Unbiased Athene Agility 10 Review

The Athene Agility 10 has quickly become one of the best-selling indexed annuities and for good reason. This 10 year fixed index annuity comes with many features built-in for free; however, as great as it is it isn’t for everyone.

In this Athene Agility 10 Review we will cover:

Is Athene a Good Annuity Company?

Athene Annuity and Life Insurance Company is a strong insurance company with an A Rating from AM Best; they are also a major player in the U.S. annuity market.

When evaluating an annuity it is always important to consider the insurer’s financial strength because an annuity’s guarantees are backed by the claims-paying ability of the issuing insurance company.

Athene passes this test with strong financial ratings and comes in #1 in overall index annuity sales in 2020.

So without further ado; let us dive into our Athene Agility 10 Review.

| Athene Annuity Ratings | Rating |

|---|---|

| A.M. Best Rating | A |

| Fitch Ratings | A |

| Comdex | 78 |

| Standard & Poor's | A |

Agility 10 Annuity Rates & Indexes

The Athene Agility 10 is a fixed index annuity with a 10-year contract term. One of the things we really like is the Athene Agility 10 offers annual and two-year annual reset options:

#2. Two-Year Point to Point

It has a participation rate and capped index crediting strategies as well as a fixed-interest option.

Indexes and crediting options

BNP Paribas Multi-Asset Diversified 5 Index

- 2-Year No Cap Point-to-Point Index Strategy (Par Rate)

- 1-Year No Cap Point-to-Point Index Strategy (Par Rate)

Nasdaq FC Index

- 2-Year No Cap Point-to-Point Index Strategy (Par Rate)

- 1-Year No Cap Point-to-Point Index Strategy (Par Rate)

Al Powered US Equity Index

- 2-Year No Cap Point-to-Point Index Strategy (Par Rate)

- 1-Year No Cap Point-to-Point Index Strategy (Par Rate)

S&P 500®

- 2-Year Point-to-Point Index Strategy (Cap)

- 1-Year Point-to-Point Index Strategy (Cap)

Fixed Account

Download: Athene Agility 10 Rates & Product Guide

Annual Point to Point Crediting Method Explained

A Guide to Fixed Index Annuity Crediting Methods

Best Fixed-Index Annuity Rates October 2025

Athene Agility Historical Performance

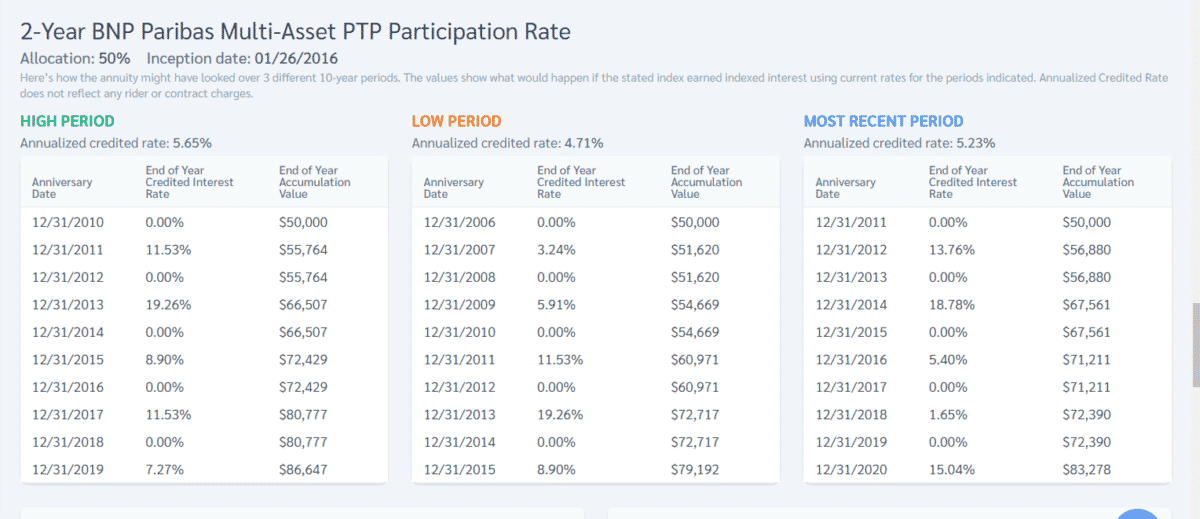

BNP Paribas Multi-Asset Diversified 5 Index 2 Yr pt.-to-pt.

Below we will look at the historical rates of return for Agility 10; remember, hypothetical illustrations are not guaranteed. I am showing an Athene Agility 10 Illustration using a $50,000 initial premium into the:

- $50,000 in the 2-Year BNP Paribas Multi-Asset PTP: 90%

Here’s how the annuity might have looked over 3 different 10-year periods. The values show what would happen if the stated index earned indexed interest using current rates for the periods indicated.

Annualized Credited Rate does not reflect any rider or contract charges.

- 5.23% for the Most Recent 10 Year Period

- 5.65% for the Highest 10 Year Period

- 4.71% for the Lowest 10 Year Period

Athene Agility Historical Performance: 2-Year Nasdaq FC Par Rate

Below are the tables from an Athene Agility 10 Illustration placing a $50,000 initial premium into the:

- 2-Year Nasdaq FC Index PTP Participation Rate: 62%

Here’s how the annuity might have looked over 3 different 10-year periods. The values show what would happen if the stated index earned indexed interest using current rates for the periods indicated.

Annualized Credited Rate does not reflect any rider or contract charges.

- 6.19% for the Most Recent 10 Year Period

- 6.19% for the Highest 10 Year Period

- 2.21% for the Lowest 10 Year Period

Get an Athene Agility Annuity Quote

Fill out the form below to receive a free annuity quote within 4 business hours, or use one of our annuity calculators.

Athene Agility 10 Annuity Product Details

Athene Agility 10 is a 10-year fixed index annuity that boasts a free income rider with 2 options available at the time of issue.

Flex premiums: | Not available | ||||

Maximum: | $1,000,000 Higher Limits may be available with Home Office Approval | ||||

Minimum: | $10,000 | ||||

Types of funds: |

| ||||

AGE RESTRICTIONS

| |||||

Owner: | 40 – 80 | ||||

Annuitant: | 40 – 80 | ||||

| FEES: | Athene Agility 10 has no fees | ||||

PREMIUM NOTES | |||||

Minimum: $5,000 in AK, HI, MN, MO, NJ, OR, PA, TX, UT and WA Terminal Illness: You can withdraw up to 100% of your annuity’s Accumulated Value if the Annuitant is diagnosed with a Terminal Illness that is expected to result in death within one year and you meet the eligibility requirements. This waiver is available after your first Contract Anniversary. You may not be diagnosed during the first Contract Year. Additional limitations, state variations, and exclusions may apply. Please see the Certificate of Disclosure for more information. Confinement Confinement must begin after the first contract year. Additional limitations, state variations, and exclusions may apply. Please see the Certificate of Disclosure for more information. Bail-Out After the 30-day Bailout Window, all charges may apply. | |||||

SURRENDER CHARGE SCHEDULE

1 yr. 2 yr. 3 yr. 4 yr. 5 yr. 6 yr. 7 yr . 8 yr. 9 yr. 10 yr.

9% 9% 8% 7% 6% 5% 4% 3% 2% 1%

Athene Agility 10 Income Rider Included at No Cost

Lifetime Income Base Bonus

How is the Athene Agility 10 Lifetime Income Amount Determined?

Your Benefit Base will continue to receive Interest Credits — even while you’re getting your “retirement paycheck.”

Prior to starting income, your Benefit Base will increase by 175% of any Interest Credits that are added to your annuity’s Accumulated Value.

Once you start receiving your retirement paycheck, your Benefit Base will continue to grow by 175% of any interest credits you earn. This provides you with an enhanced Death Benefit.

The Benefit Base is equal to the Initial Premium, plus the Benefit Base bonus amount. On each Anniversary, the Benefit Base will be credited 175% of the dollar amount credited to the Accumulated Value.

During the Income Phase, the Benefit Base will continue to grow 175% of the dollar amount credited to the Accumulated Value.

Enhanced Death Benefit

The Benefit Base is paid out in equal payments over the currently declared Death Benefit Payout Period. The Death Benefit Payout Period is currently set to five years and is guaranteed not to exceed ten years.

Enhanced Death Benefit capped at 125% Cash Surrender Value or 250% net premium in AK, HI, NJ, PA, and WA.

Enhanced Income Benefit Availability and Qualification

To qualify for the Enhanced Income Benefit, the person for whom Lifetime Income Withdrawals are based must be confined to Qualified Care Facility for 180 out of the last 250 days.

The Lifetime Income Withdrawal amount will be doubled if qualifications are met, and the Accumulated Value is greater than zero. Not available in all states.

Athene Agility 10 Income Payments

Below are the tables from a $100K Athene Agility 10 Illustration placing $50,000 of premium into each of these 2 crediting options:

- 2-Year Nasdaq FC PTP Rate: 62%

- 2 -Year BNP Paribas Multi-Asset PTP Rate: 90%

The annuity was purchased at age 55 and income payments are deferred for 10 years; the number is for single lifetime income payments.

Hypothetical Income at 65

Here’s how the annuity might look over a 30-year period. The values show what would happen if the allocations earned interest using current rates in all years. The indexed interest is based on actual index performance during the most recent 10-calendar year period for the first 10 years. We repeat the index performance from this 10-year period afterward.

Age | Annual Payment | Account Value | Interest | Income |

65-66 | $12,381 | $162,061 | 0% | $237,156 |

66-67 | $12,381 | $159,513 | 6.88% | $219,038 |

67-68 | $13,233 | $146,281 | 0% | $200,868 |

68-69 | $13,233 | $159,576 | 19.96% | $182,697 |

69-70 | $15,874 | $143,702 | 0% | $164,523 |

70-71 | $15,874 | $131,314 | 2.7% | $146,349 |

71-72 | $16,303 | $115,011 | 0% | $128,180 |

72-73 | $16,303 | $106,841 | 8.48% | $110,010 |

73-74 | $17,686 | $89,155 | 0% | $91,800 |

74-75 | $17,686 | $87,902 | 22.78% | $73,589 |

75-76 | $21,715 | $66,187 | 0% | $55,410 |

76-77 | $21,715 | $47,256 | 6.88% | $37,231 |

77-78 | $23,209 | $24,047 | 0% | $18,946 |

78-79 | $23,209 | $1,006 | 19.96% | $661 |

79-80 | $27,841 | $0 | 0% | $0 |

80-81 | $27,841 | $0 | 2.7% | $0 |

81-82 | $28,594 | $0 | 0% | $0 |

82-83 | $28,594 | $0 | 8.48% | $0 |

83-84 | $31,019 | $0 | 0% | $0 |

Guaranteed Income at 65

Here’s how the annuity might look over a 30-year period. The values show what would happen if the indexed allocations earn zero indexed interest and the fixed allocation earns the minimum guaranteed fixed rate in all years.

Age | Annual Payment | Account | Interest | Income |

55-56 | $0 | $100,000 | 0% | $125,000 |

56-57 | $0 | $100,000 | 0% | $125,000 |

57-58 | $0 | $100,000 | 0% | $125,000 |

58-59 | $0 | $100,000 | 0% | $125,000 |

59-60 | $0 | $100,000 | 0% | $125,000 |

60-61 | $0 | $100,000 | 0% | $125,000 |

61-62 | $0 | $100,000 | 0% | $125,000 |

62-63 | $0 | $100,000 | 0% | $125,000 |

63-64 | $0 | $100,000 | 0% | $125,000 |

64-65 | $0 | $100,000 | 0% | $125,000 |

65-66 | $6,063 | $93,938 | 0% | $117,422 |

66-67 | $6,063 | $87,875 | 0% | $109,844 |

67-68 | $6,063 | $81,813 | 0% | $102,266 |

68-69 | $6,063 | $75,750 | 0% | $94,688 |

69-70 | $6,063 | $69,688 | 0% | $87,109 |

70-71 | $6,063 | $63,625 | 0% | $79,531 |

71-72 | $6,063 | $57,563 | 0% | $71,953 |

72-73 | $6,063 | $51,500 | 0% | $64,375 |

73-74 | $6,063 | $45,438 | 0% | $56,797 |

74-75 | $6,063 | $39,375 | 0% | $49,219 |

75-76 | $6,063 | $33,313 | 0% | $41,641 |

76-77 | $6,063 | $27,250 | 0% | $34,063 |

77-78 | $6,063 | $21,188 | 0% | $26,484 |

78-79 | $6,063 | $15,125 | 0% | $18,906 |

79-80 | $6,063 | $9,063 | 0% | $11,328 |

80-81 | $6,063 | $3,000 | 0% | $3,750 |

81-82 | $6,063 | $0 | 0% | $0 |

82-83 | $6,063 | $0 | 0% | $0 |

83-84 | $6,063 | $0 | 0% | $0 |

84-85 | $6,063 | $0 | 0% | $0 |

Pros & Cons of the Athene Agility 10

Advantages

- 5 Different Indexes to choose from

- Uncapped crediting options available on 4 of the indexes

- Annual point-to-point and two-year point-to-point options available for diversification

- Innovative AiPex, BNPMAD5, and Nasdaq FC Indexes

- Athene is a Strong and Financially Stable Insurance Company

- Enhanced Death Benefit no cost

- Enhanced Income Benefits at no cost

- All riders are built-in at no cost (no fees)

- The hypothetical Rate of return on back-testing is not as good as other annuity products, including Athene’s own Performance Elite 7.

- You must wait at least 10 years to turn on the lifetime income rider.

- The income rider is mandatory.

- A 25% premium bonus only applies to Benefit Base

- To qualify for the Enhanced Lifetime Income Withdrawals you must be confined to Qualified Care Facility for 180 out of the last 250 days. (can’t use for in-home health cases like you can in the Athene Ascent Pro 10)

Athene Agility 10 Review: Final Thoughts

I’ll wrap up my Athene Agility 10 review with some final thoughts. The Agility 10 is not a great annuity if your objective is safe accumulation. The cap and participation rates are lower than they are on Athene’s other annuity products.

Additionally, the Athene Agility 10 has a 10-year contract term and I suggest staying in the 5 to 7-year range for accumulation.

This is a great option if you are less than 60 years of age and plan to use this annuity as part of your retirement income plan.

Bottom Line: I would not recommend the Athene Agility 10 if you are looking for an annuity to grow your money in a safe and steady way. If you plan to turn this portion of your portfolio into a lifetime income stream, Agility 10 is quite possibly the best option available (Allianz 222 also gets consideration).

More Athene Annuity Reviews

This is an independent Athene Agility 10 review, not a recommendation or solicitation to buy or sell an annuity. Athene Annuity and Life Company have not endorsed this product review in any fashion and we don’t receive any compensation from it.

Be sure to do your own due diligence, we recommend consulting with a properly licensed tax, legal or financial professional regarding any questions you may have prior to making any purchasing decision.

Values shown are not guaranteed unless specifically stated otherwise. Rates and annuity payout rates are subject to change. Actual values may be higher or lower than the values shown. The illustration is not valid without all 18 pages and the statement of understanding. Not available in all states.

Annuities are subject to the terms and conditions of the specific contract issued by the insurer, are not FDIC or NCUA insured, are not bank guaranteed, may lose value, and are not a deposit. Please call (855) 583-1104 if you have any questions or concerns.