Index Annuity Crediting Methods Explained

An index annuity is a type of fixed annuity offering principal protection and the ability to earn interest based in part on the performance of an external market index. The amount of interest your annuity earns is determined by index annuity crediting methods and crediting components. In this guide, I will go over the types of crediting methods and components and how each of them works.

The three types of index annuity crediting methods are:

- Annual point to point

- Monthly Sum

- Two-year point to point

Index Annuity Crediting Components

Before we cover the available index annuity crediting methods we should explain the different types of crediting components. Crediting components will affect how your indexed interest is calculated. These crediting components include:

- Cap

- Participation Rate

- Spread

Cap

Some fixed index annuities set a maximum rate of interest (or cap) that the contract can earn in a specified period (usually a month or year). If the chosen index increase exceeds the cap, the cap is used to calculate your interest.

For example, if the annual cap in a hypothetical example were 3.00% and the value of the index rose by 4.80%, the cap amount of 3.00% would be credited to your contract. However. if the index change was 2%, your contract would be credited 2% since that is lower than our hypothetical cap.

| Index Performance | Cap | Interest Earned |

|---|---|---|

| 8% | 5% | 5% |

| 5% | 5% | 5% |

| -3% | 5% | 0% |

Participation Rate

In some annuities, a participation rate determines what percentage of the index increase will be used to calculate your indexed interest.

For example, let’s suppose the index rose by 10%. If a hypothetical FIA had a 75% participation rate, the contract would receive 7.5% in indexed interest.

| Index Performance | PAR Rate | Interest Earned |

|---|---|---|

| 10% | 80% | 8% |

| 5% | 80% | 4% |

| -5% | 80% | 0% |

Spread

The indexed interest for some annuities is determined by subtracting a percentage from any gain (spread) the index achieves in a specified period.

For example, if the annuity has a 4% spread and the index increases 10%, the contract is credited 6% indexed interest.

| Index Performance | Spread | Interest Earned |

|---|---|---|

| 10% | 2% | 8% |

| 5% | 2% | 3% |

| -5% | 2% | 0% |

How Do Index Annuities Work?

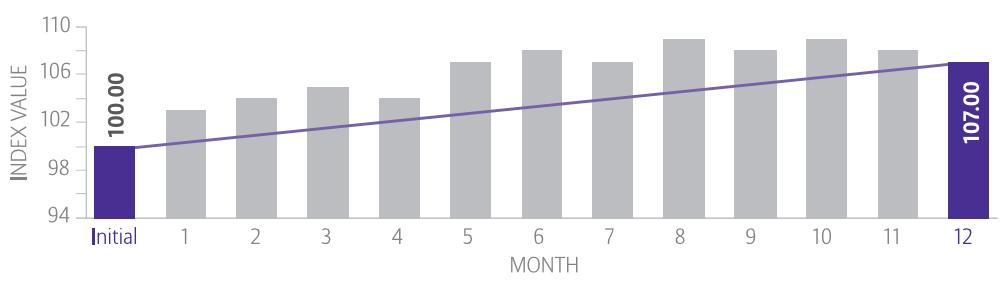

Annual Point to Point

Annual point-to-point is the simplest and most commonly used indexed annuity crediting method. Annual point-to-point uses the index value from only two points in time so this may be a good choice if you want to minimize the effects of mid-year market volatility.

- The index value from the beginning of the crediting period is subtracted from the value of the index at the end of the crediting period.

- The percentage of change is calculated.

- If the value at the end of the year is higher than the beginning of the year crediting component is applied to determine your interest credited.

As an example let’s assume an index change of 7% and apply the cap, spread, or participation rate. For this example, we will assume a 5% cap, a 2% spread, and a 75% participation rate.

5% Cap = 5% Interest credited (index change up to the cap)

2% Spread = 5% Interest credited (index change – spread)

75% Participation Rate = 5.25% Interest Credited (index change X spread)

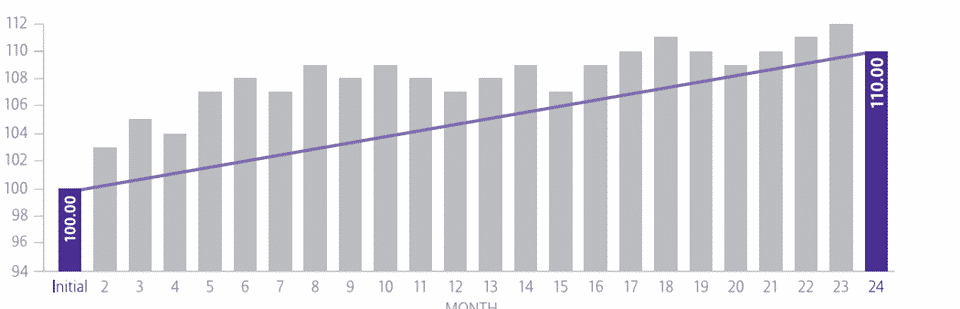

2 Year Point to Point

2-year point-to-point uses the index value from two points in two contract years apart so this index annuity crediting method may be a good choice if you want to limit the effects of volatility between these two points.

The index value from the beginning of the crediting period is subtracted from the value of the index at the end of your second crediting period (two years). The percentage of change is calculated. If the value at the end of the second year is higher than the beginning of period one a crediting component is applied to determine your interest credited.

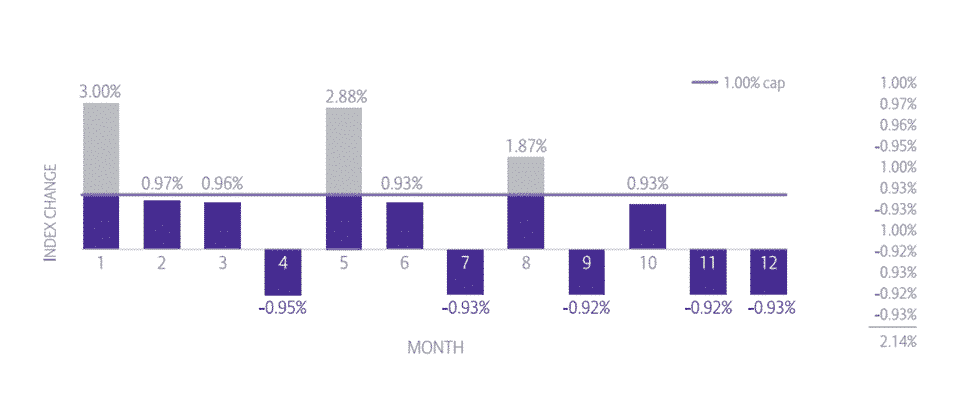

Monthly Sum

The monthly sum is the most volatility-sensitive index annuity crediting method. It can provide the most interest in steady up-markets but it can be adversely affected by large monthly decreases.

- On your contract anniversary each month, the index value is compared to the prior month’s value, and the percentage of change is calculated.

- At the end of the year, the monthly index increases, and decreases are added up. The increases are subject to a cap; however, the decreases are not.

- If the final sum is positive you’ll receive that amount as interest

- If the final sum is negative you’ll receive zero percent interest for that contract year.

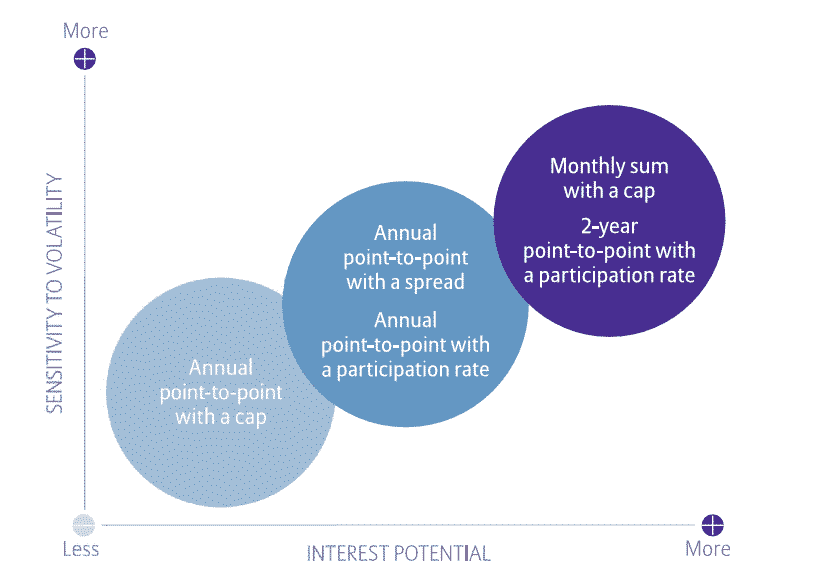

Index Annuity Crediting Methods in Summary

The index annuity crediting method you select can significantly impact how much interest you earn so you should consider your options carefully. The chart below shows each index annuity crediting method’s sensitivity to volatility and interest potential.

The monthly sum is the most sensitive to volatility but also has the highest earning potential.

Is an Index Annuity Right for you?

The answer is “Maybe”

It ultimately depends on your financial goals and needs. Before purchasing an index annuity you should consider all of the pros and cons. FINRA’s article. “ The Complicated Risks and Rewards of Indexed Annuities” is a good read for anyone considering adding an index annuity to their retirement portfolio.