Best Fixed Index Annuity Companies

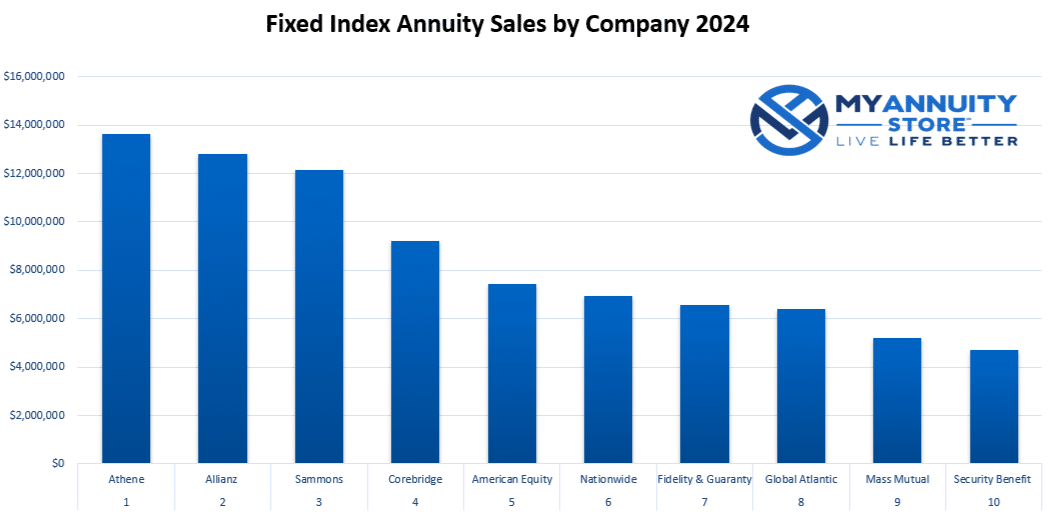

In this article, we’ll list the top 10 best fixed index annuity companies based on total sales in 2024. Fixed Index Annuities have increased in popularity over the last five years, resulting in many more top-rated annuity companies entering the market. In this article, we’ll list the top 10 best fixed indexed annuity companies based on total sales in 2024.

So, without further ado, let’s get started.

The Top 10 Fixed Indexed Annuity Companies

Best Fixed Index Annuity Companies by the Numbers

Each year, the Secure Retirement Institute publishes total U.S. Individual Fixed Annuity Sales and breaks out the results for the top 20 Annuity Companies.

In addition to overall annuity sales, they also break out the results into variable annuity, fixed annuity, and fixed index annuity sales. Total US fixed index annuity sales were $110.2 billion in 2024. (Source: LIMRA U.S. Individual Annuities Sales Survey)

The table below lists the 10 best-fixed index annuity companies based on U.S. Individual Fixed Index Annuity Sales (sales results are in Billions).

| Rank (2024) | Annuity Company | Indexed |

|---|---|---|

| 1 | Athene | $13,620,533 |

| 2 | Allianz | $12,809,835 |

| 3 | Sammons Financial | $12,143,103 |

| 4 | Corebridge Financial | $9,233,332 |

| 5 | American Equity | $7,425,474 |

| 6 | Nationwide | $6,949,000 |

| 7 | Fidelity & Guaranty | $6,560,016 |

| 8 | Global Atlantic | $6,402,201 |

| 9 | Massachusetts Mutual | $5,185,663 |

| 10 | Security Benefit Life | $4,701,020 |

Source: Secure Retirement Institute* U.S. Individual Annuities Sales Survey

Best Fixed Index Annuity Companies Since 2015

Allianz Life, Athene, and Corebridge (formerly AIG) have been the best fixed index annuity companies for the last decade. As you can see below, they have each been in the top 3 in fixed index annuity sales until 2024, when Corebridge dropped down to the number four spot.

If you are considering a fixed index annuity, I would say that each of these annuity companies warrants your consideration.

| Annuity Company | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|---|---|

| Allianz | 2 | 1 | 2 | 2 | 2 | 1 | 1 | 1 | 1 |

| Athene | 1 | 2 | 1 | 1 | 1 | 2 | 2 | 2 | 3 |

| Corebridge (formerly AIG) | 4 | 3 | 3 | 3 | 3 | 3 | 4 | 4 | 5 |

The best annuity for you will be determined by your individual goals and objectives, but generally speaking, Allianz, Athene and AIG are the best fixed index annuity companies.

My Annuity Store, Inc. Tweet

10 Best Fixed Index Annuity Companies

Athene

- Multiple income riders available for fixed index annuities

- Innovative indices and crediting strategies across FIA lineup

- Offers SPIAs, Fixed, and Fixed Index Annuities

#2 Allianz Life

- AM Best Rating: A+ (Superior)

- Popular FIAs with income riders

- Strong consumer brand and financial strength

- Streamlined e-app process

#3 Sammons Financial Companies

- AM Best Rating A+ (Superior)

- Owns Midland National and North American

- Competitive MYGA and Fixed Index Annuity lineup

- Founded in 1886

#4 Corebridge Financial

- AM Best Rating: A (Excellent)

- Strong MYGA and FIA lineup across distribution

- Legacy from AIG Life & Retirement with broad market reach

- Modern e-app and processing workflows

#5 American Equity

- AM Best Rating: A- (Excellent)

- Issues Fixed and Fixed Index Annuities

- Founded in 1995

- 7 different Index Annuity products

#6 Nationwide

- AM Best Rating: A+ (2nd of 15 rankings)

- Top Lifetime Income payouts at many age brackets

- Unique index annuity crediting options

- Strong brand recognition and consumer reviews

#7 Fidelity & Guaranty

- AM Best Rating: A (3rd of 15 rankings)

- Strong MYGA and FIA lineup across distribution

- Legacy from AIG Life & Retirement with broad market reach

- Modern e-app and processing workflows

#8 Global Atlantic

- AM Best Rating: A (3rd of 15 rankings)

- Offer SPIAs, MYGAs and Fixed Index Annuities

- Very competitive lifetime income riders on FIAs

- Client friendly website & educatinoal resources

#9 MassMutual Ascend

- AM Best Rating: A++ (1st of 15 rankings)

- Offer SPIAs, MYGAs and Fixed Index Annuities

- Simple and straightforward indexed annuities

- One of the highest rated life insurance companies (98 Comdex Score)

#10 Security Benefit

- AM Best Rating: A- (4th of 15 rankings)

- Offer SPIAs, MYGAs, variable annuities, and Fixed Index Annuities

- Index crediting options have a good rate of return historically

- Four different income rider options

Request an Annuity Quote

Complete the form below to get an annuity quote within 4 business hours. If urgent, you may reach us at 855-583-1104.

You can shop and compare fixed annuity rates here if you are looking for them instead.

Best Fixed Index Annuity Rates 2025

This list of best fixed index annuity rates is based on the highest S&P 500 annual point-to-point with a cap crediting strategy.

There are many other indexes and crediting options available; too many to list here in a single table.

Visit our index annuity online store to view more best fixed index annuity rates for 2025.

What is the Best Fixed Index Annuity?

The table below lists the fixed index annuity rates and crediting strategies for the top fixed index annuities available today. Click the compare button to compare up to 3 annuities side by side.

| Compare | Carrier | AM Best / S&P | Product | Indexing Strategies (Highlights) | Current Caps & Rates | Surrender Schedule | Min Guarantee | State Availability | Min Premium | Issue Ages | Notable Features |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MassMutual Ascend | A++ / A+ | WealthChoice 7 (Single) | Fixed Rate 1-Year S&P 500 Annual Pt-to-Pt Cap Horizon Ascent 5% Index Pt-to-Pt Participation 1-Year S&P 500 Performance Trigger Additional strategies available • FireLight eligible | Fixed: 8.00% S&P 500 Pt-to-Pt Cap: 10.25% Horizon Ascent 5% Par: 165.00% Perf Trigger: 7.10% | 9, 8, 7, 6, 5, 4, 3 (7 yrs) | 87.5% of premium @ 1.00% | Except: AK, HI, ME, NY | $20,000 | 0–90 | Cap Bailout (S&P 500) 6.75%; 10% free W/D yr 1; TI/NH waivers; Income rider (with cost, max issue age 75 with GLBR); Non-MVA in AK, PA, UT (lower caps/rates); CA higher caps/rates, no MVA; E-Application only; Rate/Cap decrease noted 10/27. | |

| Nationwide Life Ins. Co. of America | A+ / A+ | American Legend 7 (Flexible) | Fixed Rate S&P 500 Annual Pt-to-Pt Cap S&P 500 7-Year Cap Lock Pt-to-Pt S&P 500 RC Pt-to-Pt Participation Additional strategies available • FireLight eligible | <$100k / $100k+ Fixed: 4.05% / 4.25% S&P 500 Cap: 9.50% / 10.00% 7-Yr Cap Lock: 7.00% / 7.25% RC Participation: 70.00% / 75.00% | 9, 8, 7, 6, 5, 4, 3 (7 yrs) | 87.5% of premium @ 3.00% | Except: NY | $10,000 (NQ / Q); add-ins $2,000 | 0–85 (NQ/Q) | 10% free W/D yr 1; LTC/Confinement & TI waivers (varies by state); Additional premium in 1st year only; CA surrender/rate variations. | |

| Delaware Life | A- / A- | Peak 10 (Single) | Fixed S&P 500 Avg DRC Ann Pt-to-Pt Cap AB Growth & Value Bal Par (2-Year) J.P. Morgan Cycle Par (2-Year) S&P 500 Avg DRC Par (2-Year) Additional strategies available | <$100k / $100k+ Fixed: 3.70% / 3.95% Avg DRC Cap: 8.50% / 9.50% AB G&V Par (2-Yr): 220% / 240% JPM Cycle Par (2-Yr): 235% / 250% Avg DRC Par (2-Yr): 195% / 205% | 10, 10, 9, 8, 7, 6, 5, 4, 3, 2 (10 yrs) | 1.00% on 87.5% of premium | Except: CA, DE, NY | $25,000 | 0–85 | Guaranteed Income Solution included (no fee); Bonus Income+ Rider (with fee); State variations for surrender & rates/caps; LTC/Confinement & TI waivers (varies). | |

| MassMutual Ascend | A++ / A+ | WealthChoice 5 (Single) | Fixed Rate 1-Year S&P 500 Annual Pt-to-Pt Cap Horizon Ascent 5% Index Pt-to-Pt Participation 1-Year S&P 500 Performance Trigger Additional strategies available • FireLight eligible | Fixed: 7.00% S&P 500 Pt-to-Pt Cap: 10.25% Horizon Ascent 5% Par: 160.00% Perf Trigger: 7.00% | 9, 8, 7, 6, 5 (5 yrs) ± MVA | 90.8% of premium @ 3.85% | Except: NY | $25,000 | 0–90 | Cap Bailout (S&P 500) 6.50%; 10% free W/D yr 1; TI/NH waivers; Flexible premium in year 1; E-Application only; Rate/Cap decrease noted 10/27. | |

| Sagicor | A- | Sage Accumulator 5 (Single) | 1-Year Fixed 1-Year S&P 500 Annual Pt-to-Pt Cap 1-Year Pt-to-Pt MSCI EAFE ETF Par 1-Year Pt-to-Pt MSCI Emerging Market Par Additional strategies available • FireLight eligible | <$75k / $75k+ Fixed: 4.50% / 5.00% S&P 500 Cap: 9.50% / 10.50% MSCI EAFE Par: 60% / 65% MSCI EM Par: 55% / 60% | 9, 8, 7, 6, 5 (5 yrs) ± MVA | 87.5% of premium @ 1.00% | Except: AK, HI, ME, NY | $20,000 | 0–90 | 10% free W/D yr 1; TI/NH waivers; CA different rates & surrender charges. | |

| Sagicor | A- | Sage Accumulator 7 (Single) | 1-Year Fixed 1-Year S&P 500 Annual Pt-to-Pt Cap 1-Year Pt-to-Pt MSCI EAFE ETF Par 1-Year Pt-to-Pt MSCI Emerging Market Par Additional strategies available • FireLight eligible | <$75k / $75k+ Fixed: 4.50% / 5.00% S&P 500 Cap: 9.50% / 10.50% MSCI EAFE Par: 60% / 65% MSCI EM Par: 55% / 60% | 9, 8, 7, 6, 5, 4, 3 (7 yrs) ± MVA | 90.8% of premium @ 3.85% | Except: NY | $250,000 | 0–90 | 10% free W/D yr 1; TI/NH waivers; CA different rates & surrender charges. | |

| Delaware Life | A- / A- | True Path Income (Single) | 1-Year S&P 500 Annual Pt-to-Pt Cap 1-Year S&P 500 Pt-to-Pt w/ Performance Trigger Fixed Rate Additional strategies available • FireLight eligible | <$100k / $100k+ S&P 500 Cap: 5.00% / 5.50% Perf Trigger: 4.50% / 5.00% Fixed: 3.10% / 3.35% | 10, 9, 8, 7, 6, 5, 4, 3, 2, 1 (10 yrs) ± MVA | 87.5% of premium (less w/d & related charges, excl. MVA) @ 2.65% | Except: NY | $25,000 (add-ins $500 NQ) | 45–85 | 30-day free withdrawal/surrender window at end (or prior, if applicable) of guarantee period. |

What is a Fixed Index Annuity?

A fixed index annuity is a type of fixed annuity that credits interest based on the performance of an external market index rather than a guaranteed annuity rate.

An indexed annuity offers an opportunity to earn more interest when the markets perform and provide downside protection from a potential market downturn.

NOTE: You may also hear fixed index annuities referred to as:

- FIA

- Equity Indexed Annuity

- EIA

- Hybrid Annuity

- Indexed Annuity

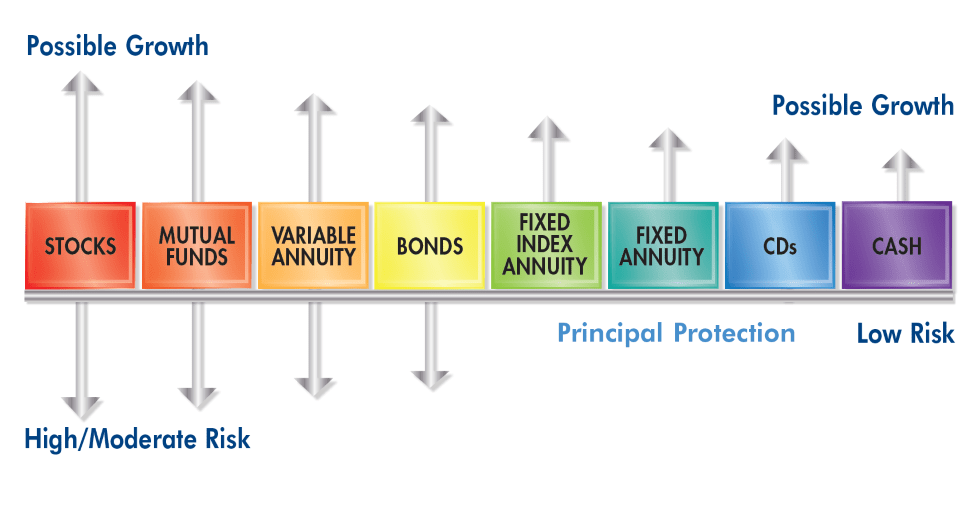

The below infographic illustrates where a fixed index annuity falls between a fixed annuity and variable annuity as well as other investment vehicles on the investment continuum.

Indexed annuities have increased in popularity largely because they offer the most growth potential of any investment that provides principal protection; especially where today’s CD rates are at.

How Do Fixed Index Annuities Work?

The amount of interest you will earn in a fixed index annuity is based on the performance of an external stock market index. You are not directly investing in the stock market, and you can not lose money in a fixed index annuity due to stock market declines.

If the index goes down, you earn zero percent, and if the index goes up, your annuity will earn a portion of the increase. The amount of interest a fixed index annuity earns is determined by crediting methods. Some of the crediting methods are a little tricky at first; I’ll explain each briefly below.

Point-to-Point

- This is the simplest and most common method.

- It compares the index value at the beginning of a period (e.g., one year) to the index value at the end of that period.

- If the index has increased, you receive a percentage of that increase, subject to caps, spreads, or participation rates.

- If the index decreases, you typically receive 0% interest for that period, protecting your principal.

- Multi-year point-to-point options are also available (e.g., two-year or five-year), comparing values over a longer period.

Annual reset (Annual point to point or less often, multi-year point to point)

- This method assesses the index’s performance annually and credits interest each year there’s a gain.

- Any interest earned is “locked in” and won’t be lost due to future market downturns.

- If the index goes down, you would earn zero percent, but your starting point for the upcoming year will be lower.

Monthly sum (or monthly point-to-point)

- This method looks at the index value each month, comparing it to the prior month.

- Monthly increases are capped, and the changes (positive and negative) are added up at the end of the year. A monthly decrease is not capped.

- If the final sum is positive, you receive that amount as interest.

- This method is more sensitive to monthly fluctuations than point-to-point methods.

Monthly average

- This method aims to smooth out volatility by averaging the index’s value over a year.

- The average is then compared to the starting index value, and a spread may be applied to determine the interest credited.

- It can be beneficial in volatile markets.

Performance-Triggered

- This method credits your annuity with a predetermined interest rate if the index change is equal to or greater than zero.

- This provides a guaranteed interest rate in flat or positive market conditions.

- Performance-triggered rates are usually lower than annual point-to-point caps.

Crediting Factors

One of these options is applied to the crediting methods above to determine the interest credited. An annual point-to-point with a cap is the most common.

- Caps: A maximum interest rate that can be credited. For example, if the index rises 7% but the cap is 1%, you only get 1%.

- Participation rates: Determine what percentage of the index increase will be used to calculate your interest. If the index gains 7% and the participation rate is 50%, you get 3.5%.

- Spreads (or index margins): A percentage subtracted from any index gain before interest is credited. If the index gains 7% and the spread is 5%, you get 2%.

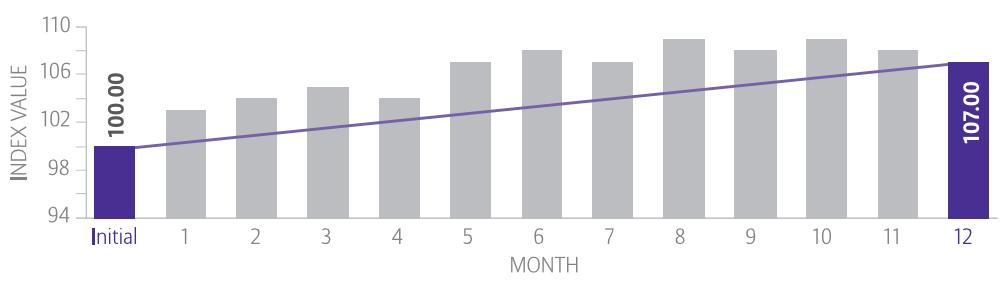

Point to Point Crediting Example

Annual point to point uses the index value from only two points in time making it simple and straightforward to calculate.

Calculating index performance using the annual point-to-point method:

- Subtract the index at the end of the term from the value at the beginning of the term.

- If you have a positive number then the index has performed and you divide it by the starting value to get the percent increase.

Step #1: 107,000(end) – 100,000(initial) = 7,000 positive changes in the index value.

Step #2: 7,000 (end) / 100,000(initial) = 7% index performance.

Applying the Crediting Factors

There is three fixed index annuity crediting methods available in index annuities:

- Spread (Assume 2%)- index’s increase (7%) – spread (2%) = 5% interest earned.

- Cap – (Assume 5%) 100% of the index’s increase (7%) up to the cap(5%) = 5% interest earned.

- Participation Rate – (Assume 50%) The index’s increase 7% X (50%) = 3.50% (the participation rate) = interest earned.

Fixed Index Annuity vs. Variable Annuity

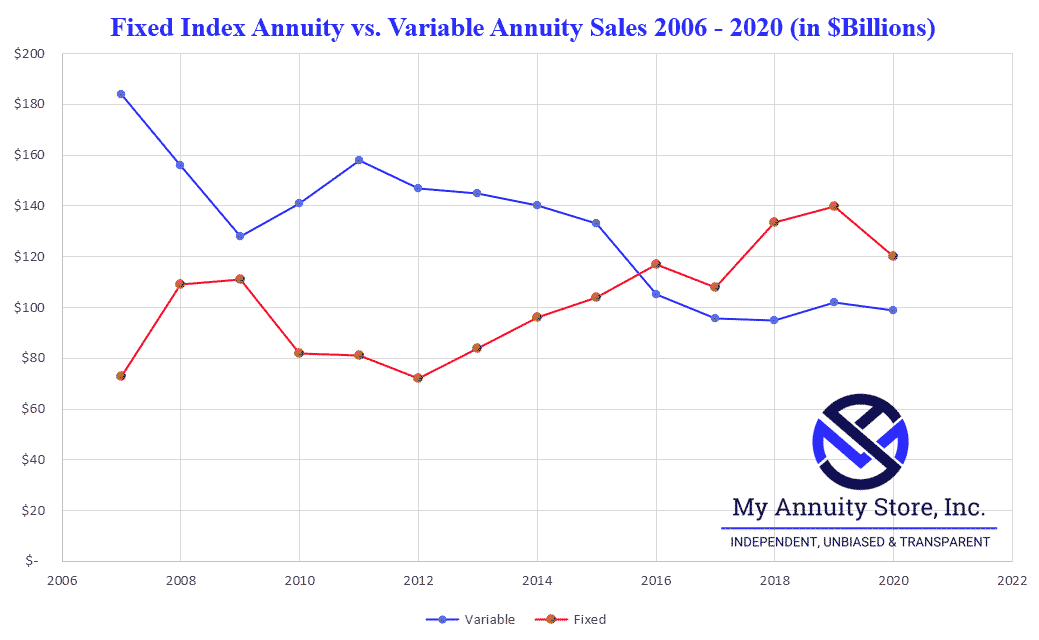

The line chart below compares the sales of variable annuities (VA) and fixed index annuities (FIA) in the United States from 2006 to 2020.

Variable annuities are represented by the blue line while the red line represents fixed indexed annuity sales.

As you can see, variable annuities have decreased in popularity significantly, while fixed index annuities are becoming increasingly popular.

VA sales decreased from approximately $185 billion in 2006 to ~$100 billion in 2020, while FIA sales increased from ~$75 billion to ~$120 billion during the same timeframe.

This is due in large part to the high cost and fees associated with variable annuities.

Typical Variable Annuity Fees

- M&E (mortality and expense) – average around .50%

- Sub-Account Fees – average 1.00%

- Optional Rider Fees (income rider or death benefit rider) – Average 1.00% each

Fixed Index Annuity Fees

- No Sub-Account Fees

- No M&E Fees

- Death Benefit is Full Account Value – No Fee

- Optional Income Riders – Typically .95% to 1.25% annually

Best Uncapped Fixed Index Annuities

Allianz, AIG, and Athene have all been innovators in the indexed annuity space, and I would attribute much of their success to that fact.

Specifically, they all have uncapped crediting strategies and offer proprietary volatility-managed indexes.

Based on historical back-testing, I’ve compiled a list of what I believe to be the best stock market indices available in a fixed index annuity with uncapped crediting options.

Our 2025 Methodology for Ranking Fixed Index Annuity Companies

We independently evaluate fixed index annuity (FIA) carriers using a multi-factor framework designed to balance safety, product competitiveness, and real-world client usability. We are not owned by, affiliated with, or obligated to promote any single insurer.

1. Financial Strength (Weighted 25%)

We review current AM Best, S&P, Moody’s, and (where available) Comdex scores to assess claims-paying ability. Carriers must meet baseline adequacy before product features are considered. Always verify the most current rating directly with the insurer or rating agency.

2. Product Breadth & Optionality (Weighted 15%)

Depth of product lineup: accumulation-focused, income-focused (with rider), hybrid liquidity options, and index crediting method diversity (caps, participation, spreads, performance triggers, fixed rate buckets).

3. Income Competitiveness (Weighted 15%)

We compare roll-up features (if any), payout factor strength by age bands, and projected guaranteed lifetime income using standardized hypothetical scenarios (e.g., 60-year-old deferred 10 years, joint vs. single life).

4. Growth Potential & Renewal Rate Practices (Weighted 12%)

Initial cap/participation settings are less meaningful if renewal integrity is weak. We prioritize carriers with a documented or observed pattern of competitive renewal adjustments relative to rate environments.

5. Index & Crediting Architecture (Weighted 10%)

We evaluate the balance between proprietary volatility-controlled indices and traditional benchmarks (e.g., S&P 500), plus availability of multi-asset or fixed interest buckets for risk calibration.

6. Liquidity & Client Flexibility (Weighted 8%)

Free withdrawal %, cumulative provisions, return of premium (if applicable), nursing home / terminal illness waivers, and penalty-free RMD treatment.

7. Cost Transparency (Weighted 5%)

Base policy cost (generally $0) plus any rider fees (income, enhanced death benefit, performance multipliers). We favor clearly disclosed, stable rider charge structures.

8. Advisor & Client Service Experience (Weighted 5%)

Turnaround times, e-app efficiency, clarity of statements, contract delivery speed, and support response quality (subjective but experience-based).

9. Innovation & Competitive Positioning (Weighted 5%)

Unique differentiators: volatility overlays, stacked multipliers, fee-less income features, enhanced legacy options, ESG-aligned strategies, or simplified suitability processes.

Top Fixed Index Annuity Companies (2025 Snapshot)

Below is a structural comparison. Replace placeholder data (ratings, features, caps/pars) with current verified specs before publishing. Use this as a scannable decision aid—then model real proposals.

| # | Carrier | Best For | AM Best* | Comdex* | Notable Feature | Income Strength | Liquidity Highlight | Index / Crediting Depth | Rider Fee (If Used) |

|---|---|---|---|---|---|---|---|---|---|

| 1 | Allianz Life | Balanced Growth + Stability | A+ (Placeholder) | 94 (Placeholder) | Multi-option bonus + laddering | Strong (Age 60–70) | 10% free withdrawals (typical) | High (Blend of proprietary + classic) | 0.95% (Example) |

| 2 | Athene | Income Optionality | A (Placeholder) | 80 (Placeholder) | Competitive roll-up alternatives | Very Strong (Deferred) | Up to 10% after year 1 | High (Alt indices + fixed bucket) | 0.95% (Example) |

| 3 | Nationwide | Consumer Brand Trust | A+ (Placeholder) | 90 (Placeholder) | Stacked strategy flexibility | Competitive | Return of premium (select) | Medium-High | 0.85% (Example) |

| 4 | Pacific Life | Diversified Index Choice | A+ (Placeholder) | 90 (Placeholder) | Indexed volatility smoothing | Solid | Nursing home waivers | High | 1.00% (Example) |

| 5 | North American (Sammons) | Customization & Allocation | A+ (Placeholder) | 83 (Placeholder) | Blend-friendly chassis | Competitive | Standard RMD friendly | High | 0.95% (Example) |

| 6 | Protective Life | Conservative Stability | A+ (Placeholder) | 86 (Placeholder) | Smooth service & operations | Moderate | Terminal illness waivers | Medium | 0.85% (Example) |

| 7 | American Equity | Legacy / Income Balance | A- (Placeholder) | 75 (Placeholder) | Bonus variants | Competitive (Select ages) | Cumulative withdrawal (select) | Medium-High | 1.05% (Example) |

| 8 | Corebridge (AIG) | Brand History & Scale | A (Placeholder) | 70 (Placeholder) | Diverse FIA suite | Moderate | Income flexibility | Medium | 0.95% (Example) |

| 9 | F&G (Fidelity & Guaranty) | Enhanced Growth Riders | A- (Placeholder) | 65 (Placeholder) | Volatility-controlled indices | Moderate | Accelerated benefits (select) | Medium | 1.10% (Example) |

| 10 | Lincoln Financial | Hybrid Planning Contexts | A (Placeholder) | 75 (Placeholder) | Balanced designs | Moderate | Confinement waivers | Medium | 0.95% (Example) |

Fixed Index Annuity Company FAQs

What is the safest fixed index annuity company?

“Safest” usually refers to financial strength—assessed via independent ratings agencies (AM Best, S&P, Moody’s, Fitch) and composite metrics like Comdex. Several A or A+ rated carriers offer FIAs. However, a highly rated carrier does not guarantee best growth or income features. Your advisor should match rating level with your objectives. Always verify current ratings before you apply.

How do fixed index annuity companies make money?

Insurers invest premium primarily in high-quality fixed income portfolios. A portion of expected yield funds option budgets used to credit index-linked interest. They retain a margin (spread) to cover expenses, risk management, and profit. That’s why caps, participation rates, and spreads vary over time with bond yields and volatility pricing.

Are fixed index annuities good for income?

FIAs can be effective income tools when paired with an optional lifetime income rider or built-in guaranteed withdrawal benefit. They typically emphasize stability over maximum upside. If you need future predictable lifetime income with downside protection—not equity-level growth—an FIA with a strong payout factor schedule may fit. Compare rider fees vs. projected lifetime benefit values before choosing.

How do I choose between two FIA carriers?

Align selection with your primary objective: accumulation flexibility, earliest income start, deferral-based growth of a benefit base, or legacy efficiency. Then compare: (1) insurer strength, (2) renewal rate practices, (3) liquidity provisions, (4) rider fee vs. payout factor competitiveness, (5) index menu alignment with your risk tolerance. Model both contracts under conservative and moderate index credit assumptions.

What fees do fixed index annuities have?

Most base FIAs have no explicit annual policy fee. Costs appear indirectly via caps, participation rates, or spreads that limit potential interest. Optional riders (income, enhanced death benefit, multipliers) typically charge an annual fee—often 0.75%–1.20% of a benefit base or account value. Surrender charges apply for early withdrawals beyond free allowances during the surrender period.

How are caps and participation rates set?

They are primarily a function of option budget—driven by prevailing interest rates (bond yields), option pricing (volatility), hedging costs, and insurer margin targets. Rising bond yields often allow higher caps or participation rates; declining yields or higher volatility can pressure them lower. Renewal integrity matters more than a one-time attractive new business rate.