Best Fixed Annuity Rates by Term

As of June 15, 2025, the best fixed annuity rate is 6.70% simple interest for 7 years. Fixed annuity rates are specified for a set period and are often called ” CD-type annuities ” because they resemble Certificates of Deposit.

| Term | Insurer | Rate | Company | Annuity | AM Best | Free withdrawals | Application |

|---|---|---|---|---|---|---|---|

| 2 Years | 5.10% | CL Life | CL Sundance | B++ | Interest Only | Apply | |

| 3 Years | 5.65% | Revol One | DirectGrowth MYGA | B++ | none | Apply | |

| 4 Years | 5.50% | Nassau | Simple Annuity | B++ | 5% | Apply | |

| 5 Years | 5.85% | Revol One | DirectGrowth MYGA | B++ | none | Apply | |

| 6 Years | 5.75% | Nassau | Nassau Simple Annuity | B++ | 5% | Apply | |

| 7 Years | 6.70% Simple | Knighthead Life | Staysail Annuity | A- | None | Apply | |

| 8 Years | 5.40% | Clear Spring LIfe | Preserve MYGA | A- | None Yr 1 10% Yrs. 2-8 | Apply | |

| 9 Years | 5.40% | Clear Spring LIfe | Preserve MYGA | A- | None Yr 1 10% Yrs. 2-9 | Apply | |

| 10 Years | 5.90% | Revol One | DirectGrowth MYGA | B++ | None | Apply |

*NOTE: Click on the insurance company or annuity product name for more details. You can find fixed index annuity rates here if you are looking for them instead.

Best 3 Year Annuity Rates

Today’s best 3-year fixed annuity rate is 5.85% as of June 13, 2025.

| Term | Insurer | Review | Rate | Annuity | AM Best | Apply | |

|---|---|---|---|---|---|---|---|

| 3 Years | Revol One | 5.65% | DirectGrowth MYGA | B++ | Apply | ||

| 5 Years | Knighthead Life | 5.49% | Staysail Annuity | A- | Apply | ||

| 3 Years | CL Life | 5.35% | CL Sundance | B++ | Apply | ||

| 3 Years | American Life | 5.35% | American Classic 3 | B++ | Apply | ||

| 3 Years | Farmers Life | 5.05% | Safeguard Plus | B++ | Apply |

Best 5 Year Fixed Annuity Rates

Knighthead Life has the best 5-year fixed annuity rate today at 6.45% simple interest. Use the comparison table below to compare the top 5 year fixed annuity rates available today.

| Term | Insurer | Rate | Annuity Company | Annuity | AM Best | Apply |

|---|---|---|---|---|---|---|

| 5 Years | 6.45% Simple | Knighthead Life | Staysail Annuity | A- | Apply | |

| 5 Years | 5.85% | DirectGrowth MYGA | DirectGrowth MYGA | B++ | Apply | |

| 5 Years | 5.75% | DirectGrowth MYGA | DirectGrowth MYGA | B++ | Apply | |

| 5 Years | 5.75% | Nassau | MyAnnuity | None | Apply | |

| 5 Years | 5.60% | Farmers Life | Safeguard Plus | B++ | Apply | |

| 5 Years | 5.55% | Nassau | MYAnnuity | B++ | Apply |

You can use this calculator to learn how much your annuity would earn. You’ll need to enter your investment amount, the annuity rate from the table above, the length of annuity in years, and select how often interest compounds (we recommend annually if you are not sure).

Best 7 Year Fixed Annuity Rates

Knighthead Life offers the best 7-year fixed annuity rate at 6.70% simple interest.

| Term | Insurer | Company Details | Rate | Annuity | AM Best | Apply | |

|---|---|---|---|---|---|---|---|

| 7 Years | Knighthead Life | 6.70% Simple | Staysail Annuity | A- | Apply | ||

| 7 Years | Revol One | 5.85% | DirectGrowth MYGA | B++ | Apply | ||

| 7 Years | Nassau | 5.80% | MyAnnuity 7 | B++ | Apply | ||

| 7 Years | Ibexis | 5.95% Simple | MYGA Plus | A- | Apply | ||

| 7 Years | Aspida | 5.65% | Synergy Choice | A- | Apply |

Best 10 Year Fixed Annuity Rates

The best 10-year fixed annuity rate is 5.90% offered by Revol One Life Insurance Company.

| Term | Insurer | Rate | Review | Annuity | AM Best | Application |

|---|---|---|---|---|---|---|

| 10 Years | 5.90% | DirectGrowth MYGA | DirectGrowth MYGA | B++ | Apply | |

| 10 Years | 5.35% | Farmers Life | Safeguard Plus | B++ | Apply | |

| 10 Years | 5.35% | Clear Spring Life | Preserve MYGA | A- | Apply |

How do Fixed Annuities Work?

Fixed annuities offer a guaranteed rate of return for a set period. For example, when you buy a 5-year annuity, the annuity rate is guaranteed for 5 years.

To better understand annuities, let’s delve into their mechanics. Annuity contracts consist of two phases:

- Accumulation Phase - The accumulation phase is a period of time when money is saved for a future purpose.

- Distribution Phase - When an individual begins taking income from their annuity.

Understanding the Types of Annuity Rates

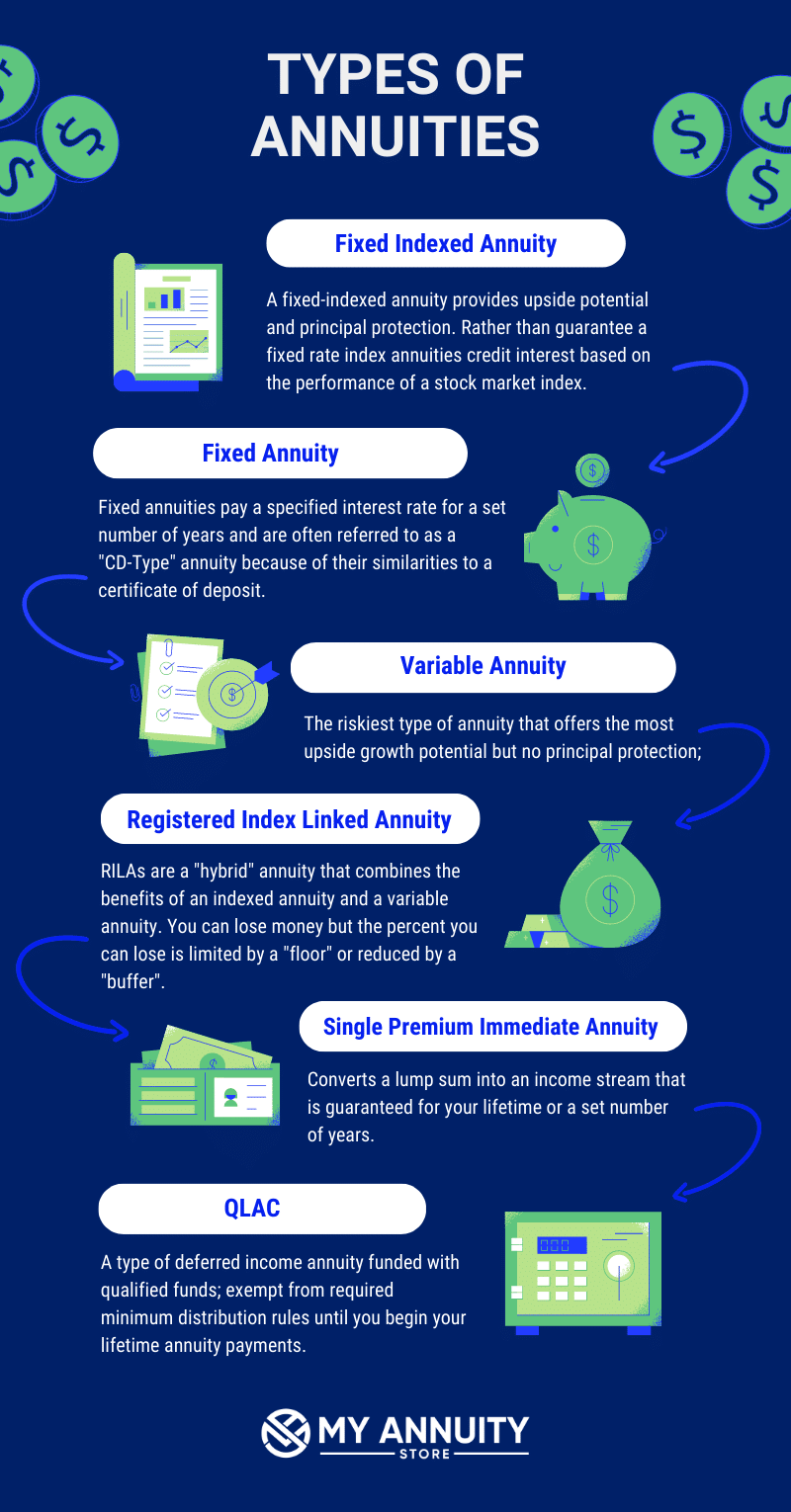

Multi-Year Guaranteed Annuity Rates

Multi-Year Guaranteed Annuity Rates (MYGA) are set for the length of your contract. Most annuities provide some liquidity but not all; so that is something to keep in mind.

Traditional Fixed Annuity Rates

Traditional fixed annuity rates do not guarantee a set interest rate for the entire length of the annuity contract. The first years rate is specified and a new rate is set on each anniversary.

Fixed Index Annuity Rates

Fixed index annuity rates combine elements of both fixed and variable annuities. They offer a minimum guaranteed interest rate, similar to fixed annuities, but also provide the potential for additional earnings based on the performance of a stock market index.

How are Annuity Rates Established?

The rate of return on an annuity is a crucial factor to consider when choosing an annuity product. Annuity rates are typically based on several factors, including the age and health of the individual purchasing the annuity and the length of the payout period.

One of the main factors that determines annuity rates is the current interest rate environment. In general, annuity rates tend to be higher when interest rates are higher since insurance companies can earn more on the deposits they receive from annuity purchasers.

Conversely, when interest rates are low, annuity rates may be lower as well.

Overall, the factors that determine annuity rates can be complex, and it’s important to carefully consider all of the factors involved before making a decision.

The Federal Reserve and Annuity Rates

Annuity rates are influenced by US Treasury rates because insurance companies invest much of their assets in high-quality bonds and U.S. Treasuries.

This is why current annuity rates often mirror the interest rates available in other fixed-income investments, primarily bonds and U.S. Treasuries. When bond rates increase, annuity rates usually go up as well.

The Federal Reserve signaled it would begin steadily raising interest rates in mid-March 2022 in an effort to remove stimulus to bring down inflation. The Federal Reserve has been raising the Fed funds rate since 2022 to combat high inflation, which peaked at 6.4% in January 2023.

However, as inflation falls back to the Fed’s 2% target and the economy slows down due to higher borrowing costs, the Fed is likely to pause its rate hikes by the summer of 2023 and start cutting them by the end of the year.

| Date | Rate Change | Target Rate |

|---|---|---|

| March 15-16, 2022 | 0.25% | 0.25% - .5% |

| May 3-4, 2022 | 0.50% | 0.75% - 1% |

| June 14-15, 2022 | 0.75% | 1.5% - 1.75% |

| July 26-27, 2022 | 0.75% | 2.25% - 2.5% |

| Sept. 20-21, 2022 | 0.75% | 3% - 3.25% |

| Nov. 1-2, 2022 | 0.75% | 3.75% - 4% |

| Dec. 13-14, 2022 | 0.50% | 4.25% - 4.5% |

| Jan. 31-Feb. 1, 2023 | 0.25% | 4.5% - 4.75% |

| March 21-22, 2023 | 0.25% | 4.75% - 5% |

| May 2-3, 2023 | 0.25% | 5% - 5.25% |

Are Annuity Payments Taxed?

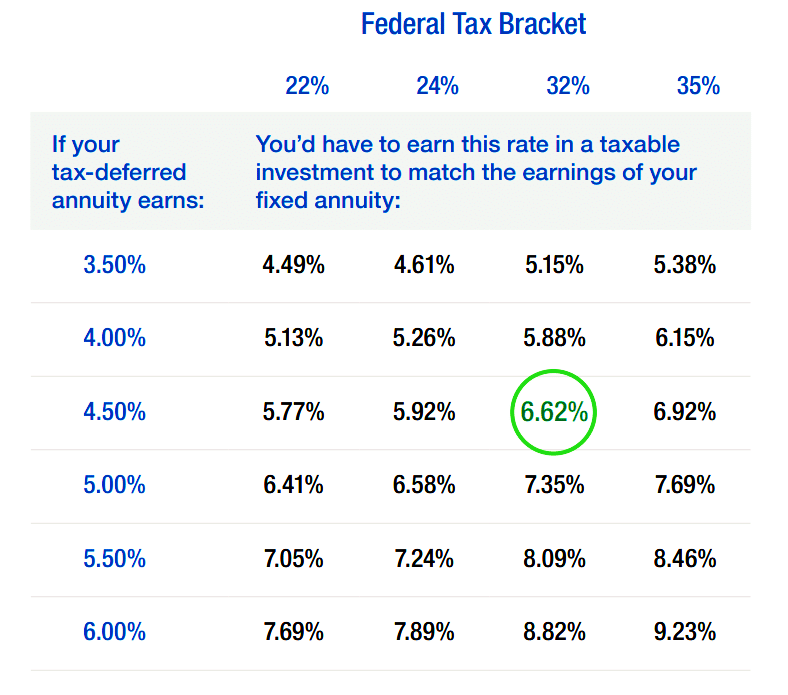

The interest you earn in an annuity grows tax-deferred, which means you don’t have to pay taxes on the interest your annuity earns until you make a withdrawal from your annuity. Generally, earnings from annuities are taxed at your ordinary income tax rate using the LIFO (last in, first out) method.

Ultimately, how your annuity earnings will be taxed depends on the type of funds you use to purchase the annuity.

Below is an example showing how tax deferral could increase your earning power. Consider someone whose Federal Tax bracket is 32% who owns an annuity that earns 4.50%. To match those same earnings in a taxable investment, they would have to earn 6.62% instead.

Under current law, annuities grow tax-deferred. An annuity is not required for tax deferral in qualified plans. Annuities may be subject to taxation during the income or withdrawal phase. Neither My Annuity Store, Inc. nor any financial professionals acting on its behalf should be viewed as providing legal, tax, or investment advice. You should be advised to rely on your own qualified tax professional.

Best Fixed Annuity Companies

In 2023, fixed-rate deferred annuity sales totaled $164.9 billion, up 46% from the 2022 annual high of $113 billion. Fxed-rate deferred annuity sales were $58.5 billion in the fourth quarter, this is the best sales quarter for fixed-rate deferred annuities ever documented.

Each year the Secure Retirement Institute publishes a U.S. Individual Fixed Annuity Sales Survey which lists the top 20 Annuity Companies ranked by the dollar amount of individual U.S. Fixed Annuity Sales.

The table below lists the top 10 best-fixed annuity companies in order by sales(in thousands).

| Rank | Insurer | Sales |

|---|---|---|

| 1 | Athene | $23,898,950 |

| 2 | Mass Mutual | $17,222,541 |

| 3 | Corebridge | $17,222,541 |

| 4 | New York Life | $9,307,837 |

| 5 | Global Atlantic | $7,405,572 |

| 6 | Western Southern | $6,368,639 |

| 7 | Symetra | $5,688,989 |

| 8 | Fidelity & Guaranty | $5,055,158 |

| 9 | Delaware Life | $4,445,059 |

| 10 | Pacific Life | $4,122,429 |

Annuities vs CDs

Fixed annuities are very similar to a certificate of deposit (CD); annuity rates are higher than CD rates; generally speaking.

| FEATURES | FIXED ANNUITY | CD |

|---|---|---|

| Issued By | Insurance Companies | Banks |

| Investment Amount | $2,000 - $1,000,000 | Essentially Any Amount |

| Investment Term | 2 years - 10 years | 3 months - 5 years |

| Interest Rates (APY) | Varies by product. | Varies by bank, term and investment amount. |

| Liquidity | Usually, 10% annually or interest earned. | Almost always accumulated interest. |

| Guarantees | Backed by Insurer & State Guaranty Associations. | Backed by the FDIC. |

| Death Benefit | May avoid probate. | Probate process required. |

Why Should You Buy an Annuity?

Annuities come with unique features that make them an attractive option for retirement planning. They offer tax-deferred growth, meaning you don’t have to pay taxes on the earnings until you withdraw the money.

Additionally, annuities can be customized to suit your preferences, offering choices in payout options and even providing death benefits for your beneficiaries.

Key Features and Characteristics of Fixed Annuities

Annuities offer several benefits that make them worth considering for retirement planning. Here are some compelling reasons to buy an annuity:

Retirement Income Stability

One of the primary advantages of annuities is their ability to provide a stable income stream during retirement. By opting for a lifetime income option, you can rest assured that you’ll have a consistent source of income to cover your living expenses, regardless of how long you live. This stability can help alleviate concerns about outliving your savings and provide peace of mind in retirement.

Tax Advantages

Annuities offer tax advantages that can be beneficial for retirement planning. During the accumulation phase, your contributions grow on a tax-deferred basis, meaning you don’t pay taxes on the earnings until you start withdrawing the money.

This tax deferral allows your investment to potentially grow faster compared to taxable investments. However, it’s important to note that withdrawals from annuities are subject to ordinary income tax.

Investment Control and Flexibility

Depending on the type of annuity you choose, you may have control over how your contributions are invested. Variable annuities, for example, allow you to allocate your funds among different investment options. This flexibility enables you to potentially earn higher returns by taking advantage of market opportunities.

Death Benefit for Beneficiaries

Annuities can provide a death benefit to your beneficiaries. If you pass away before receiving the full value of your annuity, a death benefit can be paid out to your loved ones. This ensures that your contributions and any accumulated earnings are not lost and can be passed on to your heirs.

Now that you understand the benefits of annuities, let’s discuss how and where you can purchase one.

Where Can You Buy Annuities?

There are various avenues through which you can buy annuities.

- Insurance Companies and Financial Institutions

- Independent Financial Advisors retirement goals and risk tolerance. They provide personalized advice and recommendations tailored to your specific needs.

- Online Annuity Marketplaces. Online annuity marketplaces.

Pros and Cons of Annuities

PROS

- Steady Retirement Income: Annuities offer a reliable income stream, providing a sense of financial security during retirement.

- Tax Advantages: The tax-deferred growth of annuities can lead to faster accumulation of wealth and potentially lower tax liability.

- Investment Options: Variable annuities allow for investment control and the potential to earn higher returns based on market performance.

- Death Benefit: Annuities can provide a death benefit, ensuring that your contributions and earnings are passed on to your beneficiaries.

CONS

- Lack of Liquidity: Annuities are long-term investments, often imposing penalties for early withdrawals. Make sure to consider your liquidity needs before committing to an annuity.

- Fees and Charges: Annuities can come with various fees, including administrative fees, mortality, and expense charges, and investment management fees. These costs can affect the overall returns of the annuity.

- Loss of Control: Annuities limit your access to the invested funds, potentially restricting your ability to make other investment choices.

- Complexity and Transparency: The terms and conditions of annuities can be complex, making it important to fully understand the details of the contract before making a purchase.

Frequently Asked Questions

Are 5 Year Fixed Annuities Safe?

A 5 year fixed annuity is considered to be safe by most investors. Fixed annuity guarantees are backed by the insurance company that issues them, so it is important to consider an insurance company’s financial ratings when buying an annuity.

How are fixed annuity rates determined?

Fixed annuity rates are set by the insurance company that issues the annuity contract.

How do 5 year fixed annuities work?

5 year fixed annuities pay a set interest rate for 5 years. At the end of the 5 year annuity contract, you can withdraw all of your funds during a window without penalty. Or, you can elect to renew your annuity for another 5 year term.