Understanding Premium Finance Insurance

Regardless of what you may have heard or think about premium finance insurance, it doesn’t have to be complicated and scary. The basic mechanics are actually quite simple.

In this quick guide I will cover:

- The basic mechanics of premium finance insurance financing

- Types of individuals that most often benefit from this strategy

- Next steps to proceed if you wish to explore premium financing further

Why is Premium Finance Insurance Used?

Let’s say you need life insurance but are hesitant to pull assets out of investments to pay the premiums. Using a bank loan to finance the policy allows you to keep investing while still getting life insurance protection.

If structured properly, the life insurance returns could exceed the interest being paid on the bank loan, putting you in a better position that you were in before. And if your

investments also do well, even better.

Loan Interest

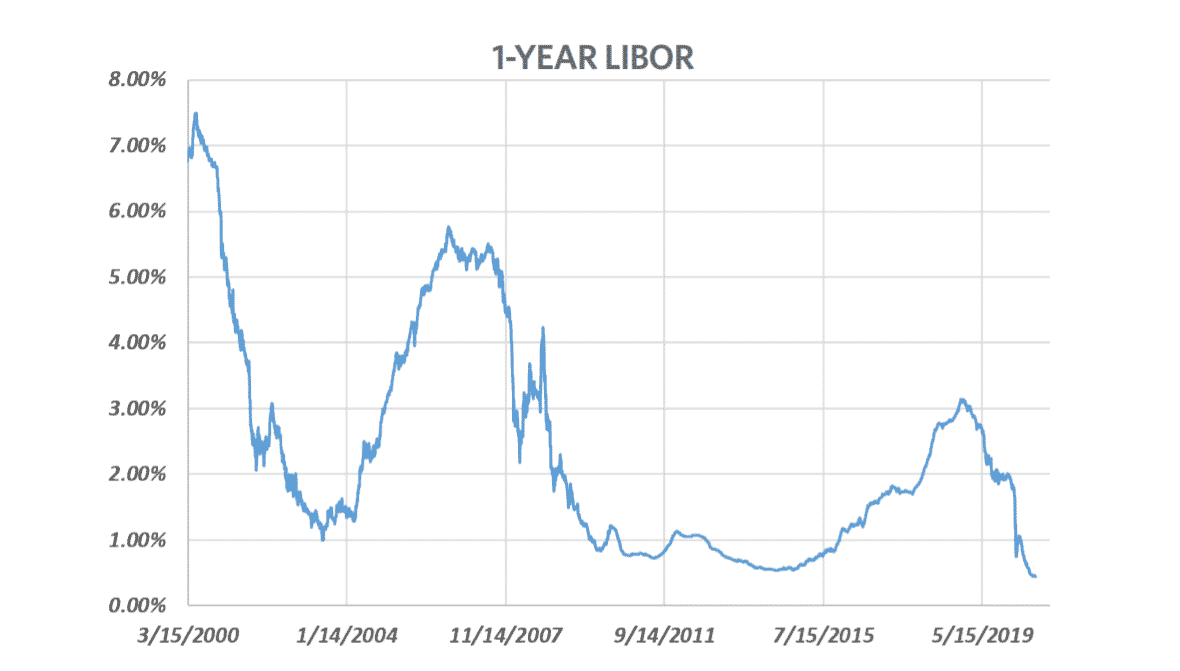

Most loan rates reset each year to reflect the LIBOR.

Loan Collateral

The primary source of collateral is the policy's cash surrender value.

Loan Exit Strategies

A clearly defined strategy for repayment is essential for successful implementation.

How Does Premium Finance Insurance Work?

To put a premium finance insurance strategy in place, you’ll need to work with a commercial bank to borrow funds to pay life insurance premiums. You post both the insurance policy and outside assets as collateral for the loan and, in most cases, pay loan interest out-of-pocket for a defined period, at which point you repay the loan.

Premium finance loans are typically made at a relatively low interest rate of a spread plus short-term LIBOR rates.

Who Should Try It?

Premium financing is most attractive to those that have a more compelling growth opportunity with their out-of-pocket funds and don’t want to lose that growth by tying their assets up in insurance premiums.

Additionally, this strategy is targeted for those with a significant net worth, so connect with your advisor to determine if you qualify.

The key to making premium finance insurance work is to take advantage of arbitrage.

Arbitrage: The “magic” of premium finance occurs only to the extent the life insurance policy outperforms borrowing costs.

Insurance policies leverage long-duration fixed income versus short-duration commercial loans and, when properly structured, can provide returns that are greater

than the borrowing costs.

While premium finance isn’t too hard to understand, it only works if structured properly, and for the right situation it can be a great way to get life insurance protection without diminishing your current investments.

Below are the next steps we’d suggest if you’d like to explore whether or not premium financing is a strategy worth pursuing.

Is Premium FINANCE Insurance Right for You?

- You need permanent life insurance

- You have the assets needed to pay the premiums and are reluctant to divert cash flow from productive capital assets

- You have sufficient liquid assets to post as collateral

- You need a clearly defined loan repayment strategy

NEXT STEPS:

1. Schedule a 15 minute exploratory call on my calendar at a time that is conducive to your schedule.

2. Determine if premium finance is something you really wish to pursue, and if so, schedule a 30 minute virtual meeting to complete a preliminary information gathering questionnaire.

3. If you decide it’s right for you you’ll need to begin gathering the necessary information using our checklist in preparation for the life insurance underwriting process.