Understanding the Significance of Annuity Dates

Annuity dates play a crucial role in financial planning. They determine when you start receiving income from your annuity. Understanding these dates is essential for anyone considering an annuity purchase.

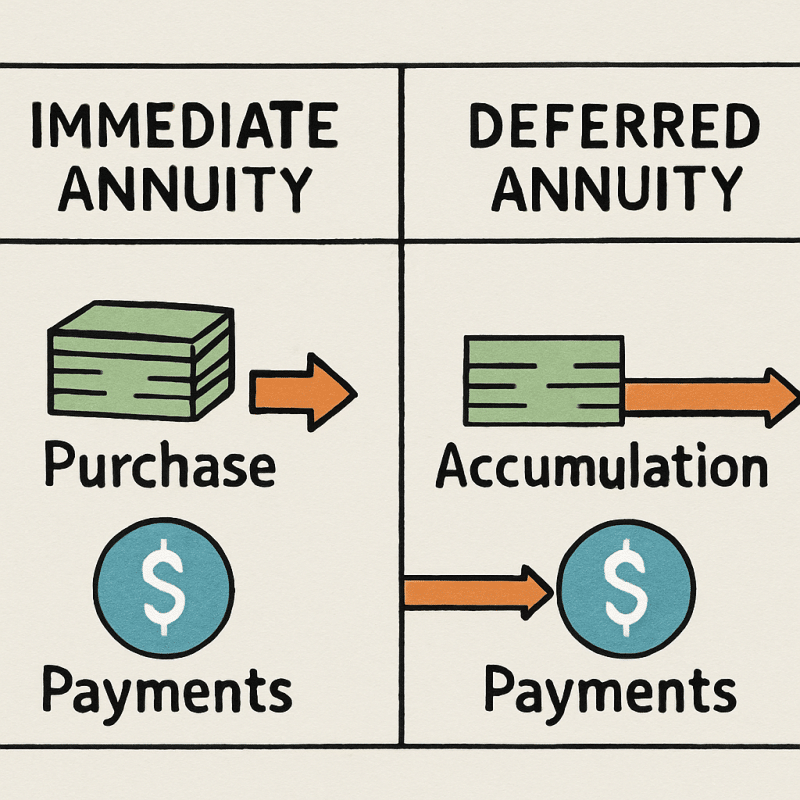

Annuity dates can be immediate or deferred. Immediate annuities start payments soon after a lump sum is paid. Deferred annuities, however, begin payments at a future date, allowing your investment to grow.

The annuity date marks the transition from saving to receiving income. It affects the amount and frequency of your payments. This date is a key factor in your retirement strategy.

Choosing the right annuity date can impact your financial security. It aligns with your retirement goals and lifestyle needs. Understanding annuity dates helps ensure a steady income stream in retirement.

In this guide, we will explore the significance of annuity dates. We will discuss their types, importance, and what happens when an annuity matures.

What Is the Annuity Date?

The annuity date is a pivotal concept in the world of annuities. It is the specific date when annuity payments commence. This date is central to determining when the annuitant will begin receiving income from their investment.

Annuity dates are often detailed in the annuity contract. They signify the transition from saving money to receiving a steady stream of income. This transition is crucial for retirement planning and financial stability.

There are different types of annuity dates. The primary ones include:

- Immediate Annuity Date: Payments start shortly after a lump sum is contributed.

- Deferred Annuity Date: Payments begin at a later, specified time, allowing investments to grow.

Understanding annuity date meaning helps annuitants make informed decisions. They can choose dates that align with their retirement timelines. These dates can be aligned with other income sources like Social Security benefits.

An annuity date not only impacts the timing of payments but also influences tax implications.

- Read the IRS rules on the annuity starting date and taxation in IRS Publication 575 (2024).

Different annuity types and dates can have different tax outcomes. Choosing the right date is integral to crafting a successful retirement income plan.

Annuity Date Meaning and Its Importance

The annuity date holds significant meaning in financial planning. It represents the moment when an annuity transitions from its accumulation phase to its payout phase. This date is crucial for defining the financial trajectory of the annuitant.

Annuity dates are essential due to their impact on income flow and financial planning. They dictate how much and how often payments are made. This affects budgeting and cash flow management for retirees.

Several factors highlight the importance of annuity dates:

- They set the timeline for receiving retirement income.

- These dates influence the annuity’s present and future value.

- They align with the annuitant’s financial goals and retirement age.

The choice of an annuity date is a strategic decision. It affects not only financial stability but also retirement lifestyle. By choosing the right annuity date, individuals can optimize their retirement income and ensure long-term financial security. Understanding the annuity date meaning guides effective financial planning for the future.

Types of Annuity Dates: Immediate vs. Deferred

Annuity dates vary based on whether the annuity is immediate or deferred. Understanding these types helps in making informed decisions. Immediate annuities begin disbursing payments shortly after the initial payment. They are ideal for those seeking instant income.

Deferred annuities, on the other hand, start payments at a later date. This delay allows the investment to grow over time. Deferred annuities suit those who can wait for income and want potential growth.

Here’s a quick breakdown:

- Immediate Annuities: Begin payments soon after purchase.

- Deferred Annuities: Start payments at a future date.

FINRA’s guide on immediate annuities is a helpful resource. It teaches you about the details of immediate annuities.

Choosing between these options depends on personal financial goals. Consider how soon you need income and your timeline for financial independence. Immediate annuities are good for people who are close to or in retirement. Deferred annuities can help with long-term plans. Tailor your annuity date choice to match your income needs and retirement timeline.

The Annuity Starting Date: How It Works

The annuity starting date marks the commencement of payments to the annuitant. It’s crucial for determining when income will be received. This date transitions the annuity from the accumulation phase to the payout phase.

Here’s how it works:

- Select an annuity product that suits your needs.

- Specify the starting date, considering your financial circumstances.

- Payments begin according to the schedule outlined in your contract.

Choosing an appropriate annuity starting date is vital. It affects the timing of your income stream. Many people align it with retirement age to ensure a seamless income transition. Customize this date by considering other income sources and personal financial goals. Your choice will impact your financial strategy and stability in retirement.

What Happens When an Annuity Matures?

When an annuity matures, it’s a pivotal event for the annuitant. At maturity, the accumulation phase ends. The focus shifts to distributing funds.

This stage provides various payment options. You can choose lump-sum disbursement or regular periodic payments. There’s also an option to annuitize, which converts the funds into guaranteed income for life.

Each choice impacts financial outcomes. Consider tax implications when deciding. Different options carry unique tax situations, influencing net income.

The maturity of an annuity offers flexibility. Evaluate these options carefully:

- Take a lump sum for immediate cash needs.

- Opt for periodic payments for consistent income.

- Annuitize for life-long financial security.

Understanding what happens at maturity is vital. It affects long-term financial planning. The right decision ensures your annuity supports your lifestyle and goals. Make an informed choice to align with your future needs. Annuity maturity represents not just an end, but a transition to new financial opportunities.

Choosing the Right Annuity Date for Your Needs

Selecting the right annuity date is crucial for financial success. It’s important to align this date with your retirement goals. Consider your income needs, lifestyle aspirations, and any other financial commitments. Your choice will influence the timing and amount of your annuity payments.

Customize the annuity date to suit personal circumstances. Flexibility can be gained through careful planning. Here are a few considerations when choosing:

- Synchronize it with other retirement incomes like pensions.

- Think about life events, such as reaching a specific age or milestone.

- Factor in potential market conditions and interest rates.

The key is balancing immediate financial needs and long-term security. Evaluating these elements ensures your annuity date supports your financial well-being. Thorough planning now lays a foundation for a stable financial future.

Key Takeaways About Annuity Dates

Understanding annuity dates is essential for sound financial planning. They determine when you can start receiving income. Their timing affects your financial strategy and retirement plans.

Here are some key points to remember:

- Annuity dates can be immediate or deferred.

- They influence the payout amount and schedule.

- Choosing the right date is crucial for meeting financial goals.

- Flexibility in choosing the date can optimize tax benefits.

By grasping these concepts, you can make informed decisions. Annuity dates play a vital role in securing a steady income stream. Planning them carefully ensures long-term financial stability and comfort.