Allianz Core Income 7 Annuity Reviewed

The Allianz Core Income 7 is a seven-year fixed index annuity with a Guaranteed Lifetime Withdrawal Benefit ( for a fee). Most indexed annuities have an optional income rider that can be added; however. When considering the Allianz Core Income 7, you should note that the Core Income Benefit Rider is not optional; it is included in the product for 1.25%.

The cost of the Core Income Benefit Rider is 1.25% and is charged annually and deducted from the account value. The rider cost will begin at age 45 and is charged until the point at which the lifetime income begins.

All indexed annuities provide principal protection – meaning your account value can never decrease due to market performance. However, if your account is credited with zero interest in a year, your account value would decrease (by 1.25%)

Allianz Annuity Ratings

An annuity’s guarantees are only as good as the insurance company backing them which is why it is always important to consider an insurance company’s financial ratings when shopping for an annuity.

The below chart lists Allianz Life’s Financial ratings from every major rating agency. As you can see Allianz Life has strong financial ratings. They have been a leader in the fixed index annuity market for more than a decade and we’re the #1 on our Top Ten Fixed Index Annuity Companies of 2019.

Allianz Life definitely has strong financial ratings so we will judge the Core Income 7 based on its own merit in this review.

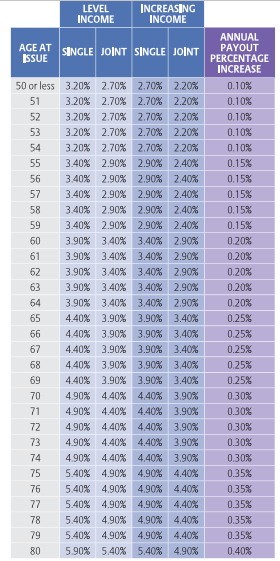

Allianz Core Income 7 Withdrawal Rates

Core Income 7 and the Core Benefit Rider can help you reduce uncertainty in the years ahead with lifetime income you can not outlive. You can begin your lifetime payments immediately.

If you are still for retirement and not ready to begin a lifetime income, the Core Income 7 provides increasing income percentages every year you wait, beginning at age 45. The higher your withdrawal percentage, the higher your income will be.

And when you are ready to start receiving the income, you can choose from two-lifetime withdrawal options:

- Level Income: Predictable, dependable income for life. This may be a good option if you want the reassurance of knowing exactly how much income you will receive every month and want a guaranteed income you can’t outlive.

- Increasing Income – Income for life, plus an opportunity for pay increases.

This begins with a smaller payment upfront but has the potential to increase each year by the interest credited to your chosen allocation options in your contract.

This chart compares both options available through the Core Income Benefit rider. It shows the lifetime withdrawal percentages and the annual increases to a contract’s lifetime withdrawal percentage, based on the payment option selected (level or increasing) and the age at which you begin taking income.

NOTE: Lifetime income withdrawals can begin on your next contract anniversary between the ages of 50 and 100. If joint lifetime withdrawals are chosen, the age of the younger person will be used for the age at which you purchase the contract.

How Does the Core Income 7 Credit Interest

External Market Indexes Options:

With Core Income 7, you can earn fixed interest or choose to base potential indexed interest on several external market indexes.

- S&P 500 Index

- Russell 2000 Index

- Nasdaq 100 Index

- Bloomberg US Dynamic Balance Index II

- Declared Rate Strategy (Fixed Rate)

Crediting Methods:

- Annual point-to-point with a Cap, Spread, or Participation Rate

- 2-year point-to-point with a Cap, Spread, or Participation Rate

Cap – is the maximum interest the annuity can earn in a crediting period.

Spread is the amount subtracted from an index’s gain during the crediting period.

Participation Rate – determines what percent of the index’s gain will be used to calculate your indexed interest.

Calculating Indexed Interest Credited:

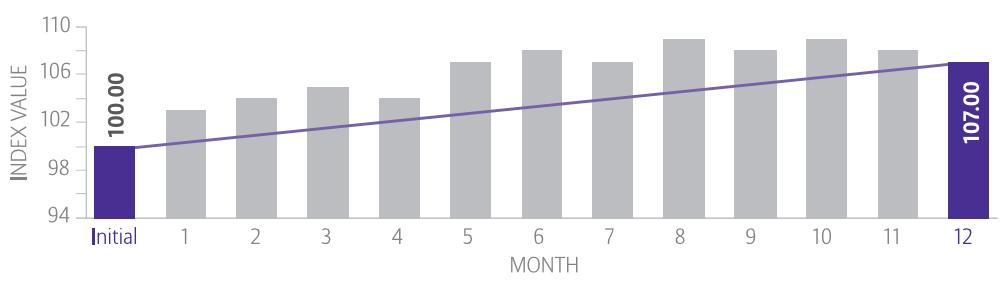

On your applicable contract anniversary, the index value from the beginning of the crediting period is compared to the index value at the end of the crediting period.

The percentage of the change is calculated. If the ending value is higher than the beginning index value, a cap, spread, or participation rate is applied. If the index value is lower, your contract won’t receive interest.

Allianz Core Income 7 Annuity Specs

Fees: 1.25% Annually

Flexible-Premium: Core Income 7 annuity is not a true flexible premium, but you are permitted to add the premium to your policy in the first contract year.

Free Withdrawal Percentages: After the first contract year, before starting lifetime income withdrawals, you can withdraw 10% of the original purchase premium annually without a surrender charge.

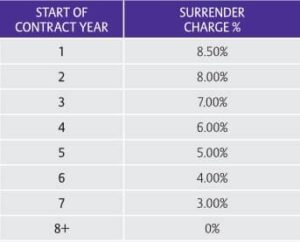

Surrender Charge Schedule: If you withdraw more than 10% of your original purchase premium in a year during the 7 surrender charge period, a surrender charge will be charged.

Required Minimum Distributions (RMDs): Allianz Core Income 7 is RMD-friendly, meaning RMDs taken from your annuity will qualify as free withdrawals.

Death Benefit: The Core Income 7 has a death benefit for your beneficiaries. You can elect for them to receive it as either a lump sum or as annuity payments.

Surrender Charge Schedule: 8.50%, 8% ,7%, 6%, 5%, 4%, 3%, 0% Years 8+

Cumulative Withdrawal Amount: Once you begin taking lifetime withdrawals under the Core Income Benefits Rider, you can choose to take less than your maximum lifetime withdrawal amount. Allianz keeps track of the amount that is “leftover”.

This amount is considered the cumulative withdrawal benefit. This feature allows you to withdraw any or all of what remains in a future year. The full account value remaining will be issued as the death benefit.

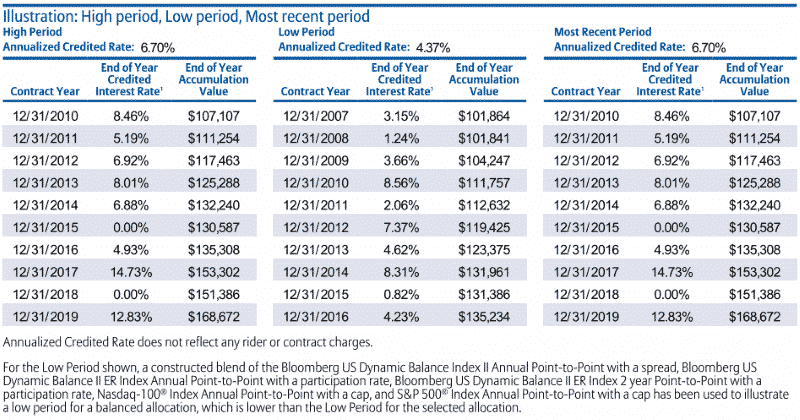

Reasonable Rate of Return Expectations

Allianz Core Income 7 Hypothetical Rate of Return

Below is a chart showing hypothetical returns for Core Income 7 during 3 separate periods: the highest, most recent, and lowest 10-year periods (12/31/2007 to 12/31/2016). In this particular example, the highest and most recent 10-year period happens to be the same ( 12/31/2010 to 12/31/2019).

- The highest 10-year period: 6.70% Average Annual ROR

- The lowest 10-year period: 4.37% Average Annual ROR

For this illustration, 100% of the premium was allocated to the Bloomberg US Dynamic II ER Index using the current participation rate of 50%.

Pros and Cons of Allianz Core Income 7

PROS

- Not required to elect single or joint lifetime income until turning income on.

- Not required to choose the increasing income option or the level income option until turning income on.

- An accumulation product with an option to turn into a guaranteed lifetime income.

- Flexible-Premium in the first year.

- Multiple External Market Index Options, including uncapped credit method options.

- Separate Crediting Components: Spread, Cap, and Participation.

- Cumulative Withdrawal Benefit

- Lifetime Income Percentages that are competitive within the industry.

- Increasing Lifetime Withdrawal Option.

CONS

- An income rider with a cost of 1.25% is mandatory.

Allianz Core Income 7 Review: Final Thoughts

After an hour of research and writing this Allianz Core Income 7 Review, it is evident to me that Core Income 7 is a very good annuity with a lot of meaningful features. Among the most unique are the cumulative withdrawal benefit option and increasing lifetime payments.

If you are looking for a safe and steady way to grow the retirement savings that you ultimately plan to convert to a lifetime income stream, the Core Income 7 is a great choice.

You can maintain control of your asset and enjoy future lifetime income guarantees. This provides flexibility should your goals or objectives change in the future.

However, if you are simply looking for a safe accumulation vehicle and don’t plan to turn your annuity into a lifetime income stream, then the Core Income 7 is not a great choice. This is because the Core Income Benefit Rider is required and comes with a cost of 1.25% annually.

Additional Resources:

This is an independent Allianz Core Income 7 Review, not a recommendation or solicitation to buy or sell an annuity. Allianz Life has not endorsed this review in any fashion, and we don’t receive any compensation for it.

Be sure to do your own due diligence; we recommend consulting with a properly licensed professional regarding any questions you may have. Values shown are not guaranteed unless specifically stated otherwise.

Rates and annuity payout rates are subject to change. Actual values may be higher or lower than the values shown. The illustration is not valid without all 18 pages and the statement of understanding.

Annuities are distributed by My Annuity Store, Inc. Guarantees are subject to the claims-paying ability of the insurer. My Annuity Store, Inc. does not advise clients on the purchase of non-fixed annuity products.

The information presented here is not of a tax or legal nature and is not intended to be a recommendation to purchase a fixed annuity, fixed index annuity, variable annuity contract, registered index-linked annuity (RILA), immediate annuity (SPIA), longevity annuity, or Qualified Longevity Annuity Contract (QLAC).

The contract features described may not be current and may not apply in the state in which you reside. Annuities are issued by Insurance companies, and contracts are state-specific. Insurance companies also change their products and information often and without notice.

Annuities are subject to the terms and conditions of the specific contract issued by the insurer, are not FDIC or NCUA insured, are issued by a bank, may lose value, and are not a deposit. Please call (855) 583-1104 if you have any questions or concerns.

The information presented here is not a representation regarding the suitability of any concept or product(s) for an individual, and it does not provide tax, accounting, or legal advice. It is important to read the prospectus carefully and consider your objectives, risks, fees, and charges associated with the contract.

You should always consult your own financial planning, tax, and legal counsel to determine if a fixed annuity, immediate annuity, longevity annuity, or Qualified Longevity Annuity Contract is suitable for your financial situation.