Nassau MYAnnuity 5 Year Fixed Annuity

Minimum Deposit: $10,000 | 5.50% APY

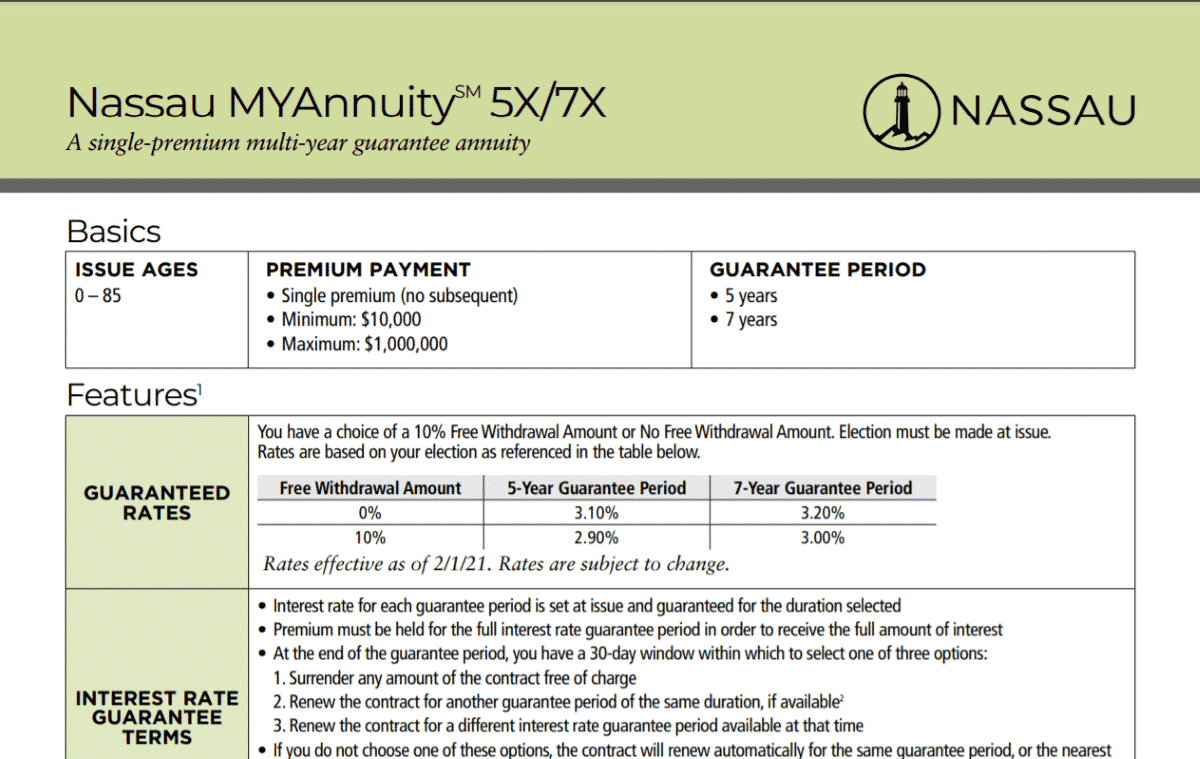

Nassau MYAnnuity 5 is a 5 year fixed annuity designed to be a high-yield retirement savings account. It is a CD Type of Annuity that pays a guaranteed interest rate for 5 years.

Nassau MyAnnuity 5 Guide

Base rate | 5.50% |

Rate guaranteed | 5 years |

Guaranteed yield to surrender | 5.50% |

Guaranteed minimum renewal rate | 1% |

Yes | |

Return of premium | No |

PREMIUM PAYMENTS | |

Type | Single |

Maximum | $1,000,000 |

Minimum | $10,000 |

Types of funds | · Non-Qualified · IRA · Spousal IRA · IRA Rollover · IRA Transfer · SEP IRA · IRA-Roth |

AGE RESTRICTIONS | |

Owner | 0 – 85 |

Annuitant | 0 – 85 |

This product may be appropriate for individuals who:

- Seek to accumulate money for retirement.

- Have a conservative risk tolerance and want to invest an inheritance or other lump sum.

- Want to secure a fixed annuity payment but not immediate income.

- Want a savings vehicle with paying more than today’s CD rates.

Not available in: CA, ME, MA, NY, PR, VI

Penalty-Free Withdrawals

Annual free withdrawals up to 10% are available (if elected at issue) without a surrender charge or market value adjustment (MVA) applied.

The owner can set up systematic withdrawals of a specified amount, however, the withdrawal may be subject to penalties if it is above the free amount.

| Annual free withdrawal | None (10% free withdrawals available for a .20% interest reduction. |

| Surrender charge period | 5 years |

| Window after surrender | 30 days |

| SURRENDER CHARGE SCHEDULE | ||||

| 1 year | 2 year | 3 year | 4 year | 5 year |

| 9% | 8% | 7% | 6% | 5% |

| Nursing Home | Surrender charges will also be waived if owner is admitted into a licensed nursing home, or if owner is diagnosed with a terminal illness that is expected to result in death within six months (24 months in MA). Waivers are subject to state approval and certain conditions. | |||

| Terminal Illness | Surrender charges will also be waived if owner is admitted into a licensed nursing home, or if owner is diagnosed with a terminal illness that is expected to result in death within six months (24 months in MA). Waivers are subject to state approval and certain conditions. | |||

| Death | Payable on death of any owner. Death benefit is equal to contract value (no surrender charges or MVA will apply). Death benefit proceeds are paid directly to named living beneficiaries and may not be subject to the probate process | |||

Taxes:

In general, annuities grow tax-deferred meaning you don’t pay taxes until you withdraw your money from the annuity.

When you withdraw from your annuity the interest earned will be taxed at your ordinary-income tax rate.

Non-Qualified Annuity

Non-qualified funds are cash, checking, savings, life insurance cash value, etc. Only the interest you have earned will be taxed as ordinary income.

Qualified Annuity

Qualified funds are 401k, IRA, SEP, 403b, TSA, etc. Both principal and interest will be taxed as ordinary income as you withdraw money.

Roth IRA Annuity

Withdrawals from Roth IRA annuities are tax-free if the IRS requirements are met.

Early-Withdrawals

You may receive a 10% tax penalty on withdrawals from an annuity prior to 59½.

Pros of the Nassau MyAnnuity 5

- Pays a guaranteed interest rate much higher than current CD Rates are paying.

- Your interest grows tax-deferred meaning you do not pay taxes on your interest until you withdraw it from your annuity.

- Death benefit is full account value and may avoid probate.

- Liquidity options to provide you the access to your money that you need.

As Seen On:

Get a Nassau MyAnnuity Quote

Fill out the form below to receive a free annuity quote within 4 business hours, or use one of our annuity calculators.

Related Reading

Our Services

Annuities

Annuities are designed to provide a guaranteed income stream for people during their retirement years and to provide financial security and peace of mind.

Annuities are best for individuals looking to save more for retirement in a tax-deferred investment vehicle or desire asset protection with upside growth potential.

Earn up to 20% More when you buy a fixed annuity vs. today's best CD rates.