Anchor MYGA 5

Provider: American Gulf • AM Best: B++

We've made it easy for you to compare today's best 5 year fixed annuity rates from the top annuity annuity providers all in one place.

*Illustrative snapshot. See the live table below for full comparison including carrier strength, liquidity, and renewal options. Rates vary by state.

Rates subject to change without notice. Availability & features vary by state and insurer. Guarantees are backed by the claims‑paying ability of the issuing insurance company. Not a bank product. Not FDIC insured. State guaranty association limits apply (vary by state). Logos are property of their respective insurers; shown for educational platform availability only and do not imply endorsement. Company availability, financial strength ratings, and product terms are subject to change.

Logos are property of their respective insurers. Display is for educational comparison and platform availability only.

The 5-year fixed annuity (MYGA) rates shown below are sourced through Annuity Rate Watch and updated automatically every 30 minutes via API. This page displays current 5-year fixed annuity rates from multiple insurance companies so you can compare terms and yields in one place.

As of January 27, 2026, the best 5 year fixed annuity rate available in our system is 6.30% for qualified buyers, subject to state availability and carrier approval.

How we source 5-year fixed annuity rates

Our 5-year fixed annuity (MYGA) rates are sourced through Annuity Rate Watch, a third-party annuity data provider. We connect to Annuity Rate Watch via a secure API, which allows us to display current 5-year rates from multiple insurance companies in one place.

How often these rates are updated

Rates on this page are refreshed automatically every 30 minutes. Insurance companies can change their rates at any time, and there may be short delays between a carrier’s internal rate change and when it appears here. Before you purchase, we will verify the current rate directly with the carrier.

Availability and limitations

Not all 5-year MYGA products or rates are available in every state or for every client. Actual rates and product options may vary based on your state of residence, premium amount, issue age, and product selection.

Our role and compensation

My Annuity Store, Inc. is an independent annuity brokerage. If you choose to purchase an annuity through us, we are paid a commission by the issuing insurance company. This compensation does not reduce your credited rate, account value, or annuity guarantees.

For full disclosures, please see the Disclosures section at the bottom of this page.

The Knighthead Life Staysail Annuity pays simple interest which is best for those who plan to take systematic withdrawals of interest.

The American Gulf MYGA is compounding interest. If you would like free withdrawals the rate goes down to 6.15%.

You can use the annuity calculator below to see how an annuity would grow. You only need to enter the amount you wish to invest, the annuity rate selected from the table above, and the term (years).

A 5-year fixed annuity, also called a 5-year multi-year guaranteed annuity (MYGA), provides a guaranteed interest rate for a full five-year term. Your money earns a fixed rate each year, and the insurance company guarantees that rate will not change during the 5 years.

5-year fixed annuities work similarly to certificates of deposit (CDs), but they are issued by an insurance company, not a bank.

My Annuity Store does not charge a fee, and none of the annuities we offer charge a fee; unless you withdraw your funds early, in which case you may be assessed a surrender charge.

It is important to note that there is a 30-day window at the end of an annuity contract in which you will need to make a decision. If you do nothing, your annuity will renew for another term at whatever annuity rate is being offered at that time. You will have several options at the end of your annuity contract, and we’ve listed them below.

You should be aware of possible tax implications. Tax considerations and potential ramifications will vary based on your annuity contract and situation. My Annuity Store recommends you carefully assess your options and consult a financial advisor to align your decision with your financial objectives.

5 year fixed annuity rates can vary based on several factors, including:

For the most accurate and relevant 5-year fixed annuity (MYGA) rates for your situation:

If you’d like help comparing options or confirming your exact rate before you apply, call us at 855-583-1104 or request a personalized quote.

Compare the annuities with the best 5 year fixed annuity rate overall, the best rate with liquidity, and the best rate for a company rated A- or higher.

Provider: American Gulf • AM Best: B++

Provider: Alpine Horizon • AM Best: B

Provider: Axonic Insurance Services • AM Best: A-

| Compare | Best Rate Anchor MYGA 5 American Gulf • AM Best: B++ | Best for Liquidity Mountain Life Alpine Horizon • AM Best: B | Best A- Rated+ Waypoint 5 MYGA Axonic Insurance Services • AM Best: A- |

|---|---|---|---|

| Annuity rate | 6.30% | 6.15% | 5.70% |

| Free withdrawals | After year 1: 0% free / year | After year 1: 5% free / year | After year 1: 10% free / year |

| AM Best rating | B++ | B | A- |

| Term | 5 years | 5 years | 5 years |

| Minimum investment | $10,000 | $5,000 | $100,000 |

| Brochure | Brochure | Brochure | Brochure |

| Next step | Get a quote Call | Get a quote Call | Get a quote Call |

When shopping for the best fixed annuity rate, it is important to look past the highest rate and consider all features of each annuity.

Key Features to Consider:

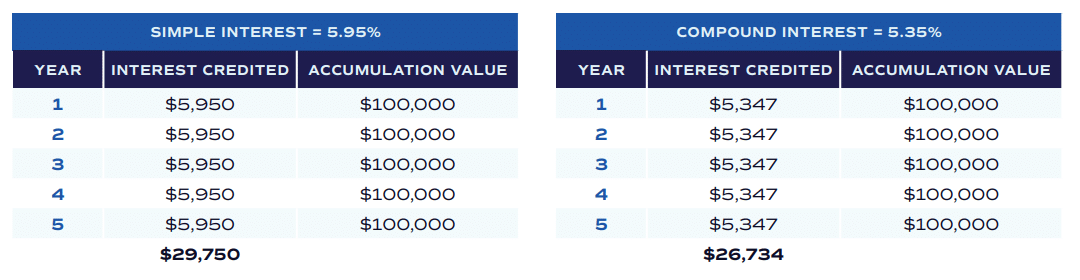

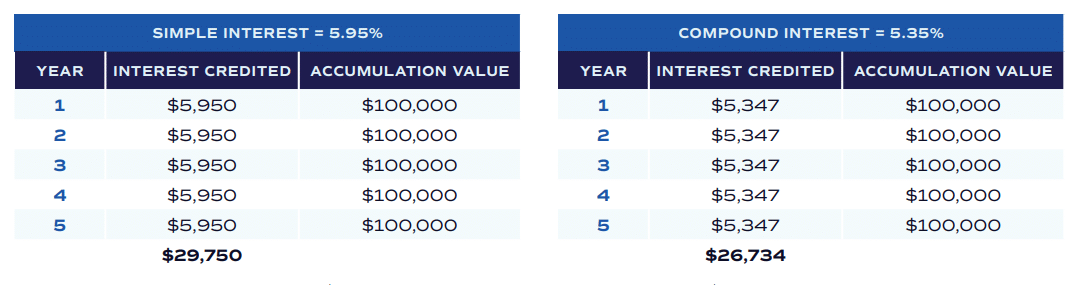

When evaluating the best 5 year fixed annuity rates, you will likely see that the majority of MYGAs, or multi-year guarantee annuities, offered by insurance companies use compound interest. Knighthead Life’s Staysail MYGA takes a more straightforward approach with simple interest.

Let’s compare two five-year fixed annuities with an initial deposit of $100,000.

The simple interest MYGA pays a rate of 5.95%, and compound interest MYGA pays a crediting rate of 5.35% annually. As you can see from the table of values below, both individuals have the same accumulated value after five years, making the products rate-equivalent.

The Difference: Income

What if you’d like to use your MYGA for income purposes and take interest-only withdrawals annually to cover certain living expenses? See how the compound and simple interest MYGAs compare over five years of annual, interest-only withdrawals. Use our simple vs. compound interest calculator

The simple interest option generates $29,750 versus the compound interest total of $26,734. That’s 11.5% more income. When it comes to income, the simple interest MYGA provides more value.

Many 5 year fixed annuities allow you to withdraw the interest earned, or up to 10% of your account value annually, without penalty. While some fixed annuities have no free withdrawal options. Example: If you have $100,000 in your annuity, you could withdraw up to $10,000 in year two without facing surrender charges.

If you do not want or need any free withdrawal options, it may be wise to consider annuities with no free withdrawal provisions because they typically pay a higher guaranteed rate.

A surrender charge is a fee applied by an insurance company when you withdraw money from an annuity during the “surrender period,” which is during the 5 year annuity contract.

Surrender charges are applied as a percentage of your annuity’s account value and decrease over time.

They reduce the total cash value you receive and are typically highest at the start, often becoming zero after 7-8 years, with some contracts allowing small penalty-free withdrawals annually.

Fixed annuities, bonds, and CDs are all worth considering if you are looking for a safe and steady way to grow your retirement savings. They each offer predictable returns and safety of principal, but there are differences among them.

The table below compares and contrasts the differences.

| Feature | 5 Year Fixed Annuity | 5 Year Bank CD |

|---|---|---|

| Current Rates | 5.50% - 6.30% | 3.50% - 4.50% |

| Tax Treatment | Tax-deferred growth | Taxed annually on interest |

| FDIC/State Protection | State guaranty association* | FDIC insured up to $250K |

| Early Withdrawal | Surrender charges apply** | Penalty (typically 3-6 months interest) |

| Best For | Long-term savers, retirement funds | Emergency funds, short-term goals |

Fixed Annuity Advantages:

A 5-year fixed annuity isn’t right for everyone. Here’s who benefits most from these products.

Pre-retirees in their 50s and early 60s who want to protect a portion of their retirement savings from market volatility while earning guaranteed returns. If you’re five to ten years from retirement, you don’t have time to recover from a major market crash. Putting some of your portfolio in a 5 year fixed annuity creates a safety net.

Recent retirees who need to preserve capital while earning more than savings accounts offer. If you’ve just retired with a lump sum from a 401(k) rollover, placing a portion in a 5 year guaranteed annuity ensures that money will be there when you need it, grown by a predictable amount.

Conservative investors who lose sleep over market fluctuations. If checking your investment balance during market downturns causes anxiety, fixed annuities offer peace of mind. The guaranteed rate means you never see a negative return, which is psychologically valuable for risk-averse individuals.

People with large cash positions exceeding FDIC insurance limits who want safe alternatives to spreading money across multiple banks. If you have $500,000 in cash, you could put $250,000 in FDIC-insured accounts and $250,000 in highly-rated fixed annuities for similar safety with potentially better returns.

Those seeking CD alternatives who want higher rates and tax deferral. If you’re already comfortable with CDs, fixed annuities are a natural next step, offering better returns in exchange for similar commitment.

On the flip side, 5-year fixed annuities probably aren’t right for you if you’re young with decades until retirement (you can afford more market risk for higher returns), if you might need the money before five years (liquidity is limited), or if you’re comfortable with market volatility and want maximum growth potential.

Age: 62

Location: Indianapolis, Indiana

Amount Invested: $200,000

Sarah plans to retire at age 67 in five years. She had been diligent about saving throughout her 30-year career as a school administrator and was satisfied with her financial situation. However, her $200,000 CD ladder was only earning 4.5%, and her bank was offering even less for renewals.

She didn't want to risk losses in the stock market with money she'd need in just five years, but she knew she could do better than what her bank was offering.

However, with just a few years to go, she was interested in finding somewhere to put her money that offered predictable growth without market risk. She discovered a 5-year fixed annuity offering an annuity rate of 6.30% that was also tax-deferred.

This intrigued her for two reasons: the annuity would grow more effectively than a 5-year CD since the interest would not be taxed each year, and she would be in a lower tax bracket when she retires and withdraws the funds.

Why this product fit her situation:

Sarah's $200,000 investment comparison:

| Year | CD Ladder (4.5%) | American Gulf MYGA (6.30%) | Extra Earnings |

|---|---|---|---|

| Year 1 | $9,000 | $12,600 | +$3,600 |

| Year 2 | $9,405 | $13,194 | +$3,789 |

| Year 3 | $9,828 | $13,825 | +$3,997 |

| Year 4 | $10,270 | $14,498 | +$4,228 |

| Year 5 | $10,732 | $15,215 | +$4,483 |

| Total Interest | $49,235 | $69,332 | +$20,097 |

| Final Value | $249,235 | $269,332 | +$20,097 |

Additional tax benefit: By deferring taxes until withdrawal at age 67 when she'll be in a lower bracket, Sarah saves an estimated additional $3,500-$5,000 compared to paying taxes annually on CD interest.

Total advantage: Over $23,000 more in her pocket compared to renewing her CD ladder.

"I was nervous about moving money out of my bank, but the team at My Annuity Store walked me through everything. They explained the AM Best rating, the state guaranty protection, and how the 10% free withdrawal worked."

"The best part? I don't get a 1099 every year anymore. My CDs were creating a tax headache even though I wasn't spending the interest. Now everything grows tax-deferred until I actually need it."

"I tell all my teacher friends about this. We worked too hard to settle for 4% at the bank when 6%+ guaranteed is available."

Sarah's situation is common among pre-retirees:

Disclaimer: This case study represents an actual client experience, but individual results will vary based on amount invested, state of residence, age, and product selected. Rates shown are subject to change. Client name changed for privacy.

A 5-year fixed annuity—often called a MYGA (Multi-Year Guaranteed Annuity)—is a fixed annuity that credits a guaranteed interest rate for 5 years. In exchange, you agree to keep most of the money in the contract during the surrender-charge period.

Not always. The best rate available can vary based on your state, premium amount, timing, and the carrier’s current pricing. Some carriers also price differently for IRA vs. non-qualified funds.

Rates can change frequently—sometimes weekly or even daily—because carriers adjust pricing based on market yields and demand. If you’re rate-shopping, it’s smart to confirm the rate the day you apply and again when the application is accepted (carrier process varies).

Rate matters, but it’s not the only thing. Compare:

MVA (Market Value Adjustment) may apply if you withdraw more than the free amount or surrender early. It can increase or decrease what you receive depending on interest rates at the time of surrender. If liquidity is a priority, you’ll want to specifically compare MVA vs. no-MVA options.

Most 5-year fixed annuities allow limited access via penalty-free withdrawals (commonly up to a stated percentage each contract year). Withdrawals above that amount may trigger surrender charges, and if you’re under 59½, taxable withdrawals may also face a 10% IRS penalty.

For non-qualified money, interest typically grows tax-deferred until you take withdrawals. Distributions are generally taxed as ordinary income to the extent of gains. If it’s inside an IRA/qualified account, taxation follows the rules of that account.

At the end of the guarantee period, you typically get a window to:

A fixed annuity is backed by the insurer’s claims-paying ability. Many consumers also like that MYGAs offer a guaranteed rate (no market downside), but you still want to evaluate the carrier and the contract terms carefully.

Start with a side-by-side comparison for your state and deposit amount, then pick the contract that balances rate + surrender terms + liquidity + MVA + carrier strength. The “best” choice is usually the best fit—not just the highest number.

We regularly update this page and cite primary sources, carrier filings, and regulator guidance:

Jason has distributed more than $1.5 billion in annuities over his 20 year career. His mission is to democratize access to annuities for all Americans and provide a safe and simple way to purchase an annuity.

Keep going with the most helpful next steps—compare options, understand costs, and see how buying online works.

Disclosures

Fixed annuity (multi-year guaranteed annuity, or MYGA) rates displayed on this page are provided for informational purposes only and are not guaranteed until your application is approved and the annuity contract is issued by the insurance company. Rates and product availability are subject to change at any time without notice.

All guarantees are backed solely by the financial strength and claims-paying ability of the issuing insurance company. My Annuity Store, Inc. does not guarantee the performance or obligations of any insurance company or annuity contract.

My Annuity Store, Inc. sources fixed annuity and MYGA rate data through Annuity Rate Watch via an API integration. While we believe this information to be reliable, we cannot guarantee its accuracy, completeness, or that all rate changes are reflected immediately. Insurance companies may change rates or withdraw products at any time. Before you purchase an annuity, your licensed agent will confirm the current rate, product details, and state availability directly with the carrier.

Not all products, rates, or features are available in every state or to every client. Actual rates and product options may vary based on your state of residence, premium amount, issue age, tax status, and other factors specific to your situation.

My Annuity Store, Inc. is an independent annuity brokerage and is not owned by or affiliated with any insurance company. If you choose to purchase an annuity through us, we are paid a commission by the issuing insurance company. This compensation is paid by the insurer and does not reduce your annuity’s credited rate, account value, or contractual guarantees.

Annuities are long-term insurance contracts and may include surrender charges, market value adjustments, and tax penalties for early withdrawals. Withdrawals of taxable amounts are subject to ordinary income tax, and if taken before age 59½, may be subject to an additional 10% federal tax penalty. You should consult your own tax advisor regarding your individual circumstances.

Nothing on this page should be interpreted as individualized tax, legal, or investment advice. The information provided is general in nature and may not be appropriate for your specific situation. You should consult your own tax advisor, attorney, and/or financial professional before making any decision about purchasing an annuity or implementing any financial strategy.

Tip: Check spam/promotions if you don’t see our email on time.

Need help sooner or have a quick question?

What happens next

Tip: Check your spam or promotions folder if you don’t see our email within the time window.