Axonic Waypoint MYGA Rates

Fixed-rate accumulation with 100% principal protection and tax-deferred growth. Choose a 2-, 3-, 5-, 7-, or 10-year guarantee period. Issued by AmFirst Insurance Company and serviced by Axonic Insurance Services.

Growth Calculator (Illustrative)

Select your premium, term, and band to see an illustrative projection. Calculator is for education only; actual contract mechanics govern.

Show Annual Value Schedule

Illustration uses nominal rate with annual compounding. Actual accumulation and crediting follow the contract. Not an offer or guarantee. Review official materials before purchase.

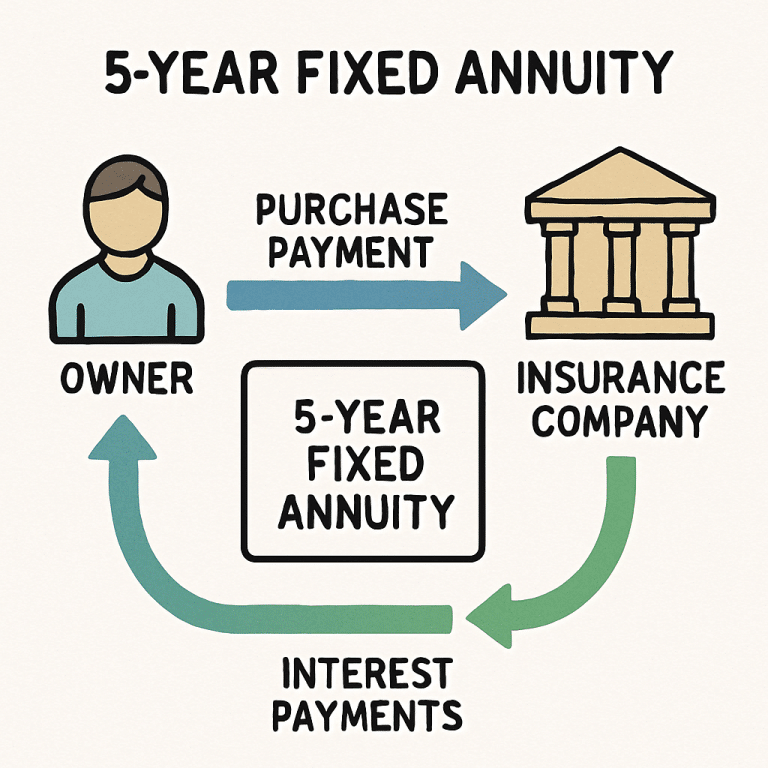

New to MYGAs? Read our quick guide: How MYGAs Work.

Product Highlights

| Initial Guarantee Periods | 2, 3, 5, 7, and 10 years |

|---|---|

| Funding Options | Non-Qualified, IRA, Roth IRA, 401(k), SEP IRA, Inherited IRA |

| Minimum Premium | $20,000 (amounts over $1,000,000 require Axonic approval) |

| Issue Ages | Up to 89 and 364 days |

| Free Withdrawals | After year 1, up to 10% of the prior anniversary contract value annually; $500 min per withdrawal |

| Riders | Nursing Home Confinement Rider and Terminal Illness Rider (not available in CA) |

| Death Benefit | Pre-annuitization: contract value paid to beneficiary. Post-annuitization: per elected payout option. |

| Renewal Options | Renew same/different period, surrender penalty-free in window, annuitize, or partial withdrawal and renew balance (per notice at end of term) |

| Insurer | AmFirst Insurance Company (A- AM Best). Serviced by Axonic Insurance Services LLC. |

Axonic Waypoint MYGA FAQs

Low Band ($20,000–$99,999): 2yr 4.70%, 3yr 5.00%, 5yr 5.15%, 7yr 5.55%, 10yr 5.30%.

High Band ($100,000+): 2yr 5.80%, 3yr 5.20%, 5yr 5.50%, 7yr 5.20%, 10yr 5.50%.

Rates effective 11/12/2025 and subject to change prior to issue.

After the first contract year, you may withdraw up to 10% of the prior anniversary contract value annually without surrender charges. Withdrawals exceeding the free amount may incur surrender charges and a market value adjustment (MVA), if applicable.

MYGAs credit a fixed rate during the selected guarantee period. This page’s calculator is illustrative; refer to the contract and carrier disclosures for exact crediting mechanics.

Axonic Waypoint MYGA is issued by AmFirst Insurance Company and serviced by Axonic Insurance Services LLC. Guarantees depend on the insurer’s financial strength and claims-paying ability.

You’ll receive a notice ~30 days prior to term end with renewal options and rates. Typically you may renew, surrender without charges during the window, annuitize, or take a partial withdrawal and renew the remaining value.