Spectrum Credit Union Rates Reviewed

Spectrum Credit Union provides personal savings accounts including competitive CD rates, money market accounts, and savings accounts. This guide will compare Spectrum Credit Union savings account, money market, and CD rates to other top bank rates in the United States.

Table of Contents

Spectrum Credit Union CD Rates

| Minimum Deposit | Term (Months) | APY |

|---|---|---|

| $500 | 12 | 0.55% |

| 24 | 0.55% | |

| 36 | 0.60% | |

| 48 | 0.60% | |

| 60 | 0.70% | |

| $100,000 | 12 | 0.60% |

| 24 | 0.60% | |

| 36 | 0.65% | |

| 48 | 0.65% | |

| 60 | 0.75% | |

| $250,000 | 12 | 0.65% |

| 24 | 0.65% | |

| 36 | 0.70% | |

| 48 | 0.70% | |

| 60 | 0.80% |

Spectrum CU Savings & Checking Account Rates

| Spectrum Credit Union Rates | Minimum Balance | APY |

|---|---|---|

| Primary Share Savings | $25.00 | 0.30% |

| Member Checking | $0 | 0.10% |

| HSA Checking | $0 | 0.10% |

| New Solutions Checking | $0 | 0.00% |

| MySavings Youth | $0 | 7.00% |

| Accumulative IRA/ Roth IRA | $0 | 0.30% |

APY = Annual Percentage Yield

CDs vs Fixed Annuity

A multi-year guaranteed annuity (MYGA) is essentially a CD that is issued by an insurance company rather than a bank. The table below compares and contrasts some of the key differences and similarities between the two.

| FEATURES | FIXED ANNUITY | CD |

|---|---|---|

| Issued By | Insurance Companies | Banks |

| Investment Amount | $2,000 - $1,000,000 | Essentially Any Amount |

| Investment Term | 2 years - 10 years | 3 months - 5 years |

| Interest Rates (APY) | Varies by product. | Varies by bank, term and investment amount. |

| Liquidity | Usually, 10% annually or interest earned. | Almost always accumulated interest. |

| Guarantees | Backed by Insurer & State Guaranty Associations. | Backed by the FDIC. |

| Death Benefit | May avoid probate. | Probate process required. |

Today's Best Guaranteed Annuity Rates

Fixed annuity rates are guaranteed for a set number number of years.

| Term | Insurer | Company | Annuity | Rate | AM Best | Free withdrawals | Application |

|---|---|---|---|---|---|---|---|

| 2 Years | CL Life | CL Sundance | 5.25% | B++ | Interest Only | Apply | |

| 3 Years | Mountain Life | Alpine Horizon | 6.00% | B+ | None | Apply | |

| 4 Years | Mountain Life | Alpine Horizon | 6.05% | B+ | 10% | Apply | |

| 5 Years | Knighthead Life | Staysail Annuity | 6.30% Simple | A- | None | Apply | |

| 6 Years | Equitrust | Certainty Select | 5.60% | B++ | Interest Only | Apply | |

| 7 Years | Knighthead Life | Staysail Annuity | 6.50% Simple | A- | None | Apply | |

| 8 Years | EquiTrust | Certainty Select | 5.65% | B++ | Interest Only | Apply | |

| 9 Years | Clear Spring Life | Preserve MYGA | 5.35% | A- | None Yr 1 10% Yrs. 2-9 | Apply | |

| 10 Years | Revol One | DirectGrowth MYGA | 6.00% | B++ | None | Apply |

Types of Annuities Overview

| Features | Variable Annuity | Index Annuity | Fixed Annuity | Immediate Annuity | Longevity Annuity |

|---|---|---|---|---|---|

| Principal Protection | No | Yes | Yes | Yes | Yes |

| Liquidity Options | Yes | Yes | Yes | No | No |

| Maintain Control of Asset | Yes | Yes | Yes | No | No |

| Tax-Deferral | Yes | Yes | Yes | No | No |

| Guaranteed Rate | No | No | Yes | No | No |

| Guaranteed Income | Yes | Yes | Yes | Yes | Yes |

| Cost of Living Adjustments (COLA) | Yes | Yes | No | Yes | Yes |

| Death Benefit | Yes | Yes | Yes | Yes/No | Yes/No |

| LTC Enhancements | Yes | Yes | Yes | No | No |

Today's Top CD Rates

3 Month CD Rates

| Best 3-Month CD Rates | APY | Term | Minimum |

|---|---|---|---|

| Signature Federal Credit Union | 5.55% | 3 Months | $500 |

| Ponce Bank | 5.40% | 3 Months | $1 |

| Western Alliance Bank | 5.41% | 3 Months | $1 |

12 Month CD Rates

| Bank | Rate | Term | Minimum |

|---|---|---|---|

| All In Credit Union | 5.85% APY | 12 Months | $100,000 |

| My eBanc | 5.77% APY | 12 Months | $100,000 |

| State Bank of Texas | 5.75% APY | 12 Months | $50,000 |

2 Year CD Rates

| Bank | Rate | Term | Minimum |

|---|---|---|---|

| Luana Savings Bank | 5.68% APY | 24 Months | $100,000.00 |

| Maple Mark Bank | 5.40% APY | 24 Months | $25,000.00 |

| Crescent Bank | 5.35% APY | 24 Months | $1,000.00 |

3 Year CD Rates

| Bank | APY | Term | Minimum |

|---|---|---|---|

| Valley National Bank | 5.60% | 36 Months | $500 |

| Bread Savings | 4.95% | 36 Months | $1,500 |

| The State Exchange Bank | 4.70% | 36 Months | $1 |

4 Year CD Rates

| Bank | APY | Term | Minimum |

|---|---|---|---|

| Bread Savings | 4.75% | 48 Months | $1 |

| The State Exchange Bank | 4.50% | 48 Months | $1 |

| Barclays | 4.45% | 48 Months | $1 |

5 Year CD Rates

| Bank | APY | Term | Minimum |

|---|---|---|---|

| Farmers Insurance | 5.00% | 60 Months | $1,000 |

| Schools First Credit Union | 4.75% | 60 Months | $100,000 |

| Bread Savings | 4.75% | 60 Months | $1,500 |

CD Interest Calculator

Use the interest calculator below to see how much interest an annuity or CD will pay you monthly. Enter your initial investment amount, the fixed annuity or CD rate and term in the calculator below then hit CALCULATE.

What is a CD (Certificate of Deposit)?

Definition: A CD, or certificate of deposit, is a bank account with a fixed interest rate that’s generally higher than that of a regular savings account, and a fixed date of withdrawal, known as the maturity date. Common terms range from three months to five years.

Pros: The ability to lock in rates when they’re high is one of the most attractive features of a CD, especially since regular savings accounts have variable rates subject to change at any time. Even outside of high-rate environments, though, CDs provide a safe, federally insured place for short-term savings.

Cons: You’ll generally have to pay a penalty if you withdraw your money before a CD matures; the penalty can be equal to several months or a year’s worth of interest.

What else to consider: Fixed Annuities provide guaranteed rates for a set number of years and typically pay higher interest rates than a CD.

How Much Interest Do CD's Pay?

Use our compound interest calculator to see how much a Certificate of Deposit will pay you monthly or annually.

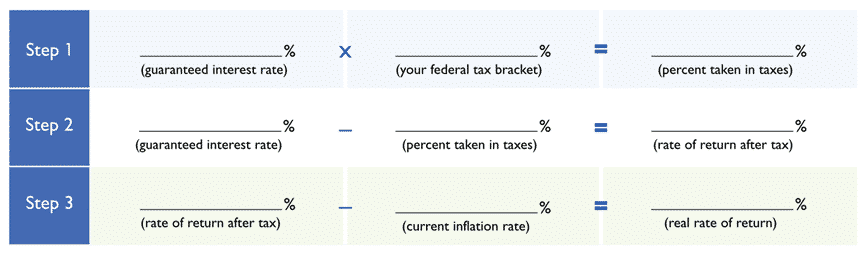

How to Calculate a CD Rate's Real Rate of Return

In 18 of the past 30 years, CDs have had a negative return (after taking into account the impact of taxes and inflation), and in three of the positive years, they earned less than a 1% real rate of return.

Have you considered the impact that taxes have on interest? Or, have you accounted for the impact inflation may have on your overall rate of return?

Generally, the interest received in these types of vehicles may not keep pace with inflation. This could mean lower purchasing power for you over time. Also, at renewal, a new rate along with a new withdrawal penalty may apply.

Here’s a quick way to determine your CD’s real rate of return:

Frequently Asked Questions

Are Annuities FDIC Insured?

While not FDIC insured, State Guaranty Associations provide a safety net for their state’s annuity policyholders. These Guaranty Associations guarantee policyholders continue to receive coverage (up to the limits spelled out by state law) even if their insurer is declared insolvent. Source: “Learn to Invest, Investment Types, Annuities, Fixed Annuities.” Financial Industry Regulatory Authority (FINRA). Visit FINRA’s Fixed Annuities Webpage

Can you Loose money in a fixed annuity?

You can not lose money in a fixed annuity. However, guarantees are backed by the claims-paying ability of the issuing insurance company so it is important to consider an insurer’s financial rating when shopping for an annuity.

Does a Fixed Annuity Have any Fees?

Fixed Annuities do not have any fees or expenses unless you add an additional rider that was not mentioned on this page.

What is a No-Penalty CD?

A no-penalty CD is a type of CD that doesn’t have a penalty for withdrawing money before the term ends. It can be appealing if you want the traditionally higher yield of a CD, compared to regular savings accounts, but you might need the money sooner than you expect.

What happens if You withdraw from a CD early?

Most CDs have an early withdrawal penalty that tends to range from several months to a year’s worth of interest earned, depending on the CD term length and the bank’s policy. No-penalty CDs are the only type of CD that lets you withdraw money from a CD early without a fee.