Best Fixed Annuity Rates for February 2026

Lock in today's best fixed annuity rates, defer taxes, and convert savings into predictable future income—all through one independent platform.

- A-Rated Carriers

- Independent & Unbiased

- Secure Quote Process

- No Sales Pressure

Highest Fixed Annuity Rates Preview

- Knighthead Life*6.50% Simple

- American Gulf*6.30%

- Mountain Life*6.15%

*Illustrative snapshot. See the live table below for full comparison including carrier strength, liquidity, and renewal options. Rates vary by state.

Rates subject to change without notice. Availability & features vary by state and insurer. Guarantees are backed by the claims‑paying ability of the issuing insurance company. Not a bank product. Not FDIC insured. State guaranty association limits apply (vary by state). Logos are property of their respective insurers; shown for educational platform availability only and do not imply endorsement. Company availability, financial strength ratings, and product terms are subject to change.

Today's Highest Fixed Annuity Rates Comparison Table

Use the fixed annuity rate comparison table below to search for the best fixed annuity rates based on your goals and objectives. Fixed annuity rates vary by state and investment amount; we recommend filtering by state and investment amount to see the most accurate annuity rates.

Read our new rankings for the 10 Best Fixed Annuity Companies of 2026.

Key takeaways

-

Insurer financial ratings: The highest annuity rates often come from companies with lower financial ratings.

-

Rate and product features: Not all rates are available in all states. The features, benefits, and liquidity options can also vary widely among products.

-

Liquidity: Some fixed annuities offer free withdrawals of your interest or 10% free withdrawals annually, but other fixed annuities are illiquid, meaning there are penalties for withdrawing funds early.

-

Shop around: The best annuity rate depends on your specific financial goals and risk tolerance. It is smart to compare offers from multiple insurers and consider consulting with a financial professional.

-

Simple vs. Compound Interest: Not every annuity credits interest the same way and this can make a big difference over time.

Best 3 Year Fixed Annuity Rates

3 year fixed annuity rates are best for short-term goals, cash you may need on a near-term timeline, or as the first rung in a ladder strategy. Three-year MYGAs can out-yield many short CDs, and interest grows tax-deferred until withdrawn.

Best 5 Year Fixed Annuity Rates

If you want a strong balance of yield and flexibility, 5-year MYGA rates typically sit in the sweet spot. You’ll lock in a competitive rate for five years, enjoy tax-deferred growth, and keep options open at the end of the term. Many contracts include 10% penalty-free withdrawals annually.

Best 7 Year Fixed Annuity Rates

7 year fixed annuity rates often add a slight rate premium versus 5-year options. They are good for money you can leave alone for a while. You won’t need cash beyond the penalty-free amount.

Best 10 Year Fixed Annuity Rates

For long-term savers seeking the highest available fixed rates, 10-year annuity rates can offer the most attractive yields. These are ideal for dollars you don’t plan to touch until maturity, or for pre-retirees laddering maturities into their retirement window.

Factors Affecting Fixed Annuity Rates

- Interest rate environment and Federal Reserve policies.

- Insurer’s financial strength (e.g., A.M. Best ratings).

- Contract term and surrender periods.

- Inflation: Low inflation can lead to lower annuity rates, and high inflation may prompt insurers to offer higher fixed annuity rates.

- Market performance: Has a bigger impact on fixed-index annuities, but can still indirectly influence fixed annuity rates by affecting the overall investment environment for insurers.

Fixed Annuity Rates by Insurer AM Best Ratings

Yield matters—but so does financial strength. We help you balance both by comparing rates across AM Best rating tiers and highlighting trade-offs. All guarantees depend on the insurer’s ability to pay claims. State guaranty associations may provide coverage up to certain limits.

A+ and A++ Rated Carriers

These insurers typically offer slightly lower rates than mid-tier carriers but bring exceptional balance sheet strength and stability. Consider A+/A++ options if:

- You prioritize long-term stability and brand strength

- You want high confidence in claims-paying ability

- You’re comfortable sacrificing a small amount of yield for stronger ratings

A and A- Rated Carriers

The “value zone” for many buyers—strong financials and competitive yields.

- Wide product selection across all terms

- Attractive balance between rate and rating

- Good fit for ladder strategies and IRA rollovers

B++ and B+ Rated Carriers

Mid-tier ratings can deliver the highest sticker yields. This tier can be suitable when:

- You’re targeting maximum rate with mindful allocation sizing

- You’re comfortable with additional due diligence

- You pair with stronger-rated carriers in a diversified ladder

Editorial note: No single rating tier is “best” for everyone. Many smart plans blend carriers across ratings and terms to diversify rate risk and company risk while capturing attractive yields. Access many more resources and current ratings at our insurance company financial ratings learning hub.

What Is a Fixed Annuity?

A fixed annuity is an insurance contract that lets you grow money at a guaranteed interest rate for a set period—think of it like a CD issued by an insurance company instead of a bank. The insurer protects your principal, your rate is locked in, and your growth is tax-deferred until you take distributions.

At the end of the term, you can renew, withdraw, or transfer to another option without market risk. It’s designed to provide safety, predictability, and the option to turn your balance into income you can’t outlive.

Key Points:

- Principal protection: Your initial premium isn’t exposed to market losses.

- Guaranteed rate: The insurer sets your interest rate upfront for a specific term (e.g., 3, 5, or 7 years).

- Tax-deferred growth: You don’t pay taxes on interest until you withdraw.

- Flexible withdrawals: Most contracts allow limited annual penalty-free access; larger withdrawals may have surrender charges.

- Income options: Convert your annuity to predictable income—often for life—if and when you need it.

How Do Fixed Annuities Work?

Fixed annuities, or multi-year guaranteed annuities (MYGA), pay a specified rate for the length of the annuity contract (typically 2 to 10 years). Insurance companies issue annuities, and product features vary by insurer and by product. Many fixed annuities allow you to take free withdrawals of your interest or up to 10% of your annuity’s account value each year.

- Guaranteed rate: Your interest rate is locked for a specific term (e.g., 3, 5, 7, 10 years).

- Principal protection: Your premium is protected by the insurer; market downturns don’t affect your contract value.

- Tax deferral: Interest grows tax-deferred until you withdraw, which can enhance compounding versus taxable accounts.

- End-of-term options: When the guarantee period ends, you can renew, transfer to a new annuity (often via a 1035 exchange), annuitize for income, or withdraw funds during the free window.

How Fixed Annuities Credit Interest?

Most annuities earn interest daily and credit the interest to the annuity account value each month. More than 90% of all fixed annuities use compound interest, which means you earn interest on top of your interest. However, recently, a handful of annuity companies have begun offering fixed annuities that credit using simple interest.

Annuities that use simple interest pay interest only on your original deposit. They do not pay interest on the interest you earn. These annuities are best for someone who plans to withdraw their interest each month. In this case, compounding does not matter.

How Annuities are Taxed

- Withdrawal taxation: All withdrawals are taxed as ordinary income, as neither the contributions nor the growth has been taxed yet.

- Early withdrawal penalty: If you withdraw funds before age 59½, you may face a 10% early withdrawal penalty from the IRS, in addition to paying ordinary income taxes.

- Withdrawal taxation: Only the earnings portion of a withdrawal is taxed as ordinary income. The part of the withdrawal that is a return of your original, after-tax contributions (your “basis”) is tax-free.

- LIFO taxation: The IRS applies a Last-In, First-Out (LIFO) rule to non-qualified annuities. This means that for withdrawals or surrenders, the gain is taxed first before your tax-free contributions are returned.

- Early withdrawal penalty: Similar to qualified annuities, non-qualified annuities are subject to a 10% early withdrawal penalty on the taxable earnings portion if you make withdrawals before age 59½.

Surrender Charges and Early Withdrawal Rules

A surrender charge is a fee charged for taking an early withdrawal from an annuity contract. This fee applies if you withdraw more money than your free withdrawal amount. Surrender charges in annuities can be high. It is important to think about your cash needs before buying an annuity.

A typical surrender charge schedule for a three-year annuity is 8% in Year 1, 7% in Year. 2, and 6% in Year 3.

At the end of the 3-year contract, you can renew for another 3 years, transfer your annuity to another insurance company using a tax-free 1035 exchange, or take possession of all of your funds without penalty.

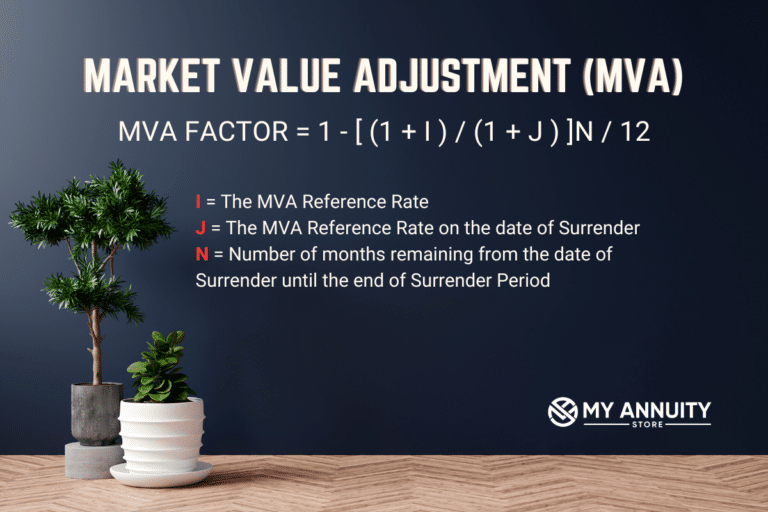

Market Value Adjustment (MVA) explained

An MVA adjusts the value of an early withdrawal based on changes in a specific interest rate index. If interest rates have risen since the annuity was purchased, the MVA will likely be a negative adjustment, decreasing your payout; if rates have fallen, it will be positive, increasing it.

The MVA is typically only applied to withdrawals that exceed any penalty-free limits or to the entire contract if surrendered before the end of a surrender period.

10% Free Withdrawals & When They Reset

10% free withdrawals are a fairly common feature among fixed annuities, although they are more common in longer-term annuity contracts. Annuities that allow for 10% free withdrawals usually have lower fixed annuity rates than annuities with no liquidity.

The way it works is you are allowed to withdraw up to 10% of your previous year’s account value. You are allowed to take the 10% free withdrawal once per annuity contract year.

59½ Rule and IRS Penalties

Which Fits Your Safety and Income Goals?

- Fixed Annuity (MYGA)

- Pros: Fixed annuity rates are guaranteed for the term, tax-deferred growth, optional lifetime income features, and typically higher yields than comparable CDs.

- Cons: Surrender charges/limited liquidity, insurer credit risk (mitigated by state guaranty associations; not FDIC), potential penalties/taxes on early withdrawals before 59½.

- Best for: Savers seeking predictable growth and tax deferral, and those open to converting assets into future income.

- Certificates of Deposit (CDs)

- Pros: FDIC insurance up to limits, simple and predictable interest, and short to medium terms available.

- Cons: Interest taxed annually, early withdrawal penalties, often lower yields than top MYGAs.

- Best for: Short-term cash needs, emergency reserves, and ultra-conservative savers prioritizing FDIC backing.

- Bonds (Treasuries, corporates, munis)

- Pros: Broad choice of durations/credits, tradable before maturity, potential tax advantages (e.g., munis), Treasuries carry full faith and credit of the U.S.

- Cons: Market price can fluctuate with interest rates and credit risk, coupons generally taxed annually (except munis), and reinvestment risk.

- Best for: Investors comfortable with market movement and want income and flexibility, or specific tax planning via munis.

- Quick contrasts

- Safety backstop: CDs = FDIC; MYGAs = insurer guarantees + state guaranty associations; Bonds = issuer/market risk (Treasuries are the highest credit quality).

- Taxes on growth: MYGAs defer until withdrawal; CDs and most bonds tax interest annually.

- Liquidity: Bonds are tradable (price risk); CDs/MYGAs penalize early access (MYGAs often allow up to 10% free withdrawals annually).

- Income options: Only annuities can convert to lifetime income; CDs and bonds provide interest only.

Fixed Annuity vs. Bonds vs. CDs

The “59½ rule” is an IRS guideline that states you can begin taking withdrawals from qualified retirement plans without incurring the standard 10% early withdrawal penalty once you reach age 59½. This applies to accounts like 401(k)s, 403(b)s, and traditional IRAs.

More CD vs Fixed Annuity Content

Fixed Annuity vs CD Calculator

Fixed Annuity vs. CD vs. Bonds Comparison Guide

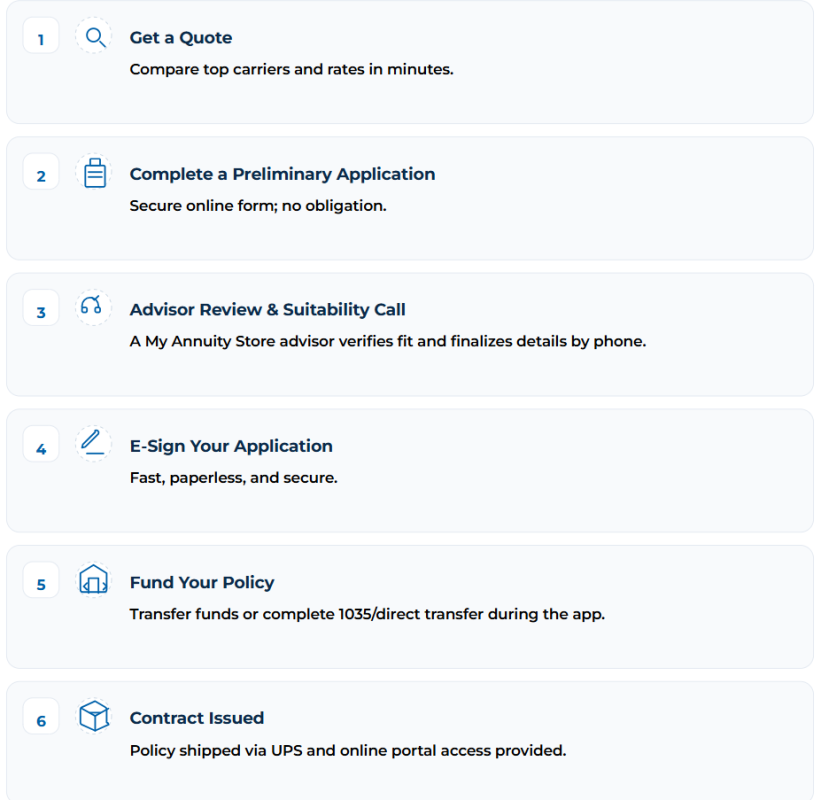

How to Buy an Annuity Online at My Annuity Store

Types of Annuity Rates

Multi-Year Guaranteed Annuity (MYGA): A Multi-Year Guaranteed Annuity (MYGA) pays a set interest rate for the duration of your contract. Most annuities offer some liquidity, but not all; therefore, this is something to consider.

Variable Annuities: Variable annuities provide an opportunity to invest your contributions in various sub-accounts tied to the performance of the stock market. This flexibility allows for potentially higher returns, but it also comes with increased risk.

Single Premium Immediate Annuity: As the name suggests, a single premium immediate annuity provides a steady stream of income shortly after an investor purchases a contract, usually within 30 days, and always within 13 months.

Traditional Fixed Annuity Rates: Traditional fixed annuity rates do not guarantee a set interest rate for the entire length of the annuity contract. The first year’s rate is specified, and a new rate is set on each anniversary.

Fixed Index Annuity Rates: Fixed index annuity rates combine elements of both fixed and variable annuities. They offer a minimum guaranteed interest rate, similar to fixed annuities, but also provide the potential for additional earnings based on the performance of a stock market index.

Who Should Consider a Fixed Annuity?

- Savers who want guarantees: Prefer a locked-in rate without stock market volatility.

- Near-retirees (5–10 years out): Looking to protect principal and earn predictable interest as retirement approaches.

- Retirees needing stability: Want steady growth and optional income without worrying about market swings.

- CD rollovers and cash on the sidelines: Seeking higher yields than traditional bank CDs, with tax-deferred growth.

- Risk-averse investors: Prioritize principal protection and simplicity over chasing higher, variable returns.

- Tax-sensitive households: Value tax-deferred compounding; pay taxes when they actually withdraw.

- Those planning laddered maturity dates: Want multiple terms (e.g., 3, 5, 7, 10 years) to manage interest-rate risk and liquidity.

- People who may need limited access: Appreciate penalty-free annual withdrawals (usually 5–10%) for flexibility.

- DIY shoppers who want unbiased comparisons: Like shopping multiple carriers for the best rate, features, and financial strength.

- Income planners: Want the option to convert to guaranteed income later—often for life.

Quick reminders:

- Guarantees depend on the issuing insurer’s claims-paying ability; not FDIC insured.

- Surrender charges can apply to withdrawals above the free amount during the term.

- State guaranty association coverage limits apply and vary by state.

What to Watch For

- Surrender schedule: Charges apply if you withdraw above the free amount during the term.

- Market Value Adjustment (MVA): Can adjust surrender values up or down if you take excess withdrawals before maturity, depending on interest rate movements.

- Renewal terms: If you do nothing at maturity, many carriers auto-renew; review your renewal notice and options.

- State availability and minimums: Products and rates vary by state; minimum premiums typically start at $10,000–$25,000.

Fixed Annuity FAQs

What are fixed annuity rates and how are they determined?

Fixed annuity rates (often called MYGA rates for Multi‑Year Guaranteed Annuities) are the guaranteed interest rates insurers credit for a set term (e.g., 3, 5, 7, 10 years). Insurers set these rates based on portfolio yields, prevailing Treasury and corporate bond yields, product features, and capital requirements.

Tip: Higher rates often come with longer terms or stricter liquidity. Always review surrender schedules and any Market Value Adjustment (MVA).

What’s the difference between a fixed annuity and a MYGA?

A fixed annuity is a broad category. A MYGA is a type of fixed annuity that guarantees a level interest rate for a specific multi‑year term. Other fixed annuities (like traditional fixed or fixed indexed annuities) have different crediting methods and features.

MYGA: simple, CD‑like guaranteed rate for 3–10 years.

Traditional fixed: insurer declares rates periodically (may change after first year).

How often do fixed annuity rates change?

Fixed annuity rates can change at any time based on market conditions and insurer pricing. Most carriers update weekly or monthly, but changes can occur intra‑month when yields move. We monitor and update rates on business days.

Always confirm the rate on the date your application is signed and received by the carrier.

Are fixed annuities safe?

Fixed annuities are backed by the claims‑paying ability of the issuing insurer. Safety is evaluated using independent ratings (A.M. Best, S&P, Moody’s, Fitch). Higher ratings generally indicate stronger financial strength but may correlate with slightly lower headline rates.

- Check A.M. Best rating (e.g., A, A‑, B++).

- Review company history, statutory reserves, and recent outlooks.

- Understand state guaranty association protections (limits vary by state; not FDIC).

What is a Market Value Adjustment (MVA)?

An MVA adjusts your surrender value (up or down) if you withdraw more than the free amount during the surrender period. If interest rates have risen since purchase, an MVA can reduce the value; if rates have fallen, it can increase it. MVA does not affect your guaranteed interest if you hold to term and stay within free withdrawal limits.

Can I withdraw money from a fixed annuity without penalty?

Most MYGAs allow annual free withdrawals (often 10% of account value) after the first year. Fixed annuities with out free withdrawal options often offer higher fixed annuity rates.

How do fixed annuity rates compare to CD rates?

Guaranteed interest rates offered by fixed annuities are often higher than CD rates.

i

Sources & Citations

We regularly update this page and cite primary sources, carrier filings, and regulator guidance:

- NAIC. “Buyer’s Guide for Deferred Annuities.” naic.org

- FINRA. “Investor Education: Annuities” finra.org

- FDIC Deposit Insurance: Know Your Risk. FDIC

- IRS Publication 575 (2024), Pension and Annuity Income. IRS Publication 575