

For help comparing annuities or company strength, call 855-583-1104 or email info@myannuitystore.com.

© 2026 My Annuity Store, Inc. All rights reserved.