Company Profile

Lawton, OK 73501

Company Information

For more than six decades, Wichita National has been committed to being your cornerstone of financial security. Steered by industry experts and years of experience, our mission transcends insurance; it’s a pledge to provide you with unparalleled innovation with cutting-edge products to secure every step of your life. Choose Wichita National for a legacy of unwavering stability, expertise, and innovation.

At Wichita, our diverse product suite is designed to secure every facet of your life. Opt for Term Life to shield your loved ones, invest in MYGA for a worry-free retirement, protect your family by settling debts through Credit Life, or ensure your child’s academic future with ScholarGuard.

Assets and Liabilities

Ratings

Wichita Financial Charts

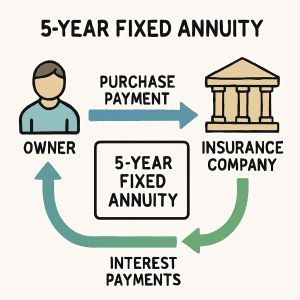

Wichita National Life Annuity Products

- Wichita Security Myga Brochure - Download Brochure (PDF)

A Best's Financial Strength Rating opinion addresses the relative ability of an insurer to meet its ongoing insurance obligations. It is not a warranty of a company's financial strength and ability to meet its obligations to policyholders. View our Important Notice: Best's Credit Ratings for a disclaimer notice and complete details at http://www.ambest.com/ratings/notice.

Data for Year-End 2024 from the life insurance companies' statutory annual statements. All dollar amounts are in thousands. All ratings shown are current as of January 15, 2026.