How Much Life Insurance Do I Need Estimator

There is no way to determine exactly just how much life insurance you need but there are a few different ways to make a very good, educated guess.

In this guide we’ll walk you through a quick and simple process that will provide you with a very good estimate of how much insurance you should consider buying.

INCOME NEEDS

1. Annual income your family would need if you die today

Typically between 60% and 80% of total income. Include all salaries, dividends, interest, and any other sources of income. $_________

2. Annual income available to your family from other sources

Enter a number that includes dividends, interest, spouse’s earnings, and social security. $_________

3. Annual income to be replaced (subtract line 2 from line 1) $_________

4. Capital needed for income

Multiply line 3 by the appropriate factor¹ in the table below $_________

| Years Income Needed | 10 | 15 | 20 | 25 | 30 | 35 | 40 | 45 | 50 |

| Factor | 9.4 | 13.6 | 15.4 | 18.1 | 20.4 | 22.4 | 24.1 | 25.6 | 26.9 |

EXPENSES

5. Funeral² and other final expenses

Typically the greater of $15,000 or 4% of your estate $_________

6. Mortgage and other debts

Include mortgage balance, credit card debt, car loans, home equity loans, etc. $_________

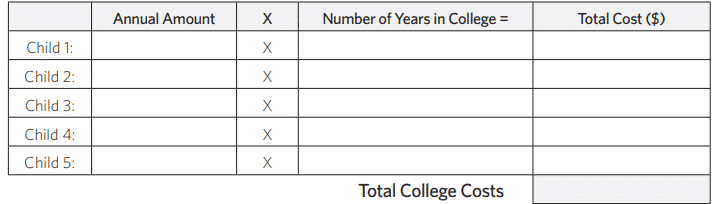

7. College costs³

2015-2016 average annual cost at four-year colleges and universities:

public – $19,548 (in-state); $34,031 – (out-of-state); private college – $43,921

8. Total Capital Required (Add lines 4, 5, 6 and 7) $_________

ASSETS

9. Savings and investments

Bank accounts, CDs, stocks, bonds, mutual funds, real estate/rental property, etc. $_________

10. Retirement savings

IRAs, 401(k) plans, SEPs, pension and profit sharing plans $_________

11. Present amount of the insurance

Include group insurance and personal insurance purchased on your own $_________

12. Total of assets (Add lines 9, 10 and 11) $_________

13. Estimated amount of additional life insurance needed (Subtract line 12 from line 8) $_________

¹Inflation is assumed to be 3%. The rate of return on investments is assumed to be 4.5% after tax.

²All data published on this page is based on the latest available government, industry, and research reports; data is updated as new information becomes available. The data on this page was last updated on July 18, 2019. https://nfda.org/news/statistics

³Source: The College Board, Trends in College Pricing 2015-2016. Costs include tuition, room and board, books and supplies, transportation, and other expenses. The College Costs numbers are the 2015-2016 national average for a four year college or university. College costs are indexed at 4.5%.

How Much Does Life Insurance Cost?

Once you’ve answered the, “how much life insurance do I need” question, it would seem the logical next step is to get life insurance quotes to see exactly how much it is going to cost you to get an appropriate amount of life insurance coverage to protect your family in the event of your death.

You can use our life insurance quotes online tool to get offers from multiple top rate insurers instantly.

General Rule of Thumb Method

Multiply your income by 10

The “times your income by 10” general rule of thumb is often shared online, but it doesn’t take a detailed look at your family’s needs, nor does it consider your savings or existing life insurance policies. And it doesn’t provide a coverage amount for stay-at-home parents, who should have coverage even if they don’t make an income.

If you or your spouse do not work outside of the home the value, he or she would still need to be replaced if they were to die. The surviving spouse/ remaining parent would need funds to pay someone for childcare and other responsibilities the stay-at-home parent was doing for free.

Tips for Calculating How Much Life Insurance You Need

- Include the appropriate amouint of life insurance in your overall financial plan and budget for the expense as part of your monthly or annual expenses.

- Don’t go too light – better to error on the high side.

- Discuss this important decision with your spouse or significant other

- Consider buying two or three smaller policies instead of a single larger life insurance policy.