Nationwide Secure Growth Annuity 7

Minimum Deposit: $10,000 | 5.15%

Deposits $100,000+ | 5.35%

The Nationwide Secure Growth 7 is a 7 Year Fixed Annuity designed to be a high-yield retirement savings account.

A fixed annuity or MYGA may be suitable for conservative investors who are looking for a safe and steady way to grow their retirement savings.

-

Compound Interest ($100,000 or more) 5.35%

5.15% Interest for deposits of $10,000 - $99,999

-

Annual Free Withdrawals 10%

Systimatic withdrawals of interest is allowed

Nationwide Secure Growth 7 Details

It’s never too early to start planning for retirement. Selecting a strategy that works best involves assessing your goals, time horizon, and risk tolerance.

The Nationwide Secure Growth 7 Annuity is a single premium, multi-year guarantee annuity. An annuity is a long-term contract issued by an insurance company. In exchange for a premium payment, the insurance company agrees to make payments to you in the future.

This annuity provides an accumulation value that earns interest through a fixed account with a guaranteed interest rate that is set for a 3-, 5- or 7-year period. This annuity also provides several options for accessing funds.

The Nationwide Secure Growth 7 may be appropriate for individuals who:

- Want a CD alternative due to low CD rates.

- Seek to accumulate money for retirement.

- Have a conservative risk tolerance and want to invest an inheritance or other lump sum.

- Want to secure a fixed annuity payment but not immediate income.

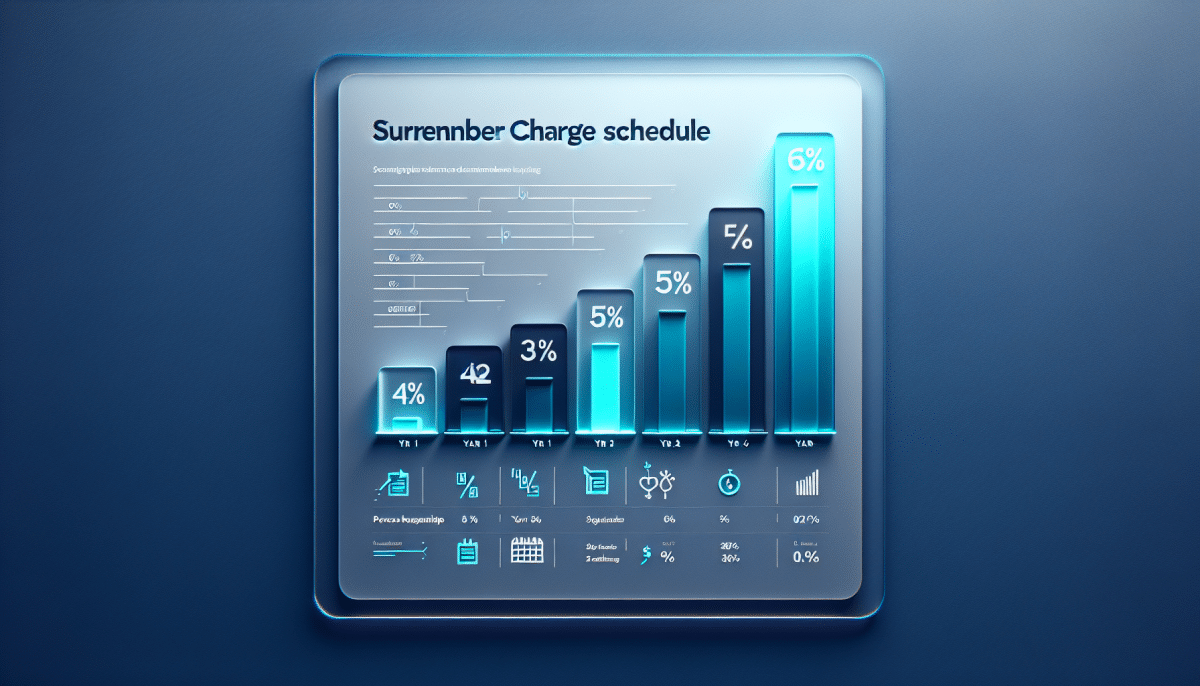

1. Withdrawal any amount free of charges and fees.

2. If you do nothing, the contract renews for the same term at the rates available at that time. Renewal rates for guarantee periods will be based on current economic conditions and are guaranteed to be no less than the guaranteed minimum interest rate of .50%.

| Base rate | .50% |

| Rate guaranteed | 5 years |

| Guaranteed yield to surrender | 5.15% (5.35% $100K+) |

| Guaranteed minimum renewal rate | .50% |

| Market value adjustment | Yes |

| Return of premium | No |

| PREMIUM PAYMENTS | |

| Type | Single |

| Maximum | $1,000,000 |

| Minimum | $10,000 |

| Free Look Period | 30 Days |

| AGE RESTRICTIONS | |

| Owner | 0 – 90 |

| Annuitant | 0 – 90 |

FREE-LOOK PERIOD

30 days

WITHDRAWALS

- 10% Free Withdrawals Each Year interest beginning year two.

- Interest-only withdrawals: Yes

- Cumulative: No

- Market value adjustment (MVA): Yes

- Return of premium: No

Nursing Home Waiver: 90 day elimination period. Maximum eligibility age 80.

Terminal Illness Waiver: Maximum eligibility age 80.

Taxes:

In general, annuities grow tax-deferred, meaning you don’t pay taxes until you withdraw your money from the annuity.

When you withdraw from your annuity the interest earned will be taxed at your ordinary-income tax rate.

Non-Qualified Annuity

Non-qualified funds are cash, checking, savings, life insurance cash value, etc. Only the interest you have earned will be taxed as ordinary income.

Qualified Annuity

Qualified funds are 401k, IRA, SEP, 403b, TSA, etc. Both principal and interest will be taxed as ordinary income as you withdraw money.

Roth IRA Annuity

Withdrawals from Roth IRA annuities are tax-free if the IRS requirements are met.

Early-Withdrawals

If you withdraw money from your annuity before you turn age 59½, you may receive a 10% IRS penalty in addition to paying ordinary income taxes.

Pros of the Nationwide Secure Growth 5Year Fixed Annuity

- Pays a guaranteed interest rate much higher than current CD Rates are paying.

- Your interest grows tax-deferred meaning you do not pay taxes on your interest until you withdraw it from your annuity.

- The death benefit is full account value and may avoid probate.

- Liquidity options provide you the access to the money that you need.

Not available in: CA, NY, DE

Visit our online annuity marketplace to view and compare more Fixed Annuity Rates. If you’d like an opportunity for more upside potential while maintaining principle protection you may want to consider a fixed index annuity.

Get a Nationwide Annuity Quote

Fill out the form below to receive a free annuity quote within 4 business hours,

or use one of our annuity calculators.

About Nationwide

Nationwide offers term and permanent life insurance and annuities, including:

- fixed index annuities (FIAs)

- traditional fixed annuities

- multi-year guarantee annuities (MYGAs)

- single premium immediate annuities (SPIAs)

Nationwide is a Fortune 100 company that offers a full range of highly ranked insurance and financial solutions.

In 2021, total investments increased to $130.8 billion, up from $125.5 billion in 2020. Net investment income of $5.3 billion in 2021 was up from $4.1 billion in 2020, driven primarily by alternative investments.

Nationwide Ratings

Nationwide is rated A+ by AM Best, A+ by Standard & Poor’s, A1 by Moody’s and has an 89 Comdex Score.

| Rating Agency | Rating |

|---|---|

| A.M. Best Company (Best's Ratings, 15 Ratings) | A+ (2) |

| Superior. Assigned to companies that have, in our opinion, a superior ability to meet their ongoing obligations to policyholders. | |

| Standard & Poor's (Financial Strength, 20 Ratings) | A+ (5) |

| An insurer rated 'A' has STRONG financial security characteristics, but is somewhat more likely to be affected by adverse business conditions than are insurers with higher ratings. | |

| Fitch Ratings (Financial Strength, 21 Ratings) | A+ (5) |

| Strong. 'A' IFS ratings denote a low expectation of ceased or interrupted payments. They indicate strong capacity to meet policyholder and contract obligations. This capacity may, nonetheless, be more vulnerable to changes in circumstances or in economic conditions than is the case for higher ratings. | |

| Weiss (Safety Rating, 16 Ratings) | B (5) |

| Good. The company offers good financial security and has the resources to deal with a variety of adverse economic conditions. It comfortably exceeds the minimum levels for all of our rating criteria, and is likely to remain healthy for the near future. However, in the event of a severe recession or major financial crisis, we feel that this assessment should be reviewed to make sure that the firm is still maintaining adequate financial strength. | |

| Ranking (Percentile in Rated Companies) | 89 |

| The Comdex gives the average percentile ranking of this company in relation to all other companies that have been rated by the rating services. The Comdex Ranking is the percentage of companies that are rated lower than this company. |

Learn more about what these financial ratings mean

Compare More Top 7 Year Annuity Rates

| Term | Insurer | Company Details | Annuity | Rate | Free Withdrawals | AM Best | Apply |

|---|---|---|---|---|---|---|---|

| 7 Years | Knighthead Life | Staysail Annuity | 6.50% Simple | None | A- | Apply | |

| 7 Years | Knighthead Life | Staysail Annuity | 6.35% Simple | 10% | A- | Apply | |

| 7 Years | Wichita National | Security MYGA | 6.10% | None | B+ | Apply | |

| 7 Years | Revol One | DirectGrowth | 6.00% | None | B++ | Apply | |

| 7 Years | Revol One | DirectGrowth | 5.90% | Interest | B++ | Apply | |

| 7 Years | Mountain Life | Alpine Horizon | 5.75% | 0%/ 5% Yrs 2+ | B+ | Apply | |

| 7 Years | AMERICO | Platinum Assure | 5.50% | A | Apply |