Company Profile

Kansas City, MO 64105

Company Information

Americo Financial Life and Annuity Insurance company is domiciled in Texas with its principal office located in Kansas City, MO. The roots of the Americo family of companies date back more than 100 years. Americo offers a complete portfolio of competitive life insurance, Medicare Supplement insurance, and annuity products.

Americo Life, Inc., Americo’s holding company, is currently one of the largest, independent, privately held insurance companies in the United States. The Americo family of companies includes:

- Americo Financial Life and Annuity Insurance Company (formerly known as The College Life Insurance Company, founded in 1946)

- Great Southern Life Insurance Company, founded in 1909

- United Fidelity Life Insurance Company

- National Farmers Union Life Insurance Company

Each of these companies has a long, successful history on which Americo is building its future.

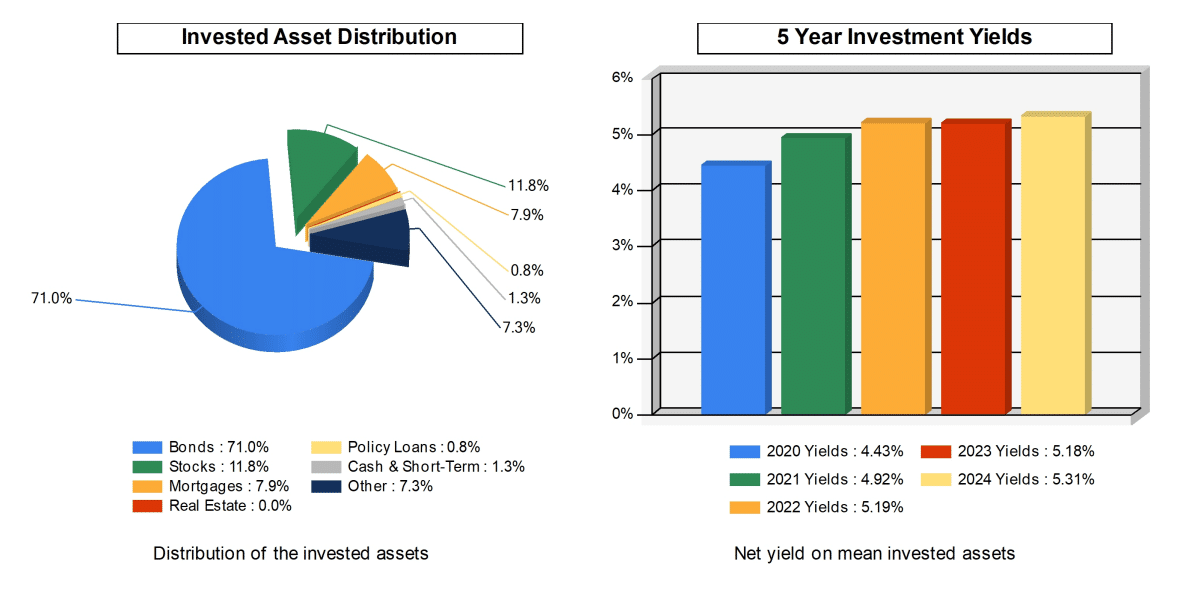

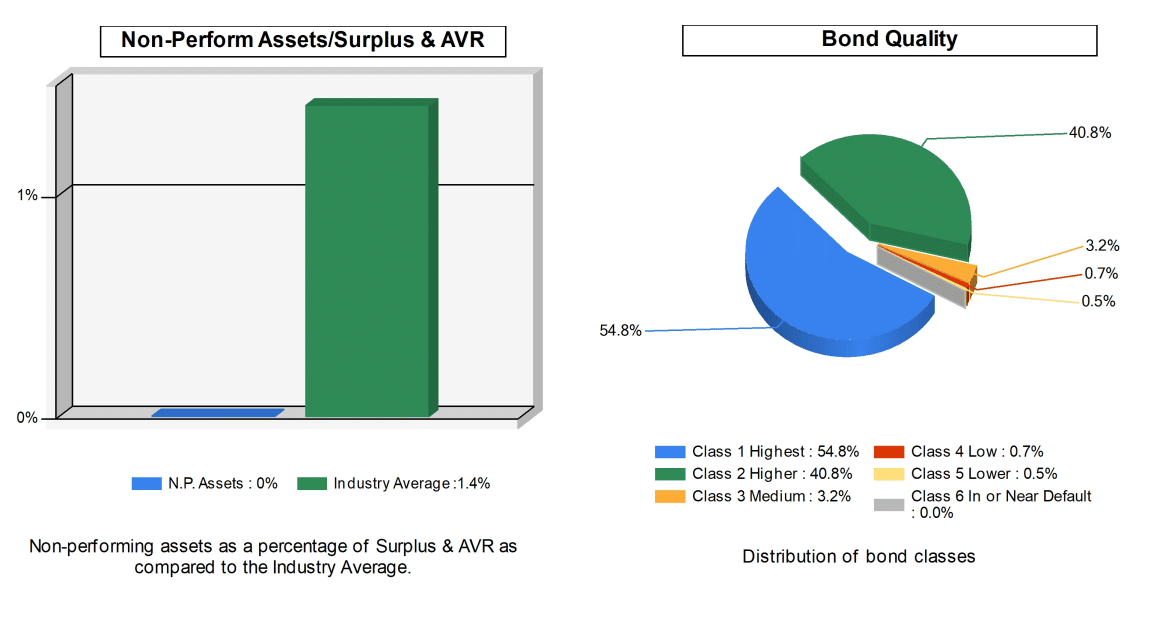

Assets and Liabilities

Ratings

Americo Financial Charts

Americo Annuity Reviews

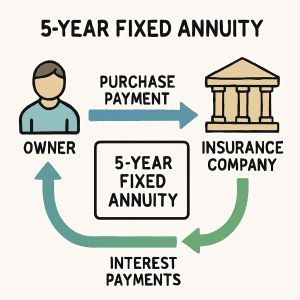

- Americo Platinum Assure 5 - Download Brochure (PDF)

A Best's Financial Strength Rating opinion addresses the relative ability of an insurer to meet its ongoing insurance obligations. It is not a warranty of a company's financial strength and ability to meet its obligations to policyholders. View our Important Notice: Best's Credit Ratings for a disclaimer notice and complete details at http://www.ambest.com/ratings/notice. Financial data for Year-End 2024 from the life insurance companies' statutory annual statements. All ratings shown are current as of October 15, 2025.