I was overwhelmed by annuities until I found My Annuity Store. Their team made everything understandable and stress-free.

My Annuity Store Makes It Easy to Buy an Annuity

My Annuity Store is America’s largest online, direct-to consumer annuity platform. We are 100% independent, unbiased, and transparent. Our mission is to democratize access to annuities for all American’s.

Fixed Annuity Rates

Discover competitive fixed annuity rates with guaranteed returns to help secure your retirement income.

Fixed Index Annuity Rates

Compare fixed index annuity rates that offer growth potential linked to a market index, with added security.

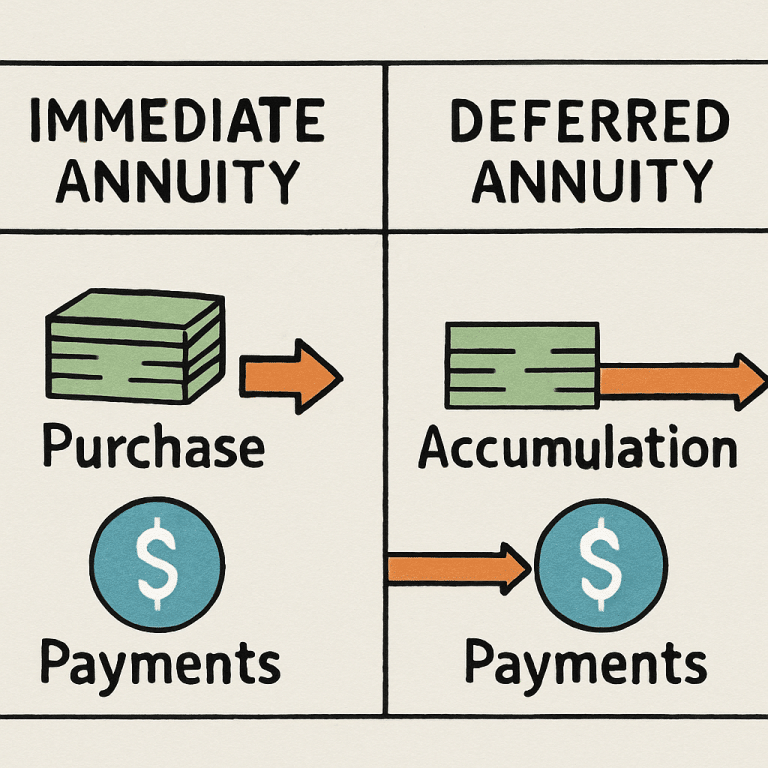

Immediate Annuity Quote

Get quick quotes for immediate annuities, providing you with reliable income right when you need it.

About Company

We are your one-stop-shop for all things annuties.

My Annuity Store is 100% independent, and our team of licensed annuity experts provides unbiased and transparent advice with your best interest at heart.

Our Four Step Process

The first step is to learn about annuities. If you don’t where to start let our AI-guide point you in the right direction.

Once you have learned what type of annuity may be right the next step is to get some annuity quotes. Our licensed annuity experts are available to consult with you via phone and email and provide any additional materials you need.

Once you have decided which annuity best meets your goals, you will complete our preliminary application online. This takes approximately 10 minutes and will help our agent with 90% of your application.

This phone call typically lasts around 15 minutes as we gather the final pieces of information and address any remaining questions you may have. Finally, we will email your application for you to sign electronically.

Need more help?

We are open Monday to Friday, 8:00 AM to 6:00 PM Eastern Time. If you have questions or need help, call us now.

Resources

Why Choose Us

Why you should trust My Annuity Store

We are independent, unbiased, and transparent. We do not sell leads, and our website does not contain any affiliate links.

As Seen On:

What Our Clients Say

No high-pressure sales tactics. Just honest advice and a great selection of products.

The online calculator was a game changer for me. I could compare options instantly and get quotes without giving up my info.