Jason has distributed more than $1.5 billion in annuities over his 20 year career. His mission is to democratize access to annuities for all Americans and provide a safe and simple way to purchase an annuity.

Secure, tax-deferred growth. Compare top-rated MYGA rates and buy online in minutes.

*Illustrative snapshot. Rates subject to change. Click "See Rates" for live data.

Rates subject to change without notice. Availability & features vary by state. Not a bank product. Not FDIC insured.

Why We Don’t Recommend Atlantic Coast Life

“Warning: Some websites display Atlantic Coast Life Safe Harbor Bonus Guarantee ‘Year 1’ bonus rate (6.45%) as the annual rate. The actual return over 5 years is significantly lower. Additionally, this product strips out standard protections like death benefits.”

Use the 5 year fixed annuity rates table below to compare more than 140 fixed annuities. We recommend you use the utillize the filters because annuity rates vary by age, state, and investment amount.

You will notice in the table below that most of the best 5 year fixed annuity rates are offered by lesser rated insurance companies, and have little or no free withdrawals available. Note that Knighthead Life credits simple interest which means interest does not compound, so it’s effective yield is lower.

Try our simple vs. compounding interest calculator

As of January 4, 2026, the best 5 year fixed annuity rate is 6.30% available in the American Gulf Anchor MYGA. For a detailed review, a downloadable brochure, and product calculators, click the product name in the table below.

| Carrier / Product Name |

AM Best Rating |

Rate (Fixed) |

Free Withdrawal Yr 1 | Yr 2+ |

Action |

|---|---|---|---|---|

| KIGHTHEAD LIFE - Staysail 5 (simple interest) | A- | 6.30% | None | Apply |

| AMERICAN GULF - Anchor MYGA 5 | B++ | 6.30% | None | Apply |

| WICHITA NATIONAL LIFE - Security 5 MVA | B+ | 6.25% | None | Apply |

| AMERICAN GULF - Anchor MYGA 5 (with 10% free w/d) | B++ | 6.15% | 10% | 10% | Apply |

| REVOL-ONE - DirectGrowth 5 | B++ | 5.85% | None | Apply |

| REVOL-ONE - DirectGrowth 5 (with interest withdrawals) | B++ | 5.75% | Interest | Apply |

| KIGHTHEAD LIFE - Staysail 5 (simple interest) | A- | 5.85% | 10% | 10% | Apply |

Results are estimates for informational purposes only.

Looking ahead to 2026, most reputable financial institutions and the Federal Reserve’s own projections (the “dot plot”) suggest a continued cooling of rates.

What does this mean for you? If the Fed continues to cut rates into 2026, annuity rates will almost certainly follow suit.

The Risk of Waiting: If the trend keeps going, waiting until 2026 could mean getting a rate that is 1% to 1.5% lower than the rates today.

The Bottom Line: If you see a rate that meets your accumulation goals today, it is generally wiser to lock it in rather than gambling on a market that is trending downward.

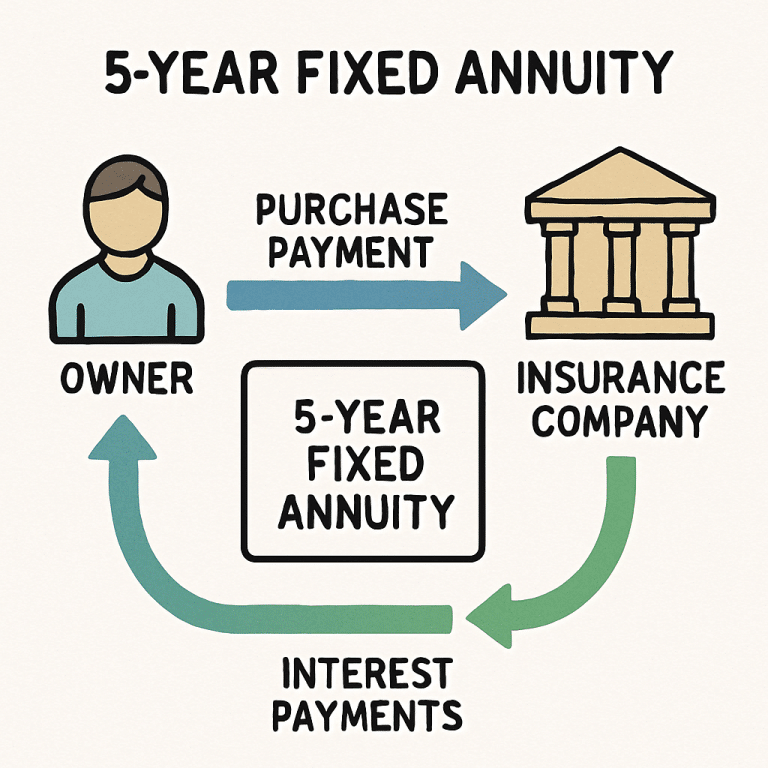

A 5-year fixed annuity is a financial contract between you and an insurance company that guarantees a fixed interest rate on your investment for exactly five years.

Think of it as a longer-term CD with insurance company backing—your principal is protected, your rate is locked in, and your interest grows tax-deferred.

Important Considerations

Important ConsiderationsA five year annuity may be right for you if:

Have a medium-term savings goal (5+ years away)

Want guaranteed returns without market volatility

Are seeking portfolio diversification with a safe component

Need tax-deferred growth for retirement savings

Are risk-averse or approaching retirement

Won’t need access to these funds during the 5-year term

Bonds, CDs, and fixed annuities are all conservative investments commonly used in the fixed income portion of a portfolio. It just happens that right now fixed annuity rates are higher than CD rates and most bond yields.

When comparing 5-year fixed annuities, the advertised rate is just the starting point. Here are the critical factors that separate a good annuity from a great one:

Your annuity is only as secure as the insurance company backing it. AM Best ratings measure an insurer’s financial strength and ability to meet its obligations to policyholders.

A+ (Superior): Exceptional financial strength, highest stability

A (Excellent): Strong financial position, very stable

A- (Excellent): Solid financials with good track record

B++ (Good): Adequate financial strength, acceptable risk

Our recommendation: For most clients, we suggest A- rated or higher carriers. However, B++ carriers with higher rates can be appropriate for diversified portfolios where you’re spreading risk across multiple products.

State Guaranty Association Backup: Every state has a guaranty association that protects annuity holders if an insurance company fails. Coverage ranges from $250,000 to $500,000 depending on your state so it is wise to be aware of the coverage limits in your state.

Not all 5-year annuities lock up your money completely. Understanding withdrawal options is crucial:

Standard Free Withdrawals: Most quality MYGAs allow you to withdraw 10% of your account value annually after the first year without penalty. This provides emergency liquidity while maintaining your guaranteed rate.

No Free Withdrawals: Some products offering the highest rates (6.25-6.30%) restrict all withdrawals. You’re trading maximum returns for zero flexibility. Only consider these if you’re absolutely certain you won’t need access to the funds.

Interest-Only Withdrawals: A middle-ground option that lets you take your earned interest annually while leaving the principal intact. Great for supplementing income without touching your core investment.

Our take: Unless you have substantial emergency reserves elsewhere, we recommend products with at least 10% free withdrawals. The rate difference is usually only 0.10-0.25%, but the peace of mind is worth it.

Surrender charges protect the insurance company’s investment in your annuity. If you take out more than your allowed free withdrawal amount you will be charged a penalty and they can be hefty. Here’s a standard schedule:

Year 1: 8-9% penalty

Year 2: 7-8%

Year 3: 5-6%

Year 4: 3-4%

Year 5: 1-2%

Year 6+: 0%

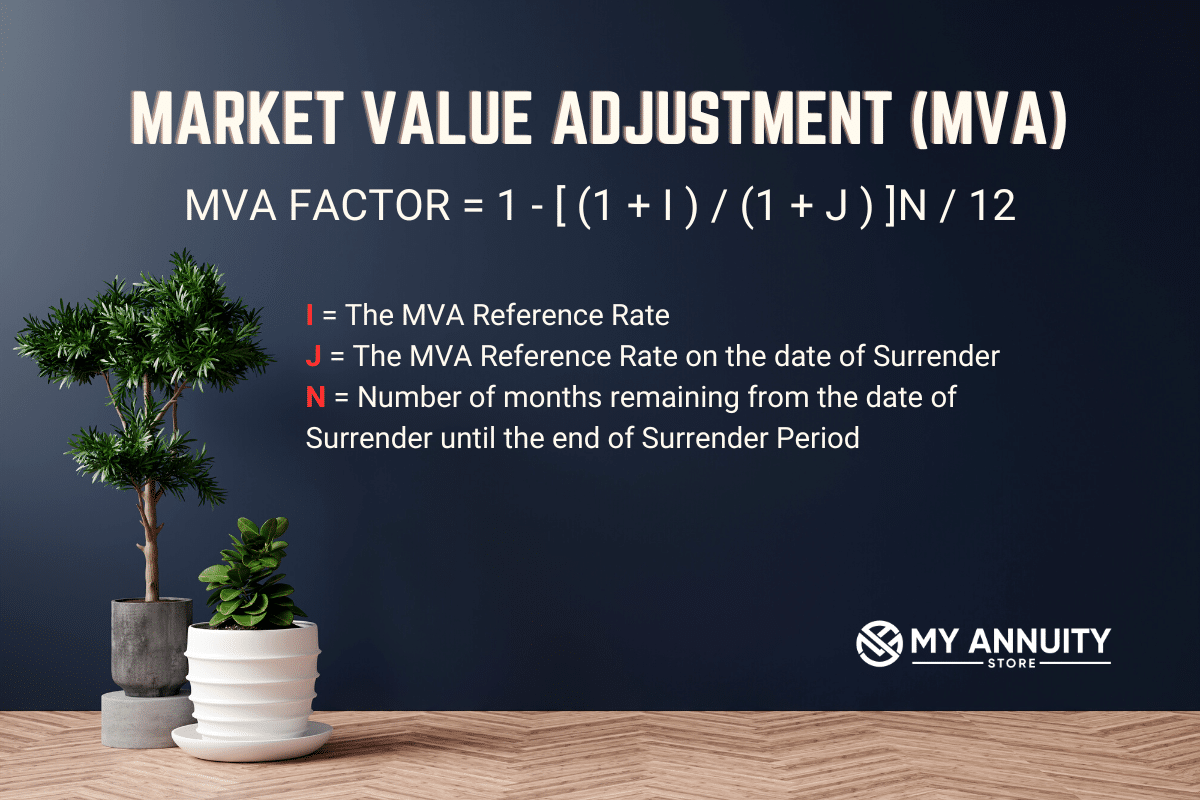

An MVA, or Market Value Adjustment, is a feature that adjusts your surrender value based on current interest rate movements if you withdraw early. Think of it like a bond—if rates have risen since you purchased, your surrender value decreases. If rates have fallen, your value increases.

MVAs only apply if you surrender your annuity early. If you hold to maturity, the MVA never comes into play. Given that we’re currently in a high-rate environment that may decline, MVA products could actually work in your favor if you need to exit early.

The Fed-Annuity Connection: MYGA rates follow Federal Reserve moves with a 6-12 month lag. When the Fed raised rates aggressively in 2022-2023, annuity rates followed — climbing from ~2% to over 6%.

What’s Happening Now: The Fed began cutting rates in late 2024. While annuity rates have held strong, they’re starting to edge downward.

2026 Outlook: Most projections show continued Fed rate cuts. Waiting could mean locking in rates 1-1.5% lower than today.

Bottom Line: Today’s rates remain historically attractive. If a rate meets your goals, locking in now beats gambling on a downward trend.

At maturity, you typically have several options: renew into a new term (often with a renewal rate), transfer to another annuity, take a full or partial withdrawal, or annuitize for income. Most carriers provide a 30-day window to choose before defaulting to a renewal or fixed account option per the contract.

Yes, but early withdrawals during the surrender period may incur surrender charges and market value adjustments (if applicable). Many contracts allow up to 10% penalty-free withdrawals annually, and most offer waivers for qualifying events like terminal illness or nursing care—subject to contract terms.

Earnings grow tax-deferred. Withdrawals are generally taxed as ordinary income, and if you’re under 59½, a 10% IRS penalty may apply to taxable amounts. In non-qualified contracts, taxes apply only to the earnings portion; qualified annuities are taxed based on plan rules. Consult a tax professional for your situation.

State guaranty associations provide protection up to statutory limits that vary by state and are not a substitute for an insurer’s financial strength. Coverage is not FDIC insurance. Always review carrier ratings and diversification. For specifics, contact your state guaranty association.

5-year fixed annuity rates generally move with intermediate-term bond yields and insurer portfolio returns. They may out-yield CDs of similar terms, with tax-deferred growth as an added benefit. Always compare net of surrender terms, liquidity features, and your time horizon.

Jason has distributed more than $1.5 billion in annuities over his 20 year career. His mission is to democratize access to annuities for all Americans and provide a safe and simple way to purchase an annuity.

Results are estimates for informational purposes only.

Important Disclosure:

The rates displayed in this comparison table are for informational purposes only and are subject to change without notice. Actual rates may vary based on individual circumstances, including age, state of residence, premium amount, and product availability.

Rates are current as of [DATE] and should be verified at the time of application. This comparison is not intended as a recommendation or endorsement of any specific insurance company or product. My Annuity Store, Inc. is an independent insurance agency and is not affiliated with or acting as a fiduciary for any insurance carrier listed.

We receive compensation from insurance companies for the sale of annuity products in the form of commissions, which may vary by carrier and product. Annuities are long-term financial products designed for retirement purposes. Early withdrawals may be subject to surrender charges, tax penalties, and other fees.

Before purchasing an annuity, carefully review the product prospectus or disclosure documents and consult with a qualified financial or tax professional to determine if an annuity is appropriate for your specific situation.

Past performance and current rates are not guarantees of future results. All guarantees are backed by the claims-paying ability of the issuing insurance company. For questions or to discuss which annuity option may be right for you, contact My Annuity Store at 855-583-1104 or info@myannuitystore.com.

Tip: Check spam/promotions if you don’t see our email on time.

Need help sooner or have a quick question?

What happens next

Tip: Check your spam or promotions folder if you don’t see our email within the time window.