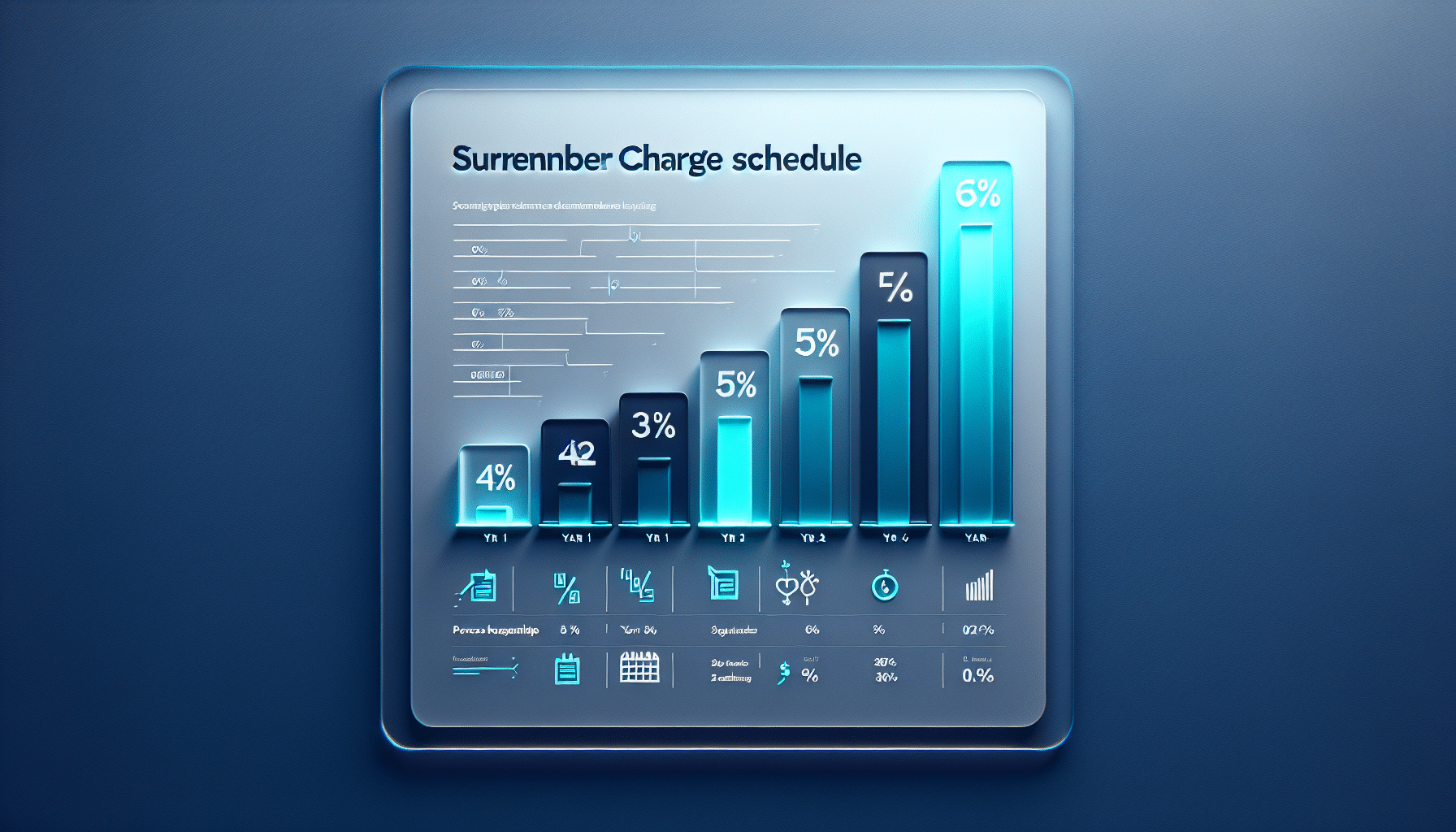

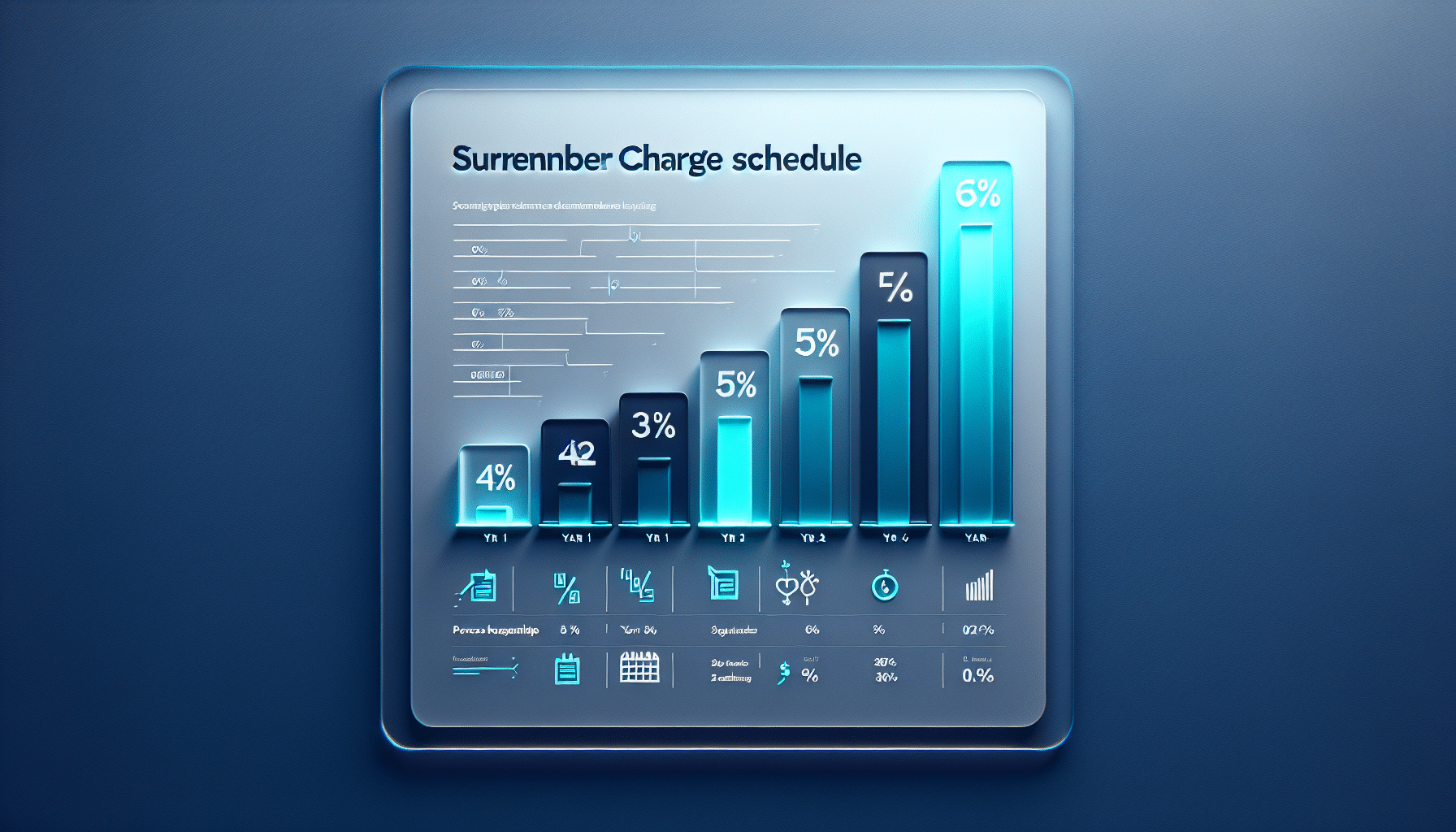

Annuity Surrender Charges: Tips how to Avoid Them

What Is a Surrender Charge? Annuity Surrender Charge Explained An annuity surrender charge is a fee the insurer may assess if you withdraw funds or

Oceanview Harbourview 4 is a 4-year fixed annuity (CD Type Annuity) designed to be a high-yield retirement savings account providing a guaranteed interest rate for 4 years.

Advantages of a Multi-Year Guaranteed Annuity (MYGA)

Features

4-Year Surrender Charge Period

Fixed Annuity Rate (Up to) | 4.90% ($80K+) |

Contract Length | 4 Years |

Cancellation Policy | 20-Day Free Look Period |

Annual Penalty-Free Withdrawals | 10% |

Annual Fees | No Fees |

Minimum Premium | $20,000.00 |

Maximum Issue Age | Age 89 |

Death Benefit | Lump-Sum, Spousal Continuation |

Premium Type | Single-Premium |

Annuitization Required | No |

State Availability | Alabama, Alaska, Arizona, Arkansas, Colorado, Delaware, District of Columbia, Florida, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maryland, Michigan, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Virginia, Washington, West Virginia, Wisconsin |

Insurance Company | Oceanview Life and Annuity Company |

Company Rating (A.M. Best) | A- (Excellent) |

Surrender Charge Waivers | None |

Maximum Premium | $1,000,000.00 |

Enhanced Benefits | None |

Premium Bonus (Up to) | None |

Accepted Funds | 401a, 401k, Cash, IRA, Non-Qualified Money, Qualified Retirement Plans, Roth IRA, TSA 403b |

In general, annuities grow tax-deferred meaning you don’t pay taxes until you withdraw your money from the annuity.

When your withdrawal from your annuity the interest earned will be taxed at your ordinary income tax rate.

Non-Qualified Annuity

Non-qualified funds are cash, checking, savings, life insurance cash value, etc. Only the interest you have

earned will be taxed as ordinary income.

Qualified Annuity

Qualified funds are 401k, IRA, SEP, 403b, TSA, etc. Both principal and interest will be taxed as ordinary

income as you withdraw money.

Roth IRA Annuity

Withdrawals from Roth IRA annuities are tax-free if the IRS requirements are met.

Early-Withdrawals

If you withdraw money from your annuity before you turn age 59½, you may receive a 10% IRS penalty in

addition to paying ordinary income taxes.

Oceanview Life and Annuity are rated A- by AM Best and issues competitive yielding fixed annuities funded and supported by its asset manager’s 25 years of investment management experience. Oceanview Life and Annuity have partnered with Oceanview Asset Management, a wholly-owned subsidiary of Bayview Asset Management to serve as Oceanview Life’s investment manager.

Bayview has a proven track record of investing since 1995 and will, through Oceanview Asset Management, LLC, manage Oceanview’s portfolio with an emphasis on high-quality mortgages and other related assets. As of November 2020, Bayview oversees approximately $16 billion in assets under management.

What Is a Surrender Charge? Annuity Surrender Charge Explained An annuity surrender charge is a fee the insurer may assess if you withdraw funds or

If you want safe growth and a set interest rate you can count on, 5-year MYGA rates are worth a serious look. They’re simple, principal-protected

With the Fed’s Sept 16-17 meeting eyeing a rate cut, explore if annuity rates are rising or falling. Compare top MYGA rates (up to 6.60%) and strategies for 2025

How Fixed Annuities Protect Against Market Volatility In today’s unpredictable financial landscape, ensuring the stability of retirement savings is a top priority for many investors.

Multi-Year Guaranteed Annuity (MYGA) This Multi-Year Guaranteed Annuity (MYGA) offers options such as the knighthead staysail annuity, providing competitive rates and security for your investments.

Rate Change Notice: DirectGrowth 5, 7, and 10-year fixed rates are decreasing from 6.00% to 5.85% effective 11/11/2025. To receive current 6.00% rates, applications must

Tip: Check spam/promotions if you don’t see our email on time.

Need help sooner or have a quick question?

What happens next

Tip: Check your spam or promotions folder if you don’t see our email within the time window.