Annuity sales keep breaking records. Sales thru the end of Q3 2025 hit $119.3B, up 4% year-over-year—the eighth straight quarter over $100B. Year-to-date sales are $345.0B, an all-time high.

RILAs lead the way

- Q3 RILA sales: $20.6B (first-ever $20B+ quarter), up 20% YoY.

- Market context: steadier volatility and strong equities made RILAs’ “protected growth” especially attractive.

- Expansion: 3 new products, 1 new carrier, several product enhancements.

- YTD RILA sales: $57.3B, up 18%.

Traditional variable annuities

- Q3 sales: $16.7B, up 11% YoY.

- YTD: $46.9B, up 6%.

- Driver: strong equity markets and inflation concerns.

Fixed annuities

- Fixed-rate deferred (FRDs): Q3 $41.7B, up 3% YoY; YTD $126.6B, up 2%. Still compelling versus CDs despite expected rate cuts.

- Fixed indexed annuities (FIAs): Q3 $33.2B, down 6% YoY; YTD $93.8B, down 1% from 2024’s record.

Income annuities

- SPIAs: Q3 $3.7B, up 6% from Q2; YTD $10.9B, down 2% YoY.

- DIAs: Q3 $1.3B, down 5% YoY; YTD $3.4B, down 11%—but still about 3x higher than five years ago.

Top Carriers Report Strong Q2 Performance

Major annuity carriers reported robust second quarter results that foreshadowed the strong Q3 performance:

Athene

Athene, a leader in fixed annuities and retirement services, reported strong retail sales in Q2 2025. They saw especially good sales in their fixed indexed annuity products. The company’s focus on competitive crediting rates and innovative index options continued to attract advisors and their clients seeking protected growth opportunities.

Allianz

Allianz Life, consistently among the top FIA writers, maintained its market leadership position through Q2 with its flagship index annuity products. The company’s emphasis on downside protection combined with upside potential resonated with risk-conscious investors navigating market uncertainty.

Sammons Financial Group

Sammons Securities reported solid Q2 results across multiple product lines, with particular strength in their multi-year guaranteed annuity (MYGA) offerings. The company’s competitive rates and strong financial ratings continued to drive advisor and consumer interest.

Nationwide

Nationwide Financial demonstrated balanced growth across both fixed and variable annuity platforms in Q2. The company’s registered index-linked annuity products showed exceptional momentum, contributing to the broader industry trend toward structured products offering market participation with downside protection.

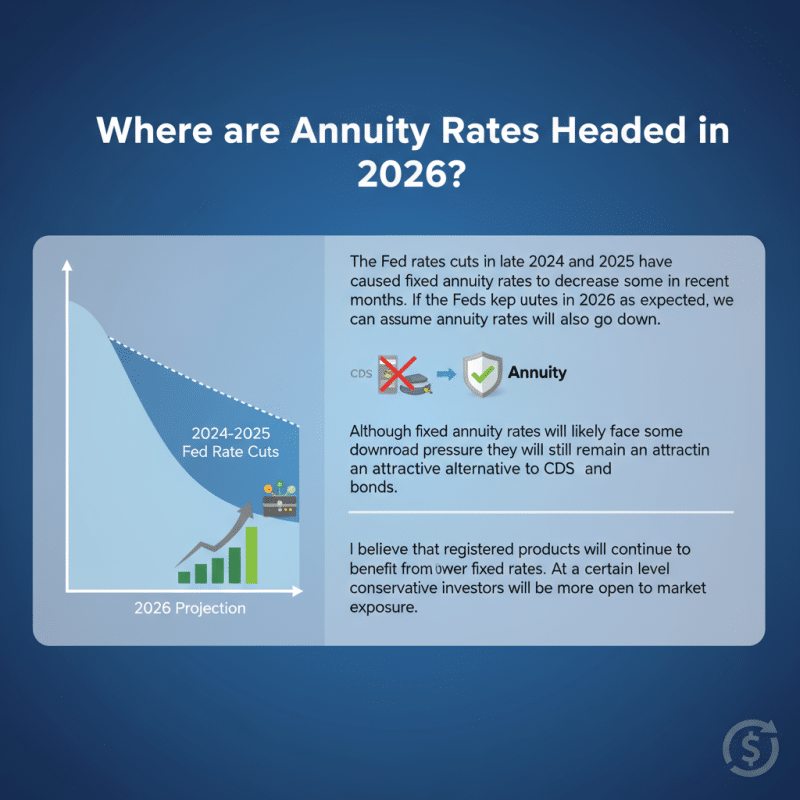

Where are Annuity Rates Headed in 2026?

The Fed rates cuts in late 2024 and 2025 have caused fixed annuity rates to decrease some in recent months. If the Feds keep cutting rates in 2026 as expected, we can assume annuity rates will also go down.

Although fixed annuity rates will likely face some downward pressure they will still remain an attractive alternative to CDs and bonds.

I believe that registered products will continue to benefit from the lower fixed rates. At a certain level conservative investors will be more open to market exposure.

The Federal Reserve’s rate-cutting cycle reflects efforts to support economic growth while managing inflation. For annuity buyers, this creates several considerations:

- Lock in rates while they’re favorable: Current fixed annuity rates, while declining, remain historically attractive

- Consider structured products: RILAs and indexed annuities offer protection against further rate volatility

- Think long-term: Annuities are retirement vehicles; short-term rate fluctuations matter less than long-term guarantees

Final Thoughts

Rates cuts will continue to cool fixed product rates in the coming months but the future remains very bright for annuities. My forecast is fixed annuity sales will begin to plateau and fixed indexed annuities will continue to gain momentum.

The Alliance for Lifetime Income by LIMRA continues its mission of helping Americans understand the role annuities play in achieving financial security in retirement. For personalized guidance on which annuity products best fit your retirement goals, consult with a qualified financial professional.

i

Sources & Citations

We regularly update this page and cite primary data, carrier filings, and industry reports:

- LIMRA. Second Quarter 2025 YTD Rankings

- SuccessCE. How the New Federal Interest Rates Will Affect Annuities

- Athene. Q2 2025 Financial Results

- Nationwide. Q2 earnings: Resilience over fear in a volatile market

- LIMRA. 2025 Q3 U.S. Individual Annuity Sales Estimates