Lock in today’s best fixed annuity rates, defer taxes, and buy your annuity at home — all through one independent platform.

*Illustrative snapshot. Click below for live updates & full comparison including carrier strength, liquidity, and renewal options.

Rates subject to change without notice. Availability & features vary by state and insurer. Guarantees are backed by the claims‑paying ability of the issuing insurance company. Not a bank product. Not FDIC insured. State guaranty association limits apply (vary by state).

Use the fixed annuity rate comparison table below to search for the best fixed annuity rate based on your goals and objectives. Fixed annuity rates vary by state and investment amount; we recommend you use the state and investment amount filters to see the most accurate annuity rates.

Fixed annuity rates are set at the time of purchase and guaranteed for the entire term of your contract. Compare today’s best fixed annuity rates by term in the table below.

| Term | Insurer | Company | Annuity | Rate | AM Best | Free withdrawals | Application |

|---|---|---|---|---|---|---|---|

| 2 Years | CL Life | CL Sundance | 5.25% | B++ | Interest Only | Apply | |

| 3 Years | Mountain Life | Alpine Horizon | 6.00% | B+ | None | Apply | |

| 4 Years | Mountain Life | Alpine Horizon | 6.05% | B+ | 10% | Apply | |

| 5 Years | Knighthead Life | Staysail Annuity | 6.30% Simple | A- | None | Apply | |

| 6 Years | Equitrust | Certainty Select | 5.60% | B++ | Interest Only | Apply | |

| 7 Years | Knighthead Life | Staysail Annuity | 6.50% Simple | A- | None | Apply | |

| 8 Years | EquiTrust | Certainty Select | 5.65% | B++ | Interest Only | Apply | |

| 9 Years | Clear Spring Life | Preserve MYGA | 5.35% | A- | None Yr 1 10% Yrs. 2-9 | Apply | |

| 10 Years | Revol One | DirectGrowth MYGA | 6.00% | B++ | None | Apply |

Read our new rankings for the 10 Best Fixed Annuity Companies of 2025.

Insurer financial ratings: The highest annuity rates often come from companies with lower financial ratings.

Rate and product features: Not all rates are available in all states. The features, benefits, and liquidity options can also vary widely among products.

Liquidity: Some fixed annuities offer free withdrawals of your interest or 10% free withdrawals annually, but other fixed annuities are illiquid, meaning there are penalties for withdrawing funds early.

Shop around: The best annuity rate depends on your specific financial goals and risk tolerance. It is smart to compare offers from multiple insurers and consider consulting with a financial professional.

Simple vs. Compound Interest: Not every annuity credits interest the same way and this can make a big difference over time.

3 year fixed annuity rates are best for short-term goals, cash you may need on a near-term timeline, or as the first rung in a ladder strategy. Three-year MYGAs can out-yield many short CDs, and interest grows tax-deferred until withdrawn.

| Term | Insurer | Review | Annuity | Rate | AM Best | Application |

|---|---|---|---|---|---|---|

| 3 Years | Mountain Life | Alpine Horizon | 6.00% | B+ | Apply | |

| 3 Years | Wichita National | Security MYGA | 5.85% No withdrawals | B | Apply | |

| 3 Years | Wichita National | Security MYGA | 5.70% 10% Free W/Ds | B | Apply | |

| 3 Years | Knighthead Life | Staysail Annuity | 5.75% Simple | A- | Apply | |

| 3 Years | Axonic | Waypoint MYGA | 5.55% | A- | Apply | |

| 3 Years | Revol One | DirectGrowth | 5.55% | B++ | Apply |

If you want a strong balance of yield and flexibility, 5-year MYGA rates typically sit in the sweet spot. You’ll lock in a competitive rate for five years, enjoy tax-deferred growth, and keep options open at the end of the term. Many contracts include 10% penalty-free withdrawals annually.

| Term | Insurer | Review | Annuity | Rate | AM Best | Apply |

|---|---|---|---|---|---|---|

| 5 Years | Knighthead Life | Staysail Annuity | 6.30% Simple | A- | Apply | |

| 5 Year | Wichita National | Security MYGA | 6.25% | B+ | Apply | |

| 5 Years | Mountain Life | Alpine Horizon | 6.15% | B+ | Apply | |

| 5 Years | Revol One | DirectGrowth | 6.00% | B++ | Apply | |

| 5 Years | Farmers Life | Safeguard Plus | 5.75% | B++ | Apply |

7 year fixed annuity rates often add a slight rate premium versus 5-year options. They are good for money you can leave alone for a while. You won’t need cash beyond the penalty-free amount.

| Term | Insurer | Company Details | Annuity | Rate | Free Withdrawals | AM Best | Apply |

|---|---|---|---|---|---|---|---|

| 7 Years | Knighthead Life | Staysail Annuity | 6.50% Simple | None | A- | Apply | |

| 7 Years | Knighthead Life | Staysail Annuity | 6.35% Simple | 10% | A- | Apply | |

| 7 Years | Wichita National | Security MYGA | 6.10% | None | B+ | Apply | |

| 7 Years | Revol One | DirectGrowth | 6.00% | None | B++ | Apply | |

| 7 Years | Revol One | DirectGrowth | 5.90% | Interest | B++ | Apply | |

| 7 Years | Mountain Life | Alpine Horizon | 5.75% | 0%/ 5% Yrs 2+ | B+ | Apply | |

| 7 Years | AMERICO | Platinum Assure | 5.50% | A | Apply |

For long-term savers seeking the highest available fixed rates, 10-year annuity rates can offer the most attractive yields. These are ideal for dollars you don’t plan to touch until maturity, or for pre-retirees laddering maturities into their retirement window.

| Term | Insurer | Review | Annuity | Rate | AM Best | Application |

|---|---|---|---|---|---|---|

| 10 Years | Revol One | DirectGrowth | 6.00% | B++ | Apply | |

| 10 Years |

| Sentinel Security | Personal Choice | 5.90% | B++ | Apply |

| 10 Years | Equitrust | Certainty Select | 5.75% | B++ | Apply | |

| 10 Years | Farmers Life | Safeguard Plus | 5.65% | B++ | Apply |

Yield matters—but so does financial strength. We help you balance both by comparing rates across AM Best rating tiers and highlighting trade-offs. All guarantees depend on the insurer’s ability to pay claims. State guaranty associations may provide coverage up to certain limits.

These insurers typically offer slightly lower rates than mid-tier carriers but bring exceptional balance sheet strength and stability. Consider A+/A++ options if:

The “value zone” for many buyers—strong financials and competitive yields.

Mid-tier ratings can deliver the highest sticker yields. This tier can be suitable when:

Editorial note: No single rating tier is “best” for everyone. Many smart plans blend carriers across ratings and terms to diversify rate risk and company risk while capturing attractive yields. Access many more resources and current ratings at our insurance company financial ratings learning hub.

A fixed annuity is an insurance contract that lets you grow money at a guaranteed interest rate for a set period—think of it like a CD issued by an insurance company instead of a bank. The insurer protects your principal, your rate is locked in, and your growth is tax-deferred until you take distributions.

At the end of the term, you can renew, withdraw, or transfer to another option without market risk. It’s designed to provide safety, predictability, and the option to turn your balance into income you can’t outlive.

Fixed annuities, or multi-year guaranteed annuities (MYGA), pay a specified rate for the length of the annuity contract (typically 2 to 10 years). Insurance companies issue annuities, and product features vary by insurance company and from product to product. Many fixed annuities allow you to take free withdrawals of your interest or up to 10% of your annuity’s account value each year.

Most annuities earn interest daily and credit the interest to the annuity account value each month. More than 90% of all fixed annuities use compound interest, which means you earn interest on top of your interest. However, recently, a handful of annuity companies have begun to offer fixed annuities that credit using simple interest.

Annuities that use simple interest pay interest only on your original deposit. They do not pay interest on the interest you earn. These annuities are best for someone who plans to withdraw their interest each month. In this case, compounding does not matter.

A surrender charge is a fee for any withdrawal from the annuity contract. This fee applies if the withdrawal is not allowed by the free withdrawal rule (like interest only or 10% free). Surrender charges in annuities can be high. It is important to think about your cash needs before buying an annuity.

A typical surrender charge schedule for a three-year annuity is 8% in Year 1, 7% in Year. 2, and 6% in Year 3.

At the end of the 3-year contract, you can renew for another 3 years, transfer your annuity to another insurance company using a tax-free 1035 exchange, or take possession of all of your funds without penalty.

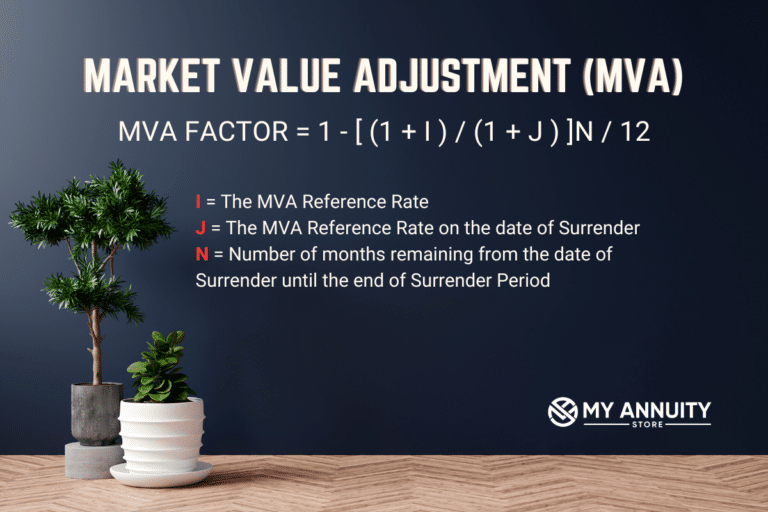

An MVA adjusts the value of an early withdrawal based on changes in a specific interest rate index. If interest rates have risen since the annuity was purchased, the MVA will likely be a negative adjustment, decreasing your payout; if rates have fallen, it will be positive, increasing it.

The MVA is typically only applied to withdrawals that exceed any penalty-free limits or to the entire contract if surrendered before the end of a surrender period.

10% free withdrawals are a fairly common feature among fixed annuities, although they are more common in longer-term annuity contracts. Annuities that allow for 10% free withdrawals usually have lower fixed annuity rates than annuities with no liquidity.

The way it works is you are allowed to withdraw up to 10% of your previous year’s account value. You are allowed to take the 10% free withdrawal once per annuity contract year.

Which Fits Your Safety and Income Goals?

The “59½ rule” is an IRS guideline that states you can begin taking withdrawals from qualified retirement plans without incurring the standard 10% early withdrawal penalty once you reach age 59½. This applies to accounts like 401(k)s, 403(b)s, and traditional IRAs.

More CD vs Fixed Annuity Content

Multi-Year Guaranteed Annuity (MYGA): A Multi-Year Guaranteed Annuity (MYGA) pays a set interest rate for the duration of your contract. Most annuities offer some liquidity, but not all; therefore, this is something to consider.

Variable Annuities: Variable annuities provide an opportunity to invest your contributions in various sub-accounts tied to the performance of the stock market. This flexibility allows for potentially higher returns, but it also comes with increased risk.

Single Premium Immediate Annuity: As the name suggests, a single premium immediate annuity provides a steady stream of income shortly after an investor purchases a contract, usually within 30 days, and always within 13 months.

Traditional Fixed Annuity Rates: Traditional fixed annuity rates do not guarantee a set interest rate for the entire length of the annuity contract. The first year’s rate is specified, and a new rate is set on each anniversary.

Fixed Index Annuity Rates: Fixed index annuity rates combine elements of both fixed and variable annuities. They offer a minimum guaranteed interest rate, similar to fixed annuities, but also provide the potential for additional earnings based on the performance of a stock market index.

Fixed annuity rates (often called MYGA rates for Multi‑Year Guaranteed Annuities) are the guaranteed interest rates insurers credit for a set term (e.g., 3, 5, 7, 10 years). Insurers set these rates based on portfolio yields, prevailing Treasury and corporate bond yields, product features, and capital requirements.

Tip: Higher rates often come with longer terms or stricter liquidity. Always review surrender schedules and any Market Value Adjustment (MVA).

A fixed annuity is a broad category. A MYGA is a type of fixed annuity that guarantees a level interest rate for a specific multi‑year term. Other fixed annuities (like traditional fixed or fixed indexed annuities) have different crediting methods and features.

MYGA: simple, CD‑like guaranteed rate for 3–10 years.

Traditional fixed: insurer declares rates periodically (may change after first year).

Fixed annuity rates can change at any time based on market conditions and insurer pricing. Most carriers update weekly or monthly, but changes can occur intra‑month when yields move. We monitor and update rates on business days.

Always confirm the rate on the date your application is signed and received by the carrier.

Fixed annuities are backed by the claims‑paying ability of the issuing insurer. Safety is evaluated using independent ratings (A.M. Best, S&P, Moody’s, Fitch). Higher ratings generally indicate stronger financial strength but may correlate with slightly lower headline rates.

An MVA adjusts your surrender value (up or down) if you withdraw more than the free amount during the surrender period. If interest rates have risen since purchase, an MVA can reduce the value; if rates have fallen, it can increase it. MVA does not affect your guaranteed interest if you hold to term and stay within free withdrawal limits.

Most MYGAs allow annual free withdrawals (often 10% of account value) after the first year. Fixed annuities with out free withdrawal options often offer higher fixed annuity rates.

Guaranteed interest rates offered by fixed annuities are often higher than CD rates.

We regularly update this page and cite primary sources, carrier filings, and regulator guidance:

Tip: Check spam/promotions if you don’t see our email on time.

Need help sooner or have a quick question?

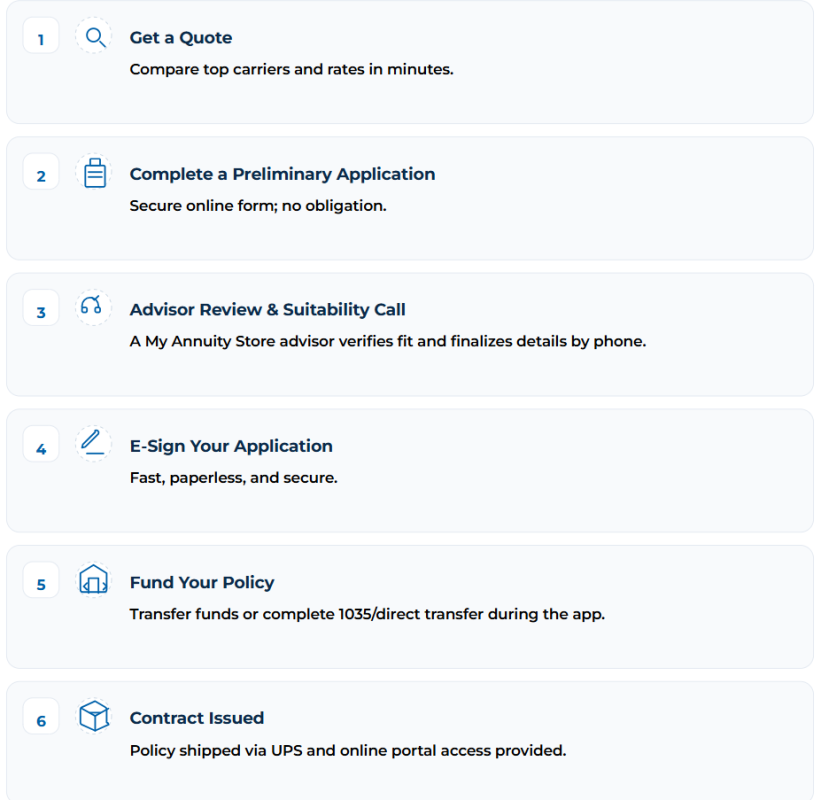

What happens next

Tip: Check your spam or promotions folder if you don’t see our email within the time window.