Is the Allianz 222 Annuity any Good?

Before we dive into our Allianz 222 Review I want to cover the financial strength of Allianz Life because the guarantees of an annuity are only as good as the financial strength of the issuing company.

Allianz Life Insurance Company of North America is rated A+ AM Best (2nd of 15 ratings). The below table also lists Allianz’s Standard & Poor’s rating, Moody’s rating, and Comdex Score.

Allianz is also consistently one of the best-fixed index annuity companies.

Things to Consider When Shopping for an Index Annuity

Annuity Sales in the United States have continued to rise over the past few years. However, they still get a lot of criticism in the media and even from some financial advisors for being overly complicated. In reality, annuities are much less complicated than most other investment products.

With that said, there are many different types of annuities, and each type is designed to achieve a certain goal; the Allianz 222 is a fixed index annuity. Indexed annuities provide long-term growth potential and protect you from a loss of principal.

- Accumulation

- Distribution

- Wealth Transfer

The Allianz 222 would not be the best choice if accumulation is your goal; lifetime income is the primary strength of the 222. We’ll try our best to make this Allianz 222 review as easy to understand as possible today.

Product Highlights

The Allianz 222 is a 10-year fixed index annuity with a guaranteed lifetime withdrawal benefit rider (GLWB) included. This means there are two separate values; an account value and a protected income value.

The account value is real money and what you could withdraw as a lump sum at the end of the contract. The protected income value is only used to determine annual lifetime income.

The Allianz 222 offers a premium bonus and an interest-crediting bonus applied to the protected income value. It also offers lifetime income payments that can increase and even double to help pay for long-term care expenses (provided certain criteria are met).

IMPORTANT NOTE:

The premium bonus and interest crediting bonus do not apply to your account value it is applied only to your PIV value. As stated above the PIV value is only used to determine your lifetime; it is essentially a fictitious account and doesn’t exist as far as the IRS is concerned.

Minimum Premium: $20,000

Issue ages: 0-80

Crediting Methods:

Monthly Sum with a cap

Annual Point to Point with a cap

Annual Point to Point with a spread

Annual Point to Point with a participation

2-year point-to-point with a participation rate

Free Withdrawals: Beginning the 2nd contract year, up to 10% of the contract’s premium can be withdrawn annually without any surrender charges.

Death Benefit: Upon death, the beneficiary will receive the full account value or the protected income value if taken over 5 years.

Fees: There are no fees

The Allianz Income Multiplier (AIM) Benefit will double your annual income withdrawal amount for long-term care if you become confined to a living facility for at least 90 days in a consecutive 120-day period, or you’re unable to perform at least 2 of the 6 activities of daily living (ADLs).

The ADLs are:

- bathing

- continence

- dressing

- eating

- toileting

- and transferring.

- Nursing home benefit and Flexible Annuity Option Rider

- RMD Friendly – no penalty for taking your RMD

- PIV Bonuses (Protected Income Value): 15% Premium Bonus paid initially, only credited towards protected income value. In addition, an interest crediting bonus of 50% is credited to the PIV value for the life of the contract. Again, this is only credited toward the PIV value (not the accumulation value).

Get an Allianz 222 Annuity Quote

Allianz 222 Fees

The Allianz 222 Annuity has no fees or expenses.

Historical Rate of Return

PIMCO Tactical Balanced ER Index with participation rate: 40%

Any Allianz 222 review would not be complete without a look at historical rates of return! Below is a chart showing hypothetical returns for the Allianz 222 using:

This table lists the hypothetical annualized credited rate for the highest 10-year period, the lowest 10-year period, and the most recent.

The annualized rate of return for the

- the most recent period was 2.46%

- 2.45% for the highest annualized period

- lowest 10-year period 1.75%.

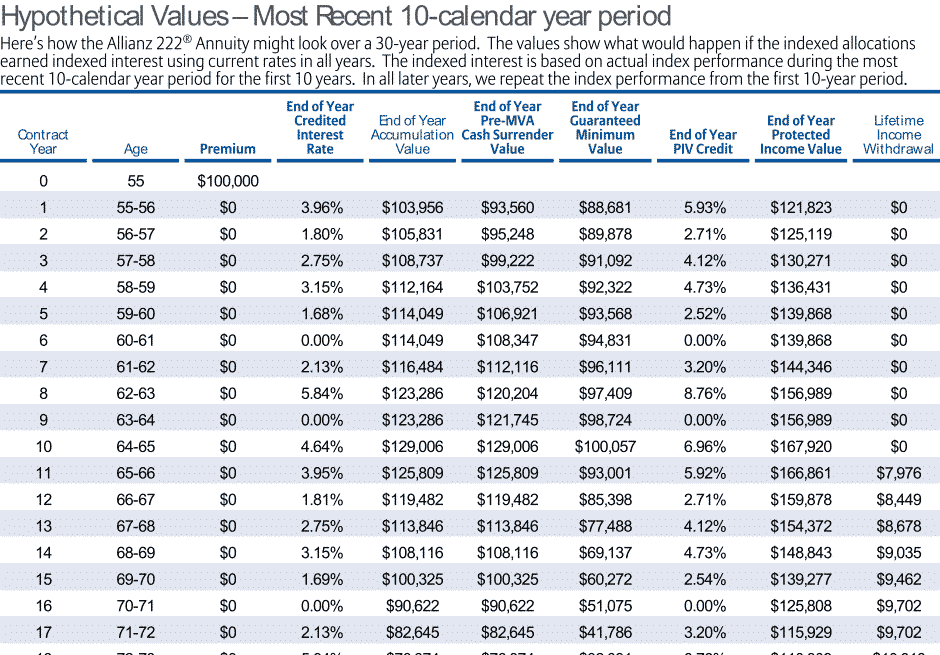

Bloomberg Dynamic Balanced Index II with a Participation Rate: 40%

The following table shows hypothetical returns for the highest 10-year period, the lowest 10-year period, and the most recent 10-year period using the:

The annualized rate of return for three 10-year periods:

- The most recent period also happens to be the highest period was 2.70%

- The lowest 10-year period had an annualized rate of return of 1.75%.

If you noticed there isn’t much difference average rate of return for these two index annuity crediting methods, and the worst 10-year period was the same for both (1.75%).

Allianz 222 Review: Protected Income Value (PIV)

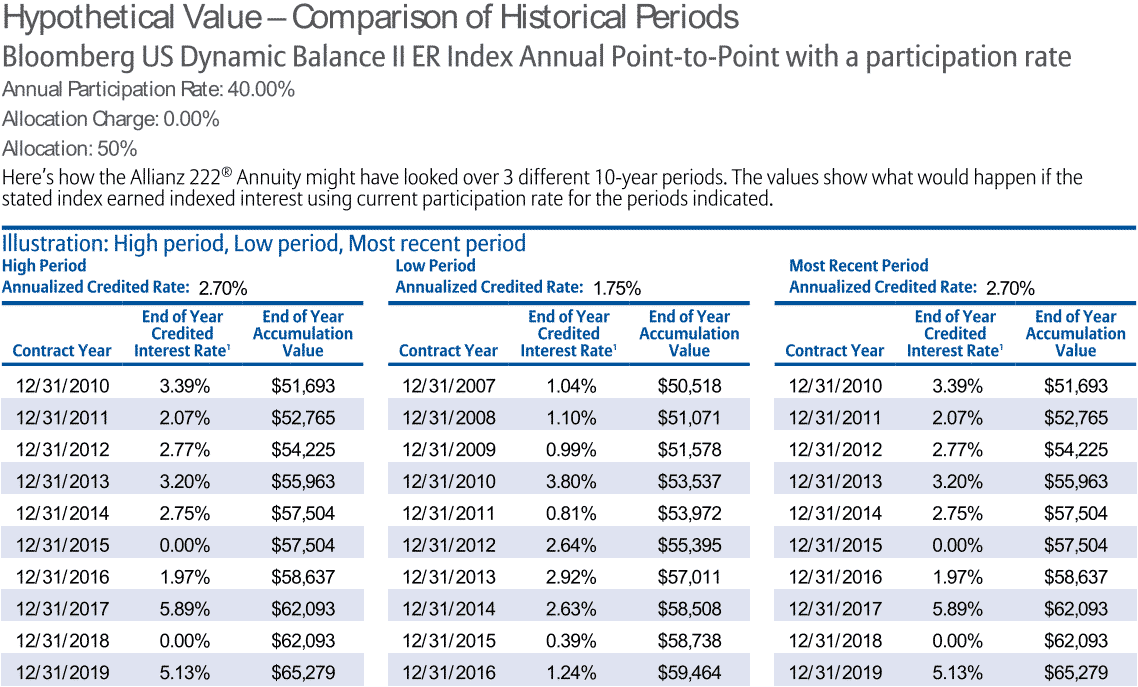

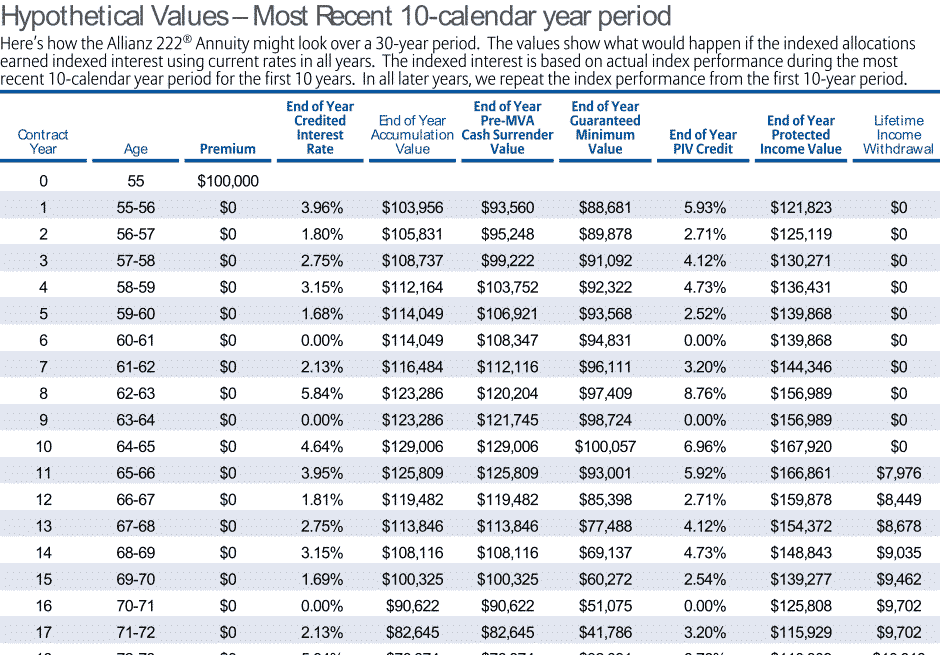

Example:

- Deposit: $100,000

- Purchased at Age: 55

- Income Begins at Age: 65

Each year the lifetime income withdrawal amount increases the end-of-year credited interest is earned in the account value multiplied by 1.50%. You can see in the chart below that when the account value does not earn any interest there are no increases to the lifetime withdrawal amount the following year.

For example, take a look at a contract year 4. In the 4th column, you’ll see the end-of-year credited interest is 3.15% of the account value. Now if you slide over to the 3rd from the last column (End of Year PIV Credit) you can see that 4.73% was credited. That is 1.50% x 3.15% = 4.73%.

This is hypothetical, not a guarantee. These estimates are based on what would have happened had a 55-year-old purchased this annuity contract 10 years ago applying today’s current rates.

It is however, it is meant to provide an idea of what you may expect to happen. In this case, $100K was deposited into the Allianz 222 at age 55 and 10 years later began generating a Lifetime Income Withdrawal of $7,976.

Pros and Cons of Allianz 222

Pros

- Income Rider is included at no cost.

- Income can increase annually. Your income will increase by 150% of the interest credited in any given year.

- Single-life or joint-life income can be decided at the time income is started and does not have to be decided at contract issue.

- 6 different market indexes to choose from.

- 5 different crediting methods and a fixed interest account.

- Allianz Income Multiplier doubles the annual maximum income withdrawal amount if the owner becomes confined to a nursing home facility for 90 days in a consecutive 120-day period. Or if they are unable to perform 2 out of the 6 ADLs.

- Flexible withdrawal amount – owner can elect to take a portion of the lifetime withdrawal amount or none of it in any given year. If they do, the portion of the lifetime income withdrawal amount not taken is added to a cumulative withdrawal amount that can be taken in a future year above the normal income withdrawal amount.

Cons

- The rate of return on the account value isn’t great.

- Lifetime income payments can not begin until after the 10th contract year.

- 10 10-year surrender period is a long duration if you are not using it for a lifetime income.

Allianz 222 Review: My Final Thoughts

To wrap up my Allianz 222 review, it is probably not the right annuity for you if you are looking for an accumulation vehicle. The rates on the various index crediting methods are not great. As you saw in the hypothetical returns above, the historical returns were less than 3.00%.

However, if you want an annuity that can grow and be turned into a lifetime income stream in the future, the Allianz 222 is a great annuity.

The fact that it:

- doesn’t have a fee

- offers increasing income

- and allows you to choose between single and joint lifetime income at the time you begin taking income (many annuities require that decision be made at the time of purchase)

- The Allianz Income Multiplier (AIM) will double the income if the owner performs 2 of the 6 ADLs (most annuities require the owner to be confined to a nursing home facility).

BOTTOM LINE: Not a good annuity for accumulation, but one of the top, if not the best fixed index annuity, if your objective is lifetime income. Visit our Online Annuity Store to shop and compare more fixed index annuity rates.

More Allianz Annuity Reviews

PIMCO Tactical Balanced ER Index Reviewed

Allianz Core Income 7 Review

Bloomberg US Dynamic Balance ii ER Index

Allianz Benefit Control Annuity Review

This is an independent Allianz 222 review, not a recommendation or solicitation to buy or sell an annuity. Allianz Life has not endorsed this product review in any fashion, and we don’t receive any compensation from it. Be sure to do your own due diligence; we recommend consulting with a properly licensed tax, legal, or financial professional regarding any questions you may have prior to making any purchasing decision.

Values shown are not guaranteed unless specifically stated otherwise. Rates and annuity payout rates are subject to change. Actual values may be higher or lower than the values shown. The illustration is not valid without all 18 pages and the statement of understanding. Not available in all states.

Annuities are subject to the terms and conditions of the specific contract issued by the insurer, are not FDIC or NCUA insured, are not bank guaranteed, may lose value, and are not a deposit. Annuity guarantees are backed by the claims-paying ability of the issuing insurer. Please call (855) 583-1104 if you have any questions or concerns.

Back to Annuity Reviews