Fixed Annuity vs Fixed Index Annuity

Indexed annuities and fixed annuities offer secure ways to grow your savings; however, there are some key differences between these two types of annuities. Understanding their features can simplify planning for your financial goals.

In this fixed annuity vs fixed index annuity guide, we will explain the key differences between a fixed annuity and a fixed index annuity, specifically how they each credit interest.

Key takeaways

-

Fixed index annuities credit interest based on the performance of a stock market index. They don’t pay a guaranteed interest rate but offer more upside potential than a fixed annuity and still provide principal protection.

-

Fixed annuities guarantee a fixed interest rate and steady growth without exposure to market risk, making them a low-risk and predictable savings option.

-

Fixed index annuities are more complex than fixed annuities but still offer the same tax-deferred growth and lifetime income options. Indexed annuities offer more upside growth potential based on stock market performance, while providing principal protection from potential stock market downturns.

-

A fixed annuity is straightforward with no moving parts.

What is an Indexed Annuity?

An indexed annuity is a conservative investment that offers principal protection and provides more upside growth potential than a traditional fixed annuity. Interest is credited based on the performance of a stock market index such as the S&P 500®. Your money remains in an account with the insurance company and is not directly invested in the stock market.

The insurance company purchases call options for the stock market index. If the market goes up, you earn interest. However, in the event of a decrease, your funds remain secure, and your original deposit is safeguarded against loss.

Fixed index annuities are not a security, and your funds are not invested directly in the stock market.

What is a Fixed Annuity?

A fixed annuity is different than a fixed index annuity because it credits interest based on a specified interest rate that is guaranteed for the length of the annuity contract (usually 3 to 10 years).

When you buy a fixed annuity, you agree to deposit funds, either all at once or over time. Your money is credited a specified interest rate for the length of your annuity contract and is not tied to stock market performance.

During the accumulation phase, your money earns interest at the agreed-upon rate. Later, in the payout phase, your insurer can pay you back in regular payments for a set number of years or for life, depending on the contract.

Fixed annuities have very little risk because your interest rate is guaranteed. Your principal is protected by the claims-paying ability of the issuing insurance company. However, other financial products like indexed annuities and stocks offer more upside potential.

Money invested in a fixed annuity may benefit from compound interest. Compound interest can help your money grow more quickly over time because your interest earns interest on its interest.

Fixed Index Annuity vs Fixed Annuity

Here’s a simple hypothetical example of an indexed versus fixed annuity:

- Fixed annuity: You purchase a $50,000 fixed annuity that offers a guaranteed 5% annual return. You will earn $2,500 each year (5% of $50,000), regardless of stock market performance. This method is stable and predictable.

- Indexed annuity: You buy a $50,000 index annuity linked to the S&P 500® with a 6% cap and an 80% participation rate. If the S&P 500® rises 10% in one year, the annual cap rate is 6%, and your annuity will be credited 6% ($3000). And if the market declines, you will not lose money but may not earn anything that year.

5 Differences Between Fixed and Indexed Annuities

| Feature | Fixed Annuity | Fixed Index Annuity |

|---|---|---|

| Interest rate | Fixed | Tied to market index |

| Risk | Low | Moderate |

| Earnings potential | Limited | Higher |

| Flexibility | High for simplicity | Optional Riders Available |

| Costs | Minimal | Potential fees for riders |

| Best for | Risk-averse investors | Growth-seeking investors |

Interest rate

Fixed annuities: Pay a specified interest rate for the length of the contract. View current fixed annuity rates.

Indexed annuities: The insurance company calculates your returns based on how a stock market index performs. You are not investing your money directly in the stock market; however, the interest you earn is determined by market performance. This allows for greater growth potential while protecting your principal investment.

Earnings potential

Fixed annuities: Fixed annuities have returns that do not vary with stock market performance and offer consistent, predetermined earnings.

Indexed annuities: Individuals may benefit from increased earning potential during favorable market conditions; however, insurers typically impose caps on the maximum gains.

Risk

Fixed annuities: There is very little risk because your principal and interest rate are guaranteed.

Indexed annuities: The level of risk is greater because returns depend on market performance; however, the principal is protected.

Costs

Fixed annuities: Early withdrawals from fixed annuities are subject to surrender charges and, in most cases, a market value adjustment (MVA).

Indexed annuities: Fixed index annuities charge a fee for optional riders and features.

Growth mechanism

Fixed annuities: The interest rate remains unchanged for the length of the contract and does not depend on outside factors.

Indexed annuities: The interest rate earned is determined by market performance, with a guaranteed minimum.

.

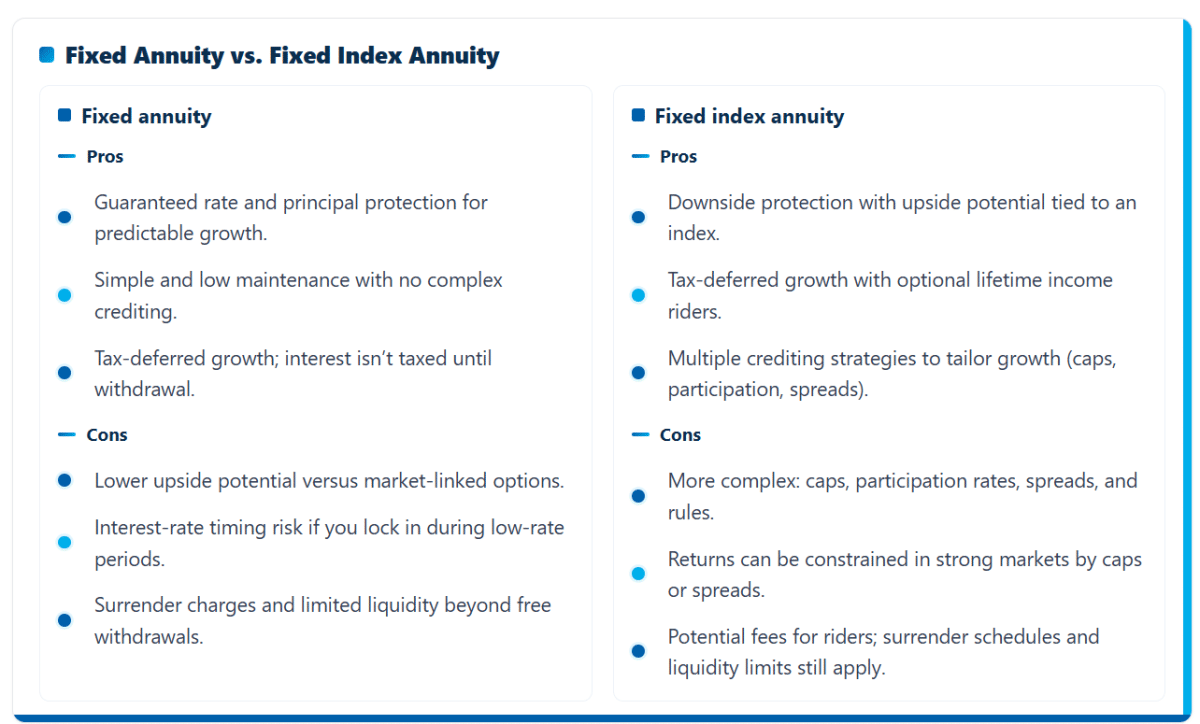

Fixed Index Annuity vs Fixed Annuity: Pros and Cons

Fixed Annuities

Pros:

- Guaranteed rate and principal protection: Predictable growth with no market risk.

- Simple and low maintenance: Easy to understand; no moving parts or complex crediting.

- Tax-deferred growth: Interest compounds without current-year taxes until withdrawal.

Cons:

- Lower upside potential: Typically lower long-term returns than market-linked options.

- Interest-rate risk: Locking in during low-rate periods can lag future opportunities.

- Surrender charges and liquidity limits: Penalties for early withdrawals beyond free withdrawal amounts.

Fixed Indexed Annuities

Pros:

- Downside protection with upside potential: Principal is protected from market losses while interest can track an index.

- Tax-deferred growth and income options: Access to lifetime income riders and tax deferral.

- Diversified crediting choices: Multiple indices and strategies (caps, participation rates, spreads) to tailor growth.

Cons:

- Complexity: Crediting methods, caps, participation rates, and spreads can be confusing.

- Potentially constrained returns: Caps/spreads/participation limits can reduce gains in strong markets.

- Fees for riders and surrender schedules: Income or enhanced benefits may add costs; liquidity limits still apply.

FAQ: Fixed Annuity vs. Fixed Index Annuity

What’s the core difference between a fixed annuity and a fixed index annuity?

Which one is safer?

Who should consider a fixed annuity?

- Guaranteed, steady growth without market exposure

- Simplicity and low maintenance

- Tax‑deferred savings with clear liquidity rules

Who should consider a fixed index annuity?

- Variable credited interest affected by caps/participation/spreads

- Reviewing crediting strategy choices and rules

- Potential rider fees for optional benefits

Do both offer lifetime income options?

How do fees and liquidity compare?

What about taxes?

Need help choosing? Call 855‑583‑1104 or email info@myannuitystore.com. We’ll keep it simple and put your goals first.