Knighthead MYGA Rates

Knighthead offers competitive MYGA rates for 5 and 7-year terms. Choose between no-free-withdrawal and 10% free withdrawal options to best suit your financial goals.

Growth Calculator (Illustrative)

Select your premium, term, and liquidity option to see an illustrative projection. Calculator is for illustration; actual contract mechanics may vary. Always refer to official disclosures.

Show Annual Value Schedule

Illustration uses nominal rate with simple interest for easy comparison. Actual accumulation may differ based on contract terms. Not a guarantee or an offer. Review official materials before purchase.

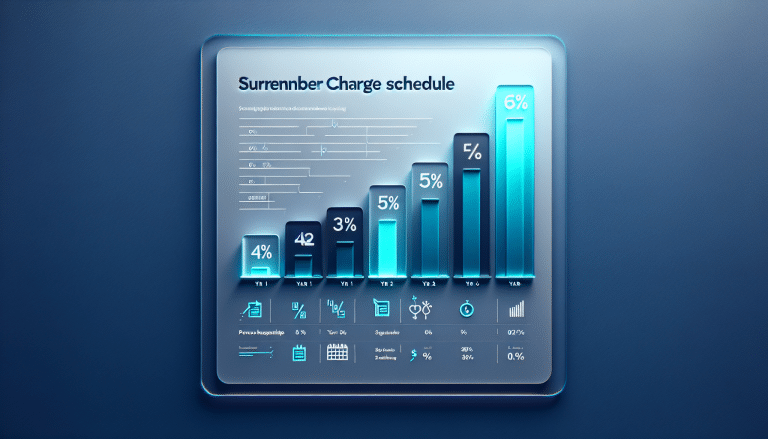

Choosing Between Liquidity and Yield

Knighthead’s structure lets you decide: the “no free withdrawals” option targets the highest fixed rate for maximum accumulation; the “10% free withdrawals” option provides annual access to a portion of your contract value without surrender charges, at a modestly lower rate. If you anticipate potential access needs during the term, the 10% option can be worth it—even before considering RMDs on qualified money.

Knighthead MYGA FAQs

No Free Withdrawals: 5-Year is 6.30%; 7-Year is 6.50%.

10% Free Withdrawals: 5-Year is 5.85%; 7-Year is 6.05%.

MYGAs typically credit interest annually at the declared guaranteed rate. Any on-page calculator is illustrative. Refer to the contract for exact mechanics.

Choose between “no free withdrawals” (highest rate) or “10% free withdrawals” (annual access up to 10% without surrender charges, per contract rules). Exceeding allowed amounts may trigger charges and possibly an MVA if applicable.

Guarantees rely on the issuing insurer’s financial strength and claims-paying ability. Not FDIC/NCUA insured. Consider carrier ratings and diversification as part of your decision.

Near the end of the 5- or 7-year term, you’ll typically get options to renew, transfer via 1035 exchange, annuitize, or withdraw during a window without new surrender charges (subject to carrier rules).