Are Annuity Lattters a Good Idea?

Building an annuity ladder can increase yield, manage reinvestment risk, and keep cash flow predictable. In 2025, with interest rates potentially stabilizing after Fed adjustments, laddering is smarter than ever.

Let’s break it down and show you how to build your own—using our platform’s Annuity Ladder Calculator and top products like the Revol One DirectGrowth MYGA at 6% for 5, 7, or 10 years.

What is an Annuity Ladder?

An annuity ladder is an income planning strategy that spreads investments across multiple annuities to provide staggered maturity dates. An annuity ladder can provide a steady stream of income while offering flexibility to adapt to changing interest rates. It mirrors bond laddering: you allocate across multiple terms so that each year, one portion matures—giving you choices to spend or reinvest at then‑current rates.

At a glance

- Why ladder

- Reduce rate‑timing risk and create scheduled liquidity.

- Good for

- Principal protection, predictable growth, and flexibility.

- Consider

- Reinvestment risk, surrender schedules, taxes and penalties before 59½.

What You Should Know: Benefits of Building an Annuity Ladder

-

🔒

Mitigates Interest Rate Risk: If rates are low at retirement, laddering avoids locking into suboptimal returns for decades by allowing subsequent purchases to capture potential rate increases and better yields.

-

🔄

Enhances Liquidity and Flexibility: Staggered maturities or purchase dates keep portions of funds accessible short-term, reducing early withdrawal penalties, and create multiple income streams to address longevity risk, ensuring you don't outlive your savings.

-

📈

Provides Inflation Protection: Arrange later-starting annuities to counter rising costs; if inflation erodes initial income, higher-rate later purchases provide a boost, while diversifying across types or providers spreads risk against insurer failure.

-

📊

Outperforms in Rising Rate Environments: Laddering can surpass a single deferred annuity by securing higher payments over time, especially with wise management of retained assets, offering a balanced approach to reliable retirement income.

Who Should Buy an Annuity Ladder?

Annuity laddering isn’t for everyone, but it can be a smart strategy if you want to build a more flexible, reliable retirement income stream without putting all your eggs in one basket. If any of these profiles sound like you, it might be time to ladder up.

1. Retirees or Near-Retirees Seeking Predictable Income

If you’re approaching retirement laddering annuities provide a guaranteed income stream. This protects you from sequence of returns risk as you won’t have to withdraw from equities when the market is down.

- Example: A 65-year-old retiree might buy annuities maturing in 3, 5, and 7 years to create a “ladder” of income that kicks in at different life stages, helping cover essentials like healthcare or travel dreams.

2. Risk-Averse Investors Concerned About Interest Rates

Laddering lets you lock in rates for longer durations without the regret of buying everything when rates are low.

- Perfect for conservative savers who prioritize stability over high-risk growth.

- Pro tip: If rates rise, you can reinvest maturing annuities at better terms, keeping your portfolio agile.

3. People Planning for Longevity and Inflation

With Americans living longer, you don’t want your income to fizzle out. A MYGA ladder strategy spreads risk and can include inflation-adjusted options.

- Great for those with family histories of longevity or who expect to need income well into their 90s.

- It also helps combat inflation by allowing periodic adjustments—think of it as building rungs that climb with rising costs.

4. Diversifiers Looking to Balance Their Portfolio

If your retirement mix is heavy on stocks or bonds, annuities add a layer of security. Laddering diversifies further by varying terms and types (e.g., fixed, indexed, or variable annuities).

- Suited for middle-class Americans who want accessible tools to protect against market crashes without needing a finance degree.

- Bonus: It’s tax-deferred growth, which is a win for anyone in a higher tax bracket during working years.

5. High-Net-Worth Individuals or Those with Lump Sums

Got a big inheritance, 401(k) rollover, or bonus? Don’t dump it all into one annuity. Laddering portions out the investment, reducing surrender charges and giving liquidity options.

- Ideal for entrepreneurs or executives who’ve built substantial nest eggs and want to optimize for taxes and legacy planning.

Annuity Ladder Calculator (2025)

Build a MYGA ladder to balance yield and annual liquidity. Tweak terms, allocations, and rates; compare to a single-term benchmark.

Educational calculator. Rates are illustrative and not an offer. Actual carrier rates, guarantees, and surrender schedules apply.

How to Build an Annuity Ladder in 5 Steps

Start by assessing retirement goals, time horizon, and liquidity needs. Choose how many rungs (often 3–5) and stagger terms annually or every few years.

- Divide your principal: Decide the number of rungs and allocate funds per rung.

- Choose intervals/terms: For example, 3–7 years, one maturing each year.

- Select providers: Favor highly rated insurers; diversify issuers for added resilience.

- Pick payout options: Accumulation MYGAs for liquidity, or add future income with SPIA/DIAs/QLACs as a separate ladder.

- Review and roll: At each maturity, spend what you need and roll the rest into a new long rung at current rates.

Finally, review and adjust periodically. As rates fluctuate, you may need to tweak your plan. Tools like annuity calculators can help simulate scenarios.

Annuities Commonly Used in Annuity Laddering

Not all annuities are ideal for laddering, but several types lend themselves well to this strategy.

- MYGA (fixed annuity): It is called a MYGA Ladder for a reason, MYGAs pay a guaranteed rate for a set period of time. Core ladder building block.

- Fixed indexed annuity: Index‑linked interest with downside protection; consider for a growth sleeve.

- SPIA/DIA/QLAC: Income annuities you can “ladder” by start dates to build future guaranteed income.

Tax Benefits of Annuity Ladders

A MYGA ladder also opens up the door of opportunity for some tax advantages in certain instances. Here is a quick example of how laddering your funds amongst multiple contracts could be advantageous.

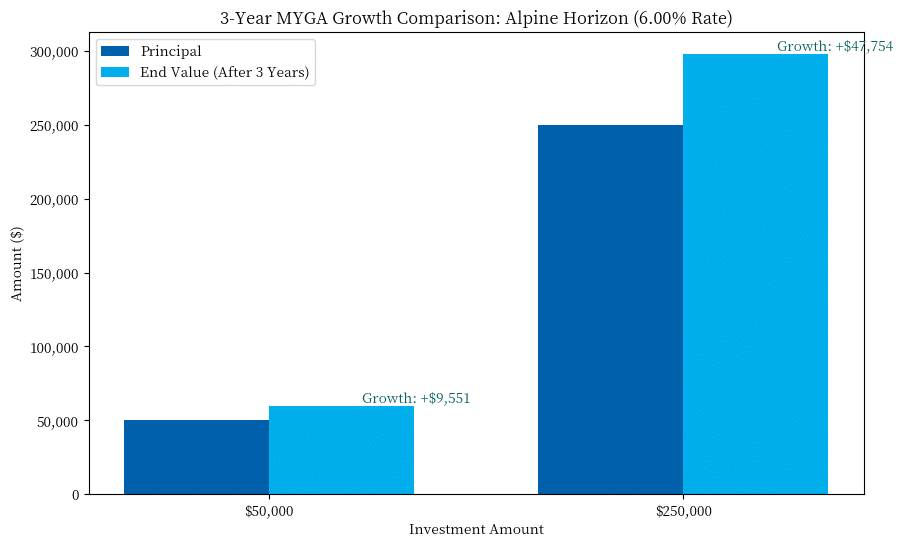

Let’s go over to options assuming you are looking to invest $250,000 into an annuity; and plan to withdraw $50,000 in 3 years..

- Split $250K into five MYGAs of $50,000 each: 3, 4, 5, 6, and 7-year terms.

- Or purchase a single fixed annuity for $250,000.

Pros and Cons of a MYGA Ladder

Pros

- Mitigates rate timing: Don’t lock your entire principal at one moment; later rungs can capture future rates.

- Liquidity and flexibility: Annual maturities create scheduled access without surrender charges.

- Option to adjust over time: Reinvest at prevailing rates as each rung matures.

- Simplicity: MYGAs make it easy to plan around guaranteed rates and maturities.

Cons

- Reinvestment risk: If rates fall, later rungs may credit less.

- Liquidity: Early access can trigger surrender charges and market value adjustments (MVAs).

- Credit risk: Guarantees rely on insurer claims‑paying ability; diversify and review ratings.

- Taxes/penalties: Gains taxed as ordinary income; a 10% penalty may apply before age 59½.

- Inflation: Could pose a risk if rates don’t keep pace, and over-reliance on annuities could limit exposure to higher-growth assets.

FAQs About Annuity Laddering

What is annuity laddering?

An annuity ladder strategy involves buying multiple fixed annuities (like MYGAs or fixed-indexed annuities) with different maturity dates. Instead of dumping all your money into one annuity, you spread it out—say, over 3, 5, and 7 years. This "ladders" your investments, giving you access to funds at intervals while locking in rates.

How can I start building an annuity ladder?

Decide your total amount and liquidity needs, choose 3–5 staggered terms (e.g., 3–7 years), and select highly rated insurers. Request carrier-specific quotes before purchasing.

Is an annuity ladder suitable for everyone in retirement?

It’s best for retirees prioritizing principal protection, predictable growth, and periodic access to funds. It may not fit those needing full liquidity or targeting higher equity-like growth.

How does an annuity ladder differ from buying a single annuity?

A single annuity locks one rate and surrender schedule. A ladder spreads purchases across multiple terms, creating annual maturities and opportunities to reset at prevailing rates.

What are the main risks associated with annuity laddering?

Reinvestment risk if rates fall, surrender charges and possible MVAs for early access, insurer credit risk (mitigated by ratings and state guaranty associations), and ordinary income taxation of gains; a 10% IRS penalty may apply before age 59½.

Conclusion

An annuity ladder can be a powerful tool in your retirement arsenal, offering a blend of security, flexibility, and potential for optimized income. By understanding its mechanics and weighing the pros against the cons, you can decide if it aligns with your goals.

Always seek professional advice to tailor this strategy to your unique situation. With careful planning, an annuity ladder could help you climb toward a more comfortable retirement.

Related

Sources

- Guttentag, J. (2022, January 11). Forbes. Do Annuity Ladders Really Make Sense For Retirees In A Rising Rate Environment?

- Hussain, A. (2022, January 23). Investopedia. Annuity Ladder: Meaning, Disadvantages, and Strategies.