If you want safe growth and a set interest rate you can count on, 5-year MYGA rates are worth a serious look. They’re simple, principal-protected annuities with multi-year guaranteed annuity rates that don’t jump around. Let’s break down how they work, how to compare them, and how to buy a MYGA online.

5- Year MYGA Rates Today

- Annuity rates last updated: February 14, 2026

| Carrier /Product Name | AMBest | Rate(GTD) | WithdrawalsYr 1 | Yrs 2+ | Min.Deposit | MaxAge | Term(Years) | Action |

|---|---|---|---|---|---|---|---|

| American Gulf — Anchor MYGA 5 MVA | B++ | 6.30% | 0% / 0% | 10,000 | 89 | 5 yrs | Apply |

| Wichita National Life Insurance Company — Security 5 MVA (i) | B+ | 6.25% | 0% / 0% | 10,000 | 89 | 5 yrs | Apply |

| Mountain Life — Alpine Horizon 5 MVA (i) | B | 6.15% | 0% / 5% | 5,000 | 90 | 5 yrs | Apply |

| Axonic Insurance Services — Skyline MYGA 5 MVA, FEE-BASED High Band | A- | 6.05% | 0% / 10% | 100,000 | 89 | 5 yrs | Apply |

| Revol One Financial — DirectGrowth 5 MVA (i) | B++ | 6.00% | 0% / 0% | 25,000 | 85 QL / 90 NQ | 5 yrs | Apply |

| Revol One Financial — DirectGrowth 5 Enhanced Death Benefit MVA (i) | B++ | 5.90% | 0% / 0% | 25,000 | 85 QL / 90 NQ | 5 yrs | Apply |

| Revol One Financial — DirectGrowth 5 Free Partial Surrender MVA (i) | B++ | 5.90% | Int / Int | 25,000 | 85 QL / 90 NQ | 5 yrs | Apply |

What Is a 5-Year MYGA?

A 5-year MYGA (Multi-Year Guaranteed Annuity) is a fixed annuity that guarantees a set interest rate for five years. Think of it like a 5-year CD alternative annuity from an insurance company, not a bank. Your principal is protected by the insurer’s guarantees, and your interest compounds tax-deferred.

There are no ongoing market fees for a no-fee MYGA annuity, and you usually get limited liquidity, like up to 10% free withdrawals each year. At the end of five years, you can renew, transfer, or withdraw. If you want stable, predictable growth without market swings, a 5-year MYGA is a safe annuity option to consider.

How Do 5-Year MYGA Rates Work?

Credited interest and compounding

Your 5-year MYGA credits a fixed rate each year. Interest compounds, so your money earns interest on interest, not just on your original deposit.

Rate guarantees and renewal periods

The rate is locked for five years. After that, you hit a renewal window. You can accept a new rate, move the money, or withdraw. Some contracts auto-renew if you do nothing, so mark your calendar.

Surrender charges and liquidity windows

If you take more than your free withdrawal amount before the five years are up, surrender charges and a market value adjustment (MVA) may apply. Many contracts offer 10% free withdrawals annually, starting in year one.

Taxes and when they’re due

Interest grows tax-deferred. You don’t owe taxes until you take money out. In non-qualified accounts, withdrawals are taxed as ordinary income on the gain. In IRAs, distributions follow IRA rules. If you withdraw before age 59½, a 10% IRS penalty may apply on taxable amounts.

Benefits of a 5-Year MYGA

- Predictable growth: You lock in multi-year guaranteed annuity rates for the full term. No guessing, no market noise.

- Principal protection: Your deposit is backed by the insurer’s claims-paying ability, making it a safe annuity option for conservative assets.

- Tax deferral: Interest compounds without current taxes, which can boost effective yield versus taxable CDs when comparing MYGA vs CD rates.

- Simple and low friction: No annual fees on standard no-fee MYGA annuity contracts. Minimal moving parts.

- Liquidity options: Many allow 10% free withdrawals annually, so you can take interest or a slice of principal if needed.

- Flexible at maturity: Renew at a new rate, 1035 exchange to another carrier, or take the cash.

Risks and Trade-Offs

- Limited liquidity: Exceeding free withdrawals can trigger surrender charges and possibly an MVA.

- Interest rate risk: If rates rise, you’re locked for five years unless you pay penalties to exit early. Laddering can help.

- Carrier risk: Guarantees are based on the insurer’s financial strength, not FDIC insurance. Ratings matter.

- Taxes on gains: Withdrawals are taxed as ordinary income, not capital gains. In non-qualified contracts, interest comes out first.

- Opportunity cost: If you need full liquidity or expect higher short-term returns elsewhere, a 5-year MYGA may not be a fit.

- Renewal uncertainty: After five years, the renewal rate could be lower. Know your options ahead of time.

Who Should Consider a 5-Year MYGA?

A 5-year MYGA can fit if you:

- Want principal protected annuity rates and steady growth without market risk.

- Don’t need full access to the money for five years.

- Prefer a simple, no-fee MYGA annuity design over complex riders.

- Need tax-deferred growth, especially if you’re in a high tax bracket.

- Want a CD alternative annuity with potentially higher after-tax yield.

- Are building an annuity ladder 5 year strategy for predictable cash flow over time.

It may not fit if you need full liquidity, expect to withdraw more than the free amount, or prefer market upside via a fixed indexed annuity vs MYGA. For those who value simplicity, a fixed MYGA is hard to beat.

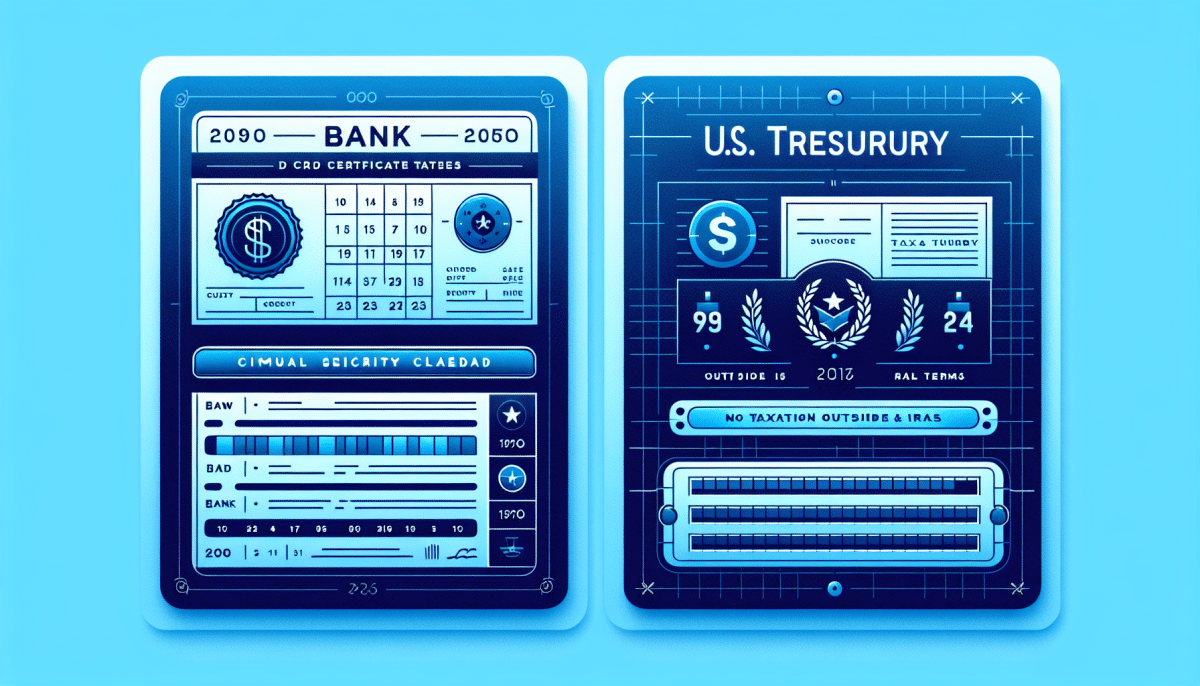

5-Year MYGA vs CDs vs Fixed Annuities vs Treasuries

Safety and guarantees

- MYGA: Backed by insurer guarantees; not FDIC insured. State guaranty associations provide limited backstop.

- CDs: Bank products, FDIC insured within limits.

- Traditional fixed annuities: Similar insurer guarantees; may have different surrender periods.

- Treasuries: Backed by the U.S. government.

Rate potential and compounding

- MYGA: Often competitive with or higher than CD rates, especially with tax deferral. Compounds inside the contract.

- CDs: Taxable annually unless in an IRA; rates vary by bank.

- Fixed annuities: Rate may be guaranteed for shorter terms; some have renewal bands.

- Treasuries: Coupon rates vary; market value fluctuates if sold early.

Liquidity and penalties

- MYGA: 10% free withdrawals are common; surrender charges and MVA if you exceed.

- CDs: Early withdrawal penalties are smaller but still sting.

- Fixed annuities: Similar to MYGA, but terms vary.

- Treasuries: Highly liquid if sold, but price can move.

Taxes and RMDs

- MYGA: Tax-deferred; RMDs apply in IRAs.

- CDs and Treasuries: Taxed annually outside retirement accounts.

Early withdrawal scenarios

- MYGA: Charges + potential MVA can reduce value if rates rise.

- CDs: Bank penalty typically forfeits a few months of interest.

- Treasuries: Sell at market price; could gain or lose.

Bottom line: A MYGA can offer attractive, stable growth with tax deferral and clear rules, making it a strong MYGA vs CD rates comparison, especially for multi-year goals.

How to Compare 5-Year MYGA Rates (Step-by-Step)

- Define goals and time horizon: Decide what this money must do: grow safely, fund income later, or bridge to retirement. Confirm you can leave principal mostly untouched for five years.

- Decide pretax vs after-tax needs: If using an IRA, coordinate RMDs. In non-qualified accounts, weigh the benefit of tax deferral versus taxable CDs.

- Check insurer financial strength ratings: Look for A- or better from AM Best when possible. Balance yield with carrier quality.

- Review current rate, guarantees, and renewal terms: Is the rate guaranteed for the full five years? What happens at maturity if you do nothing? Avoid teaser rates that drop after year one.

- Evaluate surrender schedule and free withdrawals: Confirm the surrender charge table, MVA language, and whether 10% free withdrawals start in year one and reset on each anniversary.

- Confirm state guaranty association limits: Know the coverage cap in your state and size your deposits accordingly.

- Get an apples-to-apples quote and disclosures: Use a MYGA rate comparison tool to view MYGA annuity quotes side-by-side, including carrier ratings, effective annual yield, surrender schedules, and MVA terms.

If you want a transparent marketplace, see current 5-year rates and product details here: 5-Year Fixed Annuity Rates and MYGA Guide and MYGA Overview.

How Interest Is Credited and Compounded

- Annual vs monthly compounding: Most MYGAs compound annually. Some credit daily or monthly, but the effective annual yield usually aligns with the stated rate.

- Simple vs compound illustrations: Simple interest shows interest on principal only. Compound interest reflects interest-on-interest. Focus on the guaranteed accumulated value after five years to compare offers.

- Impact of cash vs accumulated interest withdrawals: If you take your interest out each year, your effective yield can be slightly lower than if you let it compound. Reinvesting interest inside the contract maximizes total growth; taking cash can fund expenses with minimal principal impact.

Liquidity: Free Withdrawals and Penalties

- 10% free withdrawal provisions: Most MYGAs allow up to 10% of the account value per year without surrender charges. Many people take interest only; others use a fixed percentage.

- Withdrawal timing and anniversary rules: Free withdrawals often reset on the contract anniversary. Some require waiting 30 days after issue. Know your contract’s timing to avoid accidental charges.

- Market value adjustment (MVA) basics: The MVA adjusts your value on excess withdrawals based on interest rate changes. If rates rose since you bought, an MVA may reduce your pay; if rates fell, it may offset a portion of charges.

- Nursing home and terminal illness waivers: Many carriers waive charges for qualifying nursing home or terminal illness events. Waiver terms vary, so read the disclosure and confirm eligibility periods.

Taxes: What You Need to Know

- Tax-deferred growth explained: Your interest compounds without annual taxes, which can boost effective returns versus taxable alternatives.

- Non-qualified vs IRA treatment:

- Non-qualified: Gains taxed as ordinary income when withdrawn; interest comes out first.

- IRA: Distributions follow IRA rules; taxes due on withdrawals as ordinary income.

- 59½ rule and penalties: Withdrawals of taxable amounts before age 59½ may incur a 10% IRS penalty, on top of ordinary income taxes.

- RMD coordination for retirees: For IRAs, ensure the contract allows RMD-friendly withdrawals. You can take RMDs from one IRA to satisfy others but coordinate timing to avoid surrender charges.

How to Ladder 5-Year MYGAs (Strategy)

- Why laddering can reduce rate risk: Laddering spreads your money across multiple maturities. If rates rise, maturing rungs can reinvest higher; if rates fall, longer rungs keep higher locked-in yields.

- Example 3-rung ladder: Split $300,000 across three 5-year MYGAs opened one year apart, or stagger terms (e.g., 3-, 4-, and 5-year MYGAs). Each year, one rung matures to fund cash needs or reinvest.

- Reinvesting at maturity: At each maturity, compare MYGA vs CD rates and other options. Decide whether to roll, transfer via 1035 exchange, or take income.

- When laddering may not fit: If you need total liquidity soon or prefer one simple maturity date for a known goal, a single MYGA may be better. For a deeper dive, see Annuity Ladder Strategy 2025.

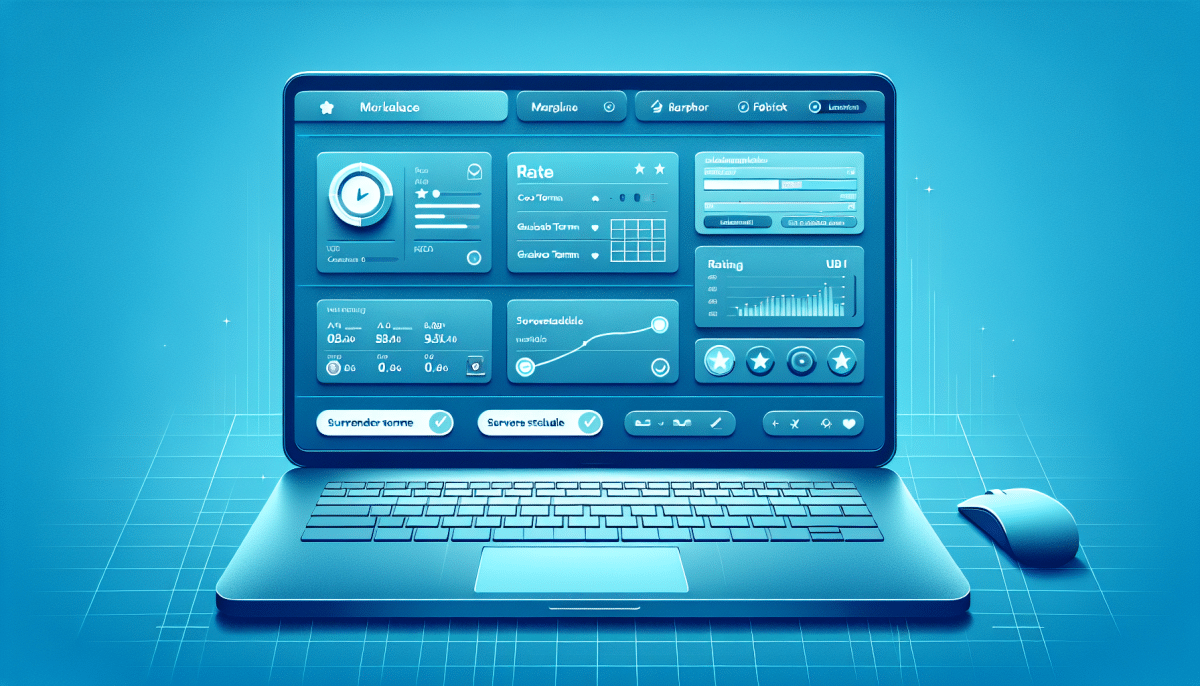

How to Buy a 5-Year MYGA Online (Process)

- Compare current rates on a transparent marketplace: Start with a clean, apples-to-apples MYGA rate comparison tool where you can sort by rate, carrier rating, liquidity, and surrender schedules. See current 5-year rates here: View 5-Year Rates.

- Verify carrier ratings and product disclosures: Check AM Best, S&P, and Moody’s if available. Read the product brochure and disclosure pages for guarantees and withdrawal terms.

- Complete e-application and suitability review: Answer basic suitability questions about goals, time horizon, liquidity, and risk tolerance. This is standard and meant to protect you.

- Funding and policy delivery: Fund via check, ACH, wire, transfer, or 1035 exchange. After issue, you’ll receive a contract packet and delivery confirmation.

- Free-look period and account setup: You generally have a free-look window to cancel and receive your money back. Set up online access, choose interest payout options if needed, and calendar your anniversary and maturity dates. To explore a direct MYGA annuity purchase and e-app, see MYGA Overview.

Top Factors That Move MYGA Rates

- Treasury yields and credit spreads: Insurers invest in high-quality bonds. When Treasury yields rise, MYGA rates often follow. Wider credit spreads can also lift yields.

- Insurer portfolio yields: Carriers set MYGA rates based on expected portfolio returns. Strong portfolio income supports higher credited rates.

- Competition among carriers: When carriers compete for deposits, you’ll often see more attractive principal protected annuity rates, especially on popular terms like five years.

- State-specific variations: Rate filings, approval timing, and market demand can differ by state, impacting availability and caps. Always check your state options.

Tips to Maximize Your Outcome (Practical Guide)

- Use laddering or split deposits: Allocate across multiple maturities or carriers to reduce rate and carrier risk.

- Match liquidity to known cash needs: If you know you’ll need cash in year three, size the free withdrawal or keep that cash in a 3-year option.

- Compare effective annual yield: Look at the guaranteed accumulated value at maturity. That’s your true apples-to-apples number.

- Watch surrender schedules and MVA terms: Choose schedules you can live with and understand how the MVA could impact early exits.

- Reassess at renewal: Don’t auto-renew blindly. Shop rates using MYGA annuity quotes and compare carriers again at maturity.

Red Flags to Avoid

- Teaser rates vs guaranteed rates: Avoid products that headline a rate not guaranteed for the full term.

- Aggressive surrender schedules: If charges stay high late into the term, think twice—especially if you need flexibility.

- Poor carrier ratings: Higher yield shouldn’t mean weak balance sheets. Favor solid insurers.

- Unclear fees or riders you don’t need: Standard MYGAs are no-fee. Skip add-ons you won’t use or don’t understand. If a product seems too complex for a fixed annuity, consider a simpler MYGA or review a product like Ibexis MYGA Plus if it fits your needs: Ibexis MYGA Plus Annuity Review.

Real-World Examples (Side-by-Side)

$100k non-qualified: accumulate vs take interest

- Accumulate: You deposit $100,000 at a fixed 5-year rate. You let interest compound, owing no taxes until withdrawal. Result: higher ending value due to compounding and tax deferral.

- Take interest: You elect annual interest payouts. You get predictable income, but your principal doesn’t compound as fast. Taxes apply to the interest you receive each year.

$250k IRA: RMD coordination

You hold a 5-year MYGA in a Traditional IRA. At age 73, you must satisfy RMDs. Many contracts allow RMD withdrawals without surrender charges, even if they exceed the 10% free amount. Coordinate timing to avoid penalties and confirm the RMD-friendly provision before purchase.

Early withdrawal scenario: impact of charges and MVA

Suppose you withdraw above the free 10% in year two. A surrender charge applies, plus a possible negative MVA if rates have risen since purchase. Your payout could be meaningfully lower than the account value. If rates have fallen, the MVA might soften the hit. Plan ahead: use emergency cash outside the MYGA and size the deposit to your real liquidity needs.

MYGA Alternatives if You Need More Flexibility

- Consider shorter-term MYGAs (3-year) if you want less commitment. See current options: 3-Year Fixed Annuity Rates.

- High-yield CDs and Treasuries are good for shorter goals or if you prefer FDIC/US government backing. Remember CDs are taxable annually outside IRAs.

- Fixed annuities with shorter surrender periods like traditional fixed annuities may offer more flexible surrender schedules than some MYGAs, depending on the product.

- Money market as a parking spot for very short-term needs, money markets offer high liquidity with variable yields.

Compliance, Guarantees, and State Protection

Insurer guarantees vs FDIC

MYGAs are insurance contracts. Guarantees rely on the insurer’s claims-paying ability; they’re not bank products and not FDIC insured.

State guaranty association basics

Each state has coverage limits for resident policyholders if an insurer fails. Limits vary by state and product type.

Why carrier strength matters

Financial strength ratings, surplus, and asset quality matter. Favor carriers with strong ratings and transparent disclosures. For an overview of rates across terms: All Fixed Annuity Rates.

Frequently Asked Questions

› What is today’s average 5-year MYGA rate?

Rates change often. Use a live MYGA rate comparison tool to see current options by state and carrier:

› Are MYGA rates fixed for the full 5 years?

Yes, for a true 5-year MYGA, the guaranteed rate is fixed for the entire term. Avoid products with teaser rates that drop after year one.

› Can I withdraw my interest without penalty?

Usually, yes. Many contracts let you take interest as it’s credited, penalty-free. Confirm whether this counts toward your 10% free amount.

› How safe are MYGAs compared to CDs?

CDs are FDIC insured at banks. MYGAs are backed by insurers and supported by state guaranty associations within limits. Safety depends on carrier strength and state coverage.

› What happens at the end of the 5-year term?

You’ll have a renewal window to: withdraw funds, renew at a new rate, or transfer to another MYGA via 1035 exchange. If you do nothing, contracts may auto-renew.

› How are MYGAs taxed in an IRA vs non-qualified account?

In an IRA, taxes are due when you take distributions. In a non-qualified MYGA, gains are tax-deferred and taxed as ordinary income when withdrawn.

› What if I need money early—are there waivers?

Some contracts offer nursing home and terminal illness waivers. RMD waivers may also apply. Read each carrier’s waiver rules carefully.

› Can I 1035 exchange into a MYGA?

Yes. A 1035 exchange lets you move from one non-qualified annuity to another without current taxes. Make sure ownership and tax status align.

› How do state guaranty associations protect me?

They provide limited protection if an insurer fails. Limits vary by state; size deposits accordingly.

› How do I compare carriers and choose the best option?

Look at rate, guarantee period, surrender schedule, MVA terms, free withdrawals, and insurer ratings. Use transparent tools and get side-by-side MYGA annuity quotes.