AIG Power 7 Protector Annuity Review

In this AIG Power 7 Protector I will cover the following information regarding the Power 7 Protector Fixed Index Annuity:

- American General Annuity Company Ratings

- Annuity Type

- Fee’s

- Current Rates

- Hypothetical Historical Rate of Return Based on Simulations

- How it’s traditionally Used: Accumulation, Distribution, or Wealth Transfer

AIG Financial Ratings

American General Life Insurance Company (AIG) is part of American International Group and is a large, strong, well-rated insurance company. The table below lists their financial ratings from the four major insurer rating agencies.

As you’ll notice they are rated A+ by both Fitch Ratings and Standard & Poor’s and have an A rating by AM Best.

Insurance Company Financial Ratings are important because they are an indicator of an insurance company’s ability to honor the financial obligations to its policyholders. For more in-depth financial information and a complete list of annuity products offered visit our American General Company Profile page.

| American General Life Insurance Company | Rating |

|---|---|

| A.M. Best Company (Best's Ratings, 15 Ratings) | A (3) |

| Moody's (Financial Strength, 21 Ratings) | A2 (6) |

| Standard & Poor's (Financial Strength, 20 Ratings) | A+ (5) |

| Fitch Ratings (Financial Strength, 21 Ratings) | A+ (5) |

| Weiss (Safety Rating, 16 Ratings) | B (5) |

| Comdex Ranking (Percentile in Rated Companies) | 82 |

AIG Power 7 Protector Annuity Reviewed

The AIG Power 7 Protector is a single premium Fixed Index Annuity with a 7-year surrender charge period and an MVA provision. It provides eight index interest crediting strategies and a fixed rate interest account.

Fixed Index Annuities are ideal for someone who wants protection from potential market downturns but would like a chance to earn more interest when the market performs well.

There is a lot of mixed information about fixed index annuities out there and while they are beginning to finally get some good press; historically most of what you’d read was bad.

Oftentimes, the individuals writing the articles were essentially creating click-bate and generally don’t have a firm understanding of the product. There are also those who do have a good working understanding and still dislike index annuities.

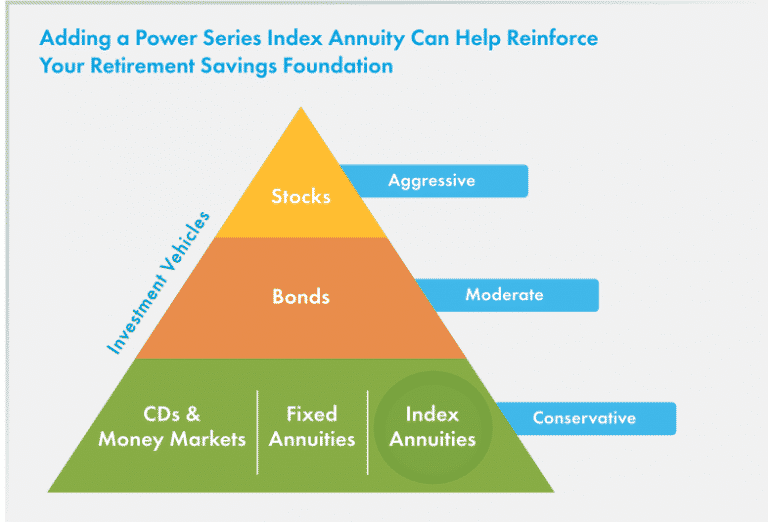

When considering a fixed index annuity is a retirement savings vehicle it is important to remember what asset class it is actually in and compare it to like products.

It will not generate equity or stock market-like returns over the long haul and it is not designed to. It is really designed with the hope of earning an extra 1.00% or 1.50% over what a guaranteed fixed annuity would pay.

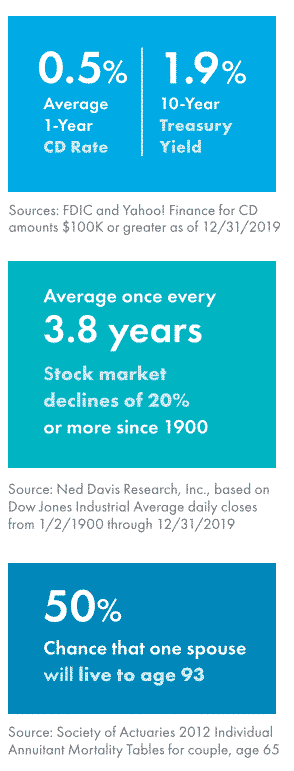

Of all the retirement savings vehicles available that offer principal protection and index annuity has the highest upside potential. The other options that guarantee your savings are certificates of deposits and fixed annuities.

I understand you are visiting this page today to learn more about the AIG Power 7 Protector annuity so I won’t dive any deeper into the weeds regarding fixed index annuities in general. If you’d like to take 15 minutes sometime and learn much more we suggest reading our Ultimate Guide to Fixed Index Annuities.

You can also shop and compare today’s best-indexed annuity rates at our online annuity store.

AIG Power 7 Protector Fees

The Power Protector 7 does not have any fees associated with the contract as there is no optional GLWB Rider (guaranteed lifetime withdrawal benefit) available for purchase.

If you find that you like this annuity but would like the ability to turn this portion of your retirement portfolio into guaranteed lifetime income at some point in the future American General does offer a “sister product” called that Power 7 Protector Plus Income that has an available income rider for a 95 basis points annual fee.

AIG Power 7 Protector Hypothetical Historical Returns

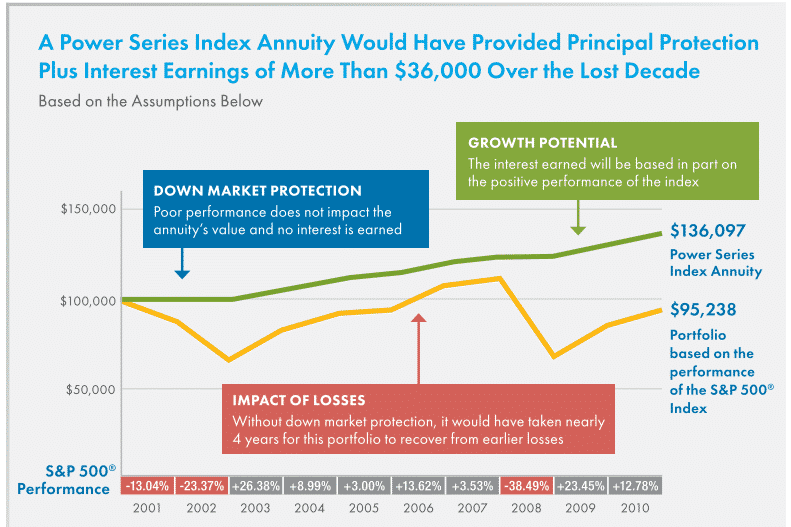

The “Lost Decade” is what many financial pundits have labeled the 10 years from 2000-2010 when key U.S. stock market indices posted either low or negative returns.

If a Power Series Index Annuity had been available during the “Lost Decade” (based on the assumptions below), it would have protected your annuity’s value from sharp market declines and provided attractive growth over this time period. Please note that past performance is not a guarantee of future results.

Hypothetical example assumptions: Power Series Index Annuity with Annual Point-to-Point Index Interest Account (S&P 500® Index without dividends), $100,000 premium, and 5% annual index rate cap, reset each year. The Annual Point-to-Point Index Interest Account earns interest based on the S&P 500® index performance from one contract anniversary (the date the contract is issued) to the next contract anniversary, subject to the 5% index rate cap.

This chart is for illustrative purposes only and is produced with the benefit of hindsight for the period, 12/31/2000–12/31/2010. It is not intended to be indicative of the performance of any specific investment. Indices are unmanaged and are not available for direct investment. Past performance is not a guarantee of future results. The index rate cap is hypothetical and may be reset at a higher or lower rate on each contract anniversary by the issuing insurance company.

It assumes no deduction of taxes or any annual fee from the annuity’s contract value or from the portfolio based on the performance of the S&P 500® Index (without dividends). If an annual fee were imposed on both accounts, the values shown here would be lower.

Free Annuity Quote

Fill out the form below to receive a free annuity quote or use one of our annuity calculators.

Best Used as a Safe & Steady Way to Grow Retirement Savings

The Power Series of Index Annuities offer growth potential through “index interest accounts” that may generate higher interest than many traditional fixed-income instruments. These FIAs also offer the comfort and security of a 1-year fixed account with a guaranteed rate of interest.

The Power of Tax Deferral

With a taxable investment, you pay taxes on interest earned each year. With a Power Series Index Annuity, your earnings are not taxed until withdrawn, giving you the potential to accumulate more assets for retirement. Plus, once you begin withdrawals, you may be in a lower tax bracket, which could provide you with additional tax savings over time.

The Power of Index-Based Performance

The growth potential of an index interest account is linked to an index like the S&P 500.® Although your assets are not invested directly in an index, a Power Series Index Annuity offers you the opportunity to earn interest based on whether the index is up or down at the end of an index term:

• If index performance is positive, your annuity may INCREASE in value. As you can see from the graph on the next page, the S&P 500® Index has been positive 73% of the time over the last 30 years, earning an average annual return of 9.11%.²

Keep in mind interest earned is subject to different factors like index rate caps.³

• If index performance is flat or down, your annuity value remains the same. Only positive performance is used to determine the interest credited.

A Power Series Index Annuity offers you the confidence of knowing that your money is protected against market downturns and that it can grow with:

• No loss of principal due to market fluctuations. Keep in mind, your contract value will be reduced by any withdrawals and/or fees.

• No loss of earned interest. Any interest earned is locked into the contract and protected from future downturns.

• No emotional ups and downs. Neither your principal nor your emotions will fluctuate in volatile times.

Not sure this is the right annuity for you? Check out some of our other annuity reviews.

Additional Resources:

Annuities are distributed by My Annuity Store, Inc. Guarantees are subject to the claims-paying ability of the insurer. My Annuity Store, Inc. does not advise clients on the purchase of non-fixed annuity products.

The information presented here is not of tax or legal nature and is not intended to be a recommendation to purchase a fixed annuity, fixed index annuity, variable annuity contract, registered index-linked annuity (RILA), immediate annuity (SPIA), longevity annuity, or Qualified Longevity Annuity Contract (QLAC).

The contract features described may not be current and may not apply in the state in which you reside. Annuities are issued by Insurance companies and contracts are ‘state-specific. Insurance companies also change their products and information often and without notice.

Annuities are subject to the terms and conditions of the specific contract issued by the insurer, are not FDIC or NCUA insured, are not bank guaranteed, may lose value, and are not a deposit. Please call (855) 583-1104 if you have any questions or concerns.

The information presented here is not a representation regarding the suitability of any concept or product(s) for an individual and it does not provide tax, accounting, or legal advice.

It is important to read the prospectus carefully and consider your objectives, risks, fees, and charges associated with the contract.

You should always consult your own financial planning, tax, and legal counsel to determine if a fixed annuity, immediate annuity, longevity annuity, or Qualified Longevity Annuity Contract is suitable for your financial situation.

- Guarantees are backed by the claims-paying ability of the issuing insurance company.

- The initial fixed rate is guaranteed for the first contract year, after which it is subject to change on contract anniversaries.

- An index rate cap is the maximum amount of interest that can be earned over a specific period.